Energy Crisis • Data Center M&A? • Reverse Split

- U.S. equity markets finished broadly lower today on another choppy session amid renewed concern over a global energy shortage and persistent inflation resulting from the ongoing Russia/Ukraine conflict.

- Giving back all of yesterday's gains, the S&P 500 retreated 1.3% today while the tech-heavy Nasdaq 100 dipped 1.4% and is now 13% below its recent highs.

- Real estate equities were also broadly lower today, but were among the better-performers, as the Equity REIT Index declined 1.2% with all 19 property sectors in negative-territory while Mortgage REITs slipped 0.9%.

- Switch (SWCH) - a data center operator that plans to convert to a REIT by 2023 - remains in the spotlight following a report earlier this week that it is exploring a potential sale of the company with Digital Realty and Equinix as potential bidders.

- MFA Financial (MFA) announced that its Board of Directors approved a reverse stock split of the Company's common stock at a ratio of 1-for-4, which will take effect following the close of business on April 4th.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished broadly lower today on another choppy session amid renewed concern over a global energy shortage and persistent inflation resulting from the ongoing Russia/Ukraine conflict. Giving back all of yesterday's gains, the S&P 500 retreated 1.3% today while the tech-heavy Nasdaq 100 dipped 1.4% and is now 13% below its recent highs. Real estate equities were also broadly lower today, but were among the better-performers, as the Equity REIT Index declined 1.2% with all 19 property sectors in negative-territory while Mortgage REITs slipped 0.9%.

The 10-Year Treasury Yield - which closed at its highest level since late 2019 yesterday - pulled back today even as energy and commodities prices resumed their rally with WTI Crude Oil (CL1:COM) advancing nearly 5%. Nine of the eleven GICS equity sectors finished lower today, dragged on the downside by Financials (XLF) and Healthcare (XLY) while homebuilders slumped following data showing a pull-back in New Home Sales in February which followed stronger-than-expected Housing Starts data last week. The Energy (XLE) sector advanced 1.7% to push its 2022 gains to nearly 40%.

Real Estate Daily Recap

Data Center: Switch (SWCH) - a data center operator that plans to convert to a REIT by 2023 - remains in the spotlight following a report earlier this week that it is exploring a potential sale of the company. JP Morgan wrote today that it expects the two major data center REITs Digital Realty (DLR) and Equinix (EQIX) to be potential buyers of SWCH at a projected price of $34-$38/share which would be a multiple in-line with the QTS Realty and CoreSite acquisitions last year by Blackstone and American Tower. In our recent data center REIT report, we noted that both Digital Realty and Equinix are both "overdue" for a major M&A move based on their historical cadence and both are sitting on a mountain of dry powder.

