Correction Deepens • Housing Shortage • Jobless Claims Jump

Summary

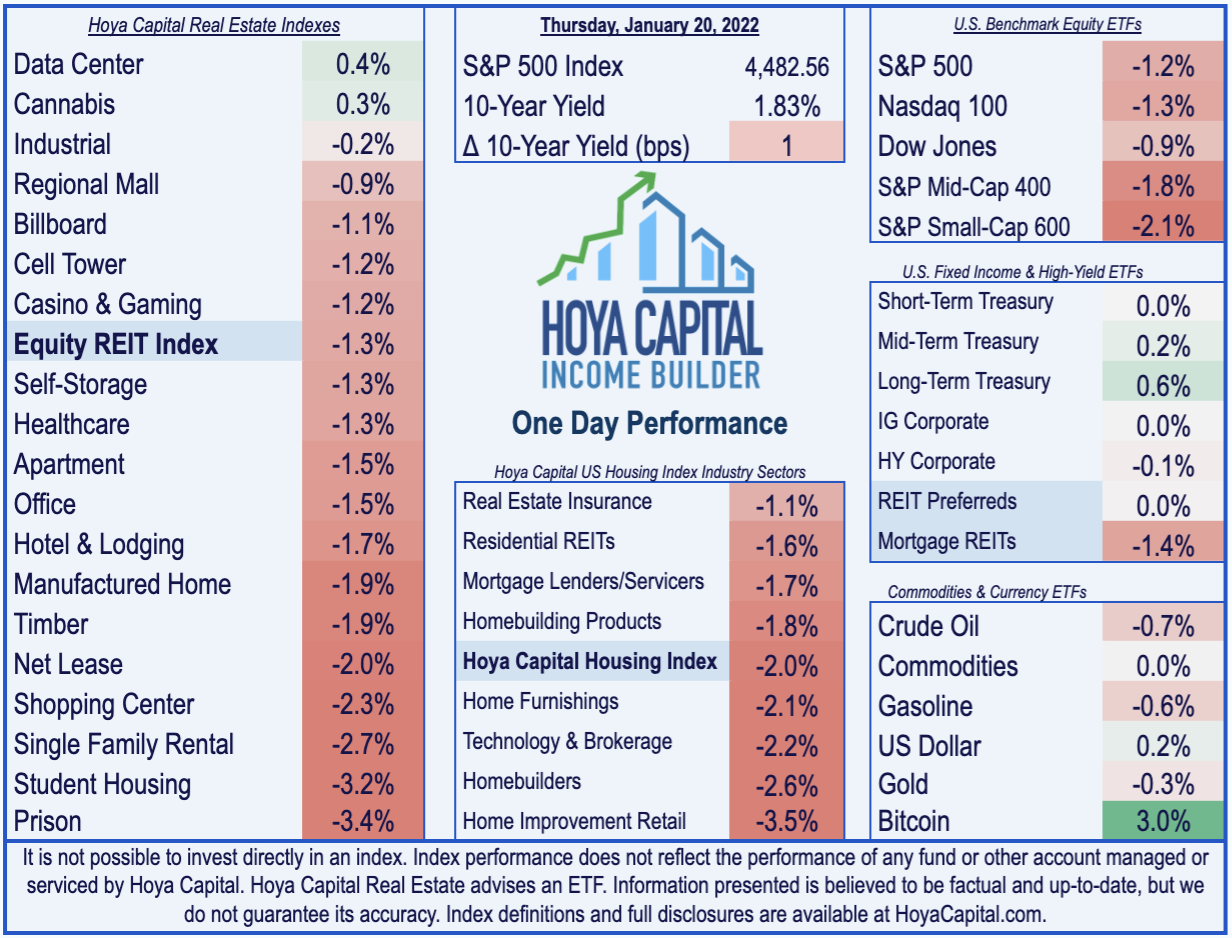

- U.S. equity markets reversed early-session gains to end lower Thursday as ongoing concerns over stagflation were deepened by employment data showing that jobless claims rose to the highest-level since October.

