Fed Hikes • Yields Dip • Blackstone Redemptions

- U.S. equity markets rallied Wednesday after the Federal Reserve hiked benchmark interest rates by 25 basis points- a step-down from prior hikes- while acknowledging that "the disinflationary process has started."

- The first day of February saw a continuation of January's rebound with the S&P 500 advancing 1.1% today while the tech-heavy Nasdaq 100 gained 2.1%.

- Real estate equities- which were among the hardest-hit sectors by aggressive monetary tightening- continued their strong start to the year. Equity REITs advanced 0.6% today with 16-of-18 property sectors advancing.

- Asset manager Blackstone's (BX) non-traded real estate platform - Blackstone Real Estate Income Trust ("BREIT") - told investors Wednesday that the fund again hit its monthly redemption limit, fulfilling just a quarter of the funds requested by investors.

- Office REIT Boston Properties (BXP) finished slightly higher today after reporting mixed results with fourth-quarter FFO topping estimates but revising lower its outlook for full-year 2023.

Income Builder Daily Recap

U.S. equity markets rallied Wednesday after the Federal Reserve hiked benchmark interest rates by 25 basis points - a step-down from prior rate hikes- while acknowledging that "the disinflationary process has started." The first day of February saw a continuation of January's rebound with the S&P 500 advancing 1.1% today while the tech-heavy Nasdaq 100 gained 2.1%. The Dow added 7 points - its seventh advance in eight sessions. Real estate equities - which were among the hardest-hit sectors by aggressive monetary tightening - continued their strong start to the year. The Equity REIT Index advanced 0.6% today with 16-of-18 property sectors in positive territory while the Mortgage REIT Index gained 2.0%. Homebuilders and the broader Hoya Capital Housing Index were again among the leaders as well.

The less-hawkish-than-anticipated commentary from Fed Chair Powell - who used the term "disinflation" a handful of times in prepared remarks and subsequent responses - fueled a rally across fixed-income securities. The 10-Year Treasury Yield dipped to 3.40% today - down 13 basis points to the lowest levels since September. Softer-than-expected ADP employment and PMI data added further downward pressure on the US Dollar ahead of the critical BLS employment report on Friday. Crude Oil dipped 3% today while Natural Gas prices resumed their sharp declines to levels last seen in late 2019. Ten of the eleven GICS equity sectors were higher on the session with Technology (XLK) and Consumer Discretionary (XLY) stocks leading on the upside.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Office: Boston Properties (BXP) finished slightly higher today after reporting mixed results with fourth-quarter FFO topping estimates but revising lower its outlook for full-year 2023. The NYC-focused REIT recorded FFO growth of 14.8% in 2022 - which was roughly 6% above 2019-levels - but expects its FFO to decline 5.3% in 2023 at the midpoint of its guidance. Total leasing volumes were disappointing in Q4 - the second slowest quarter in the past decade behind Q4 of 2022 - but occupancy rates held relatively firm and rental rate spreads actually accelerated slightly to 4.3%. Elsewhere in the office sector, Vornado (VNO) finished slightly higher after it announced that it will record approximately $600 million of non-cash impairment charges, of which approximately $480 million relates to its common equity investment in the Fifth Avenue and Times Square joint venture. We'll hear results from Kilroy (KRC) and Brandywine (BDN) this afternoon.

