Kushner REIT Deal • BOJ Intervention • Weekly Rebound

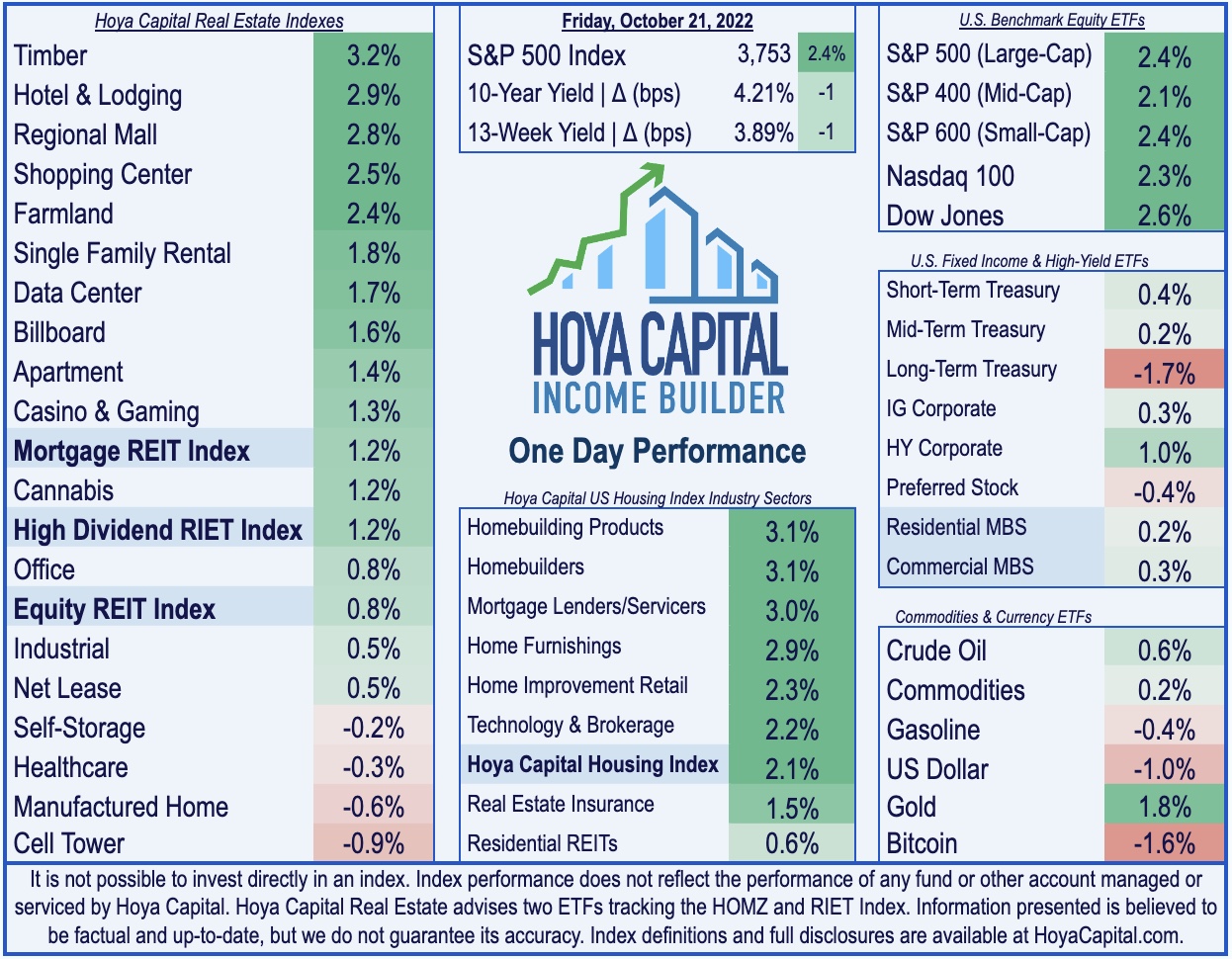

- U.S. equity markets used a late-session rally Friday to lift the major benchmarks to their best weekly gains since July after signs of further international financial market instability dragged sovereign yields lower.

