Payrolls Ahead • Cannabis Pardons • Fed Unfazed

- U.S. equity markets finished broadly lower Thursday after a chorus of Federal Reserve officials reiterated their hawkish monetary policy stance ahead of a critical nonfarm payrolls report on Friday.

- Declining for a second day but still holding on to week-to-date gains of 4.5%, the S&P 500 finished lower by 1.0% while the Mid-Cap 400 and Small-Cap 600 posted more-muted declines.

- Real estate equities were laggards again today as long-term interest rates crept back toward recent highs. The Equity REIT Index declined another 3.0% today with 17-of-18 property sectors in negative-territory.

- Cannabis REITs were the lone property sector higher today after the Biden Administration took several steps towards further decriminalization, seeking to fulfill a campaign promise ahead of the midterm elections next month.

- Federal Reserve officials continued to closely toe the party line across a half-dozen public appearances today with Minneapolis Fed President Kashkari commenting that the Fed is “quite a ways away” from pausing rate increases despite the recent market instability.

Income Builder Daily Recap

U.S. equity markets finished broadly lower Thursday after a chorus of Federal Reserve officials reiterated their hawkish monetary policy stance ahead of a critical nonfarm payrolls report on Friday. Declining for a second day but still holding on to week-to-date gains of 4.5%, the S&P 500 finished lower by 1.0% today while the Mid-Cap 400 and Small-Cap 600 posted more-muted declines. Real estate equities were laggards again today as long-term interest rates crept back toward recent highs. The Equity REIT Index declined another 3.0% today with 17-of-18 property sectors in negative territory while the Mortgage REIT Index dipped 3.2%. Homebuilders were a bright spot today following several analyst upgrades, citing historically deep discounts.

Federal Reserve officials continued to closely toe the party line across a half-dozen public appearances today with Minneapolis Fed President Kashkari commenting that the Fed is “quite a ways away” from pausing rate increases despite the recent market instability. Despite weaker-than-expected jobless claims data this morning in which both Initial and Continuing Jobless claims were roughly 20k above expectations - the 10-Year Treasury Yield climbed another 7 basis points to 3.83% while the U.S. Dollar Index rallied for a second day - each retracing more than half of their early-week declines over the past two sessions. Crude Oil rallied for a fourth-straight day - sending Energy (XLE) stocks higher on the day - but providing little relief for consumer gasoline prices which surged to fresh record highs in several West Coast states impacted by constrained refining capacity.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Cannabis: Amid disappointment over the lack of progress in federal marijuana legislation during the Biden Administration's first two years in office, the President today took several steps towards further decriminalization, seeking to fulfill a campaign promise ahead of the midterm elections next month. The President announced that he would pardon federal offenses for simple possession and urge governors to issue similar pardons. The President is also asking for a review of marijuana’s classification as a Schedule 1 drug. Existing in a legal "grey area" in which federal, state, and local laws often contradict, cannabis has been federally restricted since the 1930s, but medical usage is now legal in 38 states while recreational usage is legal in 18 states following a burst of activity last year which saw five additional states legalize weed: New Jersey, New York, Virginia, New Mexico, and Connecticut. Just four U.S. states currently maintain a full prohibition of any cannabis-based product - Idaho, Nebraska, Kansas, and South Carolina - but even within these states, cannabis usage has been incrementally decriminalized over the past decade.

