Behind The Curve? • Stocks Slump • Week Ahead

Summary

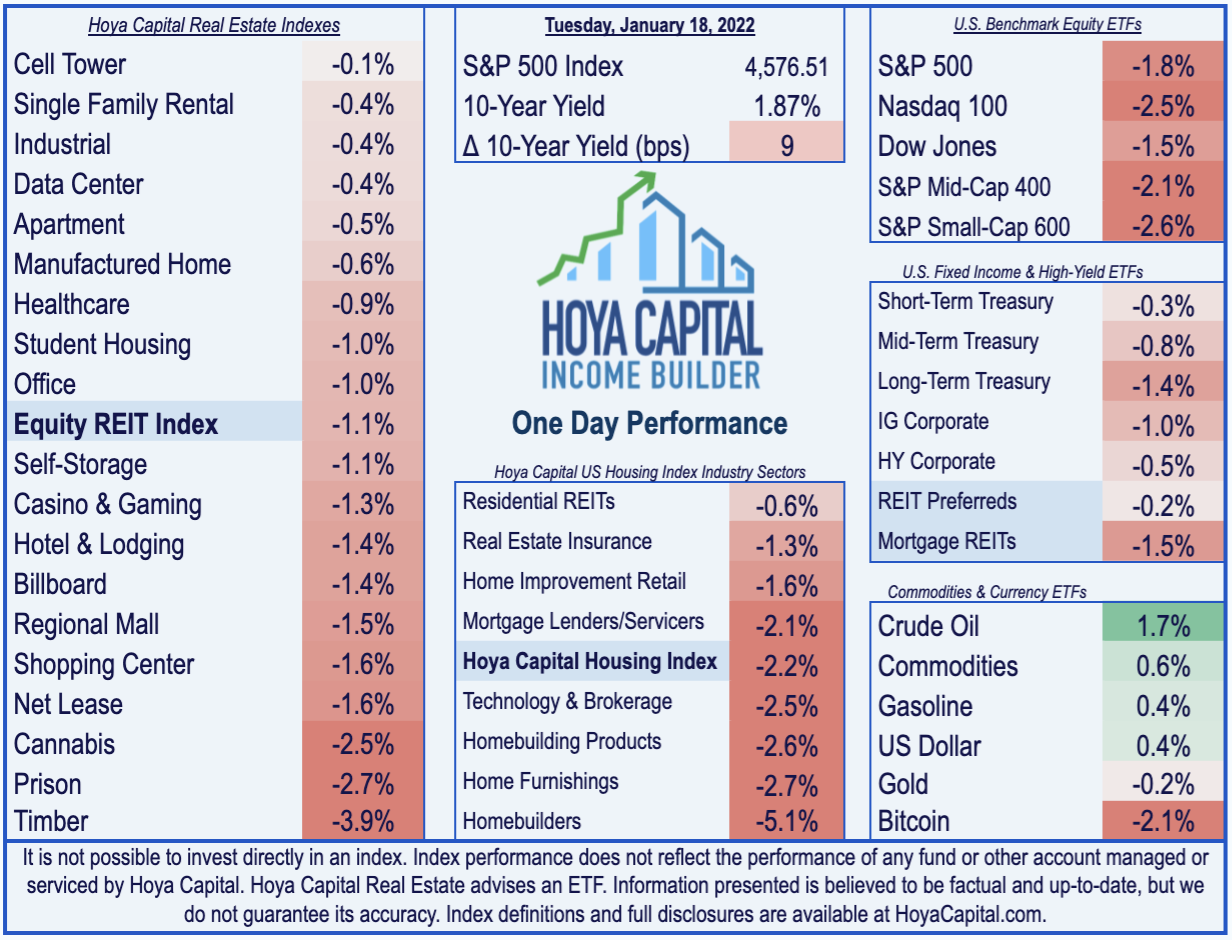

- U.S. equity markets finished broadly lower Tuesday while long-term interest rates climbed to the highest level in two years amid investor anxiety over stagflation whether the Fed is "behind the curve."

- Following modest declines last week, the S&P 500 slipped 1.8% today on another choppy session while the tech-heavy Nasdaq 100 slumped 2.5% and is now on the cusp of correction-territory.

- Real estate equities slumped as well today with the Equity REIT Index lower by 1.1% with all 19 property sectors in negative territory while Mortgage REITs declined 1.5%.

- The 10-Year Treasury Yield jumped 9 basis points to close at 1.87% today - the highest level since late 2019. Technology stocks dragged to the downside today while Energy continued its strong start to 2022.

