Bank Bailouts • Yields Plunge • REITs Rebound

- U.S. equity markets remained under-pressure Monday while benchmark interest rates plunged after regulators were forced to step-in to contain the fallout from the second and third-largest bank failures.

- Following its worst week since September 2022, the S&P 500 dipped another 0.2% today, while the Mid-Cap 400 and Small-Cap 600 were each lower by roughly 2%. The Dow declined 90 points.

- Real estate equities and other yield-sensitive industry groups rebounded following a punishing week as investors consider potential silver-linings in the sharp plunge in benchmark interest rates.

- The turmoil from the collapse of Silicon Valley Bank last week and Signature Bank over the weekend has prompted a rapid repricing in Fed rate hike expectations. Swaps markets now imply a Fed Funds rate of 4% by year-end, down from the 4.75% today.

- Valuations of residential and commercial mortgage-backed bonds have rallied over the past two sessions as tailwinds from lower benchmark interest rates have more-than-offset the widening of credit spreads while underlying delinquency rates entered this turmoil at historically-low levels.

Income Builder Daily Recap

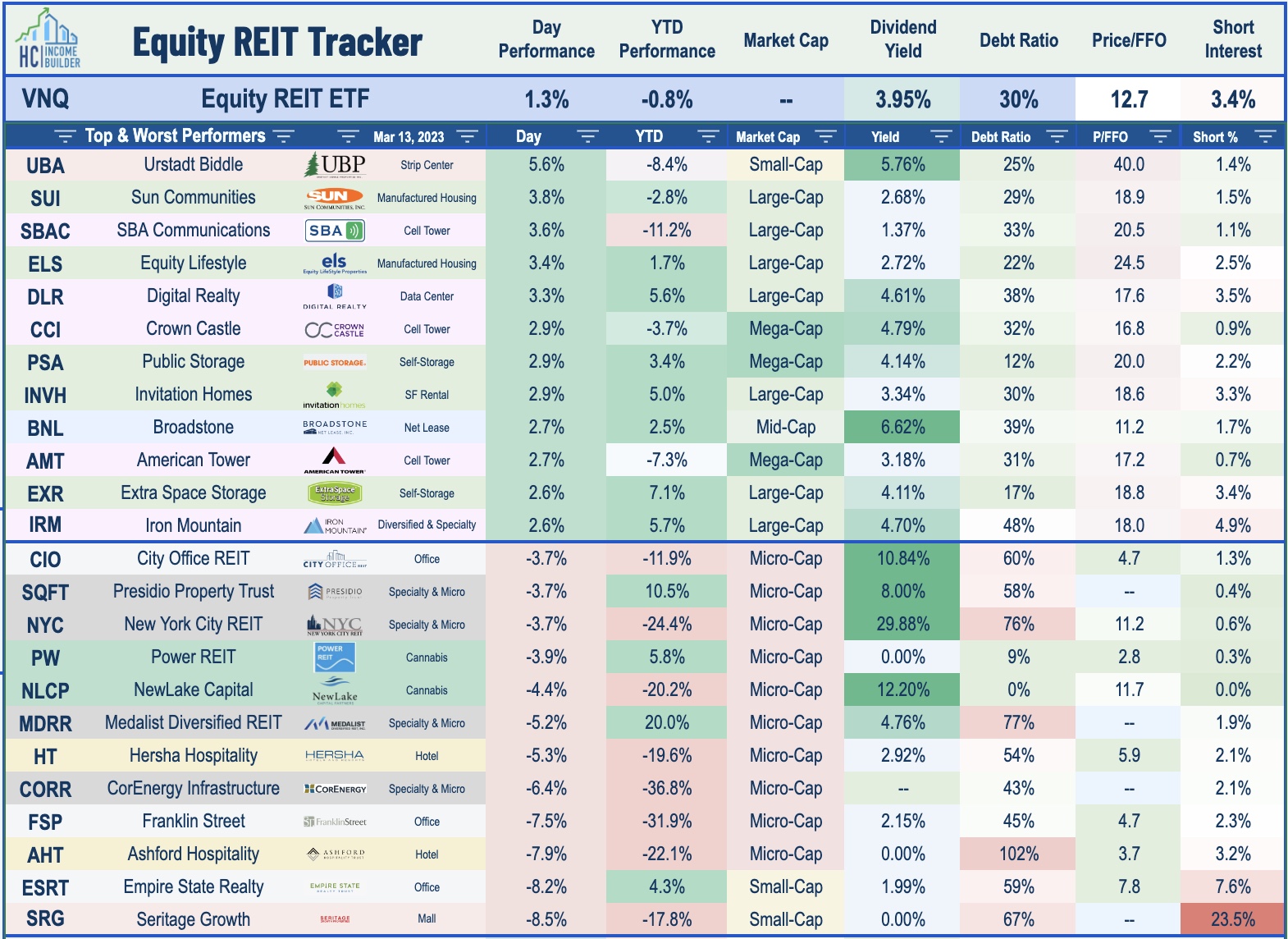

U.S. equity markets remained under pressure Monday while benchmark interest rates plunged after regulators were forced to step-in to contain the fallout from the second and third-largest bank failures. Following its worst week since September 2022, the S&P 500 dipped another 0.2% today, while the Mid-Cap 400 and Small-Cap 600 were each lower by roughly 2%. The Dow declined 90 points. Real estate equities and other yield-sensitive industry groups rebounded following a punishing week as investors consider potential silver linings in the sharp plunge in benchmark interest rates. The Equity REIT Index advanced 1.3% today with all 14-of-18 property sectors in positive territory, while the Mortgage REIT Index declined 0.8%.

The turmoil from the collapse of Silicon Valley Bank and Silvergate Capital last week and Signature Bank over the weekend has prompted a rapid repricing in Federal Reserve rate hike expectations. Swaps markets now imply a Fed Funds rate of 4% by year-end, down from the 4.75% today. After climbing to the highest level since 2007 at 5.07% last week, the policy-sensitive 2-Year Treasury Yield traded below 4% on Monday, the sharpest three-day decline on record. The 10-Year Treasury Yield dipped to 3.54%, down from its highs of 4.09% last week while the US Dollar Index dipped nearly 1%. Six of the eleven GICS equity sectors were higher on the session, led to the upside by Real Estate (XLRE) and Utilities (XLE) stocks while Financials (XLF) stocks finished sharply-lower for a third-straight session.

