Crude Cuts • Storage Wars • Blackstone Limits Redemptions

U.S. equity markets were mixed Monday while oil prices surged after OPEC+ announced a surprise oil production cut, which revived some concerns of prolonged inflationary headwinds.

Riding a three-week winning streak, S&P 500 finished higher by 0.3% today, but the Mid-Cap 400 and Small-Cap 600 each finished lower by 0.1%. The Dow added more than 327 points.

Following their best week in four months, real estate equities and other rate-sensitive equity market segments were among the laggards today. The Equity REIT Index declined 0.8%.

Life Storage (LSI) rallied more than 3% today after it agreed to be acquired by ExtraSpace Storage (EXR) in a $12.4B all-stock deal between the second and fourth largest storage REITs.

Asset manager Blackstone (BX) slid more than 3% today after it disclosed that it again had to limit withdrawals from its $70 billion real estate fund in March, fulfilling just 15% of redemption requests in March.

Income Builder Daily Recap

U.S. equity markets were mixed Monday while oil prices surged after OPEC+ announced a surprise oil production cut, which revived some concerns of prolonged inflationary headwinds. Riding a three-week winning streak, S&P 500 finished higher by 0.3% today, but the Mid-Cap 400 and Small-Cap 600 each finished lower by 0.1%. The Dow added more than 327 points. Following their best week in four months, real estate equities and other rate-sensitive equity market segments were among the laggards today. The Equity REIT Index declined 0.8% today with 15-of-18 property sectors in negative territory, while the Mortgage REIT Index declined by 0.6%.

Just as volatility from the regional bank crisis began to subside, the Organization of the Petroleum Exporting Countries ("OPEC") injected fresh uncertainty into financial markets this weekend with a surprise announcement to cut more than a million barrels of output a day starting next month, sending the WTI Crude Oil benchmark to above $80/barrel - up from lows in mid-March of $67. The response in bond markets - a strong bid across the maturity curve - was perhaps even more surprising, with the 2-Year Treasury Yield dipping 9 basis points to below 4.0% today while the 10-Year Treasury Yield retreated 6 basis points to 3.43%. Led by a surge from Energy (XLE) stocks, seven of the eleven GICS equity sectors finished higher on the session. Despite the bond bid, the more yield-sensitive equity market segments lagged today, including Real Estate (XLRE) and Utilities (XLU).

Employment data highlight a critical week of economic data in the Easter-shortened week ahead, headlined by JOLTS report on Tuesday, ADP Payrolls data on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Markets will be closed on Friday in observance of Good Friday. Economists are looking for job growth of roughly 240k in March following the surprisingly strong reports in both January and February. 'Good news is bad news' will likely be the theme of these reports as investors and the Fed await the long-awaited cooldown in labor markets which has yet to fully materialize. The closely-watched Average Hourly Earnings series within the payrolls report - which is the first major inflation print for March - is expected to show a cooldown in wage growth in March to 4.3%.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

