REIT Earnings • Risk-On • Home Sales Slow

- U.S. equity markets posted broad-based gains for a second day Wednesday as solid corporate earnings results and emerging signs of cooling global inflation have pulled some investors back into risk assets.

- Posting its first back-to-back gain in two weeks and pushing its weekly gains to 2.5%, the S&P 500 advanced 0.6% today while the tech-heavy Nasdaq 100 rallied 1.6%.

- Real estate equities were mixed today as investors gear up for a busy slate of REIT earnings reports over the coming two weeks. The Equity REIT Index slipped 0.2%.

- After the close today, Rexford Industrial (REXR) reported very strong earnings results while significantly boosting its full-year outlook, the third better-than-expected industrial earnings report this season amid concerns over a potential slowdown in leasing demand.

- Homebuilders lagged following weaker-than-expected Existing Home Sales data, which declined to the slowest pace since early in the pandemic while mortgage demand has been similarly weak.

Income Builder Daily Recap

U.S. equity markets posted broad-based gains for a second day Wednesday as solid corporate earnings results and emerging signs of cooling global inflation have pulled some investors back into risk assets. Posting its first back-to-back gain in two weeks and pushing its weekly gains to 2.5%, the S&P 500 advanced 0.6% today while the tech-heavy Nasdaq 100 rallied 1.6%. Real estate equities were mixed today as investors gear up for a busy slate of REIT earnings reports over the coming two weeks. The Equity REIT Index slipped 0.2% with 13-of-18 property sectors in positive territory while the Mortgage REIT Index gained 0.9%. Homebuilders lagged following weaker-than-expected Existing Home Sales data, which declined to the slowest pace since early in the pandemic while mortgage demand has been similarly weak.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Industrial: After the close today, Rexford Industrial (REXR) reported very strong earnings results while significantly boosting its full-year outlook, the third better-than-expected industrial earnings report this season amid concerns over a potential slowdown in leasing demand. REXR raised its full-year FFO growth outlook by 150 basis points to 14.9% and its full-year NOI growth outlook by 150 basis points to 8.75%. Noting that "tenant demand continues to exceed supply," REXR reported incredible leasing spreads of 83% GAAP and 62% cash on 1.4 million square feet of new and renewed leases with its occupancy rate at record highs above 99%. Earlier in the week, Prologis (PLD) and Duke Realty (DRE) reported similarly impressive results with few signs of slowing demand.

We'll also hear results this afternoon from industrial REIT First Industrial (FR), office REIT SL Green (SLG), and cell tower REIT Crown Castle (CCI). Yesterday, we published our REIT Earnings Preview which discusses the major themes and metrics we'll be watching across each of the major property sectors this earnings season. Since the start of last earnings season, the Equity REIT Index has declined 16%, slightly lagging the 12% decline in the S&P 500 during this time while the 10-Year Yield is essentially after a brief surge to 3.50%. The past quarter has seen a reversal in property sector performance trends since early in 2022 with interest-rate-sensitive REITs catching a bid while pro-cyclical REITs have lagged on recession concerns.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were again broadly higher today with residential mREITs gaining 1.1% while commercial mREITs advanced 0.6%. On a slow down of mREIT-related newsflow, Arlington Asset (AAIC) and AG Mortgage (MITT) led to the upside while ACRES Realty (ACR) was the laggard. With mREIT earnings season kicking off next week - a period that included the sharp bond market sell-off from mid-April through mid-June - analysts expect that residential mREITs will report average BVPS declines of around 10% in the quarter while commercial mREIT BVPS are expected to be roughly flat.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 0.36% today, on average. REIT Preferreds are lower by roughly 10% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.97%.