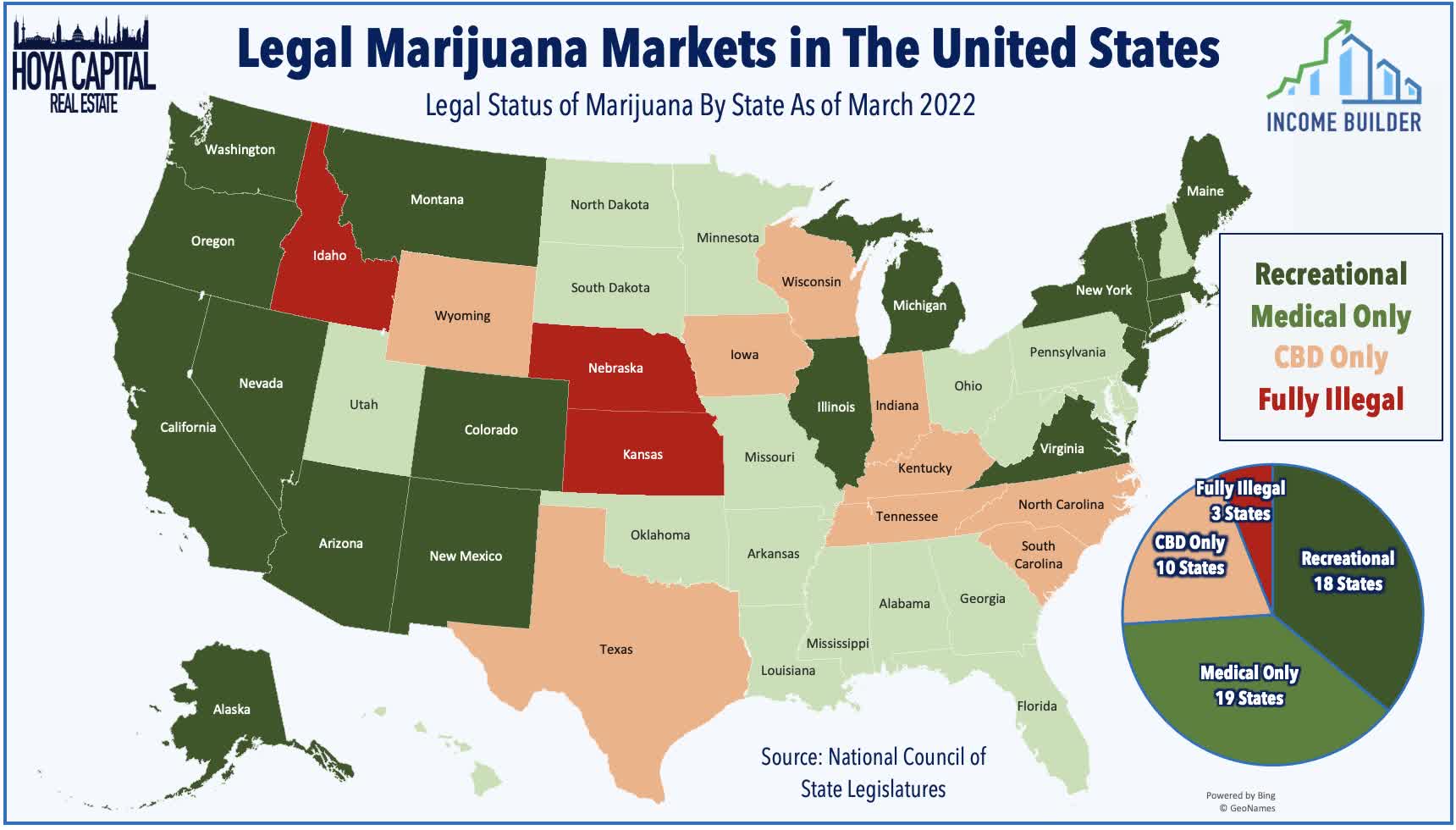

Cannabis: Today, we published Cannabis REITs: Own The Pharmland. Cannabis REITs have stumbled in early 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization. Owning the "Pharmland" - the physical real estate - has been one of the few themes in the space that has worked as cannabis ETFs have delivered dismal investment performance since 2019. Thriving in the murky and often contradictory regulatory framework of legalized marijuana, recent movement in Washington on cannabis-related bills has raised questions about the future prospects in a federally-legalized environment.

Hotels: This evening, we will publish an updated report on the Hotel REIT sector on the Income Builder Marketplace. It continues to be a 'Tale of Two Americas' for the hotel industry as Sunbelt and leisure-focused markets have substantially outperformed Coastal business-heavy markets. The Top-10 markets have all been in the Southern U.S. while the Bottom-10 markets have all been in the North. Encouragingly, recent TSA travel has indicated that the travel recovery has picked up steam in recent weeks after an Omicron-driven setback in early 2022. In the report, we'll discuss our recent trade in the hotel REIT sector and our updated outlook for 2022.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs rallied 1.6% today while residential mREITs advanced 1.5%. MFA Financial (MFA) - which currently trades at $4.07/share - announced that its Board of Directors approved a reverse stock split of the Company's common stock at a ratio of 1-for-4, which will take effect following the close of business on April 4th. Elsewhere, New York Mortgage Trust (NYMT) was among the laggards today after announcing an equity investment in AlphaFlow, a technology platform for institutional investment in real estate debt. The average residential mREIT pays a dividend yield of 11.01% while the average commercial mREIT pays a dividend yield of 7.45%.

Economic Data This Week

The economic calendar slows down a bit in the week ahead with the major reports coming on Wednesday with New Home Sales and on Friday with Pending Home Sales. On Friday, we'll also see revised Consumer Sentiment data for March which dipped to recessionary levels in the initial reading last week amid mounting anxiety over soaring inflation. We'll also be watching PMI data on Thursday and the Baker Hughes Rig Count on Friday for indications on whether U.S. oil and gas production is accelerating to address the surge in global energy prices.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.