Stocks Rebound • REIT Dividend Hikes • Satellite iPhone

- U.S. equity markets rebounded Wednesday as interest rates retreated and commodities prices fell sharply following reports of expanded lockdowns in China and deepening struggles in Europe from soaring energy prices.

- Advancing for just the second session in the past eight, the S&P 500 rallied 1.8% today while the tech-heavy Nasdaq 100 gained 2.0% to snap a skid of eight straight days of declines.

- Real estate equities were among the leaders for a second-straight day with the Equity REIT Index advancing by 2.0% today with all 18 property sectors in positive territory while the Mortgage REIT Index rebounded by 1.4%.

- Another day, another wave of REIT dividend increases. Shopping center REIT Phillips Edison (PECO) hiked its dividend by 4% while Ryman Hospitality (RHP) reinstated its dividend, bringing the full-year total to 103 REIT dividend hikes.

- Apple's new iPhone 14 will be capable of using satellites to send emergency messages when out of cellular range, a feature that had been rumored for several years and seen by some as a potential threat to traditional cell tower networks.

Real Estate Daily Recap

U.S. equity markets rebounded Wednesday as interest rates retreated and commodities prices fell sharply following reports of expanded lockdowns in China and deepening struggles in Europe from soaring energy prices. Advancing for just the second session in the past eight, the S&P 500 rallied 1.8% today while the tech-heavy Nasdaq 100 gained 2.0% to snap a skid of eight straight days of declines and the Mid-Cap 400 advanced 2.3%. Real estate equities were among the leaders for a second-straight day with the Equity REIT Index advancing by 2.0% today with all 18 property sectors in positive territory while the Mortgage REIT Index rebounded by 1.4%.

Another wave of strict lockdowns in China sent Crude Oil prices tumbling by more than 5% to the lowest levels since before the start of the Russia-Ukraine war, which helped to relieve some of the recent upward pressure on interest rates. After closing at the third-highest level of the past decade yesterday, 10-Year Treasury Yield retreated by 8 basis points today to close at 3.27%, giving a boost to some rate-senstive segments of the market including homebuilders and REITs. The U.S. Dollar Index, meanwhile, remained near two-decade highs. Ten of the eleven GICS equity sectors were higher on the day with Energy (XLE) stocks as the lone laggards. Consumer technology giant Apple (AAPL) advanced 1% following its major unveiling of the newest flagship iPhone which includes satellite communications features.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Another day, another wave of REIT dividend increases. Shopping center REIT Phillips Edison (PECO) - the newest shopping center REIT that went public in 2021 - hiked its dividend by 4% to $0.0933/month, representing a forward yield of 3.41%. Elsewhere, Ryman Hospitality (RHP) reinstated its quarterly dividend - which had been suspended since March 2020 - at $0.10/share, the sixth hotel REIT to reinstate its dividend. Also of note, NexPoint Diversified (NXDT) - which recently converted to a REIT from a closed-end fund - announced that it is switching from a monthly to a quarterly distribution frequency. We've now seen 103 REIT dividend hikes so far this year while six REITs have cut their dividends. As discussed this week in 100 REIT Dividend Hikes - our quarterly State of the REIT Nation Report - property-level fundamentals have been quite strong - and strengthening - for most property sectors in recent quarters despite the broader economic slowdown this year. Dividends per share rose by 15.1% in Q2 from last year, but total dividend payouts remain roughly 13% below pre-pandemic levels as many REITs have been exceedingly conservative in their dividend policies.