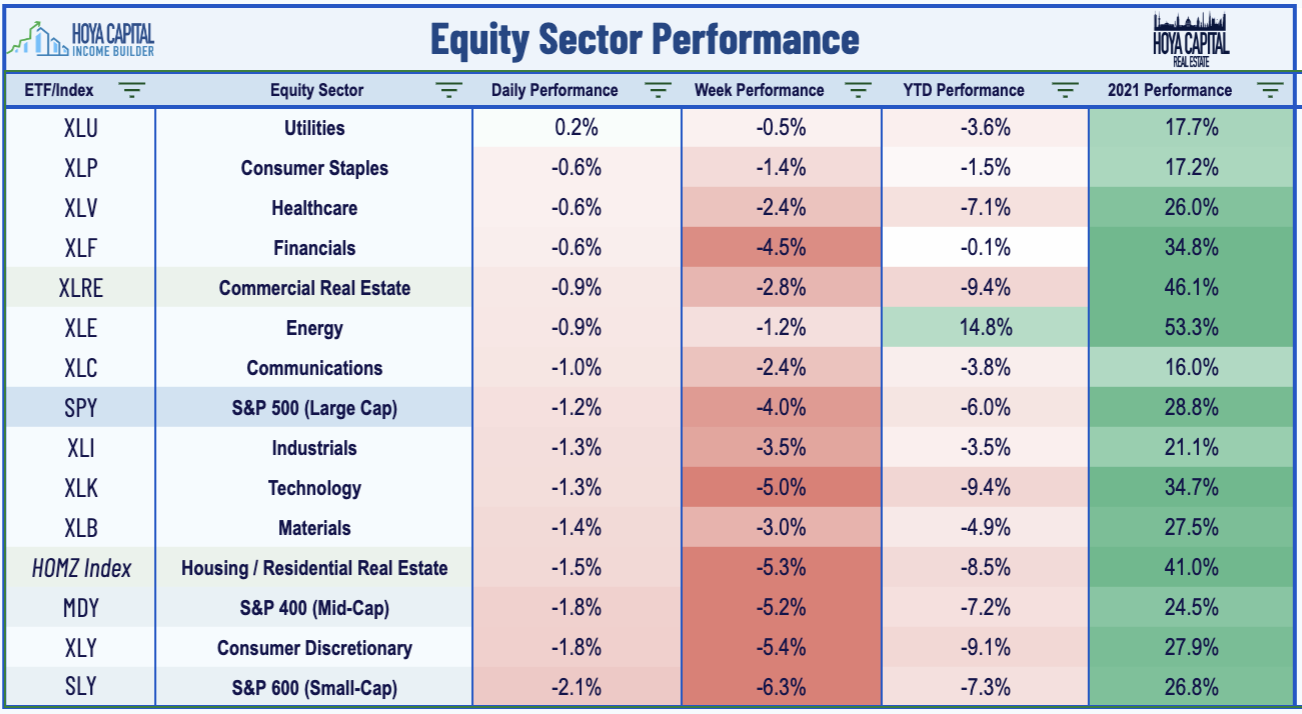

- Pushing their week-to-date gains to nearly 4%, the S&P 500 slipped another 1.2% today while the tech-heavy Nasdaq 100 declined 1.3% to push deeper into "correction territory."

- Real estate equities were among the better-performers today with the Equity REIT Index declining by 1.3% with all 2-of-19 property sectors in positive territory while Mortgage REITs declined 1.4%.

