Inflation Cools • Stocks Rally • REIT Earnings Wrap-Up

- U.S. equity markets rallied Wednesday on data showing that consumer price inflation moderated from multi-decade-highs in July as global commodities prices cooled, potentially taking some pressure off the Fed.

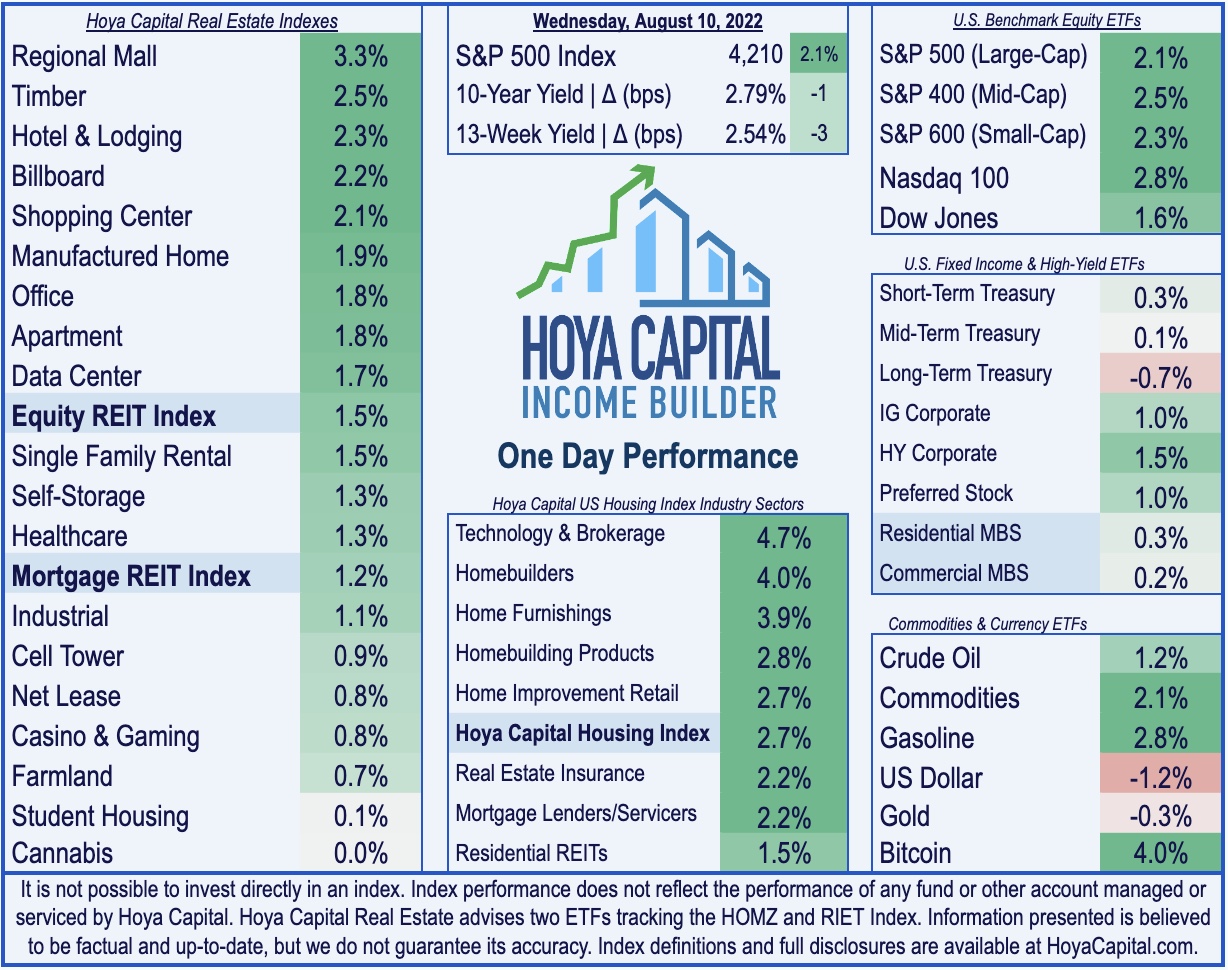

- Rebounding from two days of declines, the S&P 500 jumped 2.1% today while the tech-heavy Nasdaq 100 rallied nearly 3% - now having rebounded 20% from its recent lows.

- Real estate equities were broadly higher as well with the Equity REIT Index advancing 1.5% with all 18 property sectors in positive-territory while the Mortgage REIT Index advanced 1.2%.

- Peak Inflation? Perhaps. Consumer prices decelerated in July from multi-decade highs set in June as slowing global economic growth helped to put downward pressure on goods prices.

- Homebuilders were notable outperformers today as mortgage rates continue to pull-back from their peaks - now a half-percentage point below their June highs. Notably, Homebuilders trade at historically low P/E multiples - below their housing crisis lows.