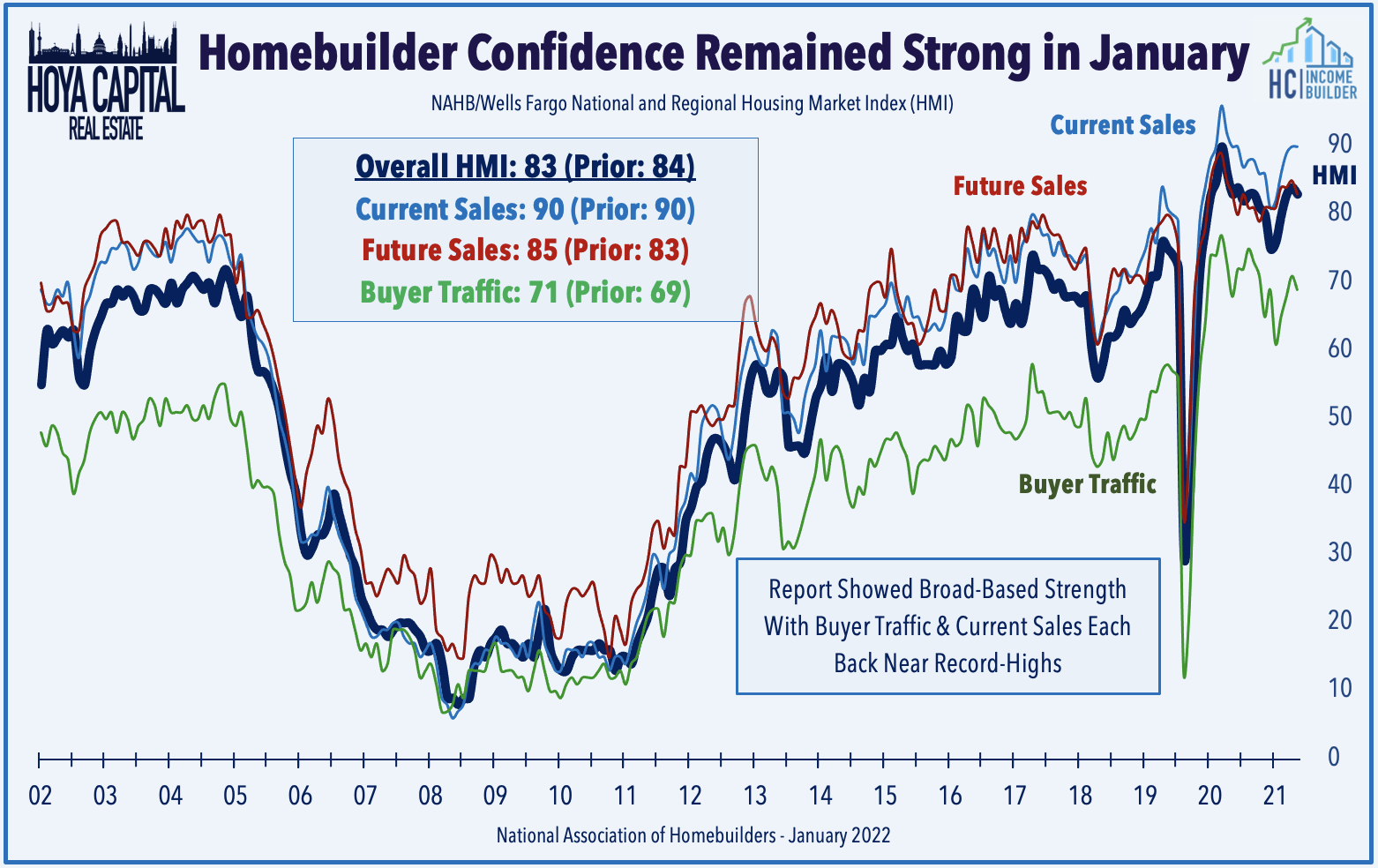

- We'll see a busy week of housing data over the next three days. Homebuilder confidence remained historically strong in January, but snapped a four-month streak of gains as lingering supply-chain disruptions partially offset robust housing demand.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished broadly lower Tuesday while long-term interest rates climbed to the highest level in two years amid investor anxiety over potential stagflation whether the Fed is "behind the curve" on hiking rates. Coming off modest declines last week, the S&P 500 slipped 1.8% today on another choppy session while the tech-heavy Nasdaq 100 slumped 2.5% and is now on the cusp of "correction territory." The Mid-Cap 400 declined 2.1% while the Small-Cap 600 finished lower by 2.6%. Real estate equities slumped as well today with the Equity REIT Index lower by 1.1% with all 19 property sectors in negative territory while Mortgage REITs declined 1.5%.

