Fed Minutes • REITs Lead • Industrial REIT Updates

- U.S. equity markets slid for the second straight day Wednesday after minutes from the latest Fed meeting revealed an aggressive - perhaps combative - monetary policy posture from the central bank.

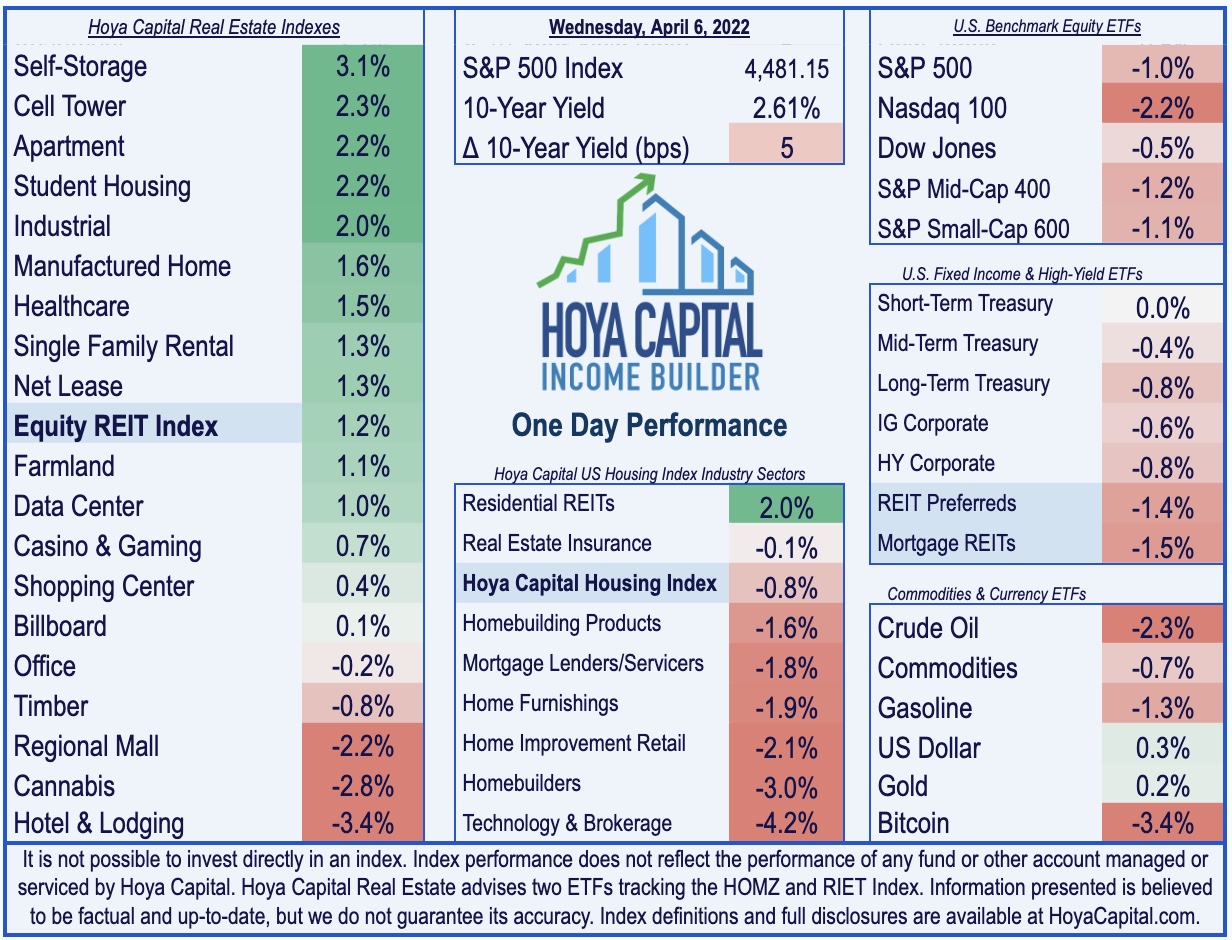

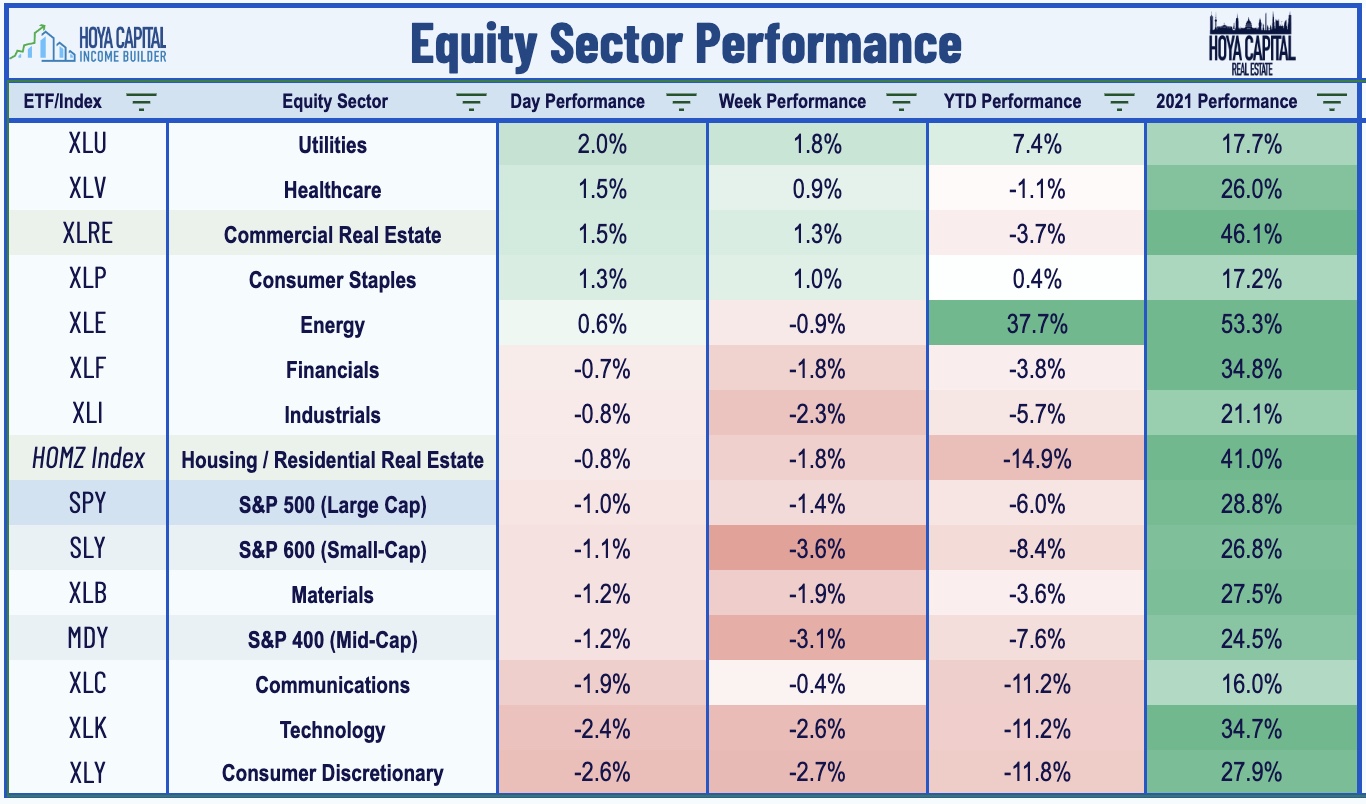

- Now lower by roughly 1.5% on the week, the S&P 500 slipped 1.0% today while the tech-heavy Nasdaq 100 dipped another 2.2%. Mid-Caps and Small-Caps were each lower by 1.1%.

- Real estate equities were outperformers for a second day- led by gains from residential REITs- as the Equity REIT Index advanced 1.2% with 14-of-19 property sectors in positive territory.

