Commodities Dip • REIT Conversion • Week Ahead

- U.S. equity markets were mixed Tuesday as mounting concerns over global economic growth drove sharp selling pressure across the commodities complex and added fuel to the recent retreat in benchmark interest rates.

- Following declines of roughly 2% last week - its 11th decline in the past 13 weeks - the S&P 500 advanced 0.2% today while the tech-heavy Nasdaq 100 rallied 1.7%.

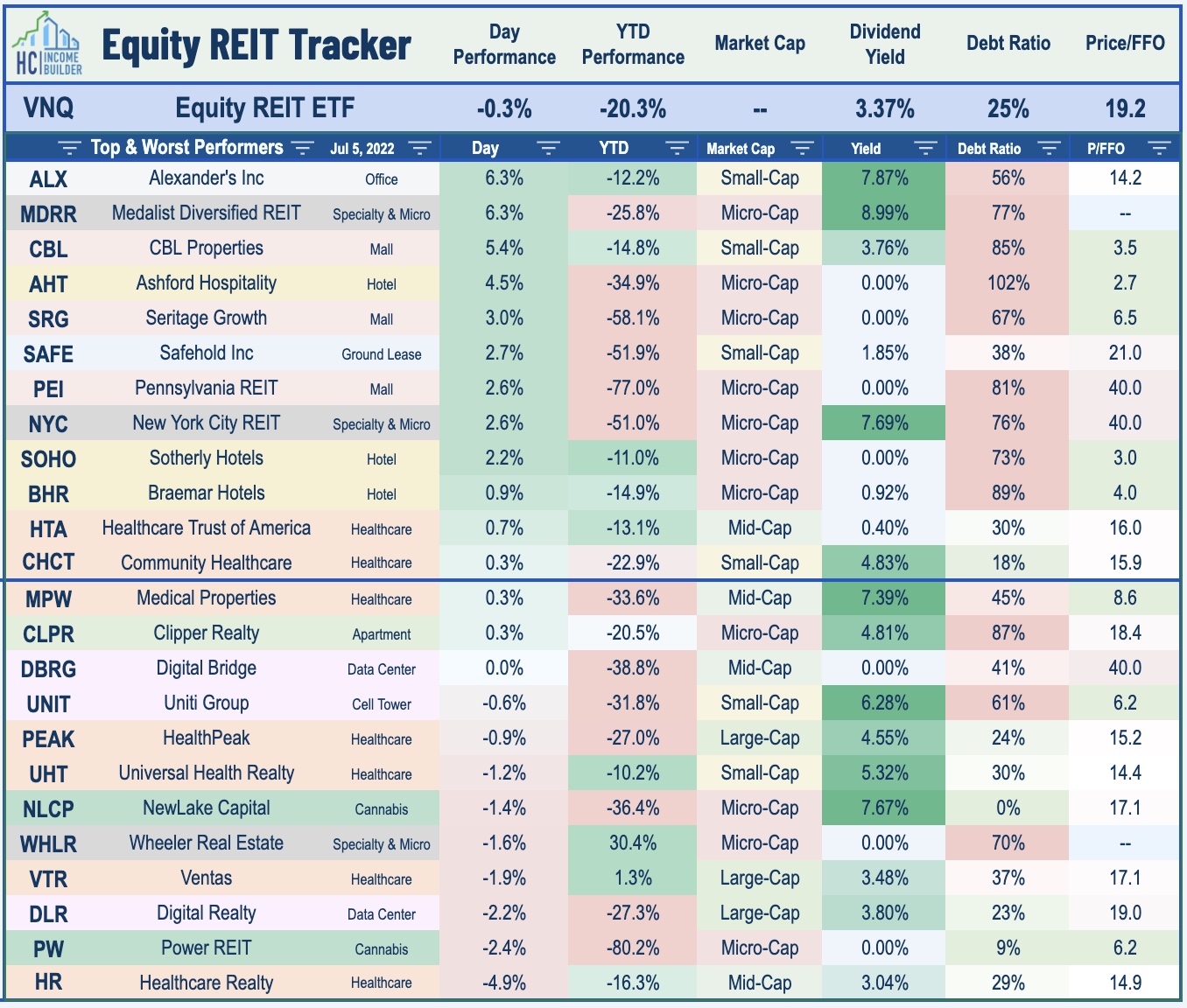

- Real estate equities - which were among the leaders last week - were mixed today. The Equity REIT Index declined 0.3% with 9 of 19 property sectors in positive territory.

