Hawkish Fed • REIT Earnings • Office Demand Recovers

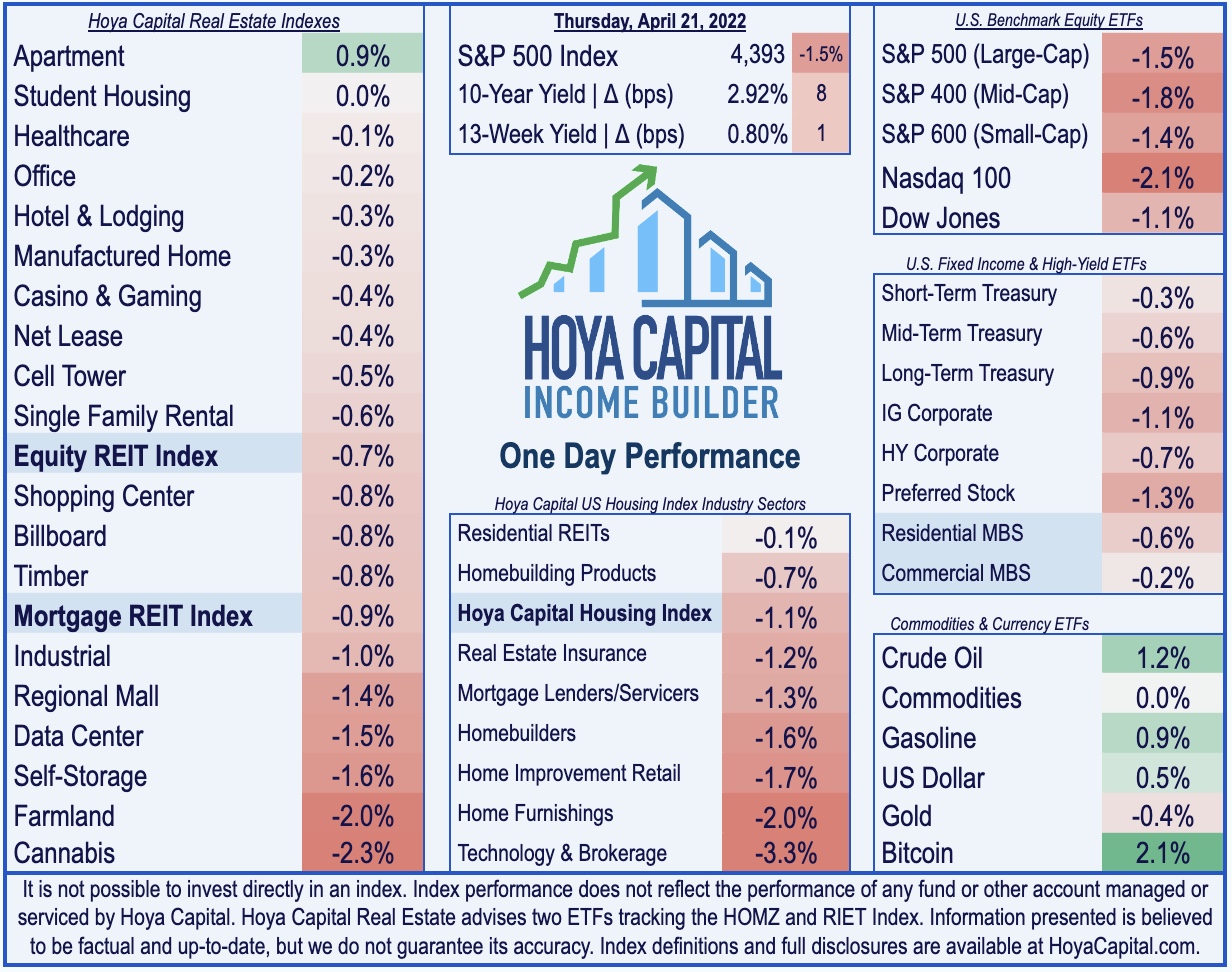

- U.S. equity markets finished broadly lower Thursday while bonds remained under pressure after Fed Chair Powell indicated that the Fed is likely to hike rates by 50 bps in its next meeting.

- Sliding throughout the session and giving up its week-to-date gains, the S&P 500 finished lower by 1.5% today while the Mid-Cap 400 declined 1.8% and the Small-Cap 600 slipped 1.4%.

- Real estate equities were again among the outperformers on strong earnings result, but still finished lower as the Equity REIT Index slipped 0.7% with 18-of-19 property sectors in negative territory.