- Gaining for just the third week in the past ten with weekly gains of 4.7%, the S&P 500 advanced 2.4% today while the tech-heavy Nasdaq pushed its weekly gains to nearly 6%.

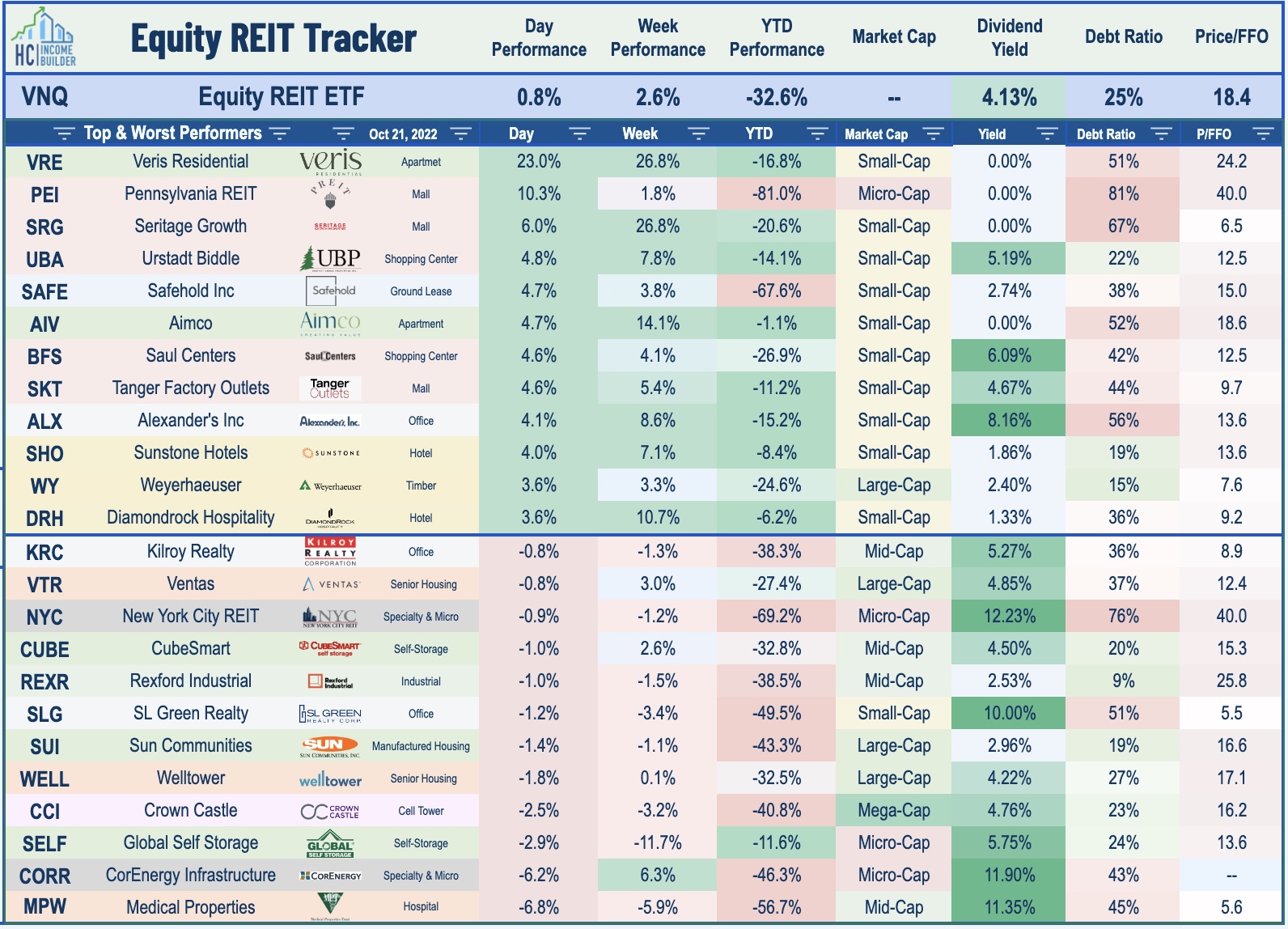

- Real estate equities were mostly-higher today as investors looked ahead to a busy two-weeks of REIT earnings reports. The Equity REIT Index advanced 0.8% today with 14-of-18 property sectors higher.

