Blackstone Inquiries • Mall Delisted • REIT Dividends

- U.S. equity markets declined for a third-straight session Friday- closing at the lowest levels since early November- as investors expressed doubt that the Fed will pivot quickly enough to avert recession.

- Extending its weekly decline to 2.5%, the S&P 500 dipped 1.1% today while the tech-heavy Nasdaq 100 fell 1.0% today and nearly 3% on the week.

- Real estate equities were under pressure today amid a busy 24 hours of newsflow, but were among the stronger-performers this week. Equity REITs slipped 2.6% while Mortgage REITs declined 2.5%.

- Bloomberg reported that Blackstone (BX) and Starwood each received inquiries from the Securities and Exchange Commission after both firms limited investor redemption requests in their non-traded real estate vehicles.

- Pennsylvania REIT (PEI) was delisted by the New York Stock Exchange after failing to maintain at least a $15M market cap for 30 days. Shopping center REIT Urstadt Biddle (UBA) and cannabis REIT New Lake Capital (NLCP) each hiked their dividends.

Income Builder Daily Recap

U.S. equity markets declined for a third-straight session Friday - and closed at the lowest levels since early November - as investors expressed doubt that the Fed will pivot quickly enough to avert a deeper recession. Extending its weekly decline to 2.5%, the S&P 500 dipped 1.1% today while the tech-heavy Nasdaq 100 fell 1.0% today and nearly 3% on the week. Real estate equities were under pressure today amid a busy 24 hours of newsflow with the Equity REIT Index declining 2.6% with 17-of-18 property sectors in negative territory while the Mortgage REIT Index finished lower by 2.5%. Homebuilders declined 1.6% today but were among the better performers on the week amid a pullback in mortgage rates.

Weaker-than-expected PMI data this morning kept downward pressure on interest rates and further widened the divide between market expectations of Fed policy and forecasts from Fed officials themselves. Despite an uptick in FOMC official's median projections of interest rates, the 10-Year Treasury Yield (US10Y) ended the week lower by 9 basis points while the 2-Year Treasury Yield (US2Y) ended the week nearly 19 basis points lower than where it started. The U.S. Dollar Index finished roughly flat today and on the week while Crude Oil held onto modestly weekly gains despite a 2% pullback today. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Real Estate Daily Recap