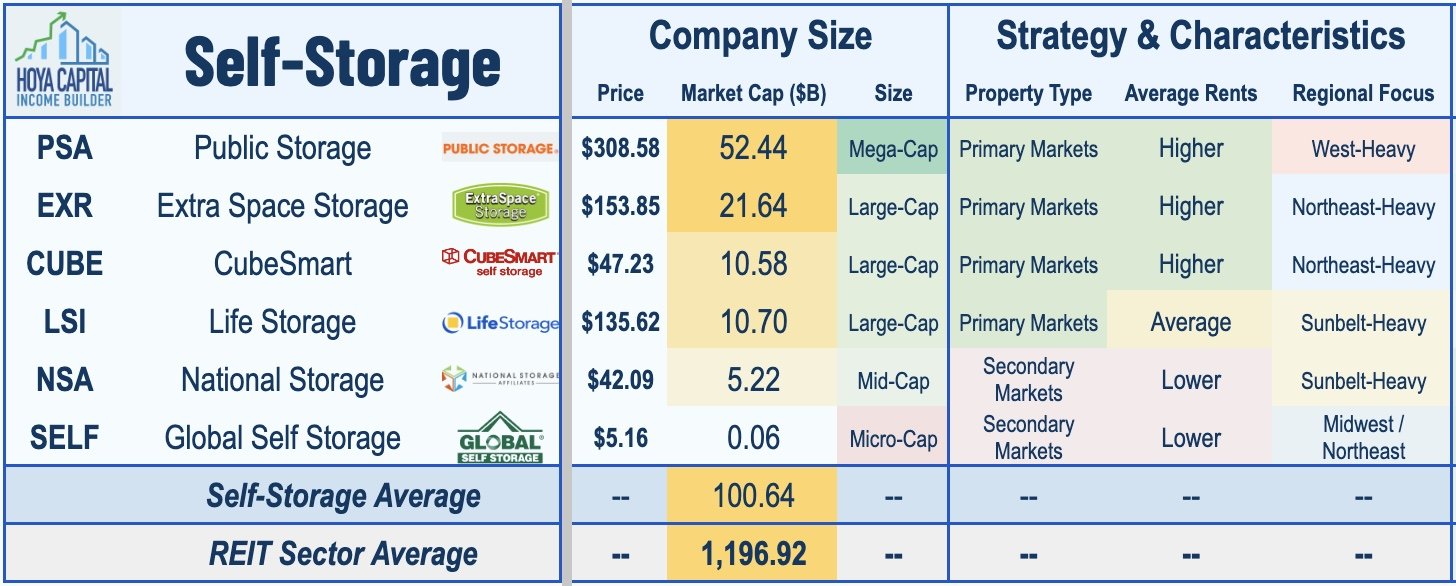

Storage: Done deal. Life Storage (LSI) - which we own in the Dividend Growth Portfolio - rallied more than 3% today after it agreed to be acquired by ExtraSpace Storage (EXR) in a $12.4B deal all-stock deal between the second and fourth largest storage REITs. The transaction will create the largest storage facility operator in the U.S. in terms of number of locations, eclipsing Public Storage (PSA), whose $11B bid for LSI earlier this year was rejected. The combined company will own 3,500 self-storage facilities, representing over 264 million square feet and serving over two million customers. Life Storage stockholders will receive 0.8950 shares of EXR share per share of LSI, representing a price of $145.82/share as of Friday's close. Last month in our Earnings Recap, we noted that Storage REITs were the top-performing sector of earnings season with the largest storage REITs easily topping their prior FFO and NOI guidance and providing an initial 2023 outlook calling for mid-single-digit earnings growth, buoyed by "sticky" rent growth on existing tenants.

Asset manager Blackstone (BX) slid more than 3% today after it disclosed that it again had to limit withdrawals from its $70 billion non-traded real estate platform in March - the fifth straight month that the firm's flagship fund limited redemptions. Total redemption requests for March jumped to $4.5B - up 15% from the prior month and Blackstone fulfilled just 15% of these requests - $666M - down from 35% in February and 25% in January. Blackstone has been exercising its right to block investor withdrawals from its privately-traded fund BREIT since November after requests exceeded its cap set at 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter. BREIT - which determines its NAV internally subject to review from a third-party appraiser - claims to have generated a positive 8.4% net return in 2022 during which time publicly-traded equity REITs were lower by 26% and private market commercial real estate valuations declined 13.2%, per estimates from Green Street Advisors. Naturally, investors have seized on the opportunity to redeem shares at these premium NAV valuations - some of which have reallocated to public REIT shares trading at significant relative discounts.

Single-Family Rental: Today, we published Single Family Rentals: Harder Than it Looks on the Income Builder Marketplace, which discussed our updated outlook and recent allocations within the sector. One of the best-performing property sectors this year, Single-Family Rental REITs have rebounded as the previously-sluggish U.S. housing sector has shown signs of life amid a moderation in mortgage rates. The dire predictions of a "hard landing" in rental markets have been rebuffed in recent months by steadying rental rates and strong occupancy trends seen across the major rent indexes. While multifamily markets face supply headwinds over the next year, single-family builders have pulled back from an already historically supply-constrained single-family market, fundamentals that support sustained inflation-beating rent growth. That said, recent upstart entrants that pushed the leverage limits are learning the hard way that SFRs are a capital-intensive and logistically-challenging business that requires considerable scale to operate profitability through business cycles, which may be a catalyst to drive further market share gains to larger institutions that have access to cheaper and deeper capital.

Additional Headlines from The Daily REITBeat on Income Builder

On Friday, S&P took several ratings actions on Office REITs including placing all ratings on Hudson Pacific Properties (HPP), including its 'BBB-' issuer credit rating, on CreditWatch with negative implications plus lowered the issuer credit rating on Office Properties Income (OPI) to 'BB' from 'BBB-' and the issue-level rating to 'BB+' from 'BBB-'.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished mostly lower today with residential mREITs and commercial mREITs each declining by 0.9%. After the close today, Rithm Capital (RITM) announced that it will be expanding its business into Europe and opening a new office in London. Rithm Europe will be led by recently hired Marty Migliara, the former head of EMEA origination and lending in Bank of America’s global mortgages and securitized products team. Per the press release, Rithm Europe will seek equity and debt investments across the real estate and consumer finance sectors in the region, sourcing opportunities for both private funds and Rithm Capital’s $32 billion balance sheet.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.