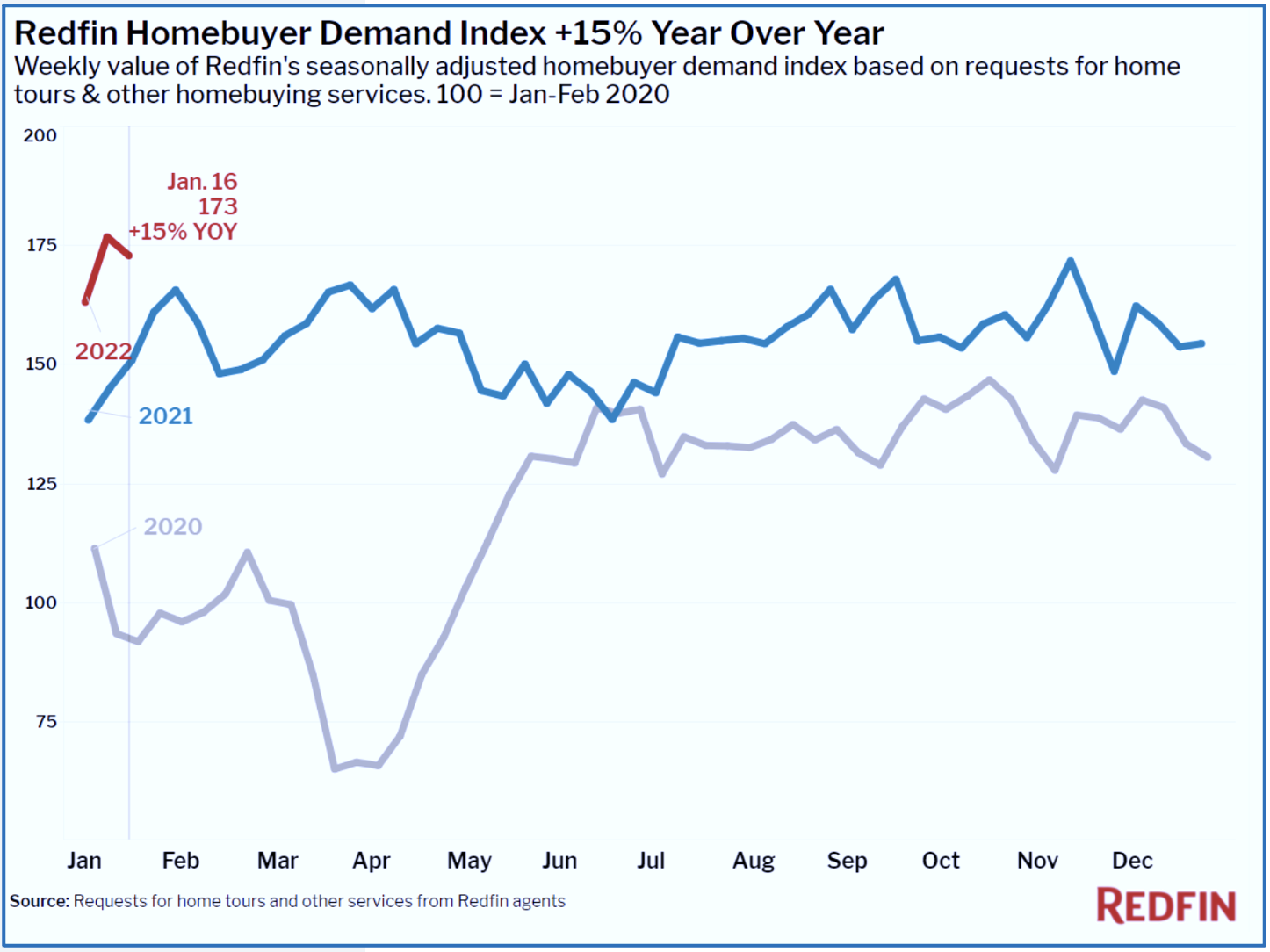

- Housing data today showed that Existing Home Sales in the U.S. surged to a 15-year high in 2021, but moderated slightly in December as housing supply levels dipped to historic lows.

- The U.S. housing industry has gathered momentum into the winter months, confirmed by a handful of reports over the past 24 hours. ReMax (RMAX) reported today that December 2021 home sales were the second-highest for the month on record.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets reversed early-session gains to end lower again Thursday as ongoing concerns over stagflation were deepened by employment data showing that jobless claims rose to the highest level since October. Pushing their week-to-date gains to nearly 4%, the S&P 500 slipped another 1.2% today while the tech-heavy Nasdaq 100 declined 1.3% to push deeper into "correction territory." The Mid-Cap 400 declined 1.8% while the Small-Cap 600 slid 2.1%. Real estate equities were among the better-performers today with the Equity REIT Index declining by 1.3% with all 2-of-19 property sectors in positive territory while Mortgage REITs declined 1.4%.

The choppiness has continued as investors have rapidly reset expectations to price in four Fed interest rates hikes in 2022 amid concerns that it is "behind the curve" in combating inflation. Ten of the eleven GICS equity sectors finished lower on the day with the Consumer Discretionary (XLY) and Materials (XLB) sectors lagging on the downside. The 10-Year Treasury Yield climbed slightly today and remains near its highest level since late 2019.

Housing data today showed that Existing Home Sales in the U.S. surged to a 15-year high in 2021, but moderated slightly in December as housing supply levels dipped to historic lows. For the full-year, existing sales rose 8.5% from a year earlier to 6.12 million. The inventory of unsold existing homes at the end of December was just 910,000, or 1.8 months of supply, the lowest levels since the association began tracking total inventoriesin 1999. Earlier this week, we published Homebuilders: Growth At Very Reasonable Prices which discussed the secular tailwinds that should continue to provide stability for the border housing sector despite rising mortgage rates.