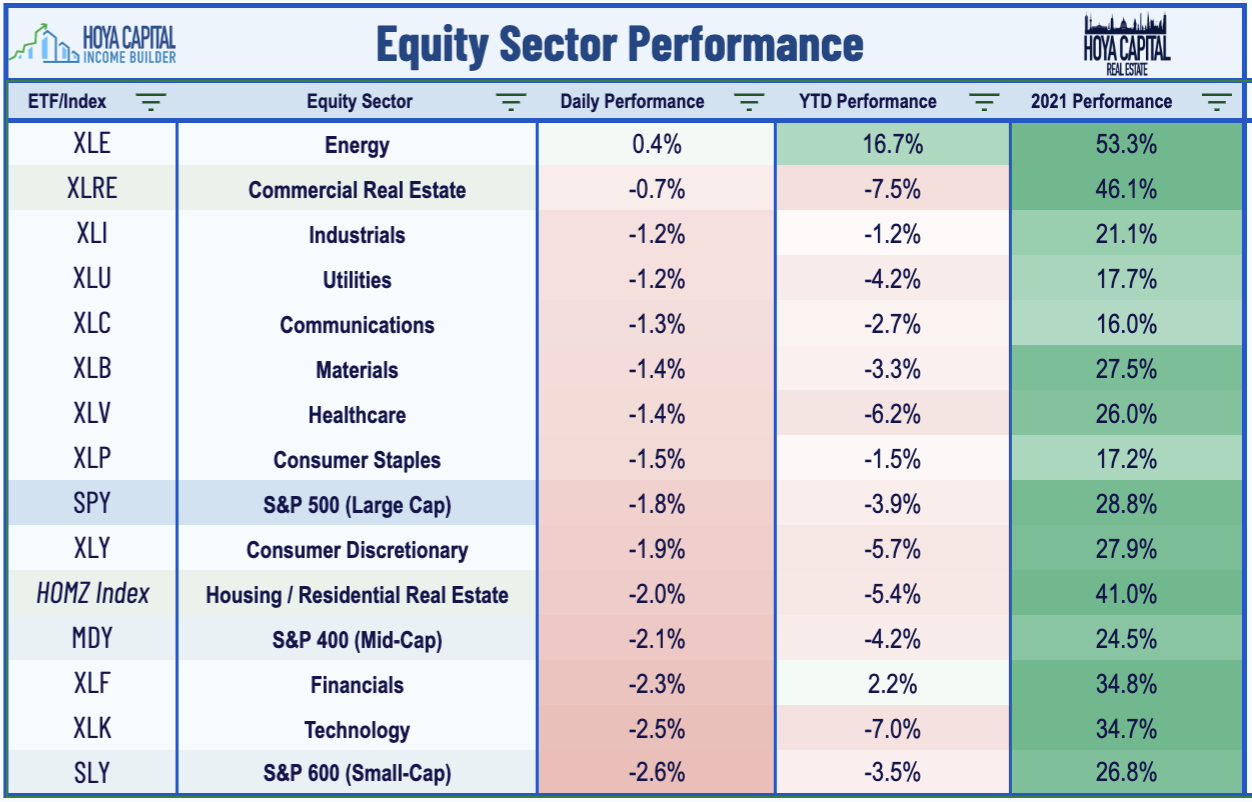

As discussed in our Real Estate Weekly Outlook, the dreaded "S-word" - stagflation - re-emerged over the past several weeks as hotter-than-expected inflation reports have been accompanied by weaker-than-expected economic data. The 10-Year Treasury Yield jumped 9 basis points to close at 1.87% today - the highest level since late 2019. Ten of the eleven GICS equity sectors finished lower today, dragged on the downside by the Technology (XLK) and Financials (XLF) sectors while Energy (XLE) was the lone sector in positive territory, continuing its strong start to 2022.

Housing Remains Source of Strength

Homebuilder confidence remained historically strong in January, but snapped a four-month streak of gains as lingering supply-chain disruptions offset solid housing demand. The NAHB reported this morning that its Housing Market Index slipped slightly from 10-month highs in early January to 83 from last month's upwardly revised reading of 84. The Current Sales sub-index held steady at 90, the Future Sales sub-index declined two points to 83, and the Homebuyer Traffic sub-index declined two points to 69. The NAHB commented that construction costs have increased almost 19% year-over-year while shortages are adding weeks to typical single-family construction times.