- Veris Residential (VRE) - which recently completed a strategy shift from an office REIT into a pure-play multifamily REIT - surged more than 20% today after an unsolicited takeover bid from Kushner Companies to externally manage the company or to acquire the company for $16/share.

- Hotel REIT Diamondrock (DRH) rallied nearly 4% after reporting preliminary third-quarter metrics, noting that its Revenue Per Available Room ("RevPAR") in Q3 was 8.7% above comparable 2019-levels while September was 9.8% above pre-pandemic levels.

Income Builder Daily Recap

U.S. equity markets used a late-session rally Friday to lift the major benchmarks to their best weekly gains since July after signs of further international financial market instability dragged sovereign yields lower. Gaining for just the third week in the past ten with weekly gains of 4.7%, the S&P 500 advanced 2.4% today while the tech-heavy Nasdaq 100 advanced 2.3% today and nearly 6% on the week. Real estate equities were mostly-higher today as investors looked ahead to a busy two weeks of REIT earnings reports. Led by the more 'pro-cyclical' property sectors, the Equity REIT Index advanced 0.8% today with 14-of-18 property sectors in positive territory while the Mortgage REIT Index advanced 1.2%.

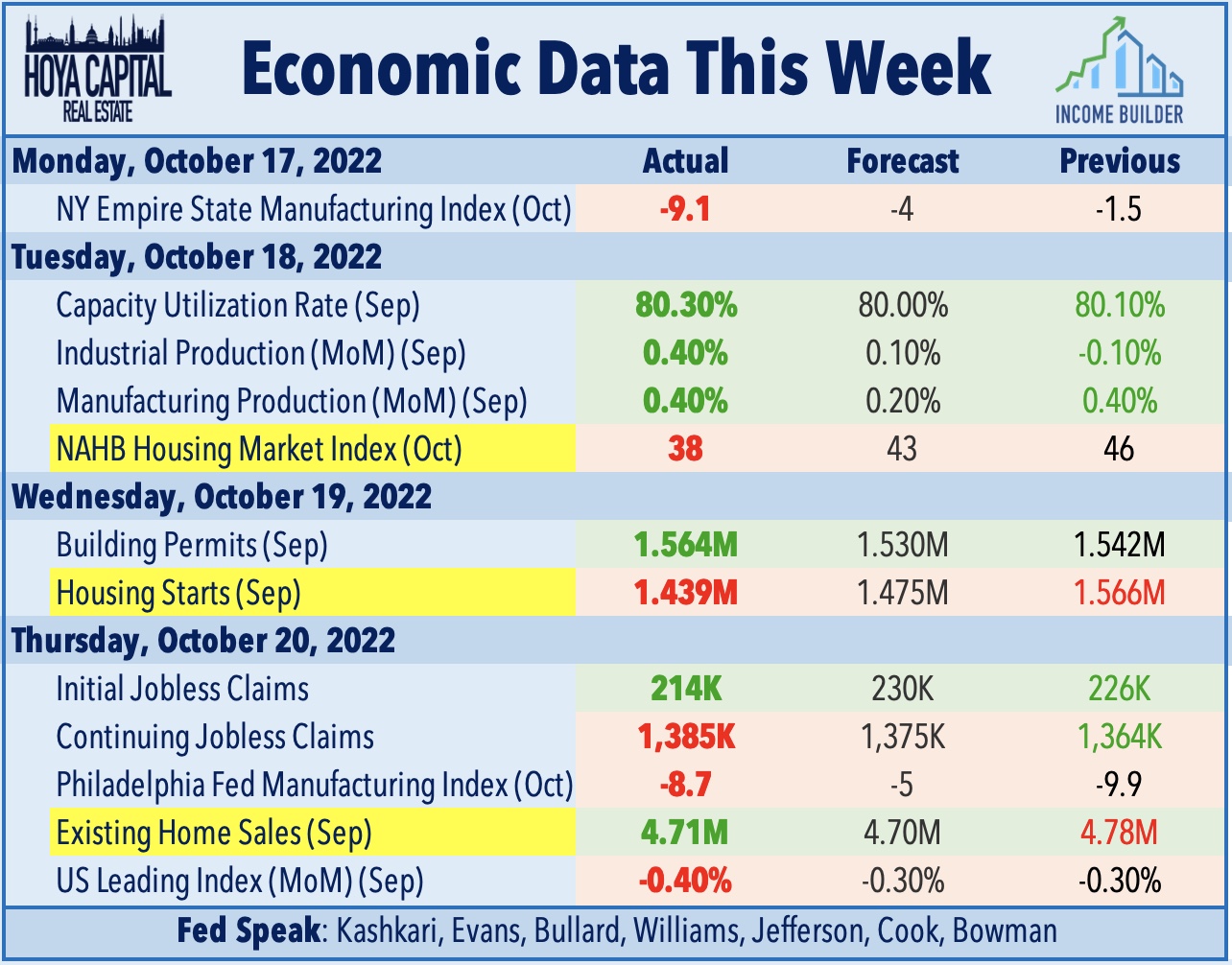

As the Federal Reserve entered its "quiet period" before its November FOMC meeting, the 10-Year Treasury Yield briefly topped 4.30% early in the session before reports of another BOJ intervention to stabilize the Yen dragged the benchmark rate lower from multi-decade highs. The U.S. Dollar Index dipped 1% on the day, pulling back from its highest-levels in two decades. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Apartment: Veris Residential (VRE) - which recently completed a strategy shift from an office REIT into a pure-play multifamily REIT - surged more than 20% today after an unsolicited takeover bid from Kushner Companies to externally manage the company or to acquire the company for $16/share - a premium of nearly 30% from its close on Thursday. The takeover bid comes after Veris - formerly known as Mack Cali - announced last week that it reached an agreement to sell its last remaining office assets in Jersey City for an aggregate price of $420M. Following the close of Harborside 1/2/3 and the stabilization of Haus25, multifamily will represent approximately 98% of Veris' Net Operating Income, up from 39% as of the end of the first quarter of 2021. Since early 2021, Veris has closed on roughly $1.4B in office sales while adding approximately 1,900 units to its residential portfolio, which is now comprised of roughly 7,700 units - primarily in the NYC metro area.