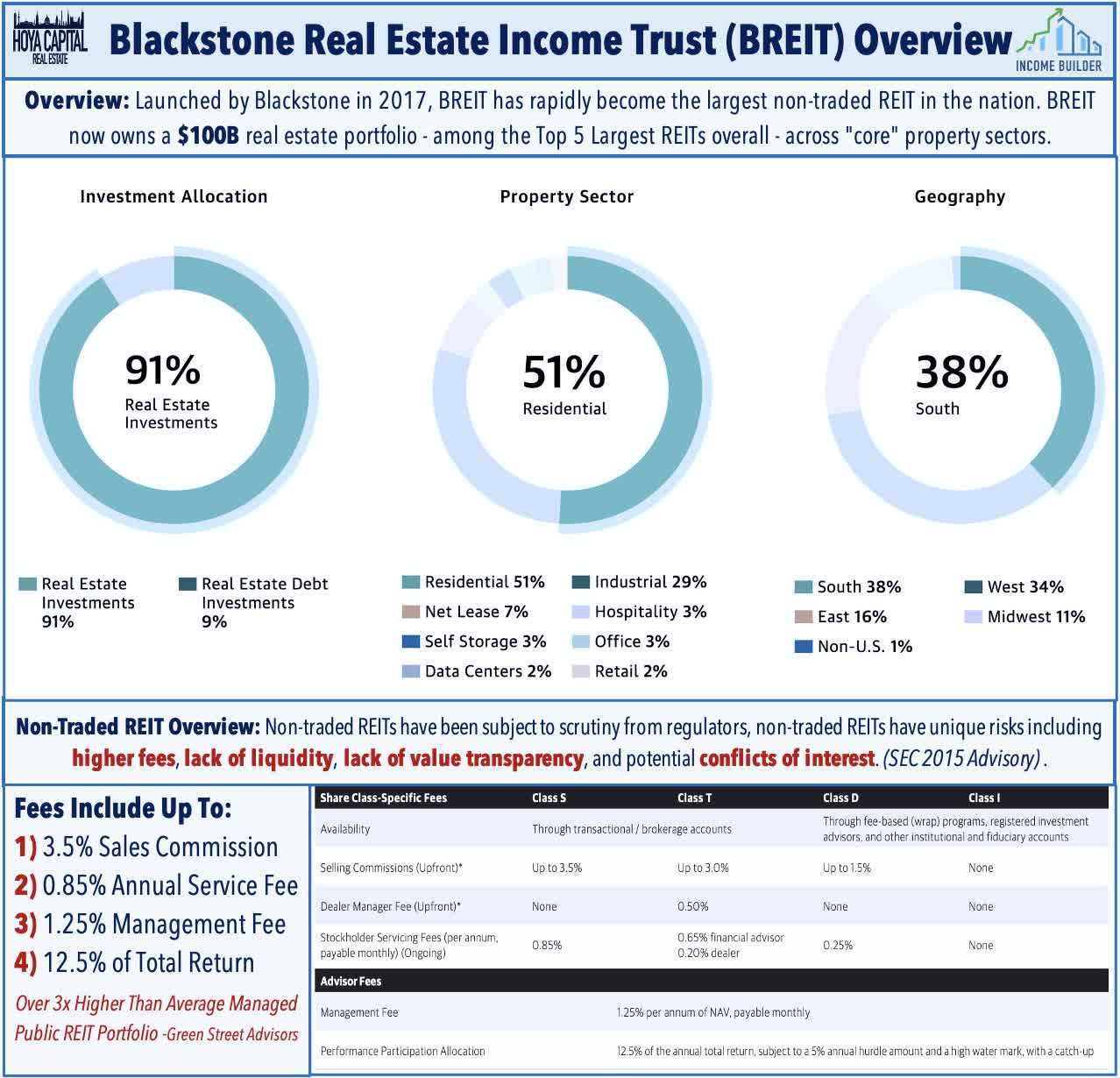

Asset manager Blackstone's (BX) non-traded real estate platform - Blackstone Real Estate Income Trust ("BREIT") - told investors Wednesday that the fund again hit its monthly redemption limit, fulfilling just a quarter of the funds that were requested by investors. January marked the third straight month that BREIT hit its redemption limit, which is capped at 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter. BREIT - which determines its NAV internally subject to review from a third-party appraiser - claims to have generated a positive 8.4% net return in 2022 during which time publicly-traded equity REITs were lower by 26% and private market commercial real estate valuations declined 13.2%, per estimates from Green Street Advisors. Naturally, investors have seized on the opportunity to redeem shares at these premium NAV valuations - some of which have reallocated to public REIT shares trading at significant relative discounts.