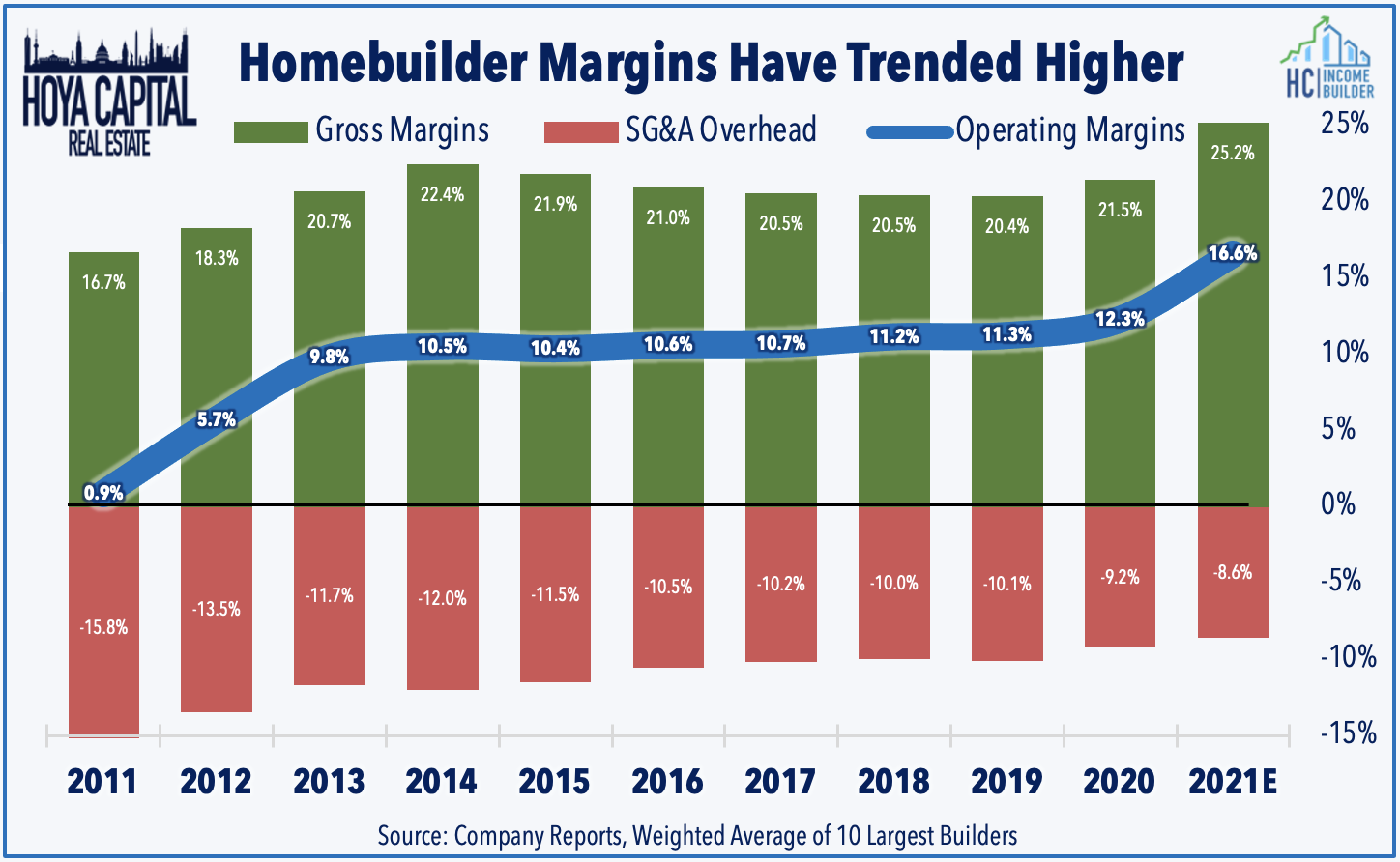

Homebuilders: On that point, today we published Homebuilders: Growth At Very Reasonable Prices. Left for dead early in the pandemic, the U.S. housing industry has been a consistent, steady-handed leader throughout the pandemic as record-low supply levels and robust single-family housing demand remain a secular tailwind. Homebuilders are selling homes as fast as they can be built, but that's not fast enough as supply chain constraints have curtailed immediate upside, but may have prolonged the favorable cycle. Profit margins have climbed to record highs as builders have more-than-offset cost pressures through higher sales prices. Scale remains a critical competitive advantage as the larger public builders continue to gain market share.

