Earnings Begin • Toxic Telecom? • Week Ahead

U.S. equity markets extended their inflation-week rally Monday while benchmark interest rates resumed their recent declines as investors parsed weak Chinese economic data and the initial slate of corporate earnings results.

Adding to last week's 2.5% advance and closing at the highest levels since April 2020, the S&P 500 gained 0.4% today. The Nasdaq 100 gained 0.9% while the Dow gained 76 points.

Real estate equities were laggards today ahead of the start of earnings season as a sharp telecom selloff hit heavily-weighted cell tower stocks. The Equity REIT Index slipped 0.7%.

Cell Tower REITs stumbled on the heels of a Wall Street Journal report that named AT&T and Verizon among several telecom companies that abandoned underground toxic lead cables, which may require expensive remediation.

Real estate earnings season kicks off this week with reports from a half-dozen REITs. This afternoon, we'll hear results from manufactured housing REIT Equity LifeStyle (ELS) and tomorrow morning we'll hear results from industrial REIT Prologis (PLD).

Income Builder Daily Recap

U.S. equity markets extended their inflation-week rally Monday while benchmark interest rates resumed their recent declines as investors parsed weak Chinese economic data and the initial slate of second-quarter corporate earnings results. Adding to last week's 2.5% advance and closing at the highest-levels since April 2020, the S&P 500 gained 0.4% today, while the Mid-Cap 400 and Small-Cap 600 gained 0.7% and 0.9%, respectively. The Nasdaq 100 gained 0.9%, while the Dow gained 76 points. Real estate equities were laggards today ahead of the start of earnings season this afternoon as a sharp telecom selloff hit the heavily-weighted cell tower stocks. The Equity REIT Index slipped 0.7% today, with 9-of-18 property sectors in positive territory, while the Mortgage REIT Index gained 1.1%.

Cell Tower: The perennially-outperforming cell tower REIT sector has uncharacteristically stumbled over the past year, mirroring the downward pressure on their primary cell carrier tenants. The selling pressure on the carriers - and these REITs - intensified today on the heels of a Wall Street Journal report that named AT&T (T) and Verizon (VZ) among several telecom companies that abandoned underground toxic lead cables, which are possibly causing environmental damage. Shares of AT&T fell nearly 7% to the lowest level in thirty years while Verizon dipped nearly 8% on Monday after the report sparked another wave of analyst downgrades. Following the Journal investigation, a Wall Street analyst estimated it could cost $59 billion to remove all the lead cables nationwide. Uniti Group (UNIT) - a REIT that focuses primarily on fiberoptic networks - dipped more than 7% on the session while SBA Communications (SBAC) posted similarly steep declines.

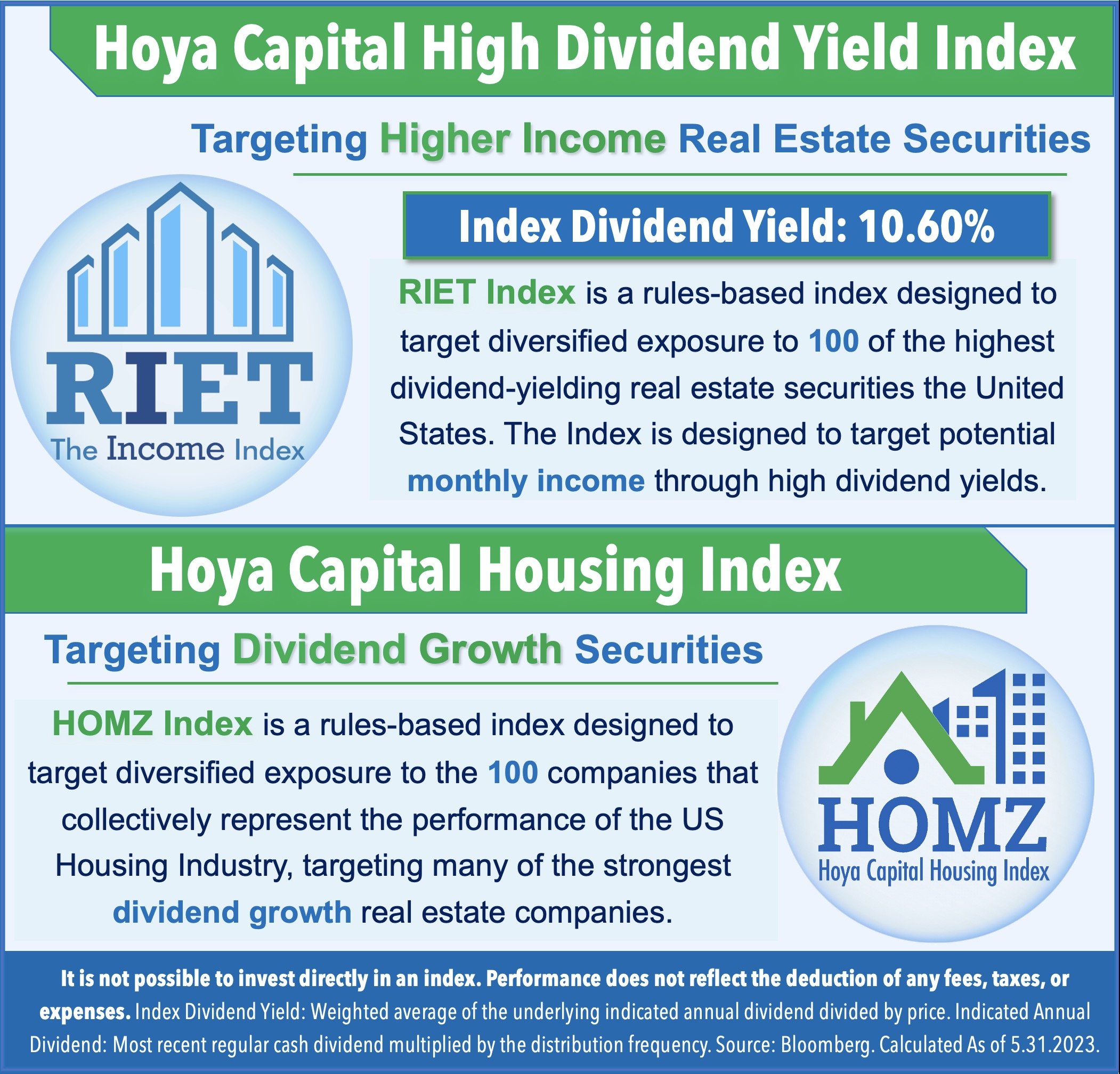

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.