Fed Decision • Strong Housing Data • REIT Earnings

Summary

- U.S. equity markets retreated from early-session gains to end lower Wednesday after Fed Chair Powell signaled that the central bank plans to begin hiking rates in March to combat inflation.

- On a third-straight session of volatile intra-day swings, the S&P 500 finished lower by 0.3% while the tech-heavy Nasdaq 100 finished lower by 0.2%, reversing early-session gains of more than 3%.

- Real estate equities were among the laggards today as the Equity REIT Index finished lower by 1.6% with all 19 property sectors in negative territory while Mortgage REITs declined 1.0%.

- New Home Sales rose in December to a nine-month high, indicating that housing demand remained strong in late 2021 despite the rise in mortgage rates and historically low levels of housing supply.

- Boston Properties (BXP) gained 0.6% today after reporting better-than-expected results yesterday afternoon, highlighted by strong leasing volume despite the persistently low utilization rates of office properties in their core coastal markets of Boston and New York.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets retreated from early-session gains to end lower Wednesday after Fed Chair Powell signaled that the central bank plans to begin hiking rates in March to combat inflation. On a third-straight session of volatile intra-day swings, the S&P 500 finished lower by 0.3% while the tech-heavy Nasdaq 100 finished lower by 0.2%, reversing early-session gains of more than 3%. Real estate equities were among the laggards today as the Equity REIT Index finished lower by 1.6% with all 19 property sectors in negative territory while the Mortgage REIT Index finished lower by 1.0%

Stocks initially rallied after the release of the updated FOMC policy statement, but lost steam during the subsequent press conference the followed as bond yields climbed back to the highest levels since before the pandemic. The 10-Year Treasury Yield gained 7 basis points to close at 1.85% Volatility levels climbed to the highest since late 2022 with the VIX Index closing the session above 31. Nine of the eleven GICS equity sectors finished lower today with Technology (XLK) and Financials (XLF) the lone sectors in positive territory ahead of a busy slate of earnings reports this afternoon.

New Home Sales rose in December to a nine-month high, indicating that housing demand remained strong in late 2021 despite the rise in mortgage rates and historically low levels of housing supply. New Home Sales rose 11.9% from a month earlier to an 811,000 annualized pace, the BLS reported this morning, well above the consensus estimate of a 760,000 rate. Last week, we published Homebuilders: Growth At Very Reasonable Prices which discussed the secular tailwinds that should continue to provide stability for the border housing sector despite rising mortgage rates.

Equity REIT Daily Recap

Yesterday we published REIT Earnings Preview: Dividend Hikes And 2022 Outlook. Real estate earnings season kicks off this week, and REITs enter fourth-quarter earnings season at an interesting crossroads, having been the best-performing asset class of 2021, but also one of the weakest through the first three weeks of 2022. REIT property-level fundamentals remain on an upward trajectory and we expect another strong quarter from residential REITs, in particular, as recent data indicates that rents continue to soar by double-digit rates. We'll from office REIT SL Green (SLG), industrial REIT Duke Realty (DRE) and cell tower REIT Crown Castle (CCI) this afternoon.

Office: Boston Properties (BXP) gained 0.6% today after reporting better-than-expected results yesterday afternoon, highlighted by strong leasing volume despite the persistently low utilization rates of office properties in their core coastal markets of Boston and New York. BXP delivered strong same-store NOI growth of 10.4% in Q4 and full-year FFO growth of 4.3% - beating its prior guidance by 60 basis points. BXP also raised its 2022 FFO outlook and now sees 12.4% growth this year, which would be 4% above its pre-pandemic level in full-year 2019. Notably, more than 25% of the square footage signed this quarter were leased to life sciences tenants.

Student Housing: Today, we published Student Housing REITs: Back to School as an exclusive report for Hoya Capital Income Builder members. American Campus Communities (ACC) - along with the broader student housing sector - have delivered a swifter-than-expected rebound as students at flagship universities returned to campus for the Fall semester. Despite the broader enrollment declines at the national level due to a myriad of short-term pandemic-related effects and structural headwinds related to demographics and the shift to online education, student housing fundamentals in top-tier university markets have returned to pre-pandemic levels.