The U.S. housing industry has gathered momentum into the winter months, confirmed by a handful of reports over the past 24 hours. ReMax (RMAX) reported today that December 2021 home sales were the second-highest for the month in report history, trailing only December 2020. Zillow (Z) reported today that housing inventory levels dropped below 1 million to record-low levels in December - down 40.5% from the pre-pandemic level in December 2019. Historically tight housing supply rents are up 15.7% from last year while home values rose by 19.6%. Redfin (RDFN) noted that 32% of homes that went under contract within one week of hitting the market, homes that sold were on the market for a median of just 28 days, and a near-record-high of 41% of homes sold above list price.

Equity REIT Daily Recap

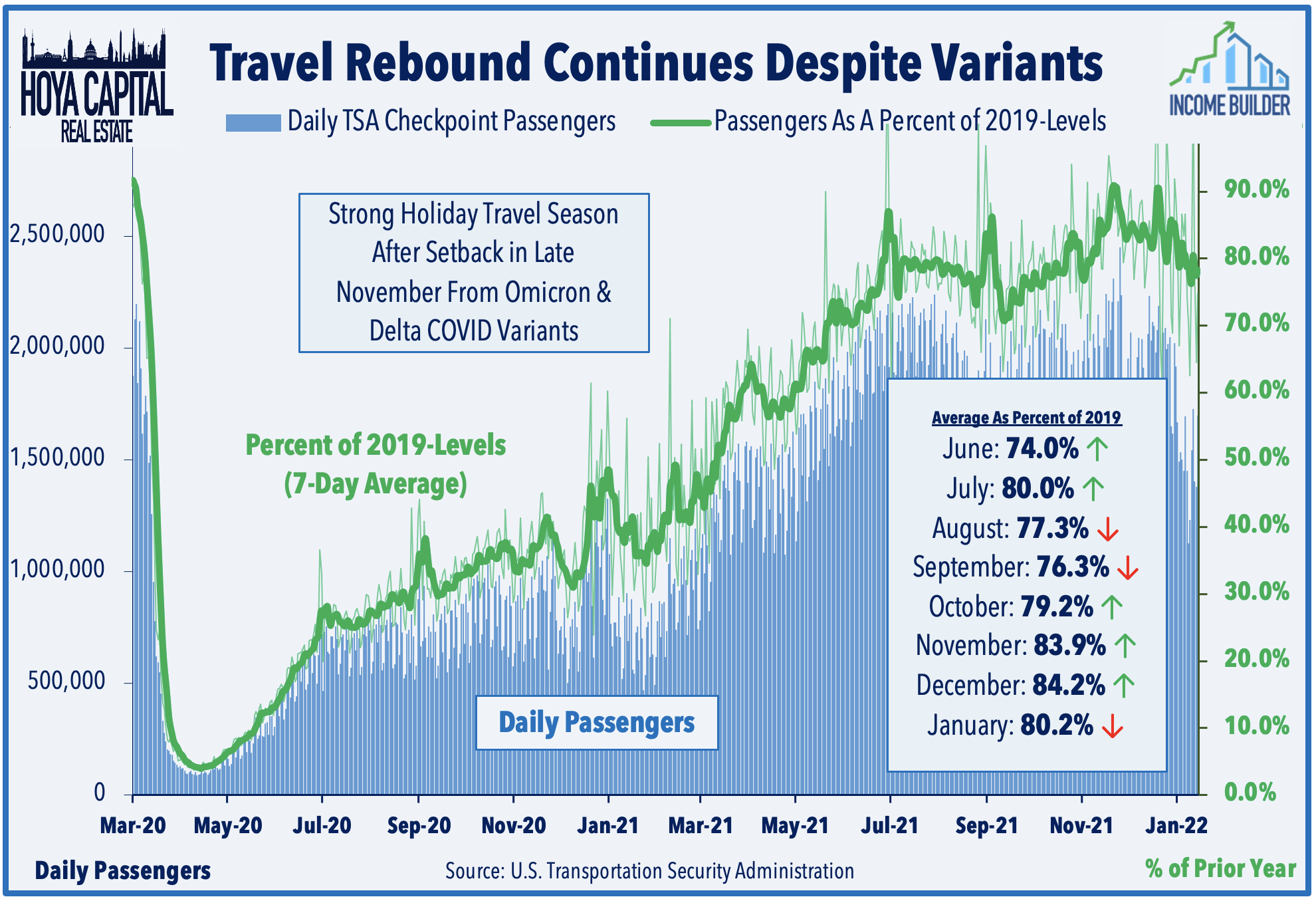