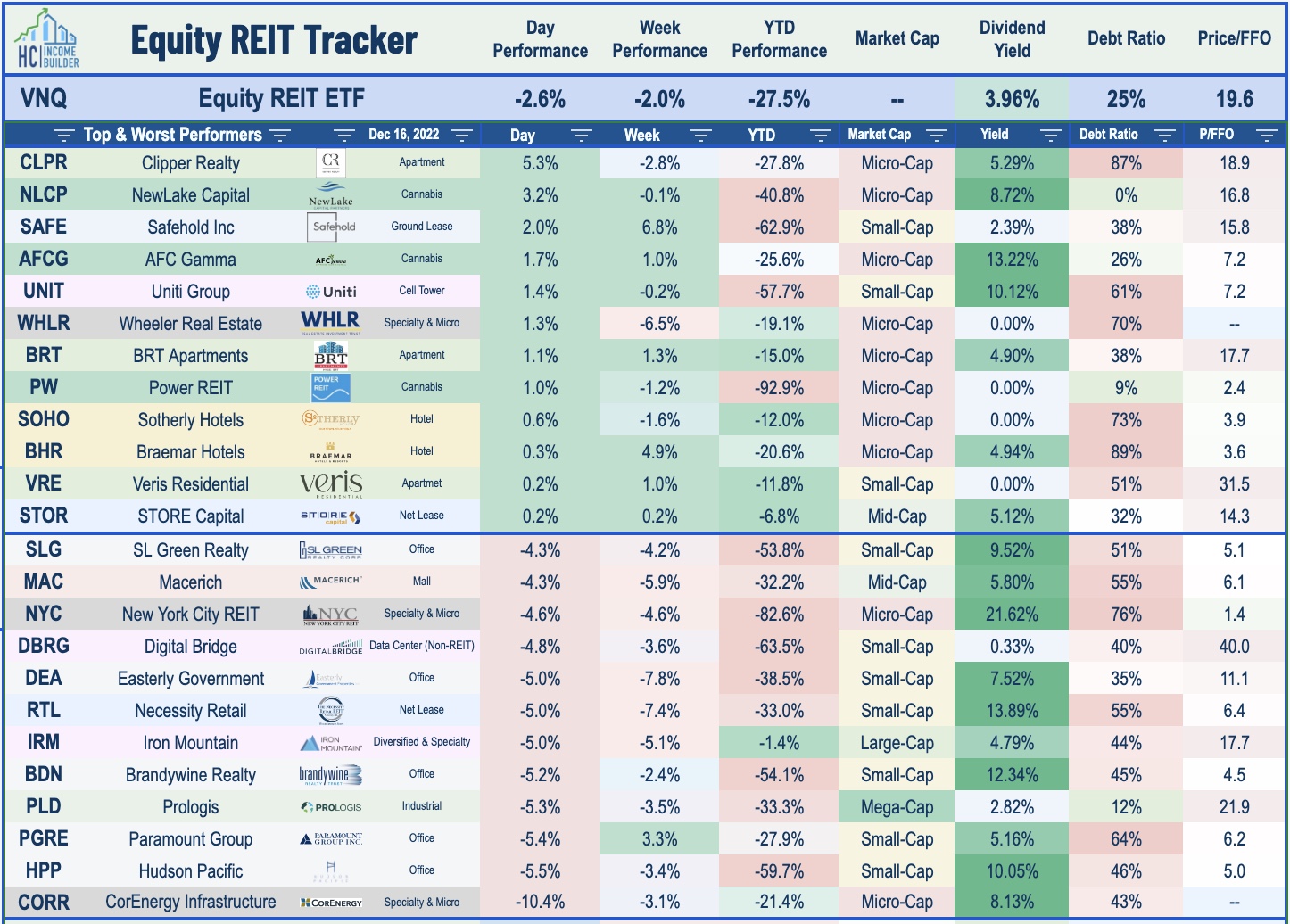

Best & Worst Performance Today Across the REIT Sector

Bloomberg reported this morning that Blackstone (BX) and Starwood each received inquiries from the Securities and Exchange Commission after both firms limited investor redemption requests in their non-traded real estate funds. BREIT and SREIT have each seen investor redemption requests exceed their quarterly limits, driven by a combination of factors including their published Net Asset Value which appears to be 20-30% above public market valuations of comparable assets. Citing unnamed sources, Bloomberg reports that the SEC "reach out to the firms... and is trying to understand the market impact and circumstances of the events, how the firms met redemptions, and if affiliates sold before clients." We've discussed the risks of non-traded REIT ("NTR") space across many reports over the past half-decade and continue to watch the area for signs of stress given their typically-high leverage and sensitivity to investor fund flows - which we expect could eventually become an area that's "ripe for picking" for the more conservatively-managed REITs.

Malls: Pennsylvania REIT (PEI) was delisted by the New York Stock Exchange after failing to maintain at least a $15M market cap for 30 days. PEI will now trade the OTC Markets, operated by the OTC Markets Group under the symbols PRET, PRETL, PRETM, and PRETN. PREIT has dipped more than 85% this year despite signs of stabilization in the beaten-down mall sector. Following nearly three years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding mall REITs with some long-elusive pricing power. While lower-tier mall REITs can't afford a deep recession, upper-tier malls are no longer teetering dangerously on edge. That said, we see more attractive valuations in non-mall retail REITs with a format better aligned with the bricks-and-clicks retail strategy.

Office: Highwoods (HIW) slipped 3% after it announced that it acquired a 550k sq. ft Class A building in Dallas through a joint venture with Granite Properties for a total purchase price of $394.7. The McKinney & Olive building was constructed in 2016 and is currently 99% leased and contains 507k square feet of multi-customer office space and 50,000 square feet of retail space. Earlier this week, HIW announced a 50/50 joint venture to construct Midtown East in Tampa, Florida with The Bromley Companies with a total value of $83 million. Located in Tampa’s Westshore submarket, the 18-story tower be the future headquarters of Tampa Electric and Peoples Gas. Construction of the project is expected to begin in the first quarter of 2023 with a scheduled completion date in the first quarter of 2025 and a pro forma stabilization date in the second quarter of 2026. Highwoods currently owns an 80% interest in a joint venture with The Bromley Companies that developed and owns Midtown West, a 150,000 square foot, $71 million office project completed in the second quarter of 2021 that was 92.5% leased as of September 30, 2022.