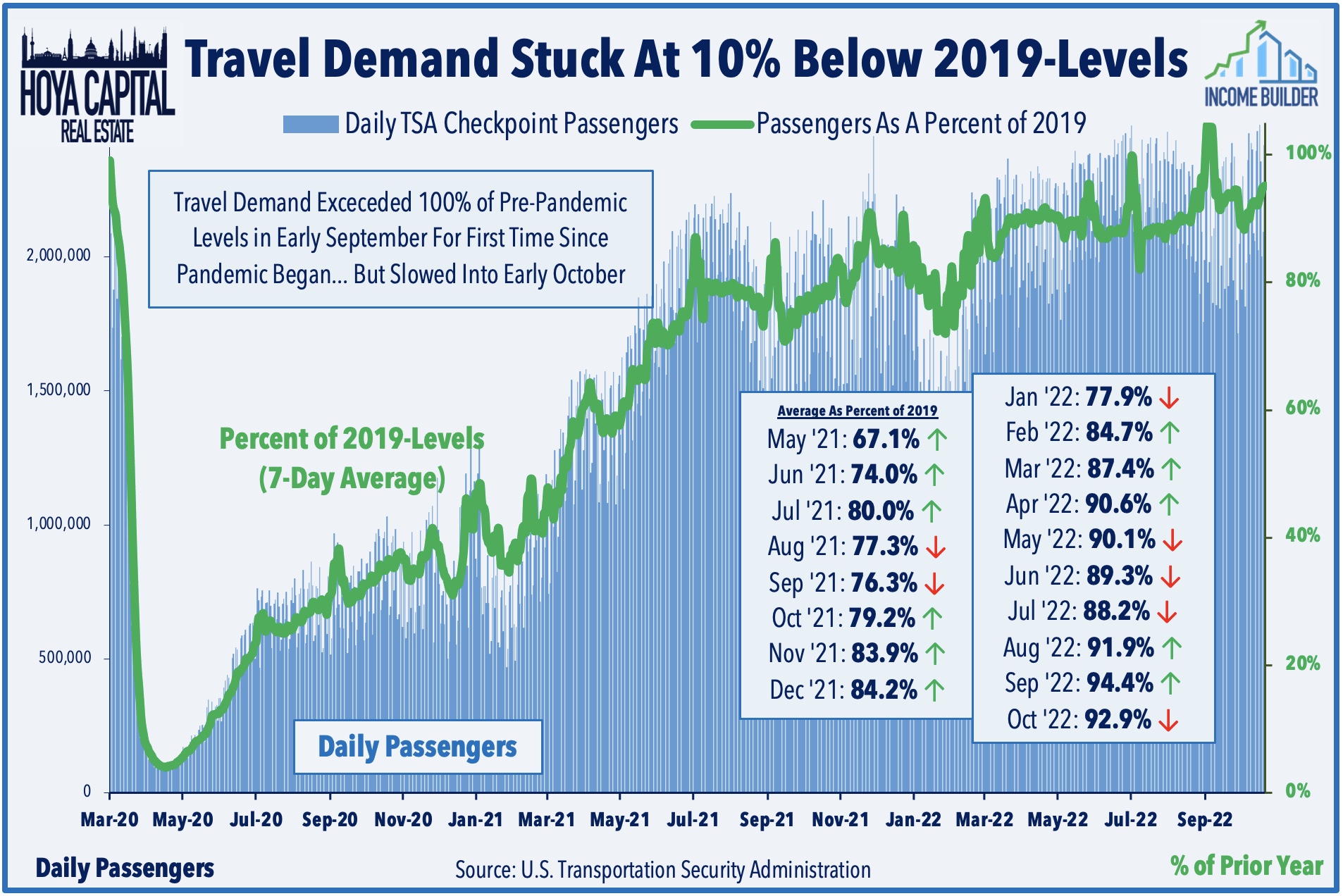

Hotel: Diamondrock (DRH) rallied nearly 4% after reporting preliminary third-quarter metrics, noting that its Revenue Per Available Room ("RevPAR") in Q3 was 8.7% above comparable 2019-levels while September was 9.8% above pre-pandemic levels. Pebblebrook Hotel (PEB) advanced 2% after reporting that its RevPAR in the third quarter was 1% above comparable pre-pandemic levels with the strongest month coming in September, which was about 5% above 2019-levels. Recent TSA Checkpoint data has shown that domestic travel throughout has held up in recent months as an uptick in business travel has offset a moderation in leisure demand.

