Bond Rout • REIT Updates • Rig Counts Rise

- U.S. equity markets were mixed Friday- but were broadly lower for the week- amid an ongoing "bond rout" as the 10-Year Treasury Yield climbed to its highest level in three years.

- Snapping a four-week streak of gains with weekly declines of roughly 1%, the S&P 500 declined 0.3% today while the tech-heavy Nasdaq 100 slipped 1.4%. Mid-Caps and Small-Caps were modestly lower today.

- Real estate equities were leaders today - and outperformed on the week - as the Equity REIT Index climbed 0.2% with 12-of-19 property sectors in positive territory. Mortgage REITs gained 0.6%.

- The 10-Year Treasury Yield rose to its highest level since May 2019 at 2.71% while the 2-Year Treasury Yield climbed to 2.52% - its highest level since March 2019.

- LXP Industrial (LXP) dipped more than 14% after announcing that it is no longer pursuing a sale of the company, citing "the significant changes to macroeconomic, geopolitical and financing conditions."

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets were mixed Friday - but were broadly lower for the week - amid an ongoing "bond rout" as the 10-Year Treasury Yield climbed to its highest level in two years on expectations of aggressive monetary tightening. Snapping a four-week streak of gains with weekly declines of roughly 1%, the S&P 500 declined 0.3% today while the tech-heavy Nasdaq 100 slipped 1.4%. Mid-Caps and Small-Caps were modestly lower on the day, but were down more than 3% this week. Real estate equities were leaders today - and outperformed on the week - as the Equity REIT Index climbed 0.2% with 12-of-19 property sectors in positive territory while Mortgage REITs gained 0.6%.

Fixed income securities across the credit and maturity spectrum remained under pressure amid a historically-weak start to the year as the 10-Year Treasury Yield rose to its highest level since May 2019 at 2.71% while the 2-Year Treasury Yield climbed to 2.52% - its highest level since March 2019. The U.S. Dollar Index strengthened once again to its highest level since May 2020 while Crude Oil (CL1:COM) finished a choppy week slightly below $98/barrel as Rig Counts in the U.S. to a two-year high. Seven of the eleven GICS equity sectors finished higher today, led to the upside by the Energy (XLE) and Financials (XLF) while homebuilders on the broader Hoya Capital Housing Index bounced back today.