- In the published minutes from their March meeting, Federal Reserve officials strongly considered a "double rate hike" of 50 basis points last meeting and outlined a plan to reduce the size of its balance sheet beginning as soon as next month.

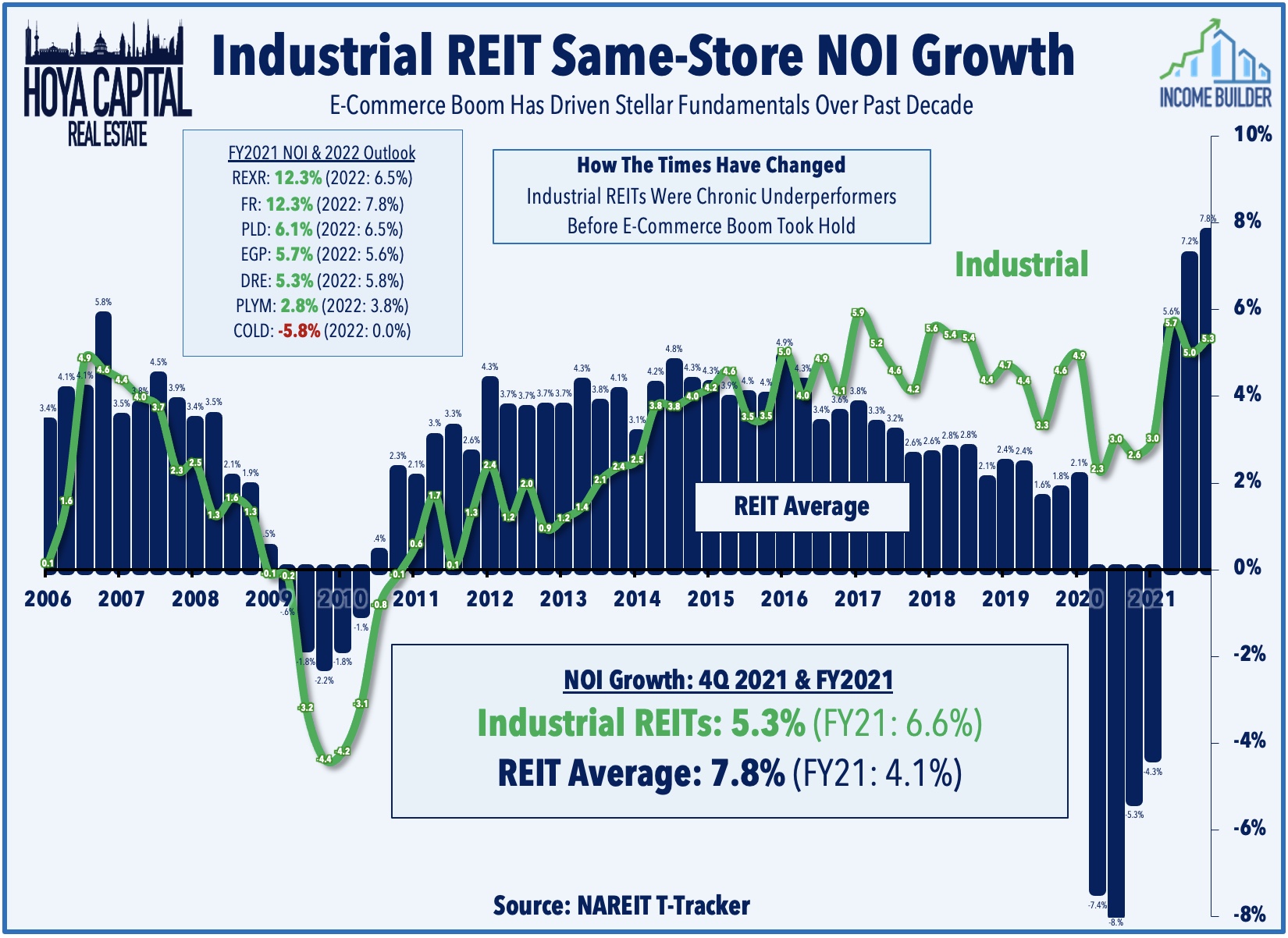

- A trio of industrial REITs were in the news today. Plymouth (PLYM) reported that it achieved rental spreads of roughly 16% on leases signed so far in 2022 while Indus Realty (INDT) reported that it achieved 15% rent growth.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets slid for the second straight day Wednesday after minutes from the latest Fed meeting revealed an aggressive - perhaps combative - monetary policy posture from the central bank to cool financial conditions. Now lower by roughly 1.5% on the week, the S&P 500 slipped 1.0% today while the tech-heavy Nasdaq 100 dipped another 2.2%. Mid-Caps and Small-Caps were each lower by 1.1%. Real estate equities were outperformers for a second day led by gains from residential REITs as the Equity REIT Index advanced 1.2% with 14-of-19 property sectors in positive territory while Mortgage REITs slipped 1.5%.

In the published minutes from their March meeting, Federal Reserve officials strongly considered a "double rate hike" of 50 basis points last meeting and outlined a plan to reduce the size of its balance sheet beginning