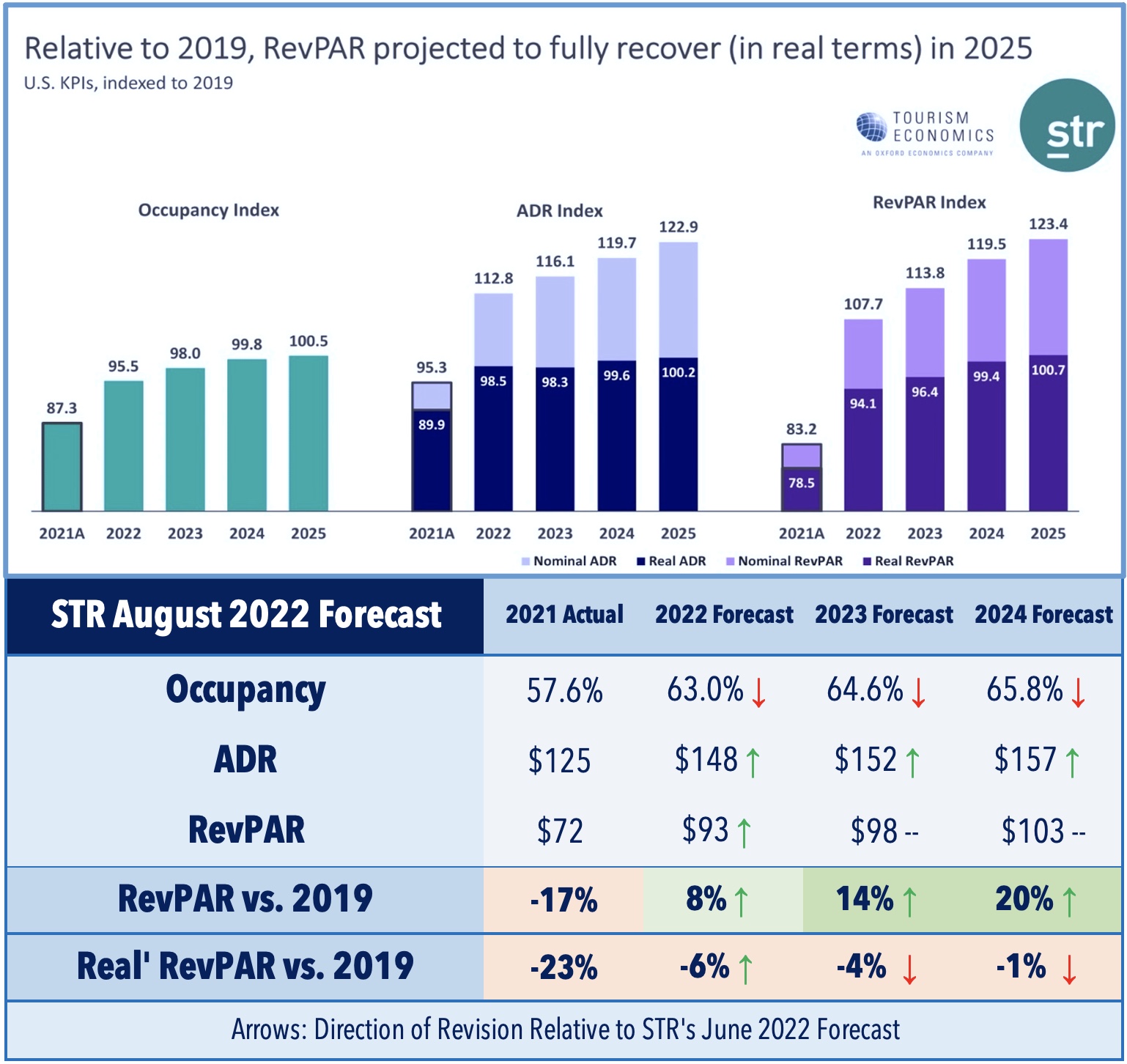

Hotels: Yesterday we published Hotel REITs: Winter Is Coming. Hotel REITs have held up surprisingly well throughout the recent market turmoil and remain one of the top-performing property sectors this year following a solid summer of operating performance. Several years of pent-up leisure demand from COVID delays helped to offset a slow business travel recovery, but we remain skeptical over the sustainability of the recovery in the upscale urban markets given the complexion of the RevPAR recovery - driven by pent-up leisure travel and surging room rates rather than an underlying occupancy recovery. While not as glamorous as full-service hotels, we see the limited-service segment as the superior source of long-term value while a handful of preferreds are also trading at compelling discounts.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, the wild week continued for mortgage REITs, which finished sharply lower for a second-straight day after a nearly-double-digit rally on Tuesday. Laggards today included Angel Oak (AOMR), Western Asset (WMC), and Two Harbors (TWO) while upside standouts included Lument Finance (LFT) and Arlington Asset (AAIC). After the close today, Ellington Financial (EFC) and Ellington Residential (EARN) each held their dividends steady with current rates.