Equity REIT Daily Recap

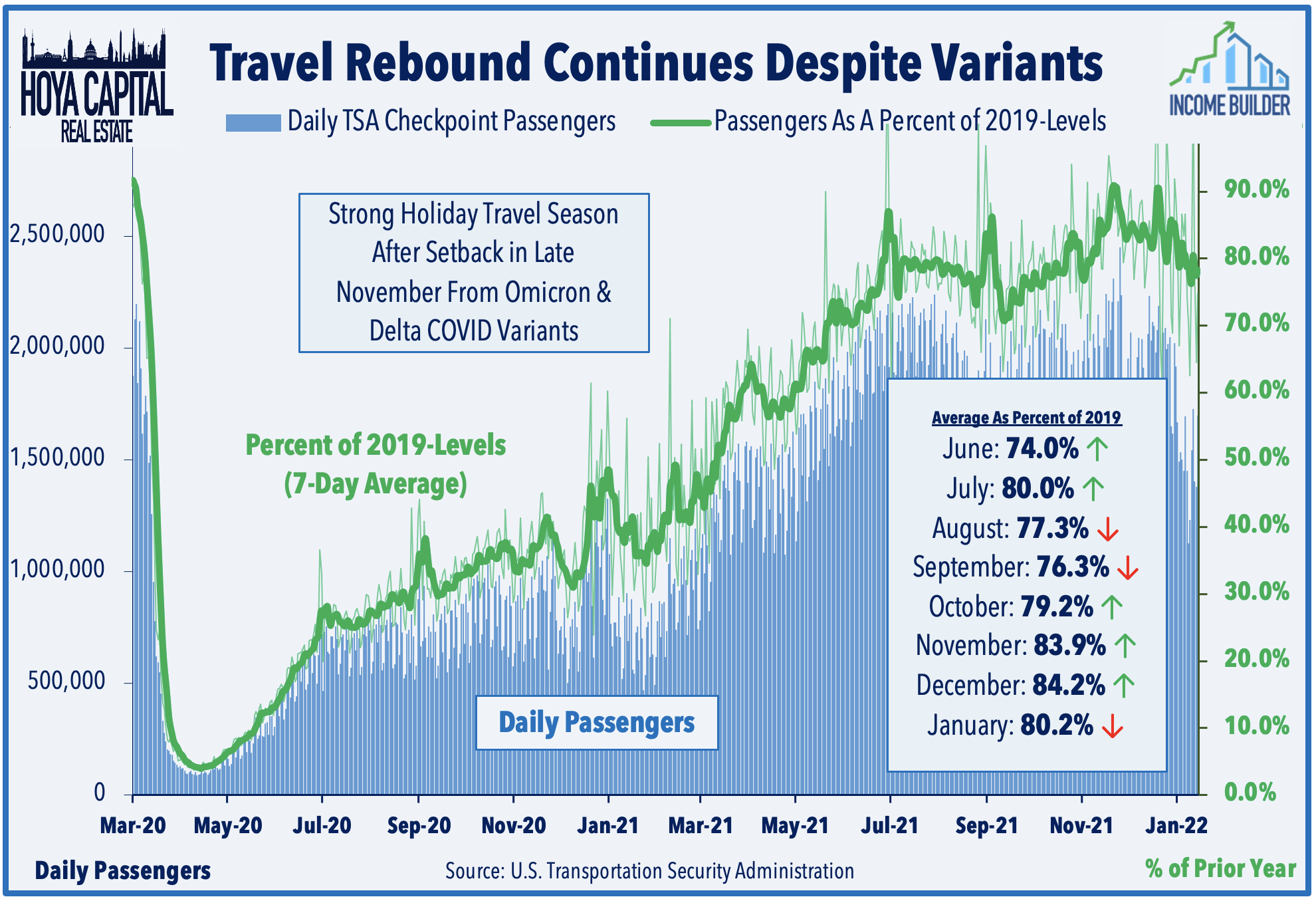

Hotels: Ashford Hospitality (AHT) and Braemar Hotels (BHR) each announced that they received letters from the Securities and Exchange Commission stating that the agency's investigation on their external manager - Ashford (AINC) - has concluded SEC enforcement staff does not intend to recommend any action against any of the three firms. The SEC investigation was over related-party deals and the usage of bailout funds, including an agreement to renegotiate mortgage debt where Ashford Hospitality Trust said it could no longer afford to make interest payments, according to the filings. Recent TSA Checkpoint data has shown that the impact of the COVID reacceleration has been relatively mild with travel still at 80% of 2019-levels.