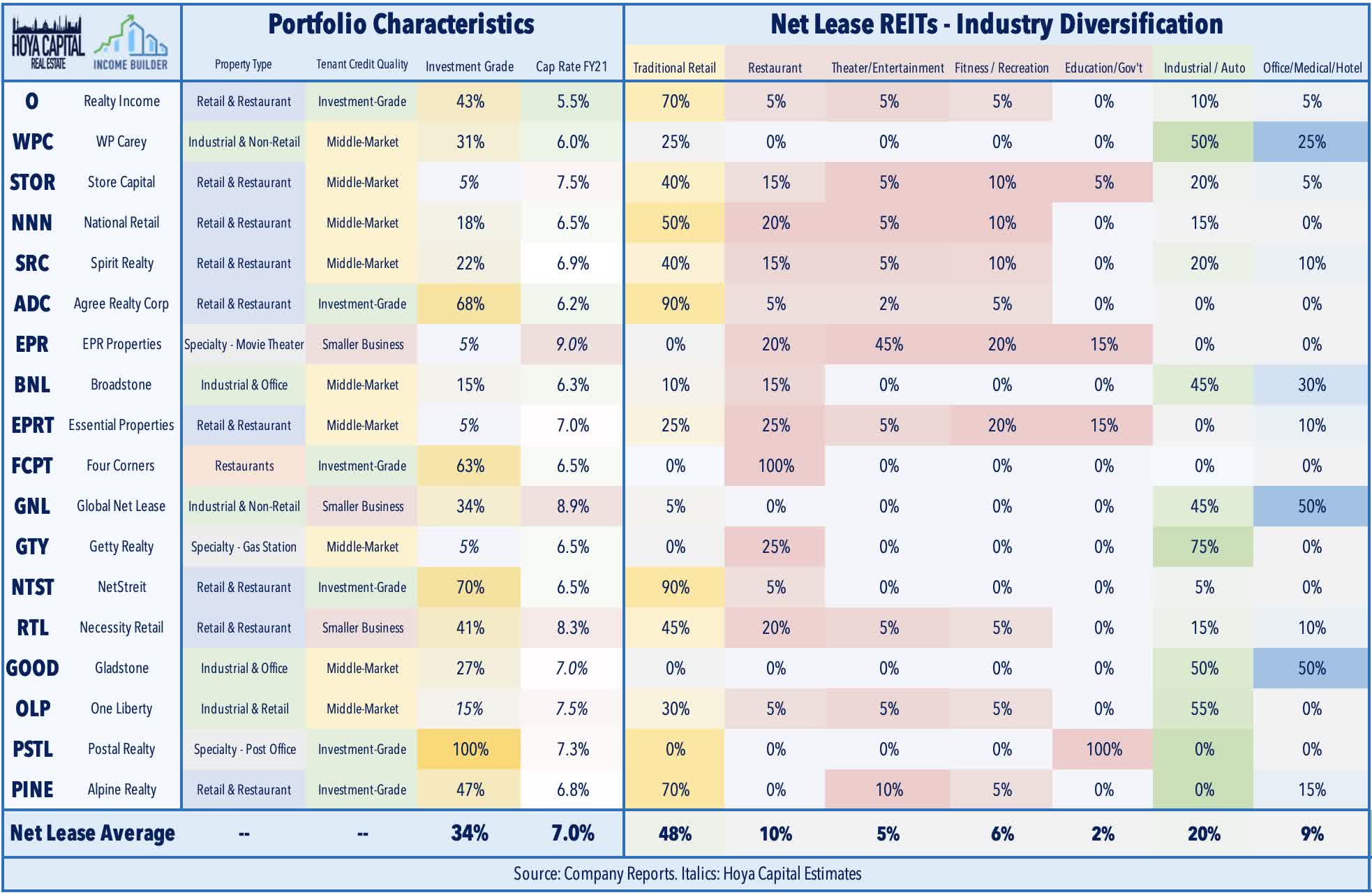

Net Lease: EPR Properties (EPR) lagged today after movie theater owner Cineworld - the global No. 2 movie-theater chain and owner of Regal Cinemas - officially filed for bankruptcy in the United States. The filing comes after reports last month that the operator was struggling financially as recent box office revenues have slowed following an early summer rebound. Cineworld noted that it anticipates emerging from bankruptcy protection during the first quarter of 2023, and it's "confident that a comprehensive financial restructuring is in the best interests of the Group and its stakeholders, taken as a whole, in the long term." Cineworld accounted for roughly 13% of EPR's rents through the first half of 2022, but analysts expect the operator to continue paying rent during the proceedings, but negotiate a "haircut" of between 10-25%. A handful of other net lease REITs have between 2-5% of their rents coming from movie theater tenants including Realty Income (O), Store Capital (STOR), National Retail (NNN), Essential Properties (EPRT), Spirit Realty (SRC), and Alpine Realty (PINE).