Hotel: Hersha Hospitality (HT) finished roughly flat today after announcing preliminary operating results for December 2021. HT noted that it achieved Average Daily Rates that were 7.2% above December 2019 levels. October and November RevPAR trailed 2019 comparable month results by 30% and 21%, respectively, while its December results trailed by 14% "despite a late month surge of the Omicron variant.” Recent TSA Checkpoint data has shown that the impact of the COVID reacceleration has been relatively mild with travel still at 80% of 2019-levels.

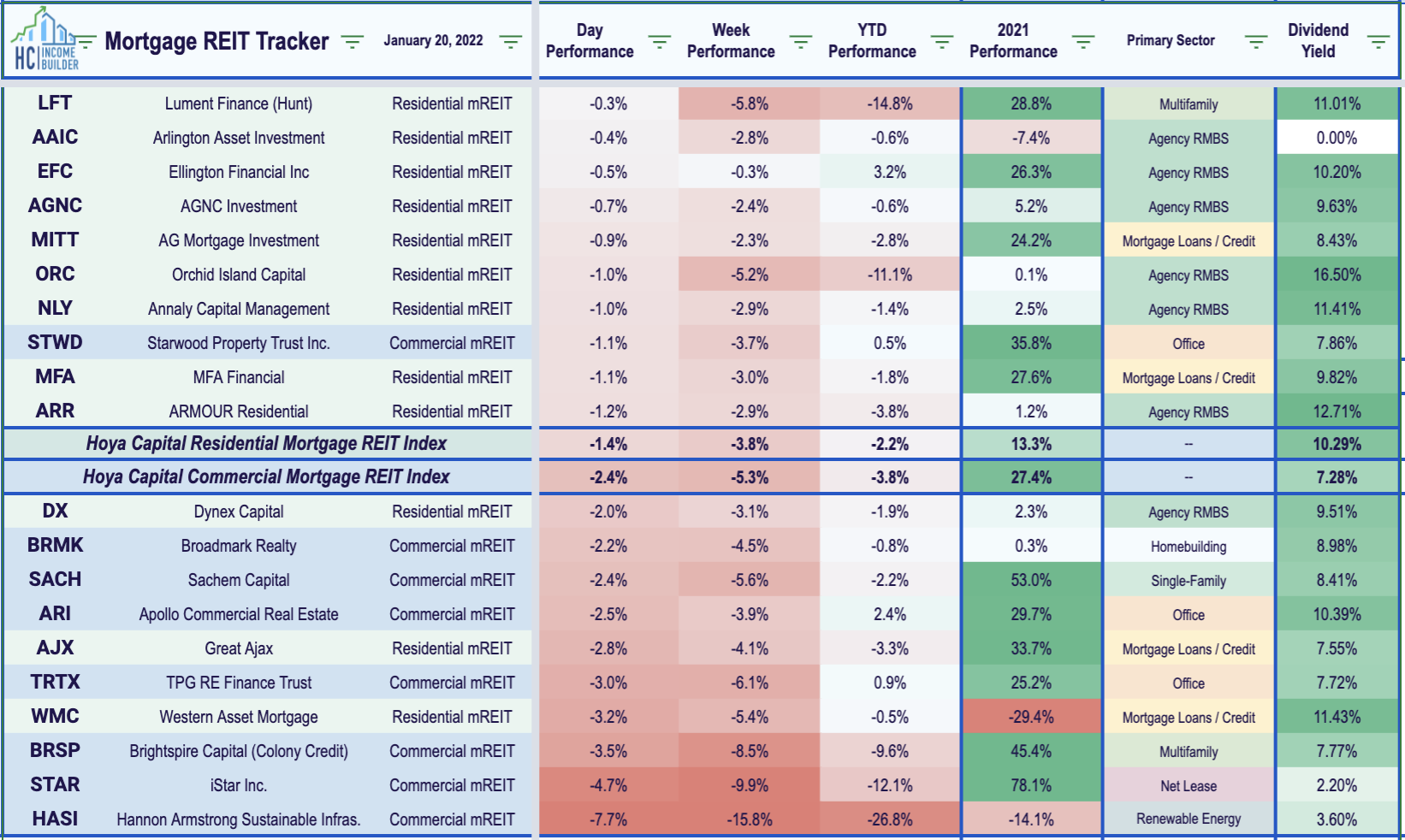

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs slipped 1.4% today while commercial mREITs declined 5.3% today. BrightSpire Capital (BRSP) slumped 3% today after revising its estimated book value per share lower by $0.33 compared to its estimate on December 22nd. Today, we published Mortgage REITs: High Yield Opportunities & Risks as an exclusive report for Hoya Capital Income Builder members which previewed the upcoming earnings season and discuss our updated outlook for the mortgage REIT sector.