Real Estate Daily Recap

U.S. equity markets rallied Wednesday on data showing that consumer price inflation moderated from multi-decade-highs in July as global commodities prices cooled, potentially taking some pressure off the Federal Reserve in their recent course of aggressive interest rate hikes. Rebounding from two days of declines, the S&P 500 jumped 2.1% today while the tech-heavy Nasdaq 100 rallied nearly 3% - now having rallied 20% from its recent lows. Real estate equities were broadly higher as well with the Equity REIT Index advancing 1.5% with all 18 property sectors in positive territory while the Mortgage REIT Index advanced 1.2%. Homebuilders and the broader Hoya Capital Housing Index were notable outperformers today as mortgage rates continue to pull back from their peaks - now a half-percentage point below their June highs.

Peak Inflation? Perhaps. Consumer prices decelerated in July from multi-decade highs set in June as slowing global economic growth helped to put downward pressure on gasoline and commodity prices, offsetting a continued rise in services costs. The annual increase in the headline Consumer Price Index decelerated to 8.5% in July - below the 8.7% rate expected - and below the 9.0% rate last month which was the highest since January 1981. Notably, the month-over-month change in the headline CPI was fractionally negative - the first monthly price decline since May 2020 - as the gasoline index fell 7.7% in July to offset increases in the food and shelter indexes. The Core CPI - the metric on which the Fed focuses its attention - rose 5.9% - steady with last month but cooler than estimates of 6.1%.

As we've discussed for the last year, we continue to project that shelter will increasingly become the primary driver of inflation - a role it assumed for much of the prior decade - which will be especially likely given the delayed recognition of soaring shelter costs - the single largest weight in the CPI Index - which are just beginning to filter into the data. The shelter index rose 5.7% over the last year, accounting for about 40 percent of the total increase in all items less food and energy. We believe this still significantly understates the actual rise in shelter costs as private market rent data has shown that national rent inflation has been in the 10-15% range over the past twelve months while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Healthcare: Senior housing REIT Welltower (WELL) was among the laggards today after reporting mixed results in the second quarter, reporting stronger-than-expected FFO in Q2 but noted that it saw a "significant drop in tour volume" in July and ended the month about 5% below June. For the third quarter, Welltower commented that it expects "robust pricing power and occupancy growth" to offset "persistent expense pressures." WELL is targeting Q3 occupancy to be about 400 basis points above its 2021-levels - a slowdown from the 500 bps improvement in Q2 - while targeting same-store revenue growth of 10% for the quarter, modestly below the 11.5% year-over-year rate achieved in Q2. More broadly, as discussed in our recent Healthcare REIT report, while Senior Housing lagged on the downside during the pandemic, it's now leading the upside recovery with the recovery expected to accelerate into 2023.

We also had some news on the REIT M&A front over the past 24 hours as a pair of acquisitions were finalized. Blackstone (BX) closed on its acquisition of student housing REIT American Campus (ACC) for its non-traded REIT platform Blackstone Real Estate Income Trust (“BREIT”) in a $12.8B deal. Meanwhile, Cedar Realty (CDR) announced with Wheeler Real Estate (WHLR) that the total proceeds to Cedar common shareholders from the sale of Cedar's assets and subsequent merger in a series of related all-cash transactions will total $29.00/share and CDR's Board of Directors declared a special dividend of $19.52 per share with the remaining $9.48 being paid out in cash as merger consideration. A controversial deal, CDR's preferred distributions are expected to be suspended upon acquisition by WHLR, which has not paid a preferred distribution since 2018.

Earlier this week we published our REIT Earnings Recap: Rents Paid, Dividends Raised. The U.S. REIT industry - which remains relatively "early" in its post-pandemic recovery - exhibited few signs of softness in the second quarter even as the U.S. entered a technical recession. Earnings results from residential, self-storage, and shopping center REITs were most impressive, followed closely behind by industrial and net lease REITs. Office REITs were the lone weak spot among major sectors. Nearly two-thirds of REITs raised their full-year guidance. Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market in which less than 50% of S&P 500 companies raised their 2022 earnings outlook. Another dozen REITs hiked their dividends this earnings season, bringing the full-year total for the REIT sector to 86.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly higher with residential mREITs advancing 0.7% while commercial mREITs gained 1.0%. Angel Oak Mortgage (AOMR) surged nearly 5% today after reporting better-than-expected results as strong distributable earnings growth offset a 12% decline in its book value per share ("BVPS"). Arlington Asset (AAIC) finished slightly lower today despite reporting a 1.8% increase in its BVPS - the only residential mREIT to record an increase in book value in Q2. As discussed in our REIT Earnings Recap, mortgage REITs have rebounded sharply since mid-June as mortgage-backed bonds (MBB) have caught a bid following a brutal first-half of 2022. We'll hear the final report of mREIT earnings season this afternoon from Ellington Residential (EARN).

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 0.29% today, on average. REIT Preferreds are lower by roughly 5% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of roughly 6.75%

Economic Data This Week

The busy week of inflation data continues tomorrow with the Producer Price Index for July which is expected to exhibit similar trends of peaking price pressures. On Friday, we'll get our first look at Michigan Consumer Sentiment for August which includes a similar inflation expectations survey. Last month, sentiment fell to the lowest level in more than 10 years as persistent inflation and worries over economic growth have weighed on confidence. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.