- Commodities were the center of the market action today amid mounting demand concerns after economic data across Europe and Asia pointed to a looming recession across several major economies.

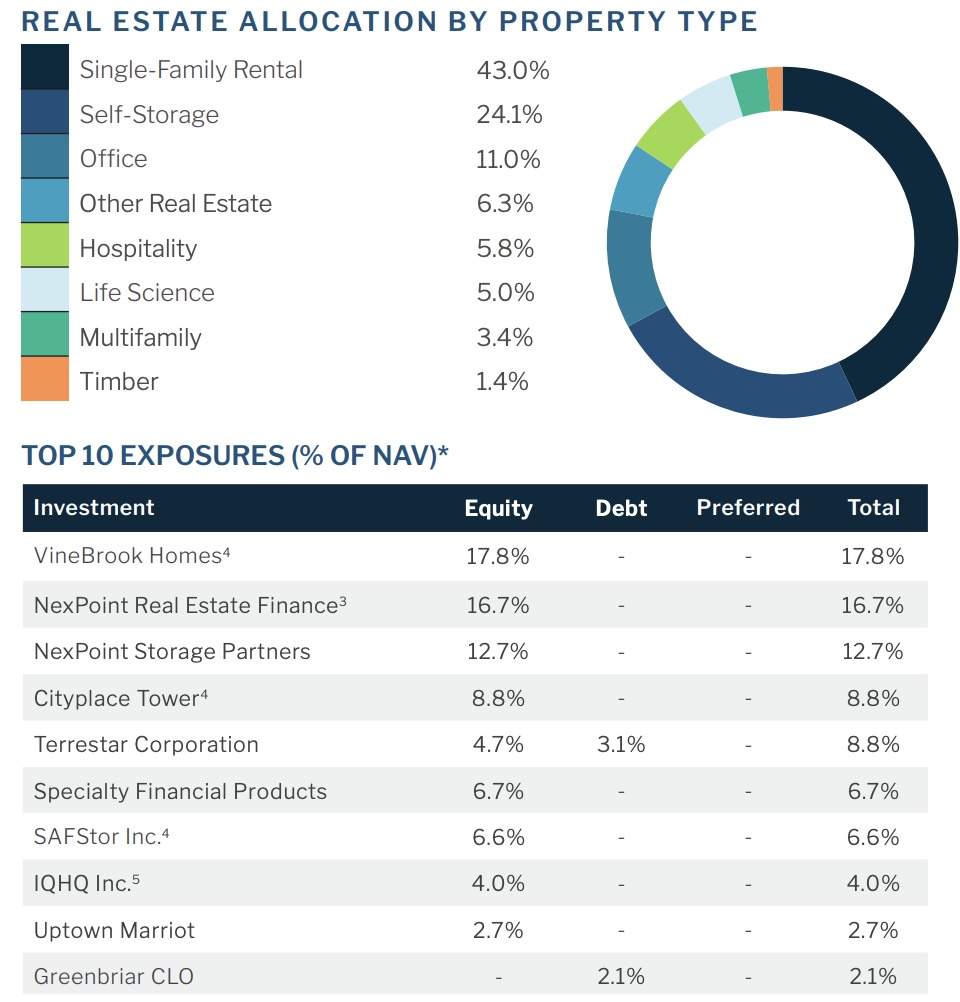

- NexPoint Diversified Real Estate (NXDT) completed its transition from a closed-end fund into a publicly-traded REIT. NXDT owns a portfolio with an enterprise value of roughly $1B, diversified across several asset classes with its most significant position in non-traded single-family rental REIT VineBrook Homes.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets were mixed Tuesday as mounting concerns over global economic growth drove sharp selling pressure across the commodities complex and added fuel to the recent retreat in benchmark interest rates. Following declines of roughly 2% last week - its 11th decline in the past 13 weeks - the S&P 500 advanced 0.2% today while the tech-heavy Nasdaq 100 rallied 1.7%. Real estate equities - which were among the leaders last week - were mixed today. The Equity REIT Index declined 0.3% with 9 of 19 property sectors in positive territory while Mortgage REIT Index gained 0.9%.

Commodities were the center of the market action today amid mounting demand concerns after economic data across Europe and Asia pointed to a looming recession across several major economies. Crude Oil slid more than 8% to close below $100 per barrel for the first time since May. Global benchmark interest rates continued their recent "u-turn" amid these recession concerns as the 10-Year Treasury Yield closed the day at 2.81%, down another 8 basis points today and nearly 70 basis points below its recent high at 3.50% in mid-June. Eight of the eleven GICS equity sectors were lower on the day but homebuilders and the broader Hoya Capital Housing Index were once again a notable bright spot, benefiting from the retreat in interest rates and expectations of U.S. economic outperformance.

