Fed Hikes • Yellen Backtracks • Storage Wars

U.S. equity markets slid Wednesday as dueling commentary from Fed Chair Powell and Treasury Secretary Yellen reversed an initial bounce in the immediate aftermath of the Fed's 25-basis point hike.

Diving into the close and reversing intra-session gains of nearly 1%, the S&P 500 finished lower by 1.7% today while the Mid-Cap 400 and Small-Cap 600 each slid by over 2.5%.

Real estate equities finished sharply lower as credit concerns across the regional banking system offset a retreat in benchmark interest rates. The Equity REIT Index dipped 3.7% today.

Treasury Secretary Yellen stole the spotlight after commenting to lawmakers that the Federal government is not considering providing “blanket” deposit insurance to stabilize the banking system.

Life Storage (LSI) was among the better performers today after Bloomberg reported that competitor Extra Space (EXR) is evaluating a rival bid for the company after it rejected an $11B bid last month from Public Storage (PSA).

U.S. equity markets slid into the close Wednesday as dueling commentary from Fed Chair Powell and Treasury Secretary Yellen reversed an initial bounce in the immediate aftermath of the Fed's 25 basis point rate hike. Diving into the close and reversing intra-session gains of nearly 1%, the S&P 500 finished lower by 1.7% today while the Mid-Cap 400 and Small-Cap 600 each slid by over 2.5%. The Dow slid more than 500 points. Real estate equities finished sharply lower as amplified credit concerns across the regional banking system offset a retreat in benchmark interest rates. The Equity REIT Index dipped 3.7% today with all 18 property sectors in positive territory, while the Mortgage REIT Index declined by 2.5%.

As expected, the Federal Reserve hiked the Fed Funds rate by another 25 basis points to a 5.0% upper bound while indicating a more cautious approach to further tightening in light of the ongoing banking crisis with Fed Chair Powell noting that a "pause" was considered. Treasury Secretary Yellen stole the spotlight, however, after commenting to lawmakers that the Federal government is not considering providing “blanket” deposit insurance to stabilize the banking system following reports that Treasury Department was reviewing such actions. The policy-sensitive 2-Year Treasury Yield tumbled back below 4% late in the day - dipping more than 20 basis points on the session - while the 10-Year Treasury Yield dipped back below 3.50%. All eleven GICS equity sectors finished lower on the session with Real Estate (XLRE) and Financials (XLF) stocks dragging on the downside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

