Peak Inflation? • Stocks Roar • Yields & Dollar Plunge

- U.S. equity markets soared Thursday- posting their best gains since the April 2020 pandemic turmoil- after cooler-than-expected CPI inflation data sparked hopes of a Fed "pivot" towards less aggressive tightening.

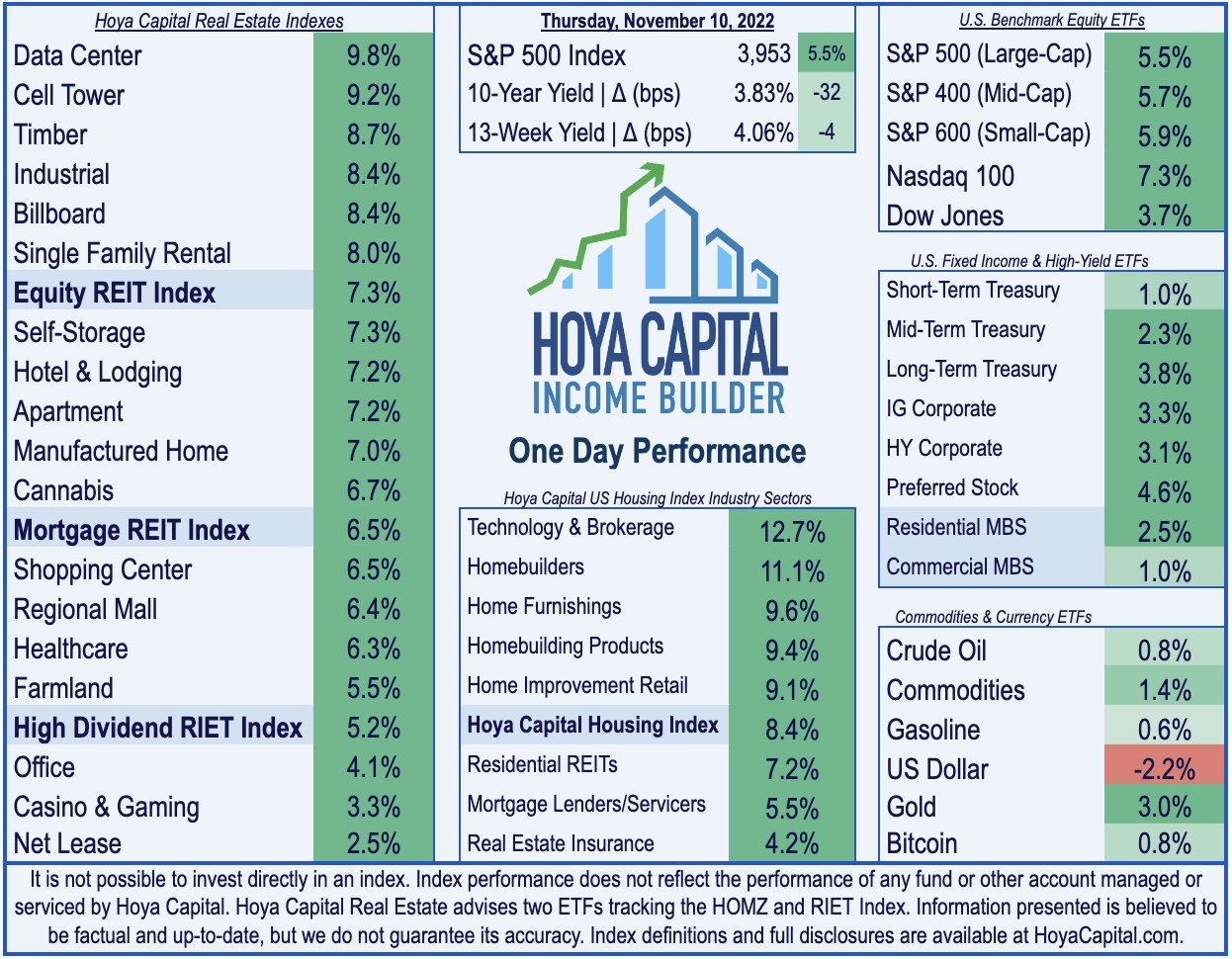

- Rebounding from a post-Election Day sell-off, the S&P 500 soared by 5.5% today while the tech-heavy Nasdaq 100 rallied more than 7%. Bitcoin stabilized following an early-week plunge.