Mortgage REIT Daily Recap

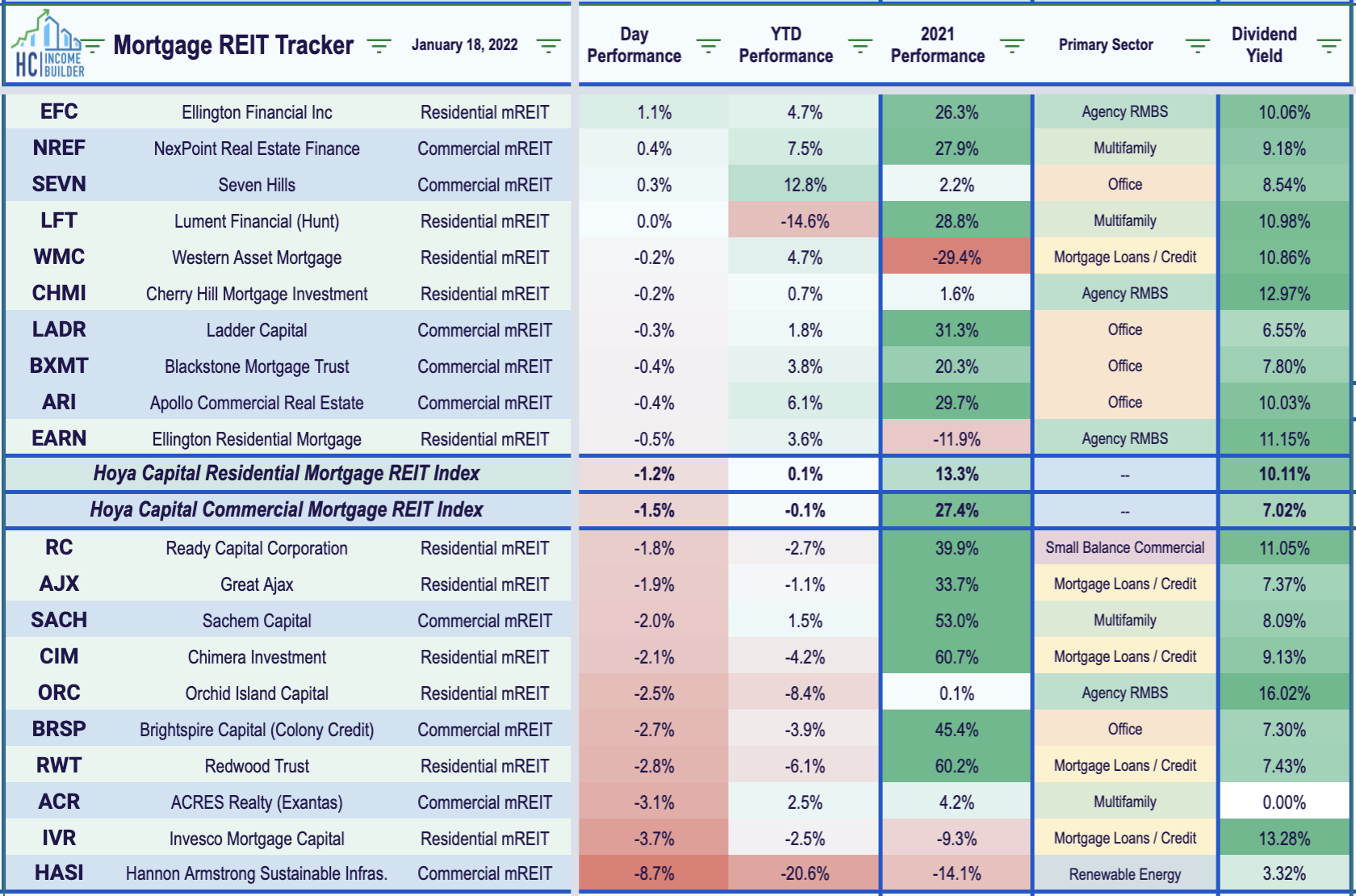

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs slipped 1.2% today while commercial mREITs declined 1.5% today. For full-year 2021, the NAREIT Mortgage REIT Index delivered price returns of 7.0% and total returns of 16.0%. This evening, we'll publish Mortgage REITs: Hedge Rising Rates as an exclusive report for Hoya Capital Income Builder members which will preview the upcoming earnings season and discuss our updated outlook for the mortgage REIT sector. The average residential mREIT pays a dividend yield of 10.11% while the average commercial mREIT pays a dividend yield of 7.02%.