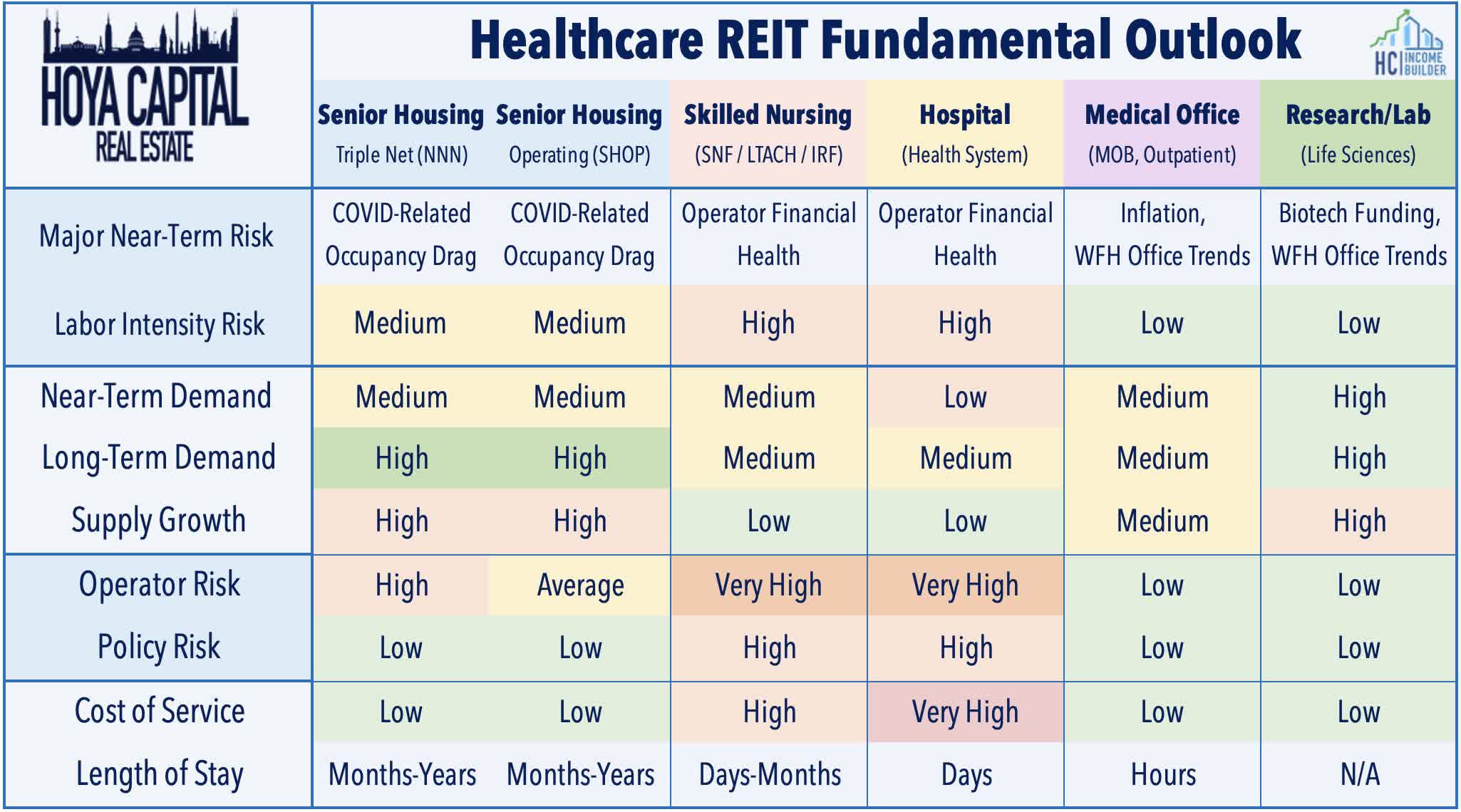

Healthcare: Healthcare Realty (HR) gained 1% today after it announced the completion of $112.5 million of asset sales in January and noted that since July 2022, the company has generated net proceeds of $1.13 billion from asset sales and joint venture transactions. Elsewhere, Diversified Healthcare (DHC) dipped another 5% today after Moody’s Investors Service downgraded its credit ratings on the firm to “Caa3” from “B3” with a negative outlook. We'll hear results from skilled nursing REIT Omega Healthcare (OHI) on Thursday.

As discussed in our REIT Earnings Preview: The New Normal, REITs enter earnings season with some momentum amid the recent moderation in interest rates and hopes of a 'softish' economic landing following a punishing year of stock price performance. How REITs are responding to this higher rate environment – both on the acquisitions and the financing side - will be closely-watched. REITs hunkered-down in 2022, but opportunities are becoming more plentiful and we see the non-traded REIT segment as one area that may be "ripe for the picking" if investor redemptions continue. Full-year FFO guidance will be the most closely watched metric, especially in the residential, retail, and office sectors given the wide range of expectations. We'll also hear results this afternoon from Mid-America (MAA) and Rayonier (RYN) in addition to the two office REITs noted above.

Additional Headlines from The Daily REITBeat on Income Builder

- Fitch Ratings affirmed the Long-Term Issuer Default Ratings and unsecured debt rating of Safehold (SAFE) and its operating partnership at “BBB+” and revised its outlook to positive from stable

- Kushner Companies sent a letter to Veris Residential (VRE) shareholders noting that “Our fully financed all-cash offer for $18.50 remains outstanding, as does, for now, our willingness to constructively engage with the Board to see if we can go higher. Our patience, however, is not endless, and we are actively considering all other alternatives."

- Yesterday morning, Terreno (TRNO) announced that it has executed a lease for 3.5 acres of improved land in Redmond, WA with a North American provider of workplace transportation services noting that the lease will commence March 31, 2023 and expire June 2033

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs continued their stellar start to the year with residential mREITs gaining 2.1% today while commercial mREITs rallied 1.2%, lifted by a strong bid for mortgage-backed bonds. AGNC Investment (AGNC) was again among the leaders today after reporting on Monday that its Book Value Per Share ("BVPS") jumped 8.4% in Q4 to $9.84/share and total economic return of 12.3% including the dividend. We'll hear results from PennyMac (PMT) on Thursday before mREIT earnings season kicks into gear next week.

Economic Data This Week

The jam-packed week of economic data continues with Jobless Claims data on Thursday and the BLS Nonfarm Payrolls report on Friday. Economists expect job growth of roughly 185k in January and for the unemployment rate to tick higher to 3.6%. Average hourly earnings - a closely-watched metric in recent months - is expected to slow to a 4.3% year-over-year rate from 4.6%.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.