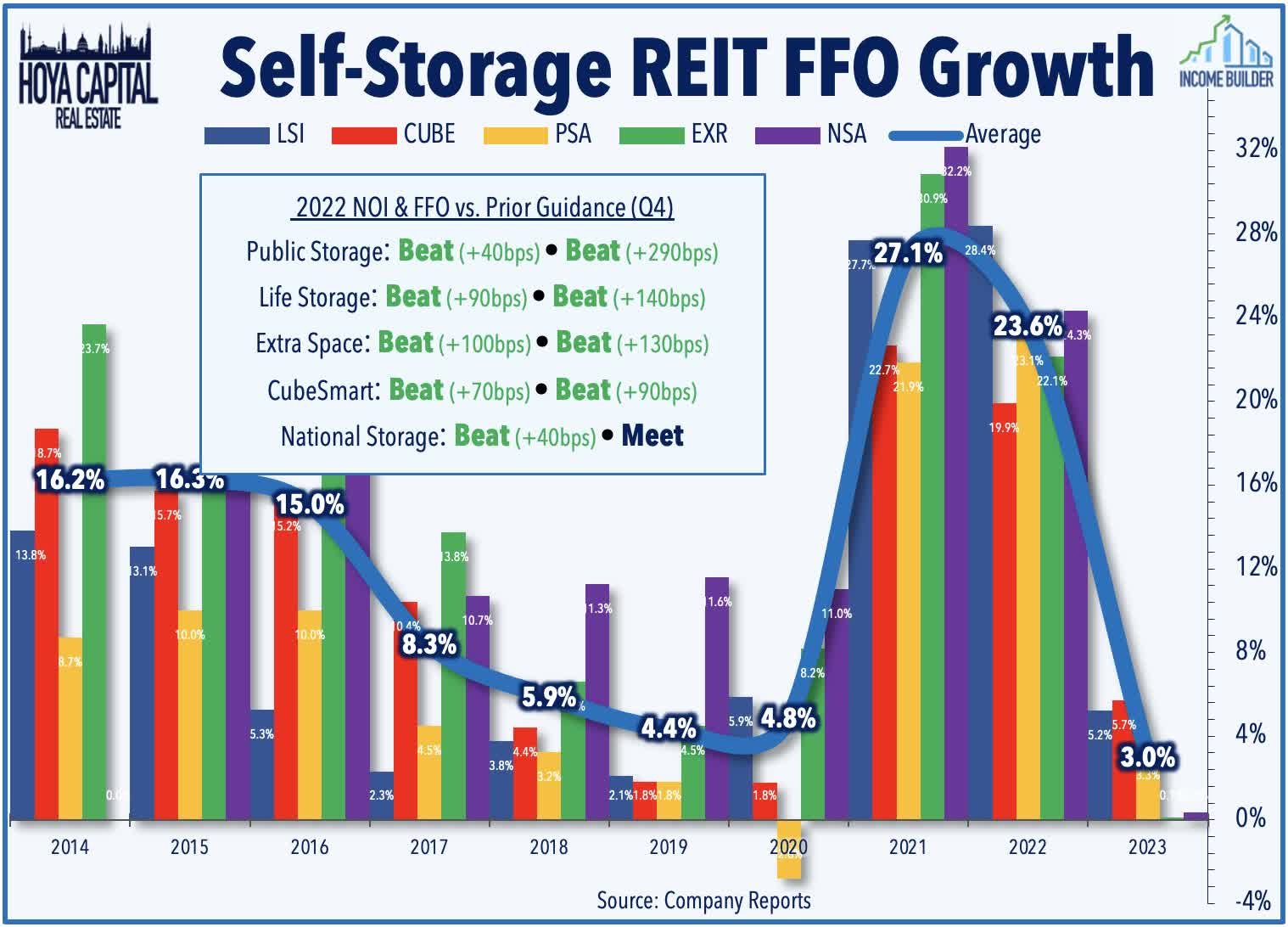

Storage: Life Storage (LSI) was among the better performers today after Bloomberg reported that competitor Extra Space (EXR) is evaluating a rival bid for the company after it rejected an $11B bid last month from Public Storage (PSA). Last week, Life Storage filed an 8-K last week to increase severance payments to executives in a change of control, fueling speculation that the company may be getting closer to a deal with either PSA or EXR. Last month in our Earnings Recap, we noted that Self-Storage REITs were the top-performing sector of earnings season with results that quieted critics forecasting a dismal year of declining rents and oversupply headwinds. The largest storage REITs easily topped their prior FFO and NOI guidance and provided an initial 2023 outlook calling for mid-single-digit earnings growth, buoyed by "sticky" rent growth on existing tenants.

Hotel: Pebblebrook (PEB) dipped more than 6% after reporting mixed operating results, noting that its comparable Revenue Per Available Room ("RevPAR") was about 6% below 2019-levels in February, an improvement from January which saw comparable RevPAR levels that were 13% below 2019-levels. Previously, PEB reported that its RevPAR in Q4 was 7.8% below pre-pandemic levels. PEB commented, "overall demand trends for Q1 continue to be in line with expectations. Leisure demand remains healthy heading into the spring break season. We have not yet seen any impact on demand from fears of an economic slowdown or recession.” Yesterday, STR reported that the U.S. hotel industry posted strong operating performance in February with RevPAR levels that were 14.3% above the comparable period in 2019. Among the Top 25 Markets, Tampa experienced the highest occupancy level (82.7%) while Chicago (50.1%) and St. Louis (52.7%) reported the lowest occupancy rates for the month. San Francisco reported the steepest decline in occupancy when compared with 2019 (-28.4%).

Net Lease: Today, we published Net Lease REITs: Avoiding The Winner's Curse. One of the most "rate-sensitive" property sectors, Net Lease have surprisingly been the best-performing major property sector since early 2021 despite the significant rise in interest rates. Private market values have remained far "stickier" than comparable public market assets. Increases in these REITs' cost of capital have far-outpaced cap rate increases, resulting in record-low investment spreads. Despite the tighter investment spreads, the pace of acquisition activity for some REITs slowed only modestly in late 2022, a strategy that could prove costly if rates remain persistently elevated. Strong balance sheets and lack of variable rate debt exposure have positioned these REITs to be aggressors as over-levered private players seek an exit, but these REITs must wait until the price is right lest they risk falling prey to the "winner's curse." We see the best value in REITs focusing on “middle-market” tenants and the middle-tier of cap rates where inflation-hedging lease structures and initial yields grant more breathing room for higher rates.

Additional Headlines from The Daily REITBeat on Income Builder

ExtraSpace Storage (EXR) priced $500 million of 5.70% senior notes due 2028 and intends to use the net proceeds of this offering to fund potential acquisition opportunities and/or to repay amounts outstanding from time to time under its lines of credit

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs finished lower today with residential mREITs slipping 1.9% while commercial mREITs dipped 3.0%. Ellington Financial (EFC) was one of the stronger-performers after it announced a $50M stock buyback of its common shares, extending its ability to buy back common stock beyond the 1.55M shares previously authorized in 2018, nearly all of which have been repurchased through Tuesday. After the close today, Western Asset Mortgage (WMC) reduced its dividend by about 13% to $0.35/share. WMC was one of the REITs we flagged as at-risk for a dividend cut in our updated Mortgage REITs report published last week. In addition, WMC reproted that its estimated Book Value Per Share ("BVPS") as of February 28, 2023, was approximately $16.95, up about 8% since the end of Q4.

As discussed in Mortgage REITs: High-Yield Opportunities & Risk, mREITs have been slammed by the fallout of the ongoing regional banking crisis amid a resurgence of interest rate volatility and credit concerns, erasing their once-robust gains for 2023. Commercial mREIT exposure to the troubled office sector has come into focus following a wave of mega-sized loan defaults from over-levered private owners. For Residential mREITs, Book Values remain in decent-shape as MBS spread-widening has been more-than-offset by a decline in benchmark rates, but sharp changes in rates heighten the hedge-related risk. Despite paying average dividend yields in the low-teens, the majority of mortgage REITs are still able to cover their dividends, but we identified several mREITs that are most at-risk of dividend reductions and broader risk factors.

Economic Data This Week

The busy week of economic data continues with New Home Sales data on Thursday. Home Sales metrics have closely correlated with changes in mortgage rates, which averaged 6.66% in February, up from 6.26% in January. We'll also be watching weekly Jobless Claims data on Thursday and a busy slate of PMI data throughout the week. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.