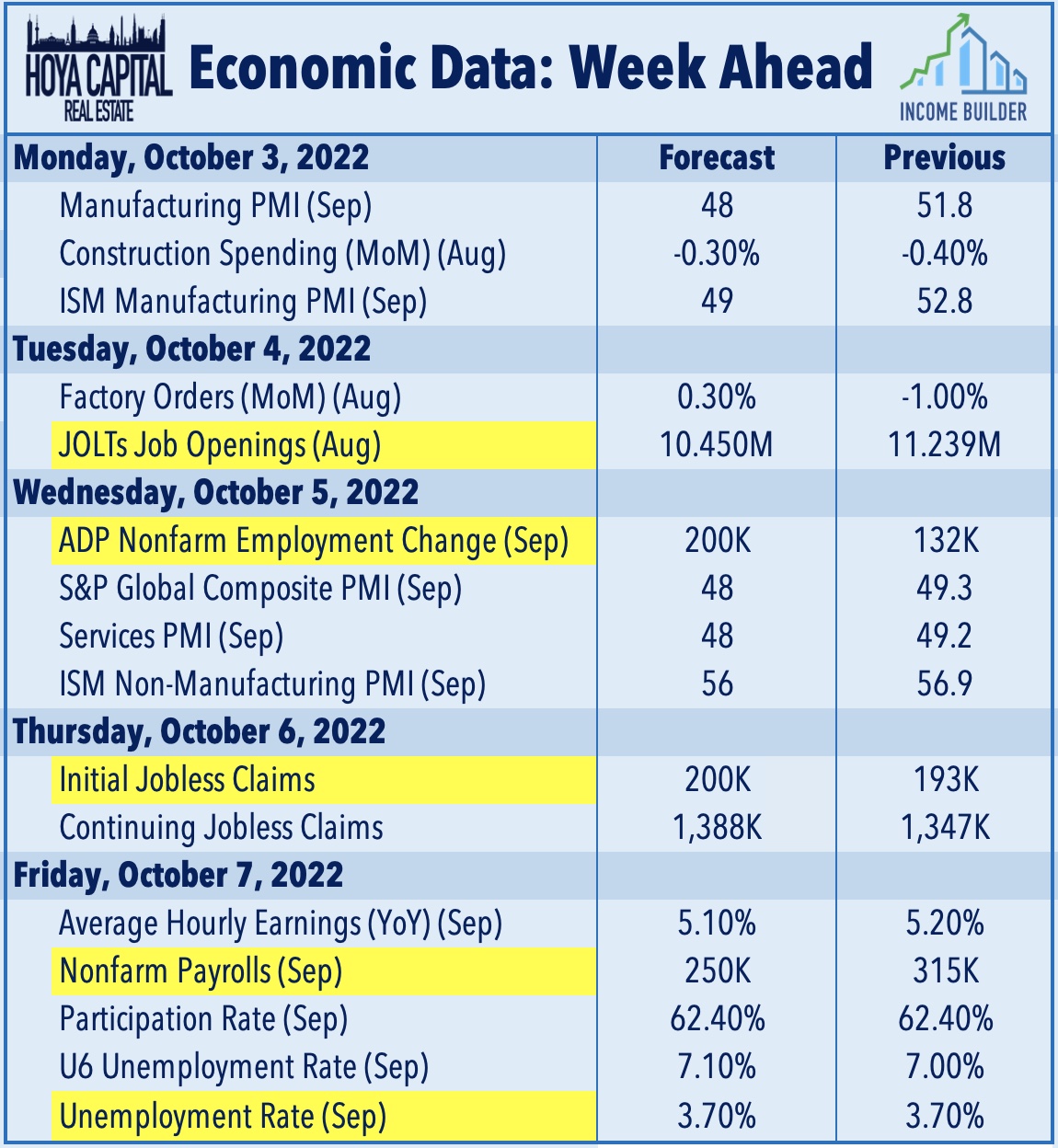

Economic Data In Week Ahead

The busy week of employment data concludes on Friday with the BLS Nonfarm Payrolls. Economists are looking for job growth of roughly 250k in September - which would be the smallest gain since December 2020 - and for the unemployment rate to stay steady at 3.70%.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.