Real Estate Daily Recap

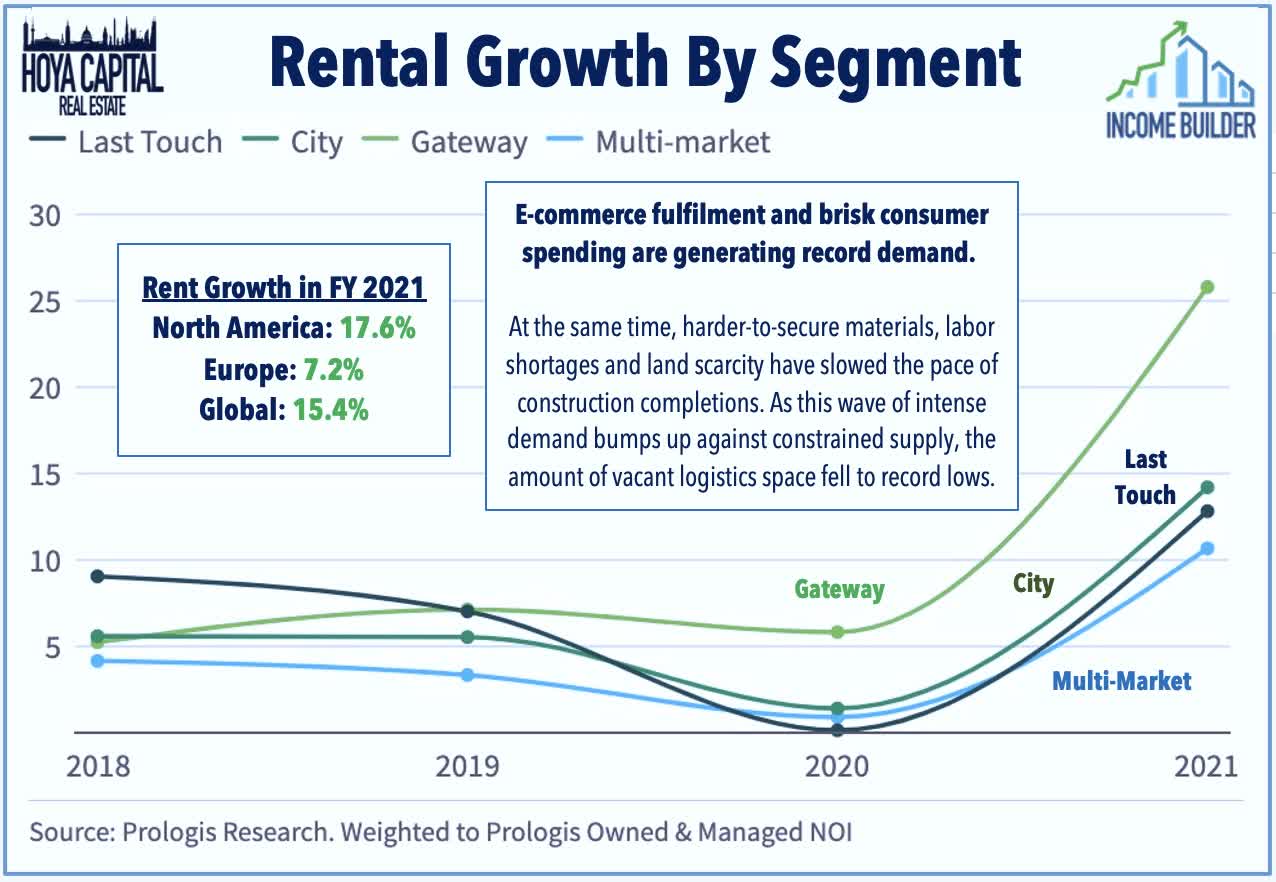

Industrial: LXP Industrial (LXP) dipped more than 14% after announcing that it is no longer pursuing a sale of the company, citing "the significant changes to macroeconomic, geopolitical and financing conditions since the commencement of the review process on February 8, 2022." LXP also provided preliminary Q1 metrics, noting that it achieved cash rental spreads of 18.1% on 2.3M in leased space. Terreno (TRNO) was flat today after providing a business update in which it achieved cash spreads of 34.8% in Q1 while increasing occupancy to 96.9% occupancy at end of Q1 compared to 95.5% at end of Q4 and 96.1% last year. As discussed in Industrial REITs: Supply Chains At Breaking-Point, industrial vacancy rates declined to record-lows below 4% by the end of 2021 despite robust levels of new development, driving rent growth of nearly 20% in North America.