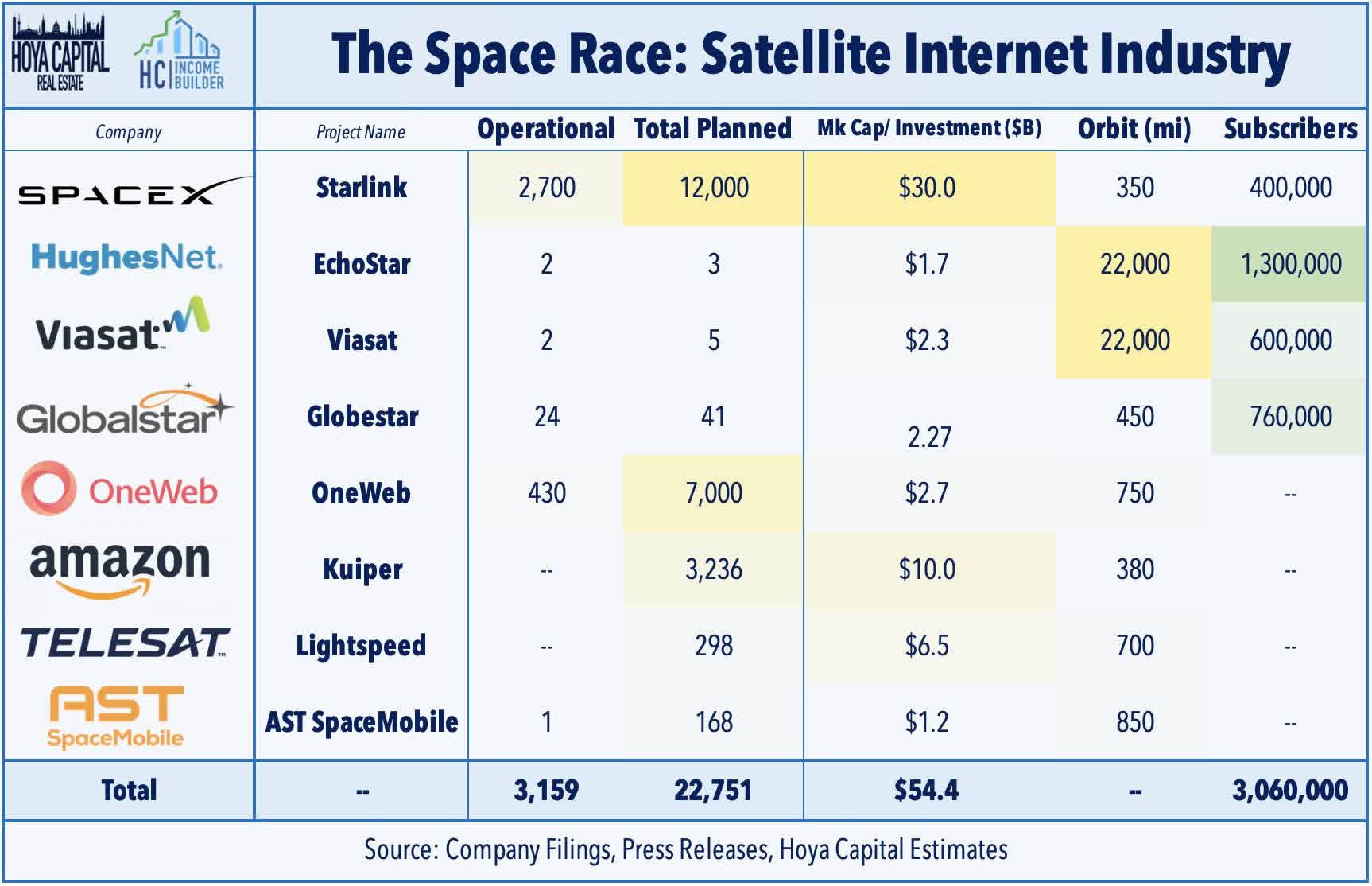

Cell Tower: Apple (AAPL) announced that its new iPhone 14 will be capable of using satellites to send emergency messages when out of cellular range utilizing the Globalstar (GSAT) network of low-earth orbit ("LEO") satellites - a feature that had been rumored for several years. Given the power consumption requirements of satellite communications, the feature will be capable of only low-bandwidth applications for a limited amount of time and users will need to physically aim the phone at the satellite. We continue to monitor - and be impressed by - the pace of Low Earth Orbit satellite service deployment, led by Starlink and OneWeb. While there is some risk of disintermediation to towers if the mobility of satellite connections improves, we see a higher likelihood that LEO networks will be “customers” rather than “competitors” to tower REITs. Cell Tower REITs - American Tower (AMT), Crown Castle (CCI), and SBA Communications (SBAC) - were each higher by more than 2% on the day.