REIT Preferreds & Capital Raising

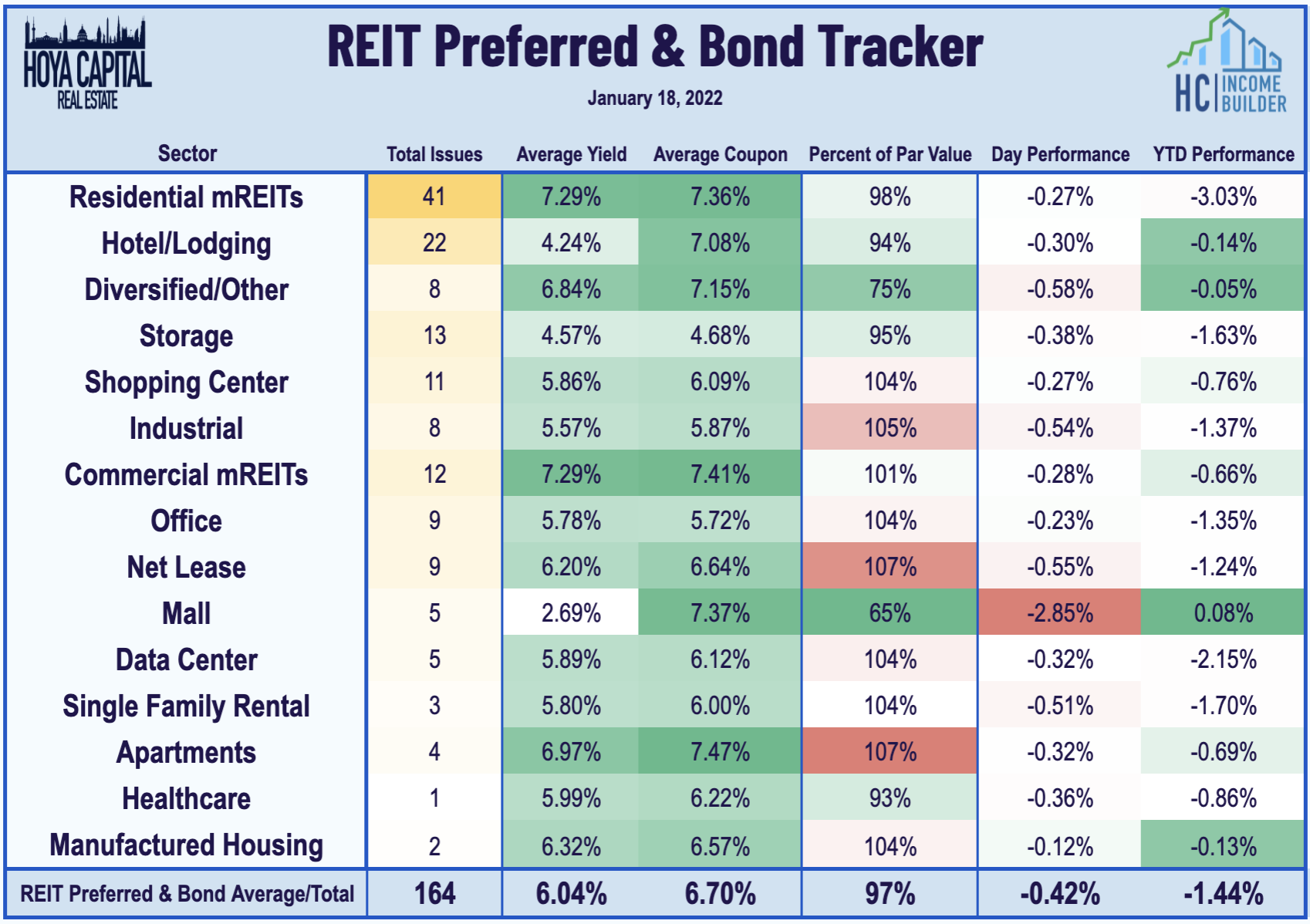

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index slipped 0.42% today and ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. Granite Point Mortgage (GPMT) traded in-line with its peers today after it launched an offering of additional shares of its 7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (GPMT.PA). There are now 165 REIT-issued exchange-listed preferred securities with an average current yield of 6.04% and an additional 12 REIT-issued exchange-listed debt securities with an average current yield of 6.57%.