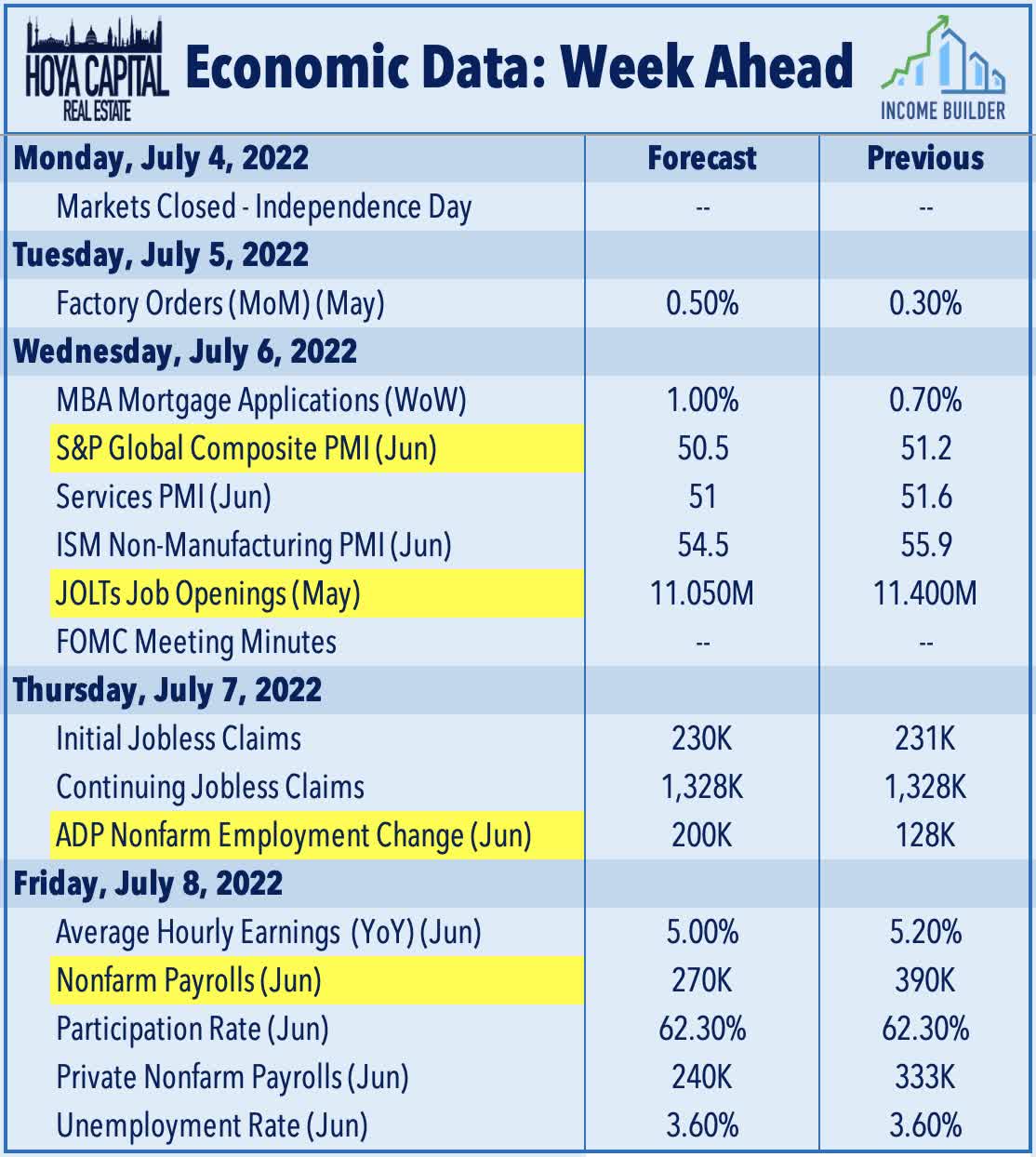

Employment data highlights another busy week of economic data in the Independence Day-shortened week ahead, headlined by JOLTS data on Wednesday, ADP Employment and Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 260k in June which would be the lowest month-over-month increase since the start of the pandemic as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have barely managed to hold on to the breakeven 50-level.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Single-Family Rental: NexPoint Diversified Real Estate (NXDT) completed its transition from a closed-end fund into a publicly-traded REIT, a conversion process that began in late 2020. Formerly known as NexPoint Strategic Opportunities Fund, the REIT will continue to be traded on the NYSE under the ticker symbol NXDT for its common stock and NXDT-PA for its preferred stock. NexPoint also serves as the external adviser to two other publicly-traded REITs: NexPoint Residential Trust, Inc. (NXRT) and NexPoint Real Estate Finance (NREF) - Both were largely formed within NXDT before launching as standalone public REITs. NXDT owns a portfolio with an enterprise value of roughly $1B, diversified across several asset classes. Its most significant position is in VineBrook Homes, a non-traded REIT that owns over 21,000 SFR homes in 23 markets. Additionally, the Company has significant positions in two private self-storage companies, along with several office buildings and life sciences facilities.