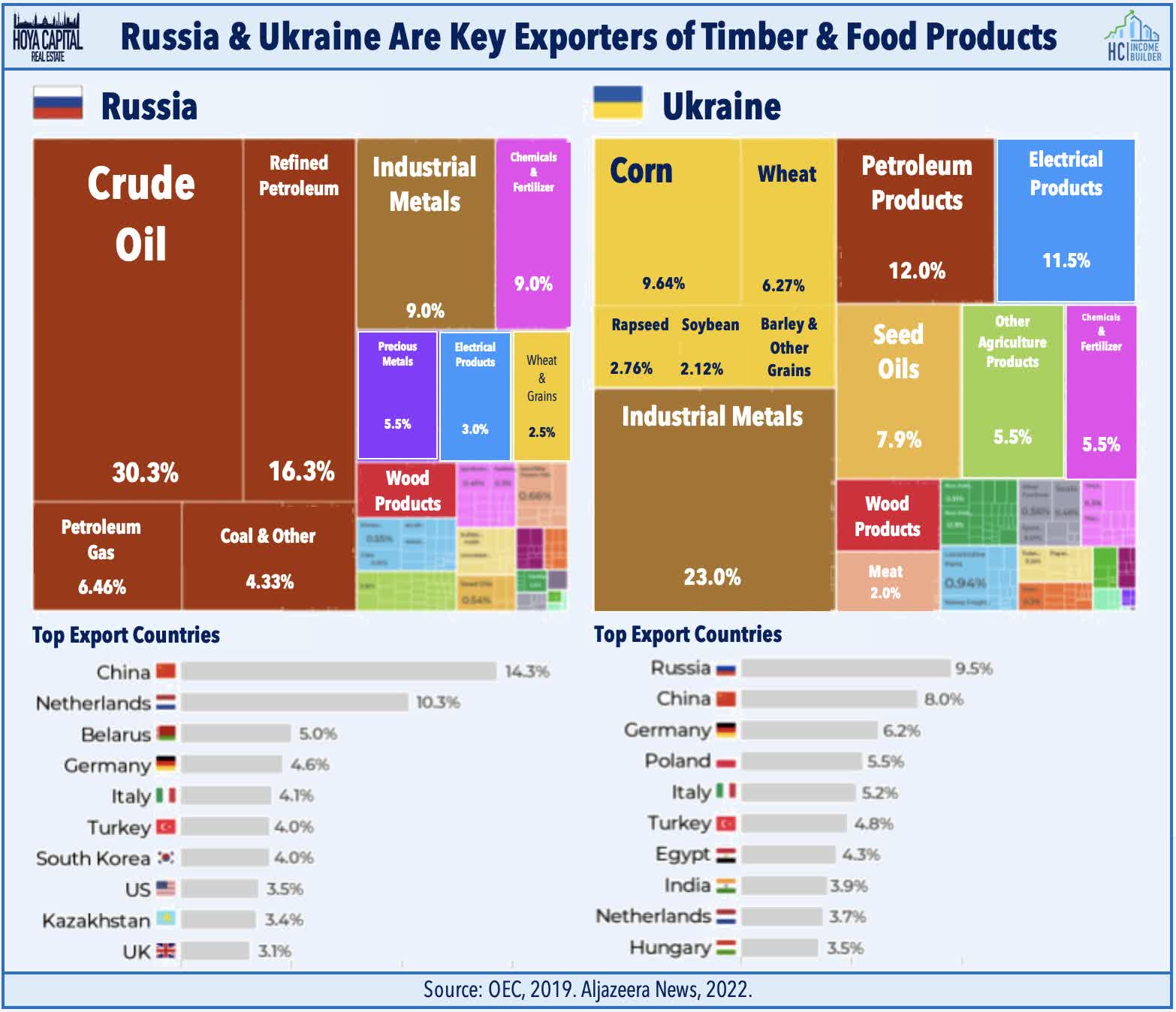

Land REITs: Today we published Land REITs: Hedge Inflation - And Chaos. While still outperforming the REIT Index this year, timber and farmland REITs have pulled back amid cooling inflation expectations, slumping global commodity demand, and regional weather complications. As the Russia-Ukraine conflict drags on, significant global market share gains are accruing to North American producers of the disrupted agricultural products - notably lumber and grains - supporting land values. "Feast or famine" has been a theme in the farmland sector of late. Despite severe drought conditions in the West, a productive growing season in the Midwest and South has raised aggregating U.S. farm incomes to near-record highs this year. For timber REITs, lumber prices have moderated back towards pre-pandemic levels as slumping home construction demand resulting from rising rates follows a record year of profitability. The rate-driven cooldown, however, simply defers the longer-term need for increased single-family home production.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded as well today residential mREITs and commercial mREITs each advancing 0.9%. On a quiet day of mREIT newsflow, iStar (STAR), Hannon Armstrong (HASI), and New York Mortgage (NYMT) led the gains on the upside while Western Asset (WMC) dragged on the downside.

Economic Data This Week

The economic calendar slows down in the Labor Day-shortened week ahead with U.S. equity and bond markets closed on Monday. Purchasing Managers' Index ("PMI") data will continue to be the major focus this week with a busy slate of reports released this morning with more to come throughout the week. We'll also be watching Jobless Claims data on Thursday. Investors should also expect another noisy week of Fed commentary as the "Blackout Period" before the September FOMC Meeting will begin at midnight on Friday.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.