- Real estate equities- the sector with perhaps the most potential upside from a Fed pivot - posted one of the strongest sessions on record. Equity REITs soared 7.3% while Homebuilders soared over 10%.

- The 10-Year Treasury Yield plunged 32 basis points to 3.83% today - down sharply from its highest late last month of 4.30% - while the U.S. Dollar Index posted one of its worst days on record, diving more than 2%.

- Sparking the rally across equity and bond markets, the Consumer Price Index showed a cooler-than-expected increase in prices in October with the Headline and Core CPI coming in well below expectations, indicating that inflationary pressures may finally be rolling over amid a broader global economic slowdown.

Income Builder Daily Recap

U.S. equity markets soared Thursday - posting their best gains since the April 2020 pandemic turmoil - after cooler-than-expected CPI inflation data sparked hopes of a Fed "pivot" towards less aggressive tightening. Rebounding from a post-Election Day sell-off, the S&P 500 soared by 5.5% today while the tech-heavy Nasdaq 100 rallied more than 7%. Real estate equities - the sector with perhaps the most upside from a potential Fed pivot - also posted their best day since the peak of the pandemic in early 2020 with the Equity REIT Index soaring 7.3% today with all 18 property sectors in positive territory while the Mortgage REIT Index advanced 6.5%. Homebuilders soared over 10%, lifting the Hoya Capital Housing Index to its best day on record.