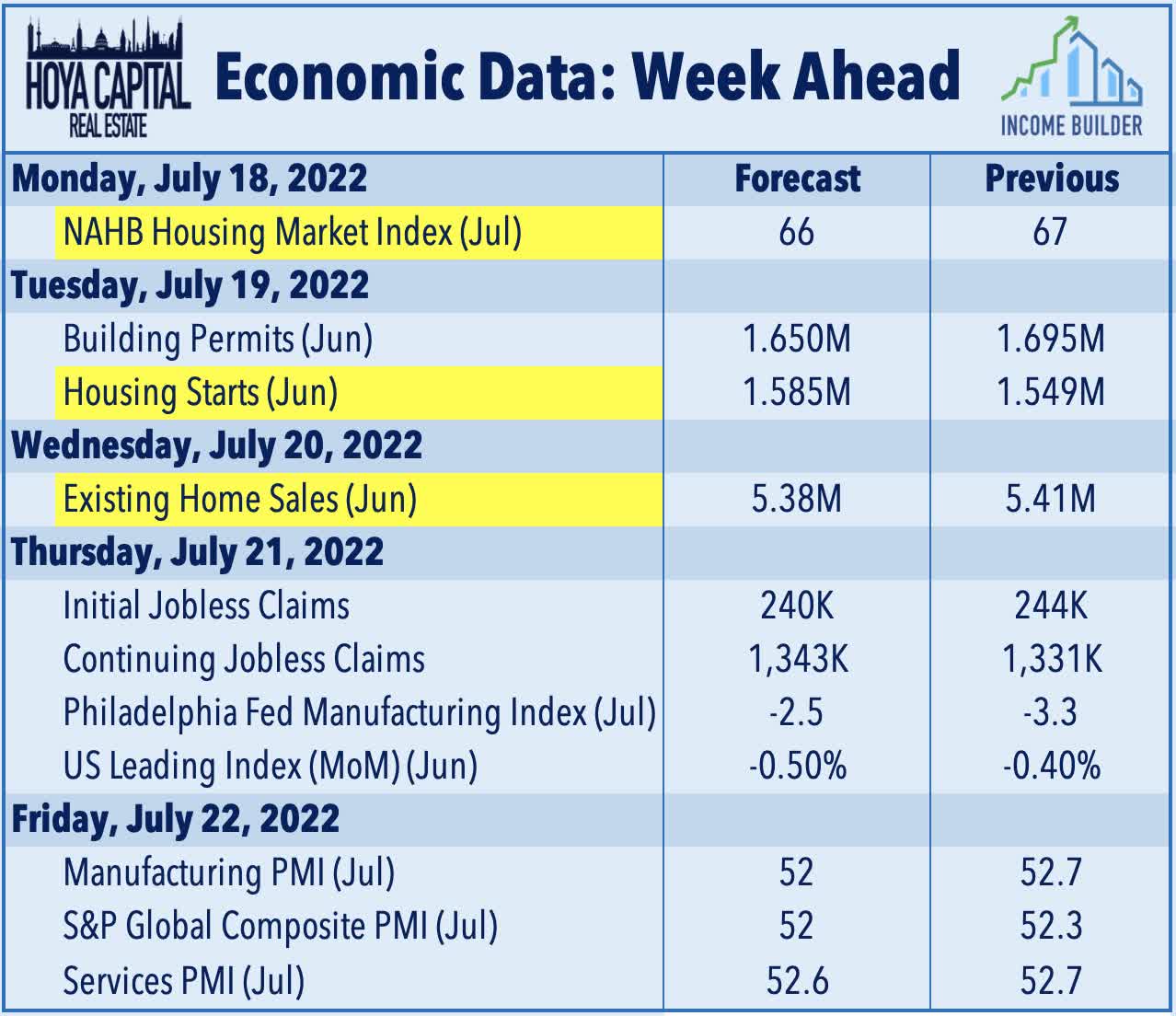

Economic Data This Week

The state of the housing market will continue to be in focus throughout the week with a trio of reports showing a continued cool down in activity over the past month, reflecting the surge in mortgage rates which climbed to nearly 6% in late June before moderating in recent weeks. On Monday we saw Homebuilder Sentiment data, on Tuesday we saw Housing Starts and Building Permits data, and today we saw Existing Home Sales. There are some early signs that the recent dip in mortgage rates, moderating home prices, and slightly higher inventory levels have pulled some potential buyers back into the fold in recent weeks, however, as the Redfin Homebuyer Demand Index has rebounded about 5% from its late-June lows.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.