as soon as next month. The 10-Year Treasury Yield rose to its highest level since May 2019 at 2.61% while the 2-Year Treasury Yield closed at 2.49%. The U.S. Dollar Index strengthened to its highest level since May 2020 while Crude Oil (CL1:COM) dipped nearly 5% to close back below $98/barrel. Five of the eleven GICS equity sectors were higher today, led to the upside by the Utilities (XLU), Healthcare (XLV), and Real Estate (XLRE) sectors.

Real Estate Daily Recap

Industrial: A trio of industrial REITs were in the news today. Plymouth (PLYM) finished roughly flat today after it provided a business update with its leasing and acquisition activity for the first quarter. PLYM commenced 1.3M SF of leases at a cash rental spread of 16.7% and signed another 2.6M SF that will commence in Q2 at a 16.7% spread. Indus Realty (INDT) gained 1% today after it provided a business update in which it announced that it signed 49k SF of space at a cash spread of 15.0%. Finally, PS Business Parks (PSB) finished roughly flat after announcing that Stephen Wilson has been appointed as the Company’s President and CEO effective immediately. As discussed in our latest industrial REIT report, industrial vacancy rates declined to record-lows below 4% despite robust levels of new development, driving rent growth of nearly 20% in North America with some markets seeing 50% increases.