Another day, another REIT dividend hike. Shopping center REIT Urstadt Biddle (UBA) was among the better performers today after it announced quarterly earnings results and hiked its quarterly dividend by 5% to $0.25/share representing a forward yield of roughly 5.4%. Cannabis REIT NewLake Capital (OTCQX:NLCP) hiked its quarterly dividend by 5% to $0.39/share, representing a forward yield of roughly 9.5%. Hersha Hospitality (HT) held its quarterly dividend steady at $0.05/share but declared a special dividend of $0.50 per common share - the fourth REIT to declare a supplemental dividend over the past week. Despite the broader economic slowdown, REIT dividend increases continue to significantly outpace REIT dividend decreases consistent with our discussion in our State of the REIT Nation which noted that REIT payout ratio ratios remain below the long-term historical averages, implying that REITs have significant 'embedded' dividend growth that should be unlocked over the coming quarters. In total, more than a dozen REITs hiked their dividend this week while three REITs reduced their payouts, bringing the full-year total to 120 REIT dividend hikes compared to 12 dividend decreases.

Net Lease: Today we published Net Lease REITs: Calling The Fed's Bluff which discussed recent developments and our updated outlook on the net lease sector. One of the more "bond-like" and rate-sensitive REIT sectors, net lease REITs have surprisingly been among the best-performing property sectors this year despite their muted property-level growth and narrowing investment spreads. Curiously, net lease REITs have seemingly never bought into the idea of a "new normal" of sustained higher interest rates and have plowed ahead with acquisitions. Acquisition cap rates have expanded only modestly - roughly 50-100 basis points on a YTD basis per recent commentary- during which time we’ve seen benchmark rates climb by 250-300 basis points. While we do believe that the worst of the inflationary pressures are behind us, there does appear to be complacency reflected in valuations and strategies in REITs with higher interest-rate risk - notably those focused on "corporate" properties with bond-like lease structures.

Additional Headlines from The Daily REITBeat on Income Builder

- UMH closed on the acquisition of a manufactured home community, located in Jackson, New Jersey, for a total purchase price of $23 million noting that this community contains 260 developed homesites, of which 98% are occupied. It is situated on approximately 42 acres

- FCPT announced the disposition of a Red Lobster property located in Ohio for $4.9 million noting that the property is corporate-operated under a triple net lease and priced at cap rate in range with previous FCPT dispositions and plans to repurpose the proceeds into new investment opportunities consistent with FCPT thresholds

- CUZ announced that it has promoted Kennedy Hicks to the role of Chief Investment Officer who will be responsible for acquisitions, dispositions, and strategic investments for the Company

- Moody’s affirmed OHI's “Baa3” senior unsecured debt rating and revised its outlook to stable from negative

- Colliers Securities initiates TRNO with a Buy rating

- RBC initiates IRM with a Sector Perform rating

- Morgan Stanley reinstates MAC with an Underweight rating

- Wolfe Research upgrades BRX to Outperform from Peer Perform

- JP Morgan upgrades FR and REG to Overweight from Neutral and EPR to Neutral from Underweight and downgrades AMH, ESS, EXR, FRT, INVH, PLD to Neutral from Overweight and AVB to Underweight from Neutral

- BMO downgrades DEA, EQR, LTC to Underperform from Market Perform

- Income Builder Members receive access to The Daily REITBeat, an institutional-quality daily note that keeps subscribers apprised of pertinent news, data, and trends specifically within the REIT industry.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished lower today with residential mREITs slipping 2.4% while commercial mREITs declined 1.7%. Ready Capital (RC) declined 2% after it trimmed its quarterly dividend to $0.40/share - down from its prior rate of $0.42. Rithm Capital (RITM) dipped 6% despite holding its dividend steady and announcing a new repurchase program of up to $200M of shares of common stock and $100M of preferred stock. Blackstone Mortgage (BXMT), Ladder Capital (LADR), and Lument Finance (LFT) each held their dividends steady at current rates as well. Last month, we published Mortgage REITs: High Yields Are Fine, For Now which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends as improved earnings power from wider investment spreads have helped to offset book value declines.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.