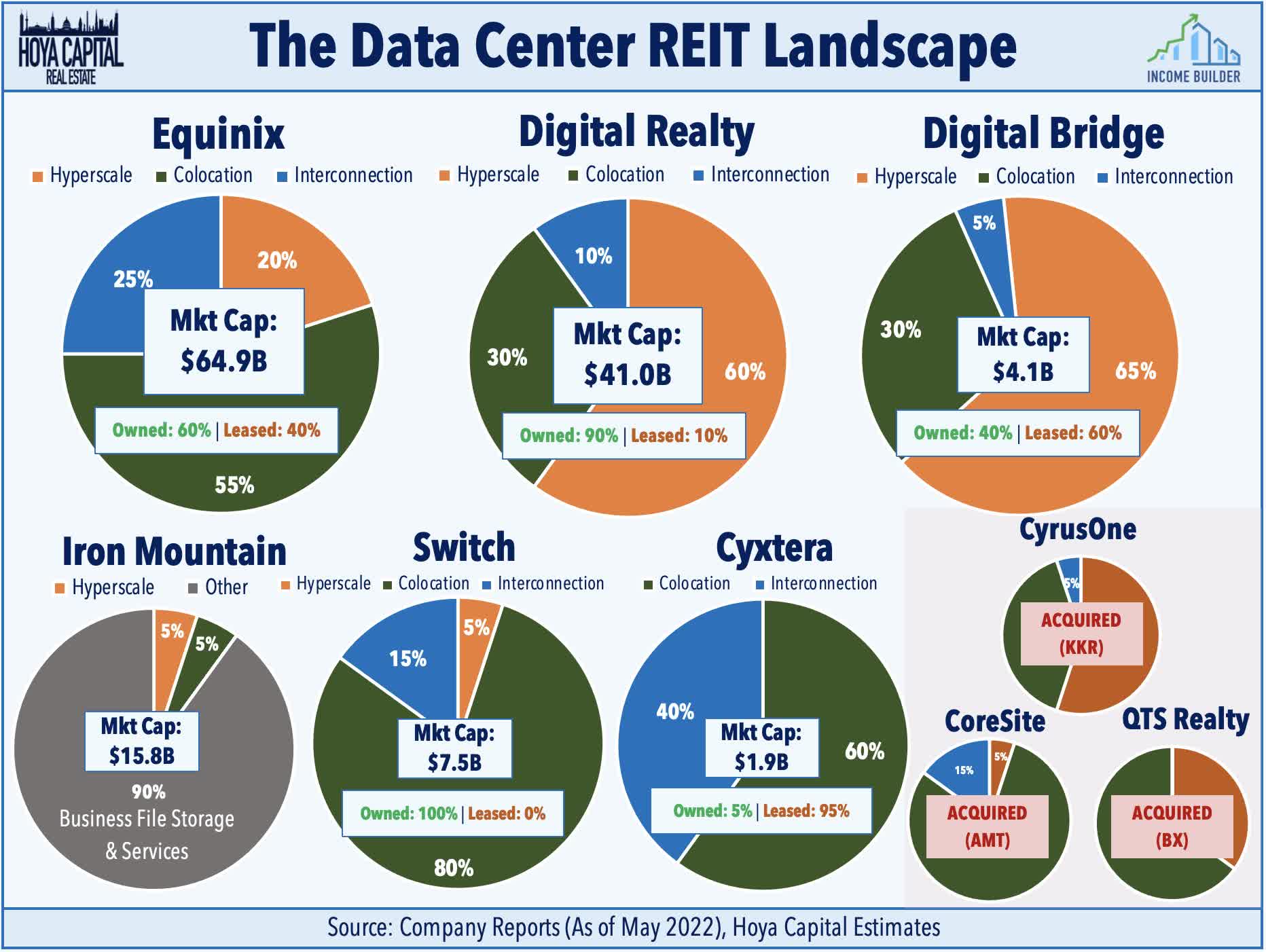

Data Center: DigitalBridge (DBRG) finished modestly higher today after announcing a $200M share repurchase program, effective immediately, which includes the authorization to repurchase both common and preferred shares. The company also announced its plan to effectuate a 4:1 reverse stock split in the third quarter of 2022. The reverse stock split is "intended to reinforce the completion of the Company’s successful business transformation, more closely align DigitalBridge’s outstanding share count with companies of similar size and scope, and generate additional administrative cost savings." As noted in our Weekly Outlook report, data center REITs have become "battleground" stocks in recent weeks after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. In a Financial Times interview, Jim Chanos described the position as the firm's "big short" based on the thesis that "value is accruing to cloud companies, not the bricks and mortar legacy data centers."