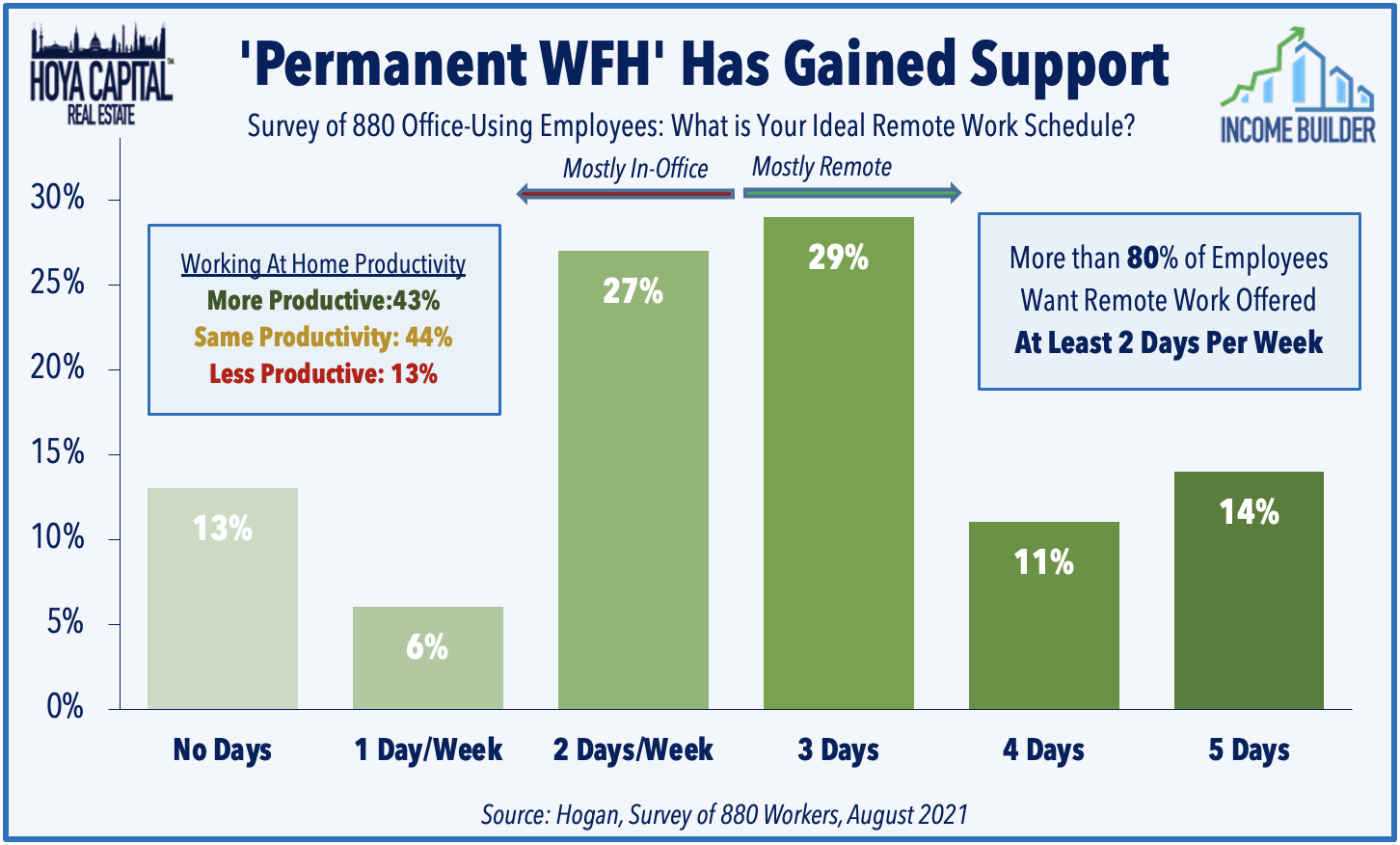

Office: Today, we published Office REITs: The New Normal? Office REITs - which lagged over the prior two years from persistent pandemic-related headwinds - have been the best-performing major property sector in early 2022. For many, Work-From-Home will transition to "hybrid" work environments over the next quarter, setting up a "now or never" dynamic for utilization rates that corporate decision-makers will be monitoring closely. Employees value hybrid WFH the same as a 10% pay rise, but most don't want to be fully remote either. With an increasingly tight labor market, employees - not employers - will chart the future of the workplace. Office leasing demand - and earnings results from these office REITs - has been surprisingly resilient, however, particularly for REITs focused on business-friendly Sunbelt regions and specialty lab space.