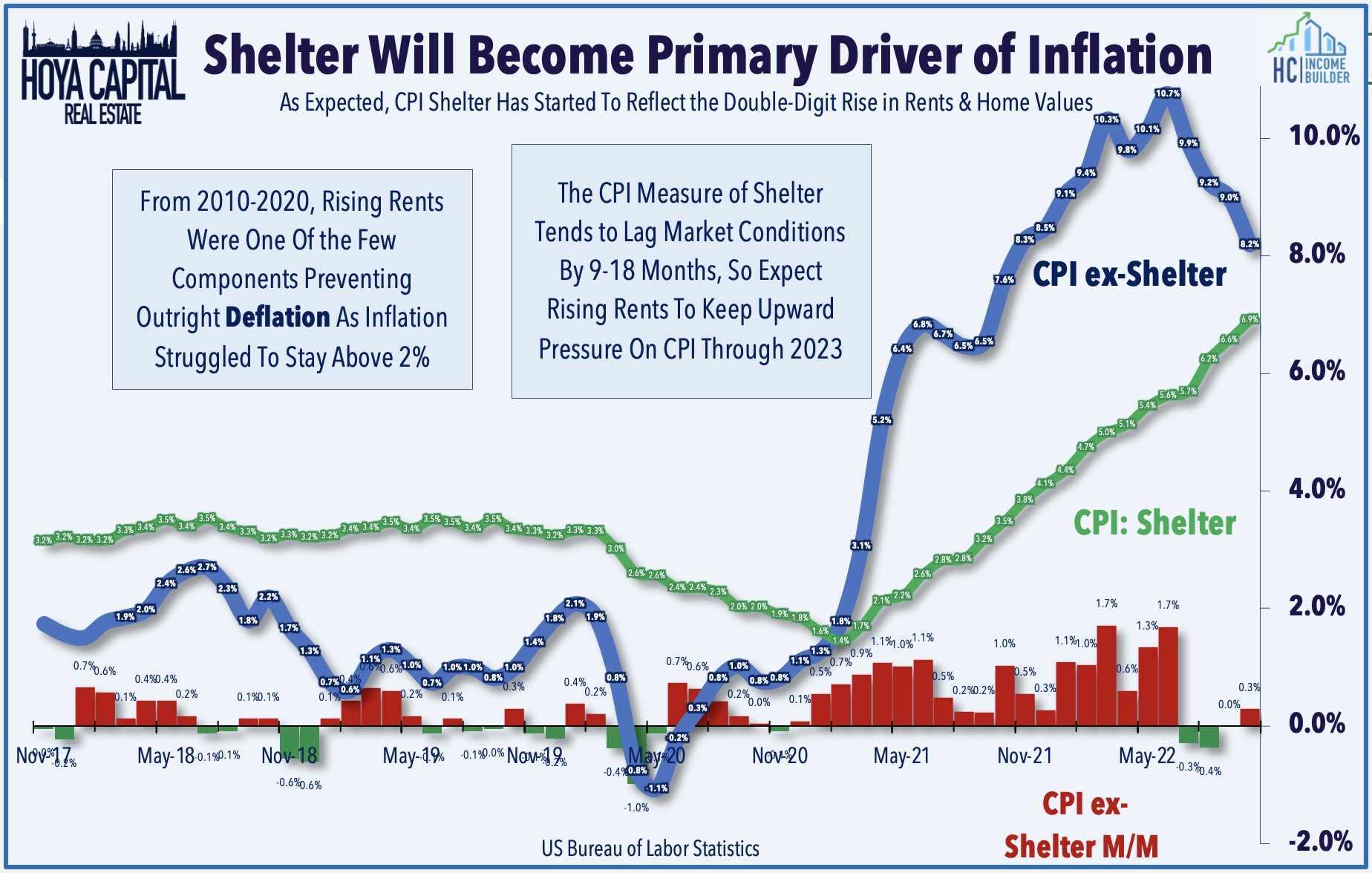

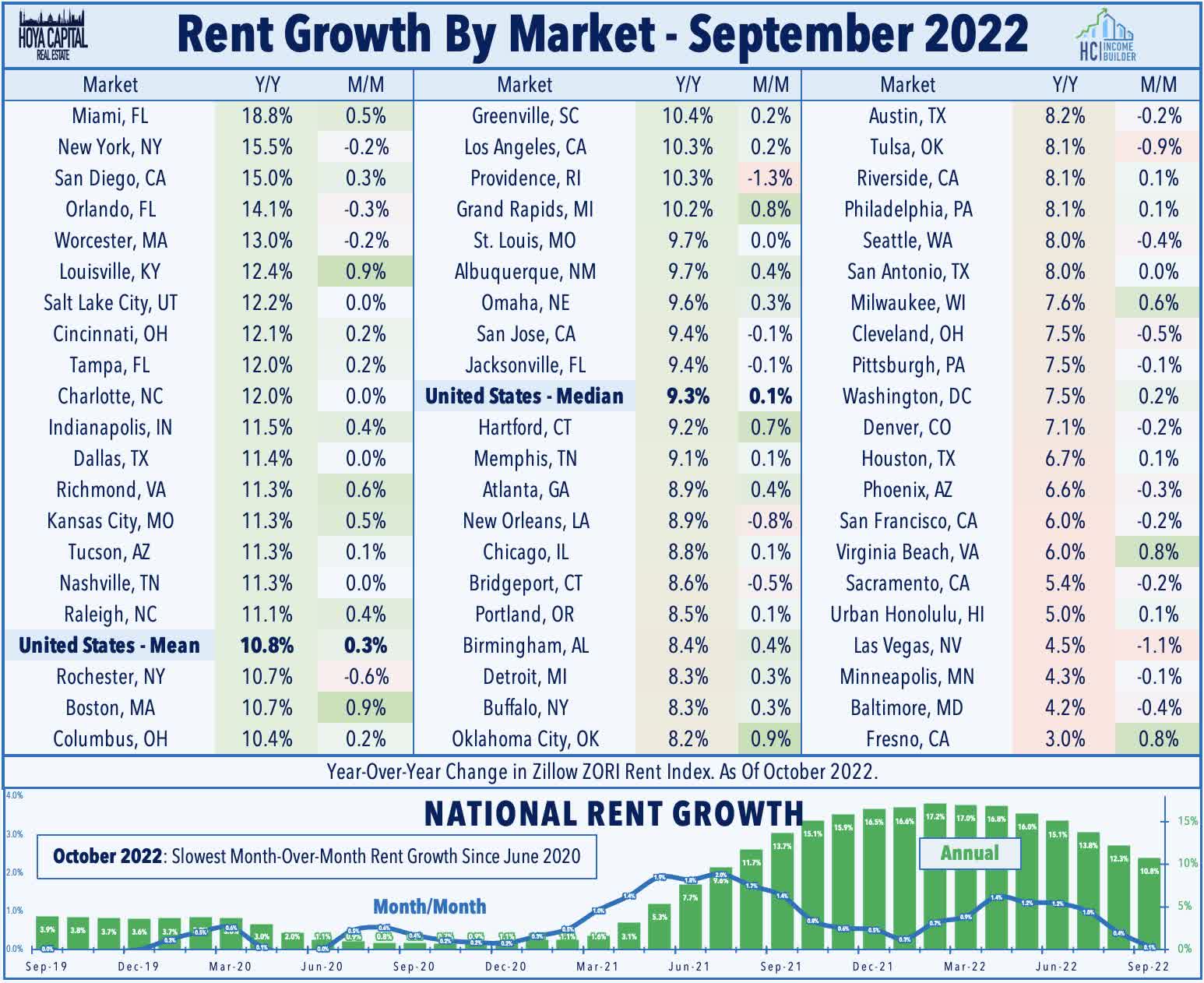

The 10-Year Treasury Yield plunged 32 basis points to 3.83% today - down sharply from its highest late last month of 4.30% - while the U.S. Dollar Index posted one of its worst days on record, diving more than 2%. Sparking the rally across equity and bond markets, the Consumer Price Index showed a cooler-than-expected increase in prices in October with the Headline and Core CPI coming in well below expectations, indicating that inflationary pressures may finally be rolling-over amid a broader global economic slowdown. The Headline CPI Index slowed to a 7.7% annual rate - the lowest since January - while the Core CPI Index posted its lowest monthly increase in over a year. The cooler-than-expected print came despite an acceleration in CPI Shelter to 6.9% - the highest annual increase since 1982 - which accounted for over half of the total increase in the Core CPI Index.