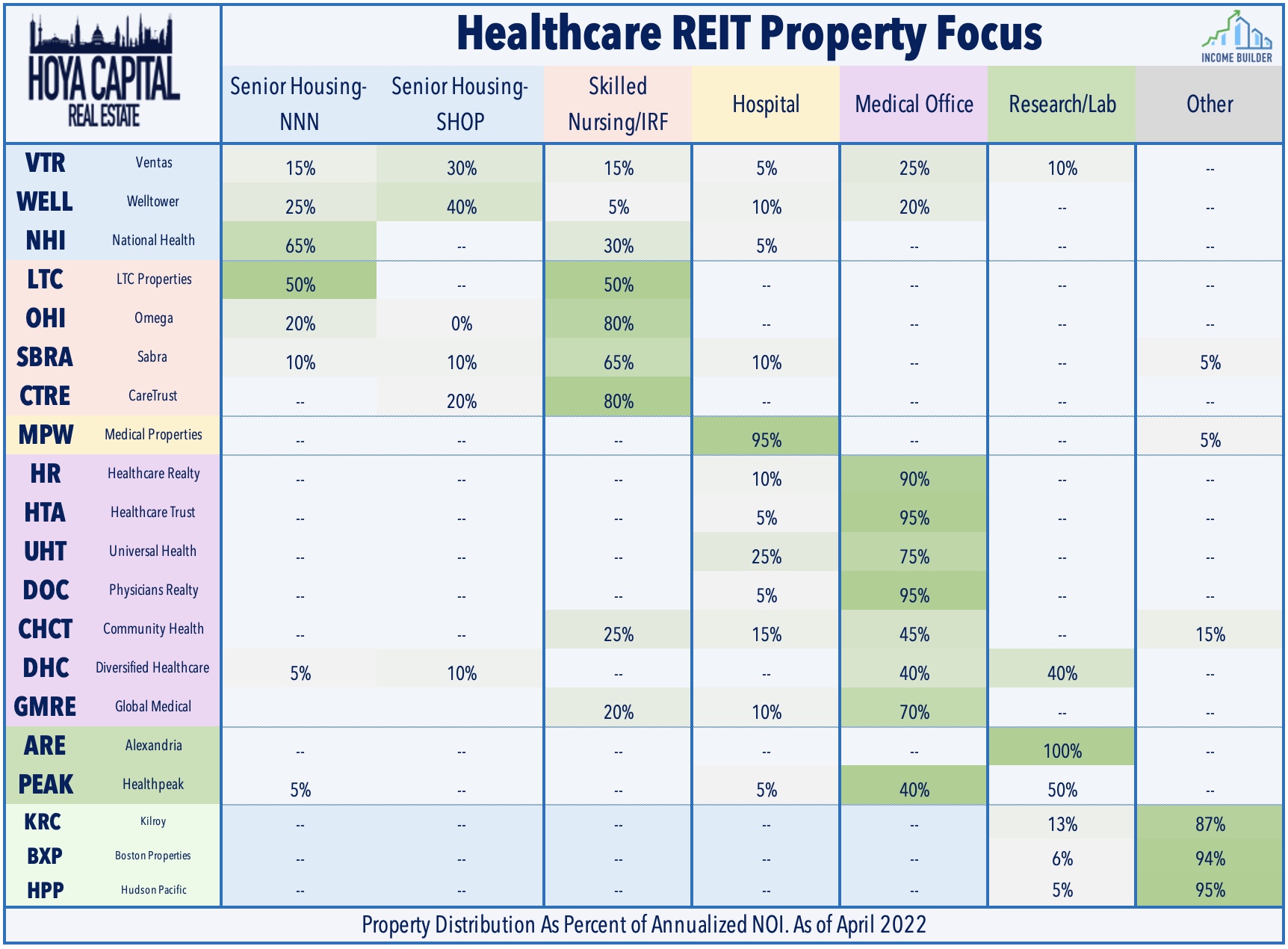

Healthcare: Healthcare Realty (HR) was among the notable laggards today after proxy firm ISS recommended "cautionary support" for its (NYSE:HR) planned acquisition of medical REIT Healthcare Trust of America (NYSE:HTA). The pair agreed in February to a $18B deal that brings together two of the largest owners of medical office buildings. The transaction, which was structured as a reverse merger in which HTA will be the corporate successor, is expected to be completed in Q3, but has been met with a lukewarm response from investors. ISS noted in the report that "if management can replicate its past achievements, the deal will create more value for them than the status quo standalone plan."