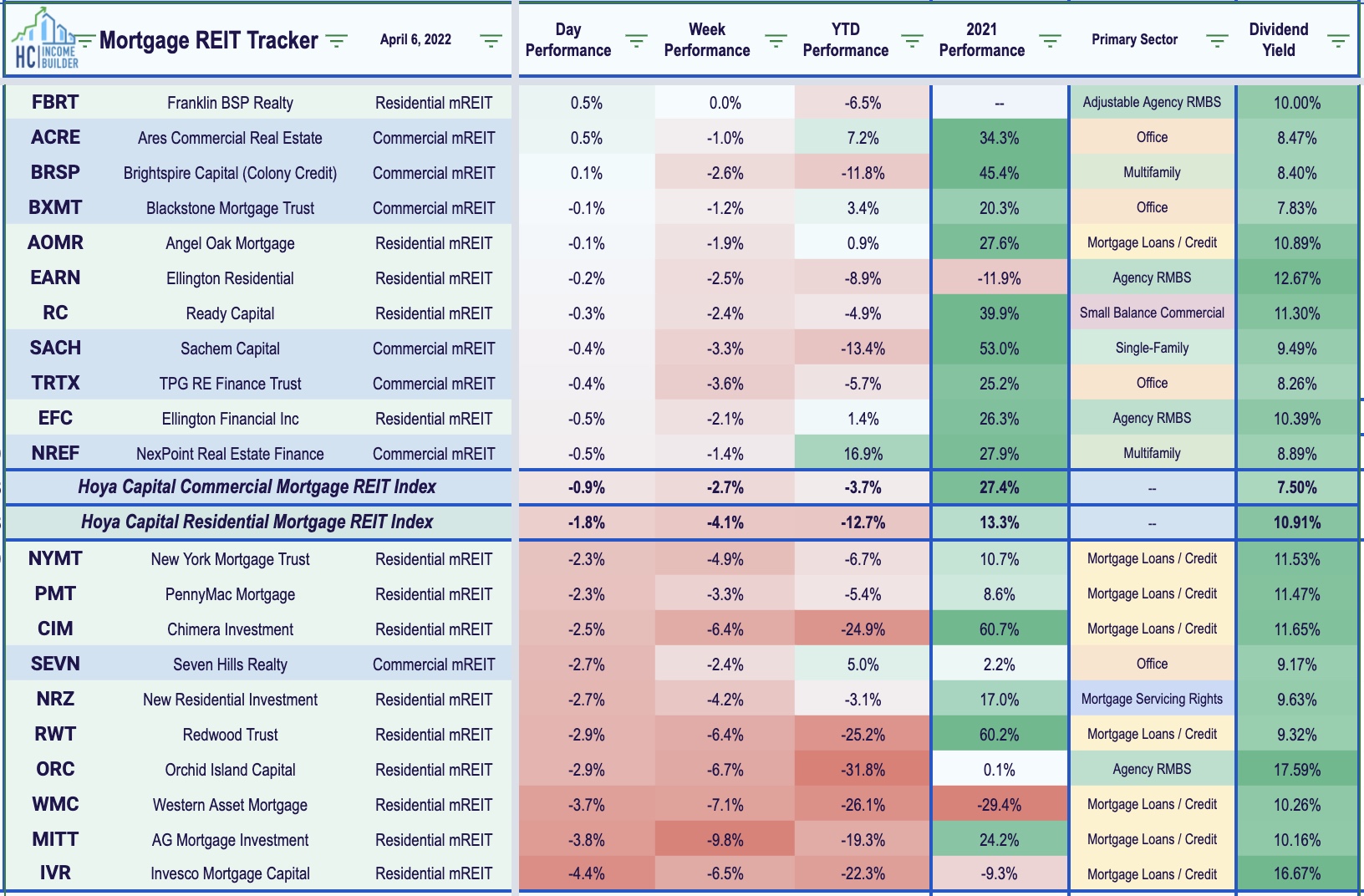

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs declined 0.9% today while residential mREITs slipped 1.8%. Of note today, in the Fed minutes released today, some Fed officials suggested it "will be appropriate" to consider mortgage-backed security sales in the future to meet its goals of balance sheet reduction, but that any decision to that effect "would be announced well in advance." The average residential mREIT pays a dividend yield of 10.91% while the average commercial mREIT pays a dividend yield of 7.50%.