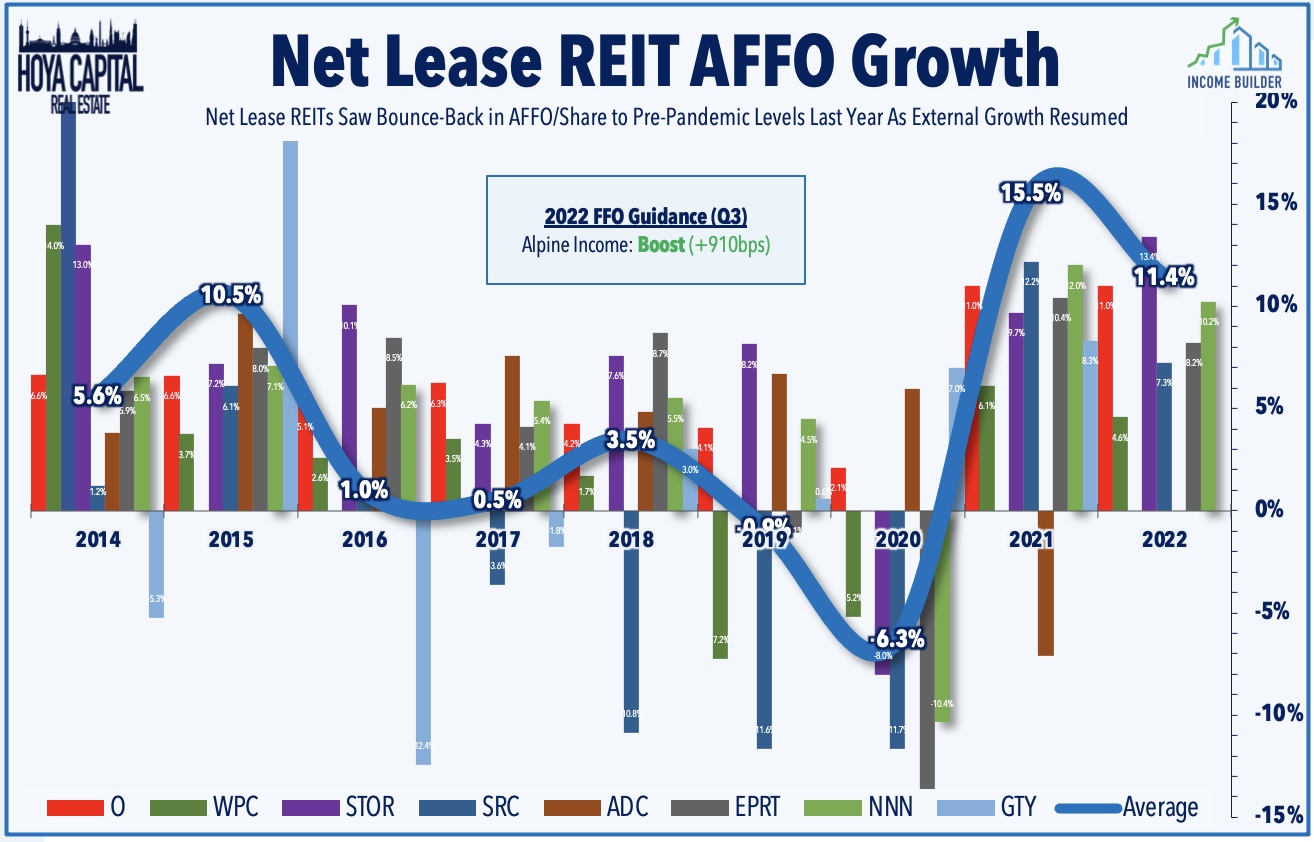

Net Lease: Small-cap Alpine Income (PINE) rallied nearly 2% today after it reported better-than-expected results and raised its full-year FFO outlook. The first net lease REIT to report Q3 results, PINE raised its full-year FFO growth target due primarily to a lower share count as the company also scaled back its acquisitions target. PINE now sees FFO growth rising 10.1% this year - up 910 basis points from its prior outlook. Acquisitions are targeted to be $170M-190M this year, down from $215M-235M in the previous guidance while dispositions are expected to be $150M-170M compared with $125M-175M in the prior target. We'll hear results next week from Getty Realty (GTY), Essential Properties (EPRT), and Netstreit (NTST).