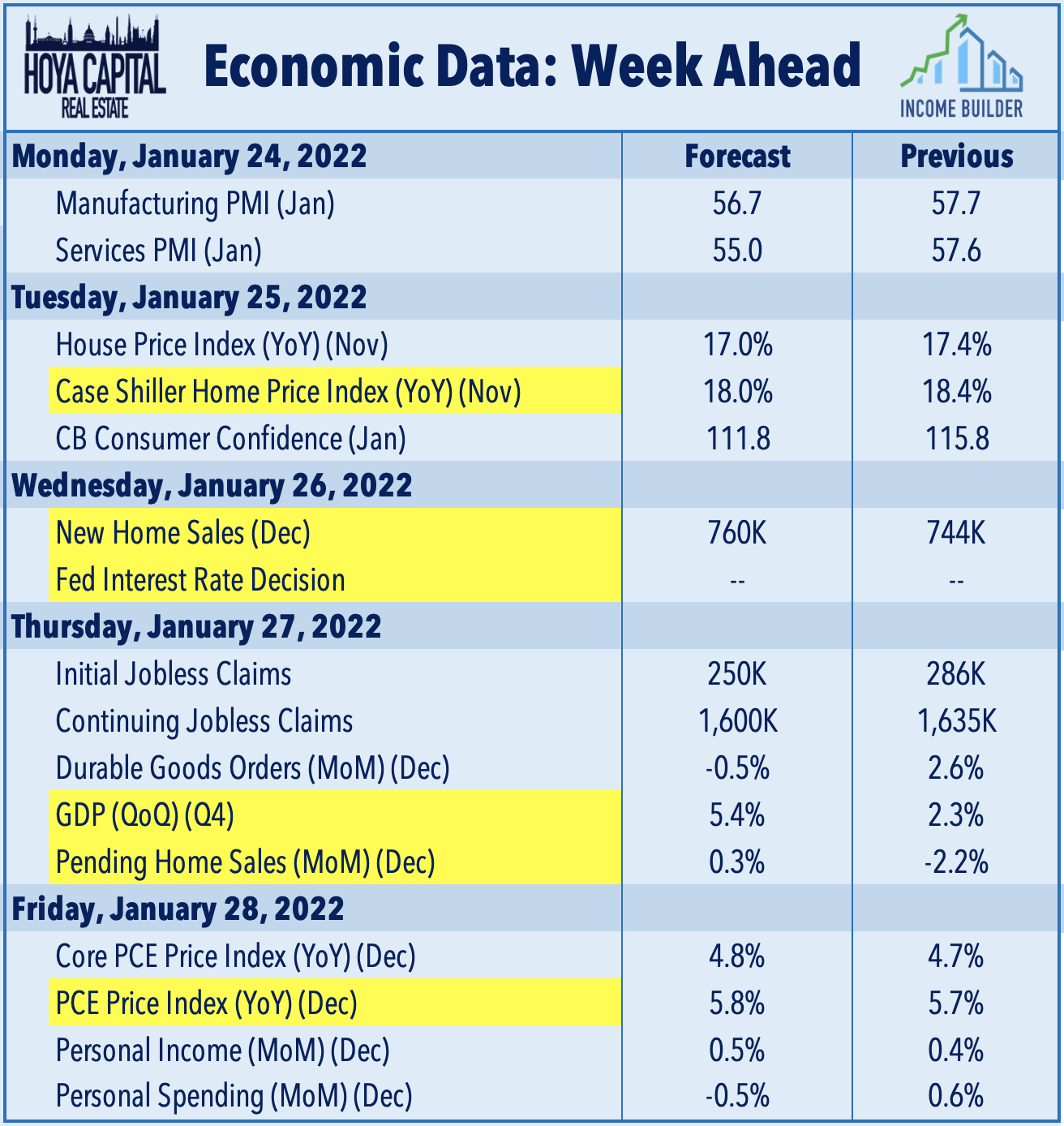

Economic Data This Week

The frenetic week of economic data, earnings reports, and Fed-related newsflow continues on Thursday when we'll get our first look at fourth-quarter GDP data as well as Pending Home Sales for December. On Friday, we'll see inflation data via the PCE Index as well as Personal Income & Spending data. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.