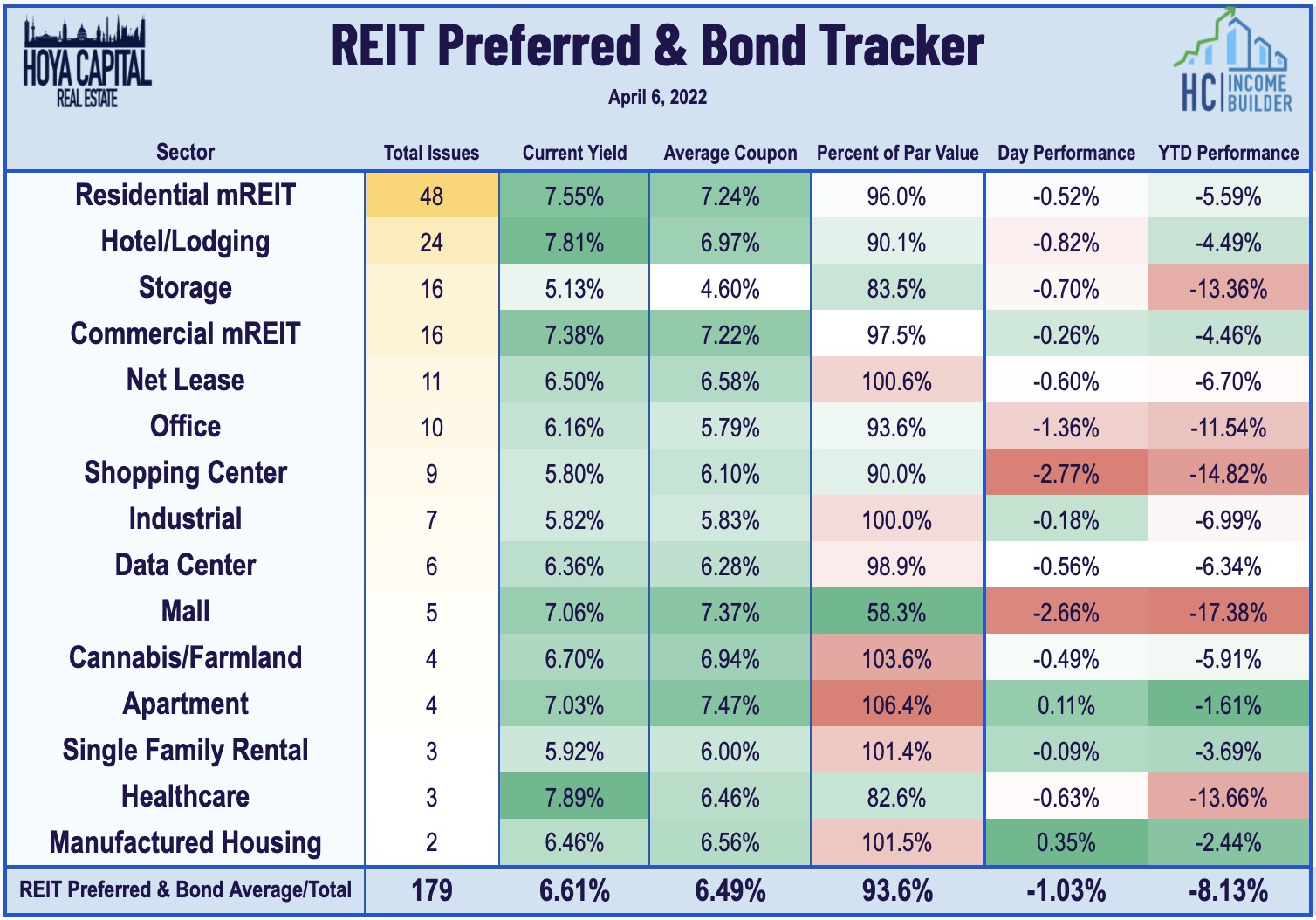

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 1.03% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.57%. In the bond markets today, Sun Communities (SUI) priced $600M of 4.20% senior notes due 2032 to fund possible future acquisitions of properties.

Economic Calendar This Week

The economic calendar slows down in the week ahead. We'll be watching Purchasing Managers' Index ("PMI") data throughout the week and the Baker Hughes Rig Count on Friday for indications on whether U.S. oil and gas production is accelerating to address the surge in global energy prices. Investors will also be reviewing the minutes from the Federal Open Market Committee meeting from the March 16th policy decision in which the FOMC raised the Fed Funds rate for the first time since 2018.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.