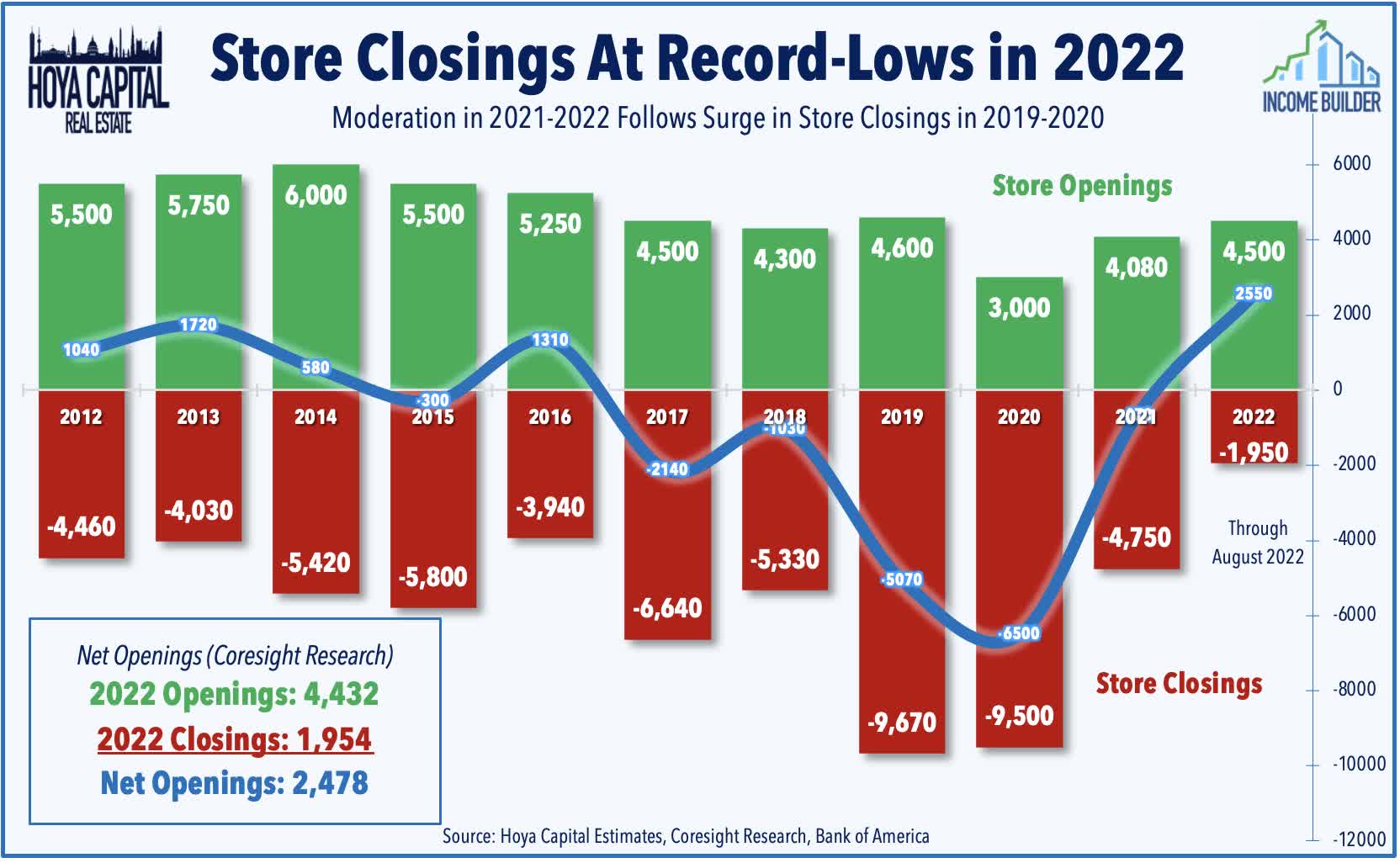

Shopping Centers: Today, we published Shopping Center REITs: Bargain Hunting. Shopping Center REITs are one of the better-performing property sectors this year- outpacing their mall REIT peers - as impressive earnings results and record-low store closings have offset looming recession concerns. The versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid "distribution centers" in last-mile delivery networks. Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since 2021 with particular strength in well-located strip centers. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are stronger than before the pandemic.