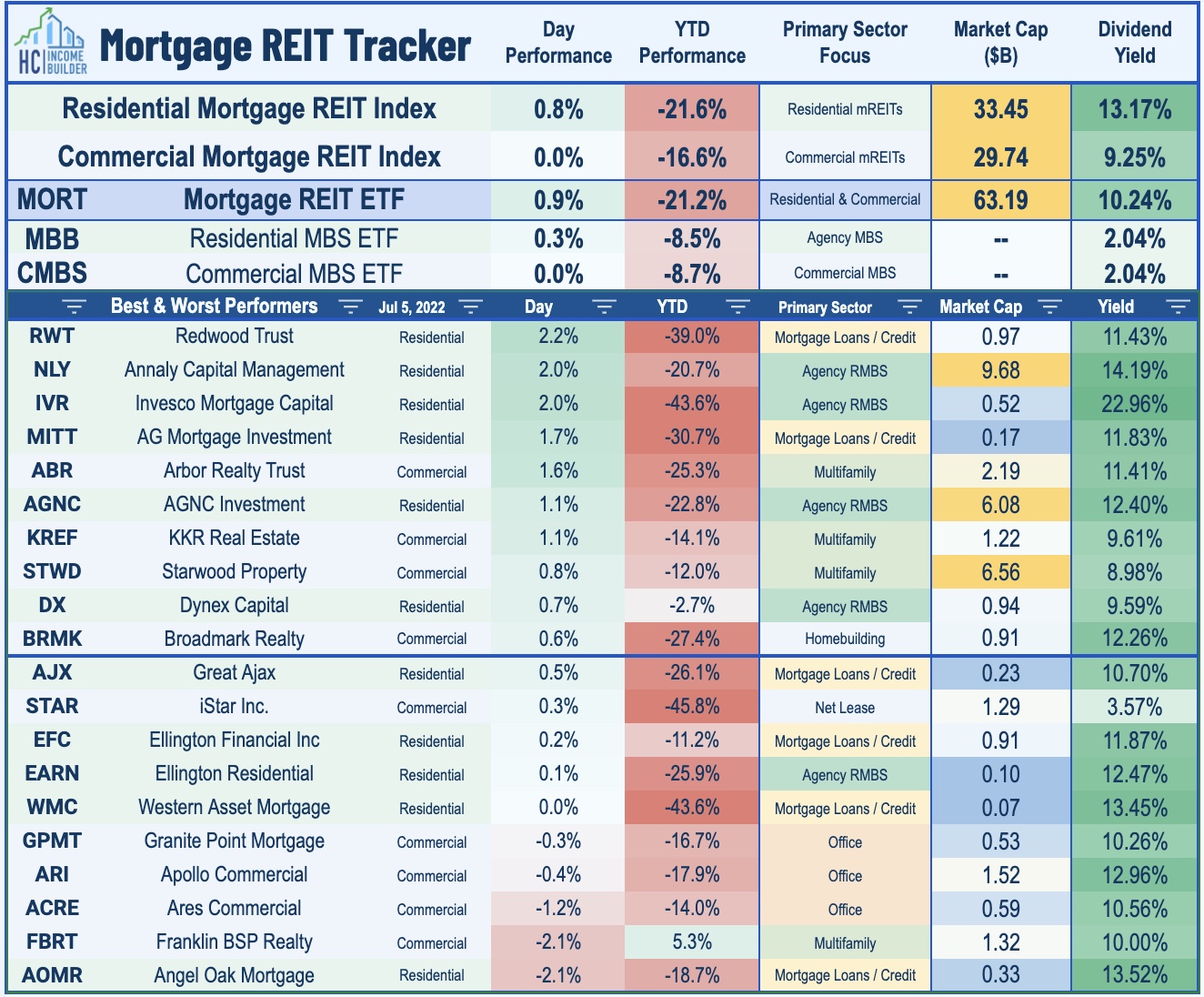

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly higher today with residential mREITs gaining 0.8% while commercial mREITs finished fractionally higher. On a quiet day of newsflow, upside leaders included Redwood Trust (RWT), Annaly Capital (NLY), and Invesco Mortgage (IVR).

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished lower by 0.88% today, on average. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 7.06%. In the capital markets today, Apartment Income REIT (AIRC) issued $400M of senior unsecured notes at a weighted average effective interest rate of 4.3% and a weighted average maturity of eight years.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.