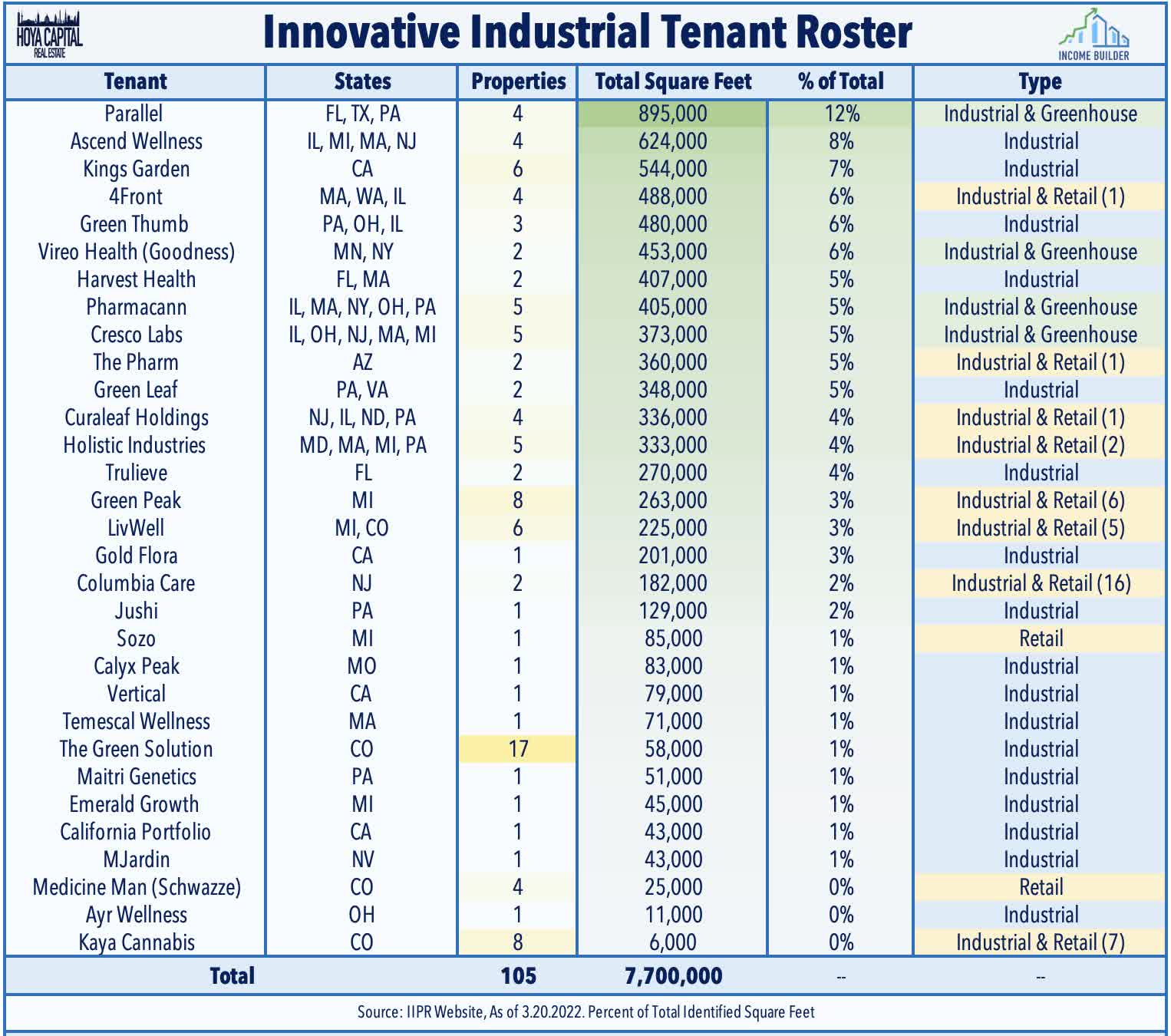

Cannabis: Innovative Industrial (IIPR) provided an operating update in which it noted that it made 4 acquisitions in Q1 for properties in California, Massachusetts, New Jersey, and Pennsylvania, and executed 4 lease amendments for additional improvement allowances at properties in Massachusetts and Michigan. As of Apr. 7, IIPR owned 107 properties - representing roughly 8M rentable square feet. As discussed in Cannabis REITs: Own The Pharmland, cannabis REITs - the best-performing property sector over the past half-decade - have stumbled in early 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization, but we believe legalization concerns are overstated.

Healthcare: The National Investment Center for Seniors Housing & Care ("NIC") published its quarterly senior housing and skilled nursing report yesterday afternoon. Consistent with the business update earlier this week from Welltower (WELL), the report showed that occupancy rates were roughly flat in Q1 despite the omicron surge while operators were able to achieve rent growth of 3.3%, the strongest quarter of rent growth since 2017. Also of note, NIC reported a slowdown in inventory growth to the lowest since 2013 - good news for senior housing REITs as supply growth had been the most persistent headwind for the senior housing sector before the pandemic.

Hotels: A pair of hotel REITs provided operational updates yesterday. Braemar Hotels (BHR) - which focuses on luxury hotels and resorts - finished lower by 3% after announcing that it expects to report occupancy of 55% in Q1 with an Average Daily Rate of $597, resulting in RevPAR of $328, which was 20% above comparable levels in Q1 2019. BHR commented, "Leisure demand has held up much better than anticipated, as trends in corporate transient and group bookings continue to build." Ashford Hotels (AHT) tumbled 7% after announcing that it expects to report occupancy of 58% in Q1 with an ADR of $166 and RevPAR of $97, which represents a decrease of 23% compared to Q1 2019. TSA Checkpoint throughput data rebounded to 90% of pre-pandemic levels this week following a slow start to 2022.

Storage: Today, we published Storage REITs: Times Are 'A-Changing. Self-storage REITs - which delivered the most impressive rebound of any property sector throughout the pandemic - have built on their gains in early 2022 following a jaw-dropping 80% surge last year. Stumbling into the coronavirus pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, self-storage demand soared over the past year, powering record occupancy increases, and rent hikes. Storage demand is closely-correlated with housing market turnover: specifically home sales and rental turnover. The surge in mortgage rates this year appears likely to slow turnover and temper storage demand. In the report, we discussed how we're allocating to the sector and our updated Price Targets.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs advanced 0.4% today while residential mREITs gained 0.4%. Ellington Residential (EARN) and Ellington Financial (EFC) were each higher after holding their monthly dividends steady at $0.10 and $0.15, respectively. The average residential mREIT pays a dividend yield of 11.39% while the average commercial mREIT pays a dividend yield of 7.41%.

REIT Preferreds & Capital Raising

In the capital markets, a pair of apartment REITs launched secondary equity offerings. AvalonBay (AVB) priced 2M common shares, raising gross proceeds of $497M to fund future acquisitions or development while Camden Property (CPT) priced 2.9M common shares for gross proceeds of $493M to fund the acquisition from Teachers Retirement System of Texas of its 68.7% interest in two of its investment funds. Elsewhere, Moody Ratings affirmed Camden Property's (CPT) credit rating of “A3” with a stable outlook and upgraded Equinix's (EQIX) credit rating to "Baa3" with a stable outlook. Fitch Ratings assigned InvenTrust (IVT) a “BBB-“ credit rating with a stable outlook.

Economic Calendar This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.