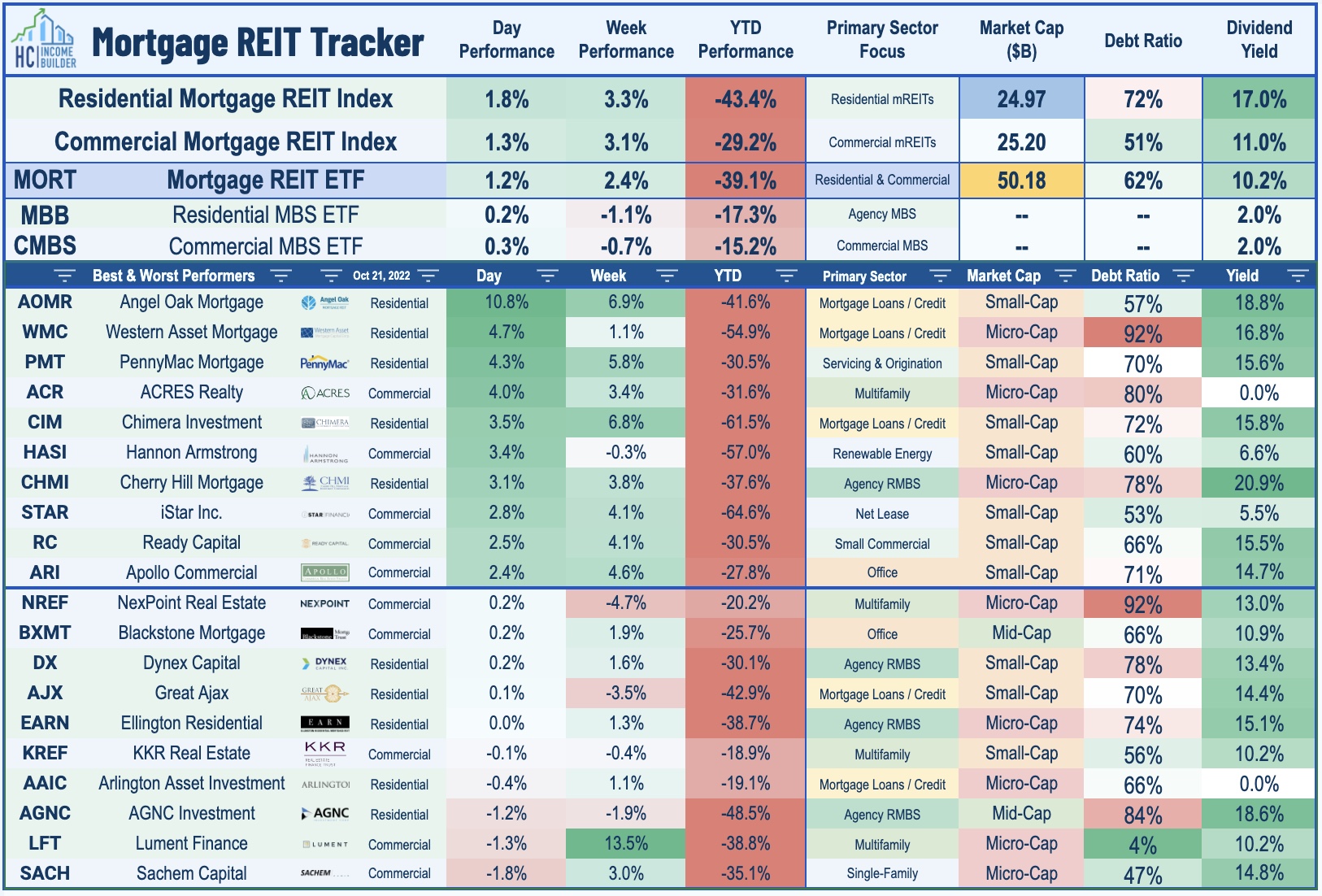

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were broadly today ahead of the start of earnings season next week with residential mREITs advancing 1.8% today while commercial mREITs gained 1.3%. As noted in our REIT Earnings Preview, over the past week, we've heard preliminary results from ten mREITs which showed BVPS declines ranging from 4-20% in Q3, but BVPS declines have been more muted for credit-focused mREITs compared to pure-play agency-focused mREITs.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.