Economic Data This Week

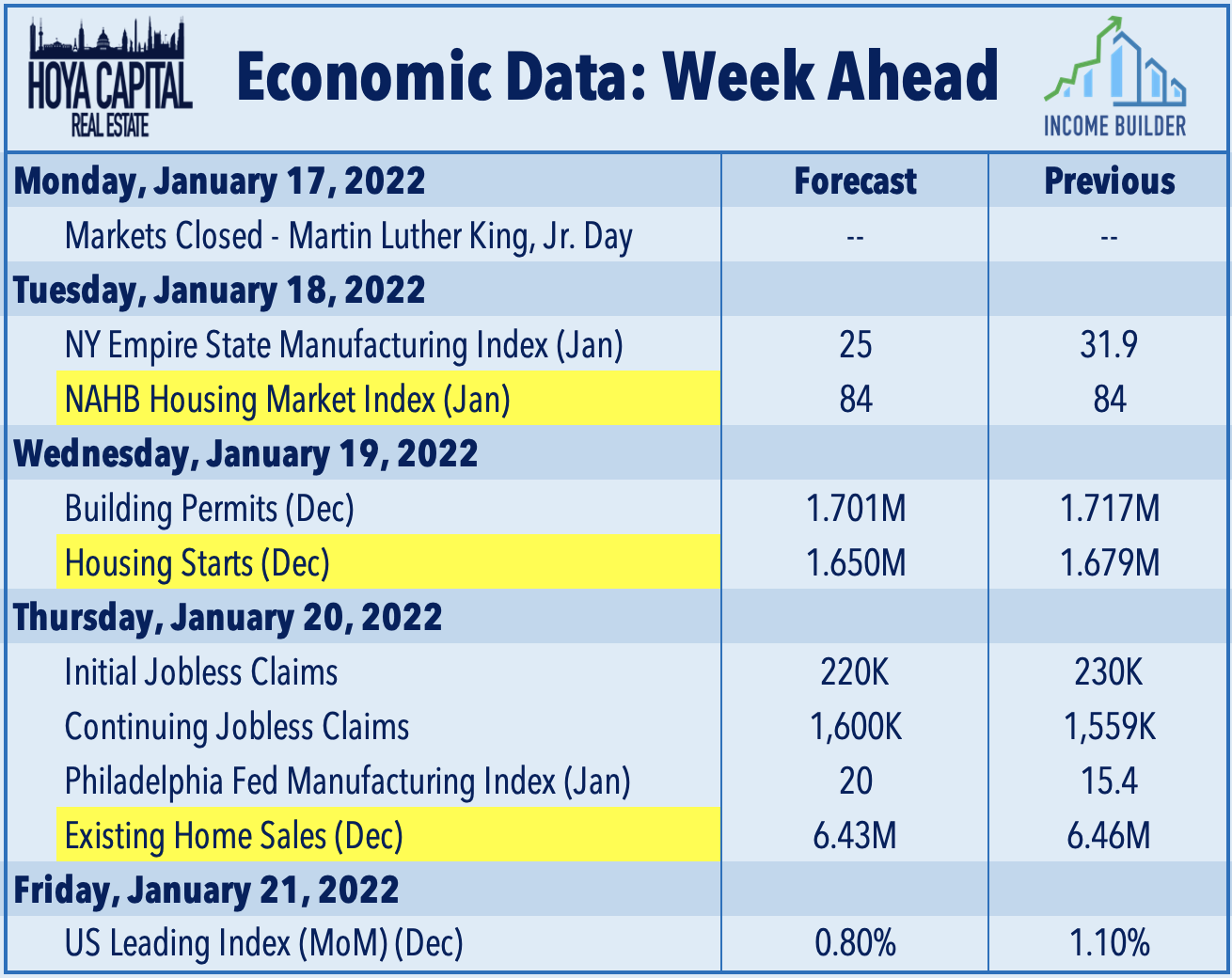

We have a jam-packed week of housing market data in the four-day week ahead. Today, we saw NAHB Homebuilder Sentiment data for January. On Wednesday, we'll see Housing Starts and Building Permits data for December. Last month, Housing start Starts climbed to 8-month highs. Finally, on Thursday, we'll see Existing Home Sales data for December which increased for a third-straight month in November to fresh 11-month highs.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.