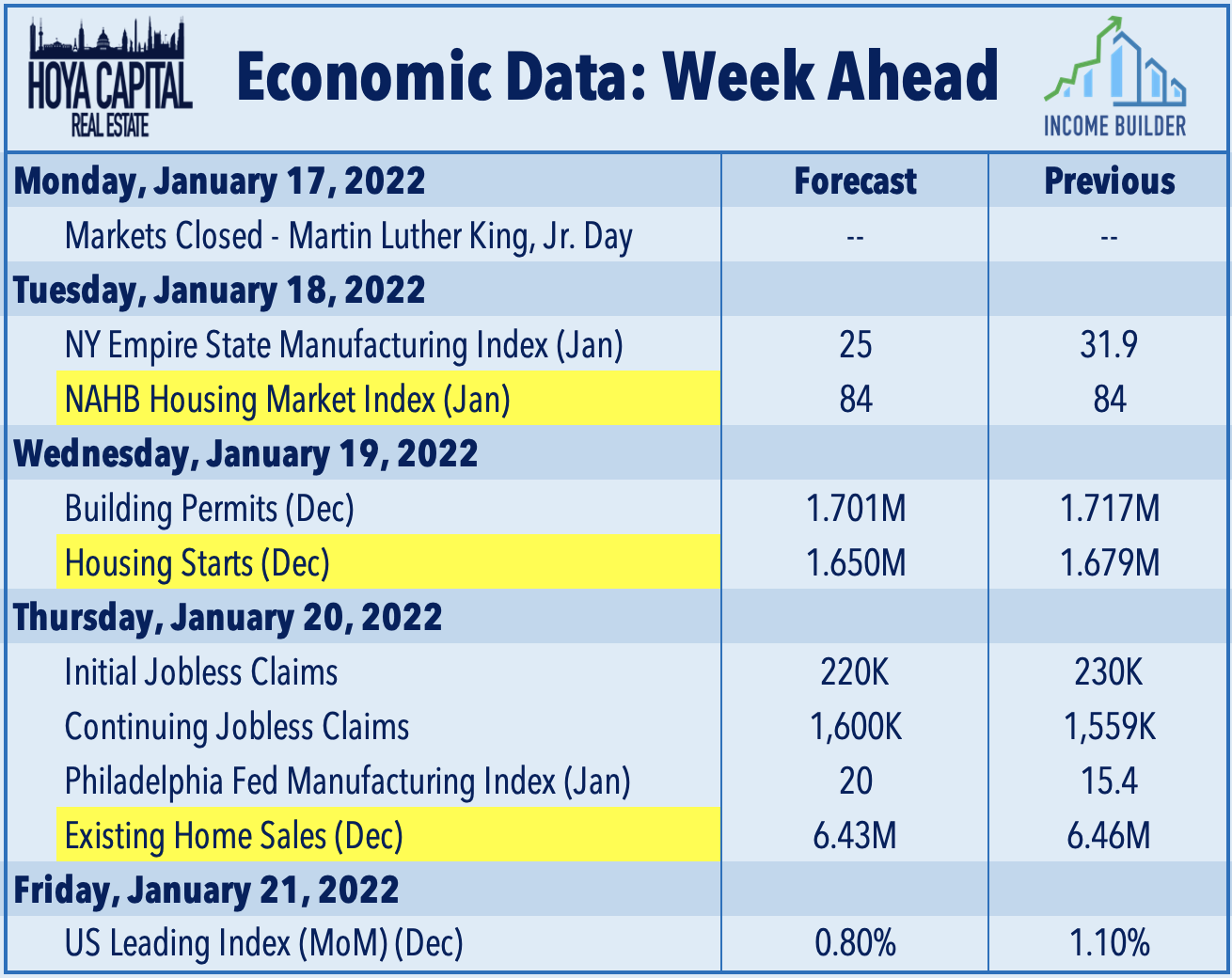

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.