Inflation, retail, and the U.S. housing market are in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Tuesday with the Consumer Price Index for February, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 6.0% year-over-year rate, while the Core CPI is expected to decelerate to 5.5%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index - which has been in deflationary territory over the past six months. Later in the week on Thursday, we'll see the Producer Price Index, which is expected to slow to similar signs of cooling. The headline PPI is expected to slow to a 5.5% year-over-year rate - down from the recent peak in March at 11.8%. We'll also see an important slate of housing market data with NAHB Homebuilder Sentiment data on Wednesday and Housing Starts and Building Permits data on Thursday, which have been closely correlated to changes in mortgage rates. On Wednesday, we'll also see Retail Sales data, which is also expected to show a decline in spending in February after a strong January.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Today we published State of the REIT Nation on the Income Builder marketplace. Amid intensifying concerns over the potential fallout from several major tech-focused bank failures, this report examines high-level REIT fundamentals to chart the likely path forward for the real estate industry. Real estate equities have been slammed particularly hard over the past week as investors draw parallels to the early stages of the 2008 financial crisis when locked-up credit markets created a cascade of distress across the more highly-levered and credit-sensitive industry groups. Owing to the harsh lessons from the Great Financial Crisis, however, most REITs have been exceedingly conservative with their balance sheet and strategic decisions, ceding ground to higher-levered private-market players. It took several quarters, but private real estate markets are finally "catching up" to the reality of sharply higher interest rates, and the recent market turmoil may accelerate the distress that loomed over private-market firms and lenders that pushed leverage limits. Many well-capitalized REITs are equipped to "play offense" and take advantage of accretive long-term acquisition opportunities as private players seek an exit.

Additional Headlines from The Daily REITBeat on Income Builder

- S&P lowered MPW's issuer credit rating to “BB” from “BB+” and lowered its issue-level rating on its senior unsecured notes to “BB+” from “BBB-“ with a stable outlook

- Fitch Ratings affirmed the “BBB” Long-Term Issuer Default Ratings for TRNO and its LLC plus revised its outlook to positive from stable

- Fitch Ratings announced plans to withdraw PEAK's ratings on or about April 10th, 2023 for commercial reasons and currently rates the Company’s Long-Term Issuer Default Rating at “BBB+” with a stable outlook

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs remained under pressure today with residential mREITs dipping 1.9% while commercial mREITs declined by 1.5%. However, the underlying Residential MBS ETF (MBB) and Commercial MBS ETF (CMBS) each gained over 1% for a second-straight session as tailwinds from lower benchmark interest rates have more-than-offset the widening of MBS spreads while underlying delinquency rates entered this turmoil at historically-low levels. Dynex Capital (DX) and AGNC Investment (AGNC) were among the leaders today after holding their dividends steady at current rates, while several of the more highly-levered mREITs lagged today, including Western Asset (WMC) and Angel Oak (AOMR).

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.