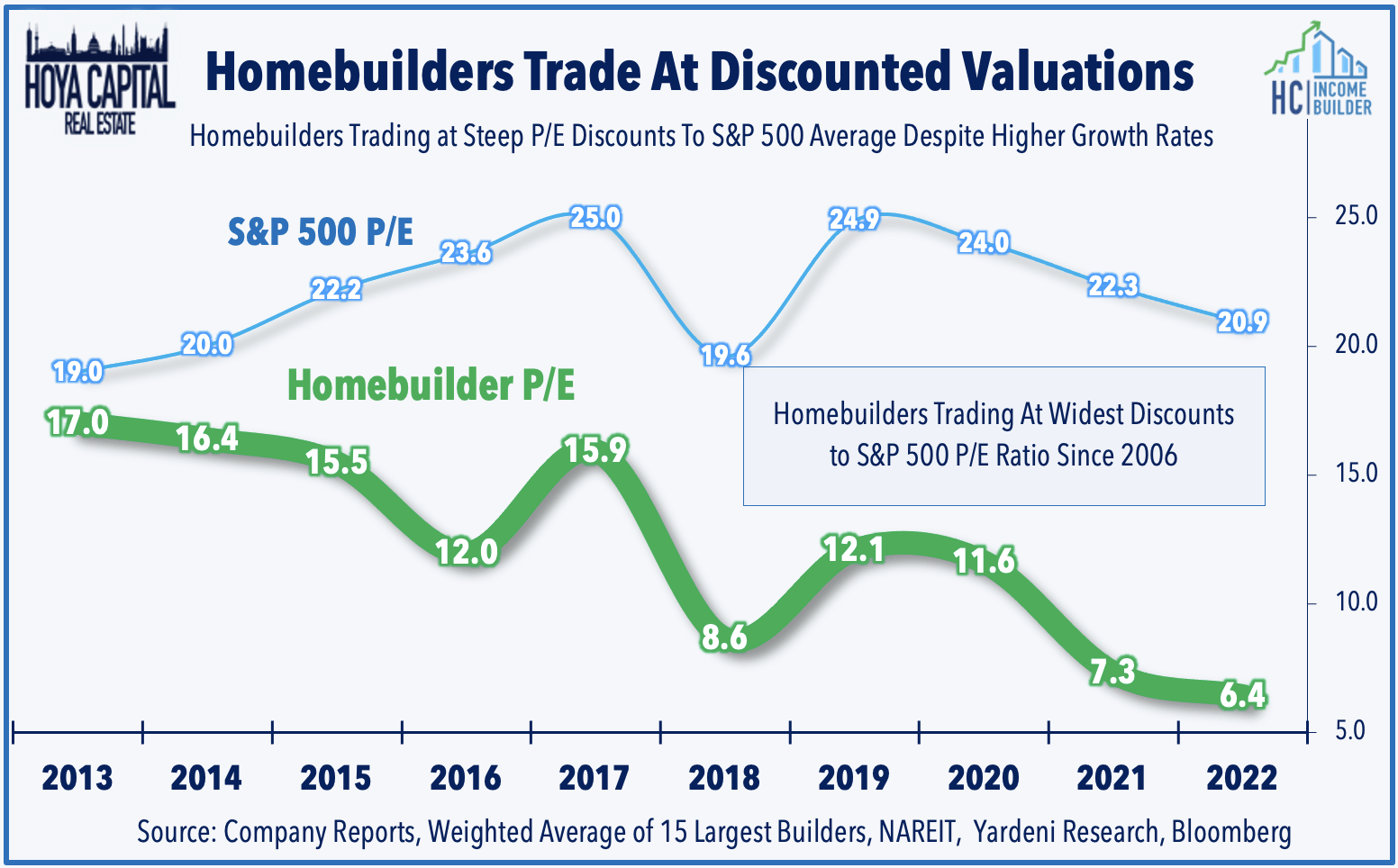

- Weighed down by concern over the impact of rising mortgage rates, homebuilder Tri Pointe (TPH) finished lower despite reporting solid results and boosting its full-year outlook. TPH commented that it's not "seeing a falloff in demand" but noted that supply chains remain an issue.