Real Estate Daily Recap

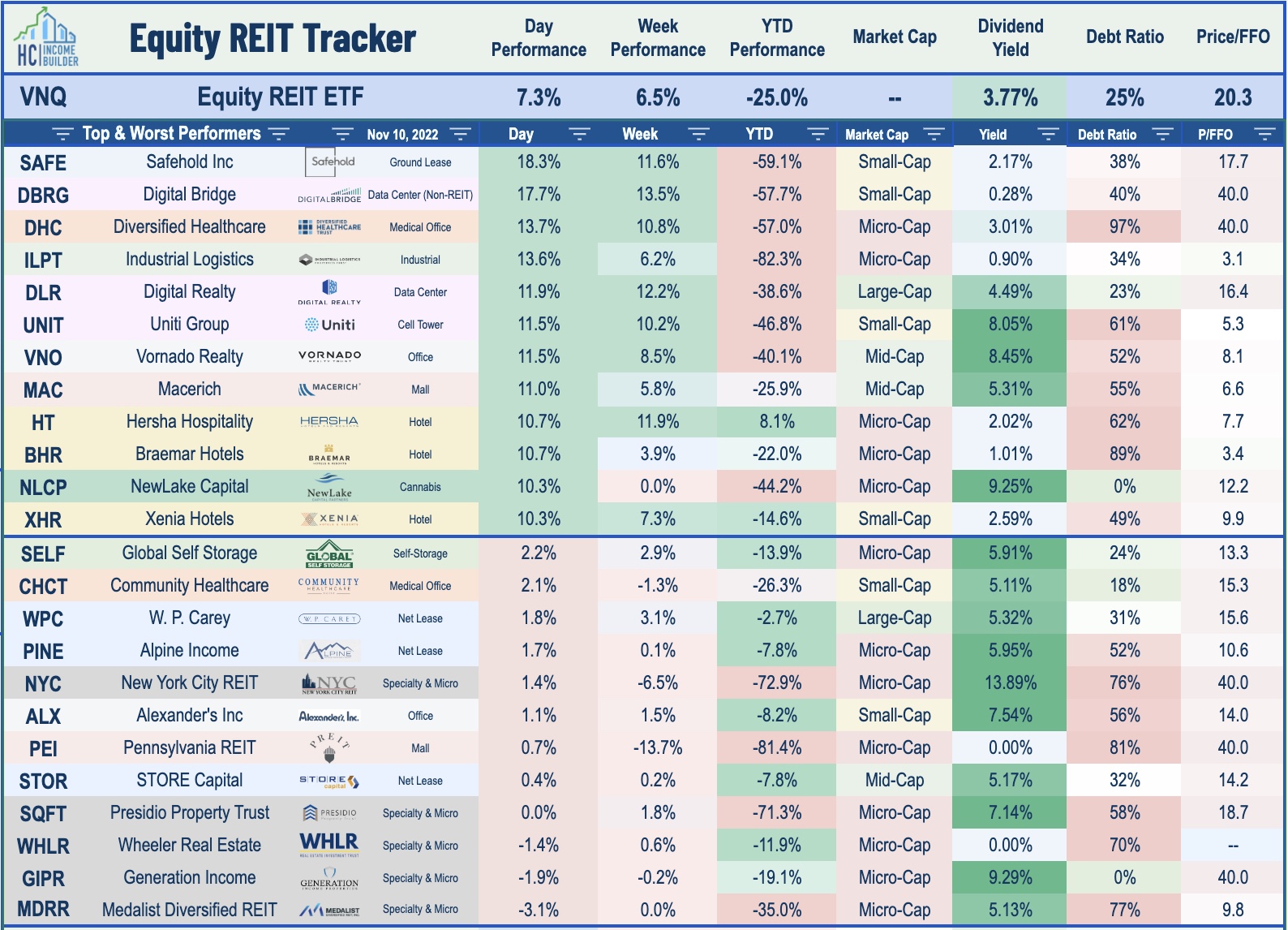

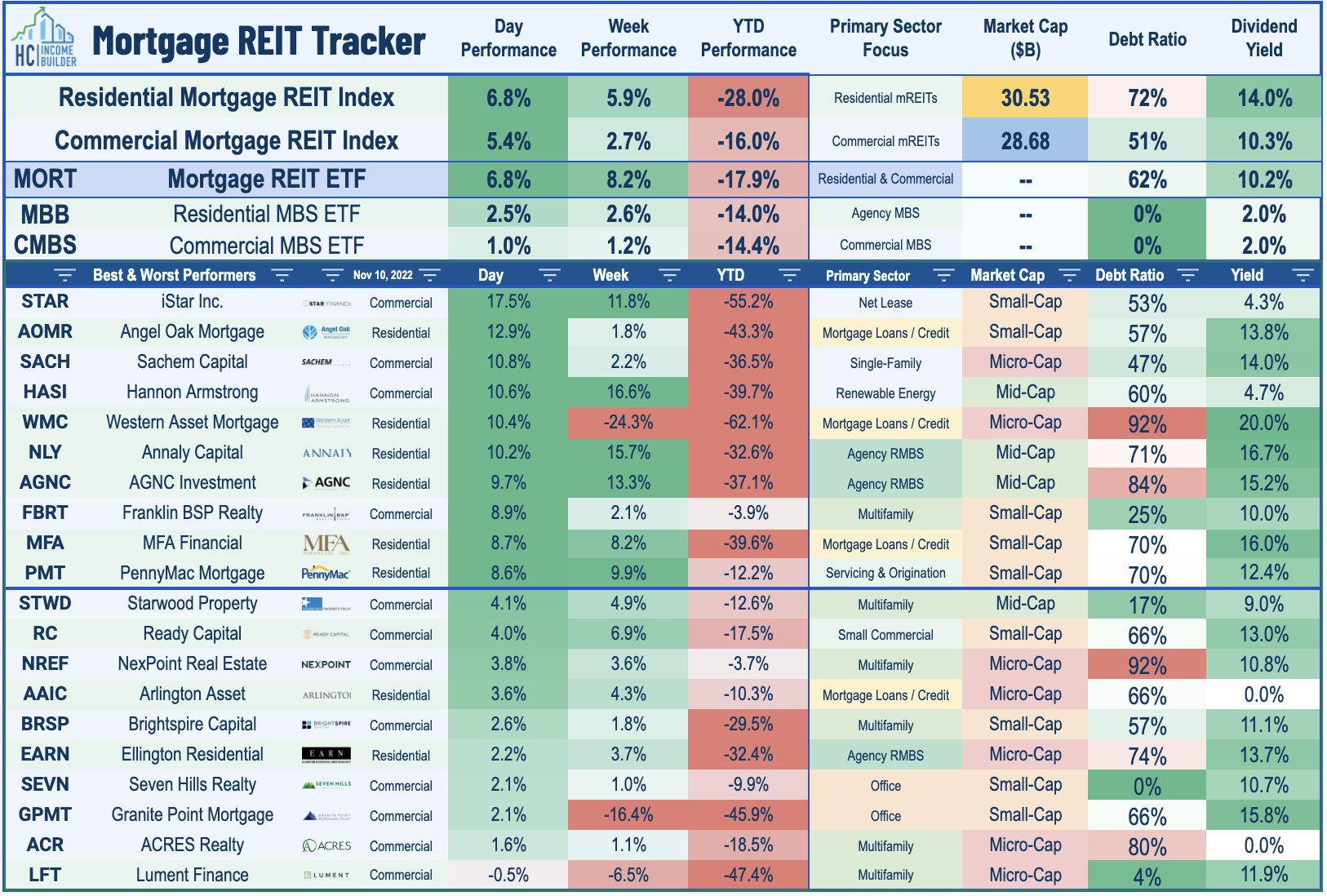

Best & Worst Performance Today Across the REIT Sector

Today we published our REIT Earnings Recap on the Income Builder Marketplace. Nearly 200 REITs and a dozen homebuilders have reported third-quarter earnings results over the past three weeks, providing critical information on the state of the U.S. real estate industry. REIT earnings season was surprisingly strong across nearly all property sectors. Of the REITs that provide guidance, nearly two-thirds raised their full-year FFO outlook alongside another two dozen dividend hikes. During third quarter earnings season, the Equity REIT Index outperformed the broader S&P 500 by nearly 10 percentage points while Mortgage REITs outperformed by over 15 percentage points. Earnings results from Shopping Center, Industrial, and Net Lease REITs were most impressive - accounting for exactly half of the 58 guidance hikes. Residential and technology REIT results were more hit-and-miss - accounting for half of the 14 downward guidance revisions. Read the full report here.

Apartments: Earlier this week, we published Apartment REITs: Roaring Rents Begin To Ease. Pressured by the broader housing cooldown, Apartment REITs have been among the weaker-performing property sectors over the past quarter despite achieving record-setting rent growth throughout the summer. While the era of 20% rent increases on new leases is over, there remains significant “embedded” rent growth in below-market renewals that should power another year of impressive growth in 2023. The importance of regional selectivity is again becoming a key factor, and we’re seeing a return to the “Sunbelt outperformance” theme with all four Sunbelt-focused REITs raising their outlook this earnings season. In the report, we discussed our updated outlook and new apartment REIT position.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished broadly higher today as earnings season wrapped up with a handful of reports. Franklin BSP (FBRT) rallied more than 8% after reporting that its Book Value Per Share "BVPS" rose about 1% in the quarter to $15.84 - one of 10 mREITs to report a BVPS increase amid an otherwise brutal quarter for fixed income assets. Ellington Residential (EARN) was a laggard after reporting that its BVPS dipped 14% - roughly at the midpoint of the average for residential mREITs this earnings season.

Economic Data This Week

The busy week of economic data wraps-up on Friday when we'll get our first look at Michigan Consumer Sentiment for September. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.