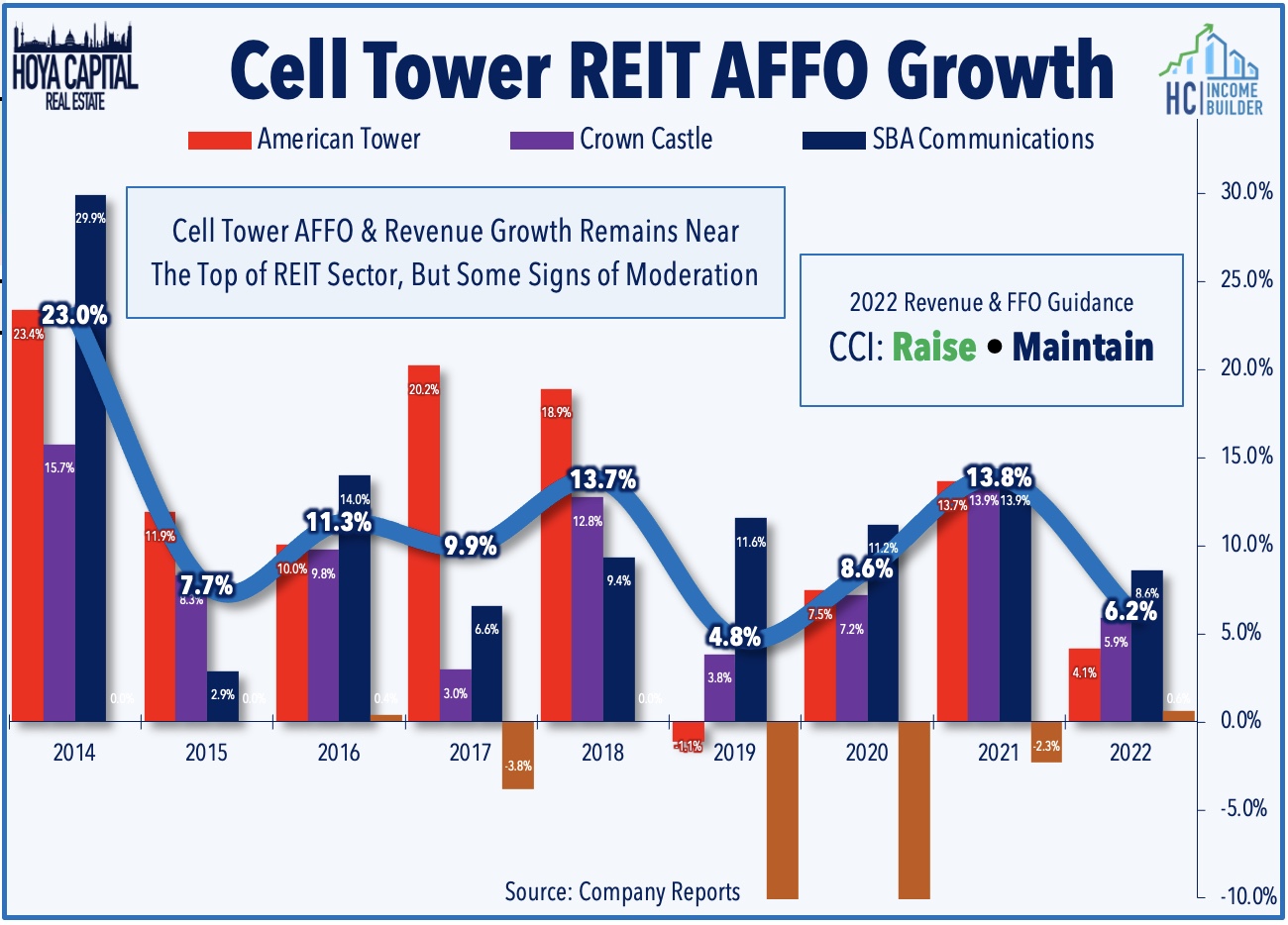

- Results from cell tower REIT Crown Castle (CCI) and office REITs Brandywine (BDN) and SL Green (SLG) were roughly in-line with expectations. Office leasing demand has been surprisingly resilient despite the slow recovery in utilization rates.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets finished broadly lower Thursday - sliding from early-session gains - while bonds remained under-pressure after Fed Chair Powell indicated that the Fed is likely to hike rates by 50 basis points in its next meeting. Sliding throughout the session and giving up its week-to-date gains, the S&P 500 finished lower by 1.5% today while the Mid-Cap 400 declined 1.8% and the Small-Cap 600 slipped 1.4%. Real estate equities were again among the outperformers on strong earnings result, but still finished lower as the Equity REIT Index slipped 0.7% with 18-of-19 property sectors in negative territory while Mortgage REITs declined by 0.9%.

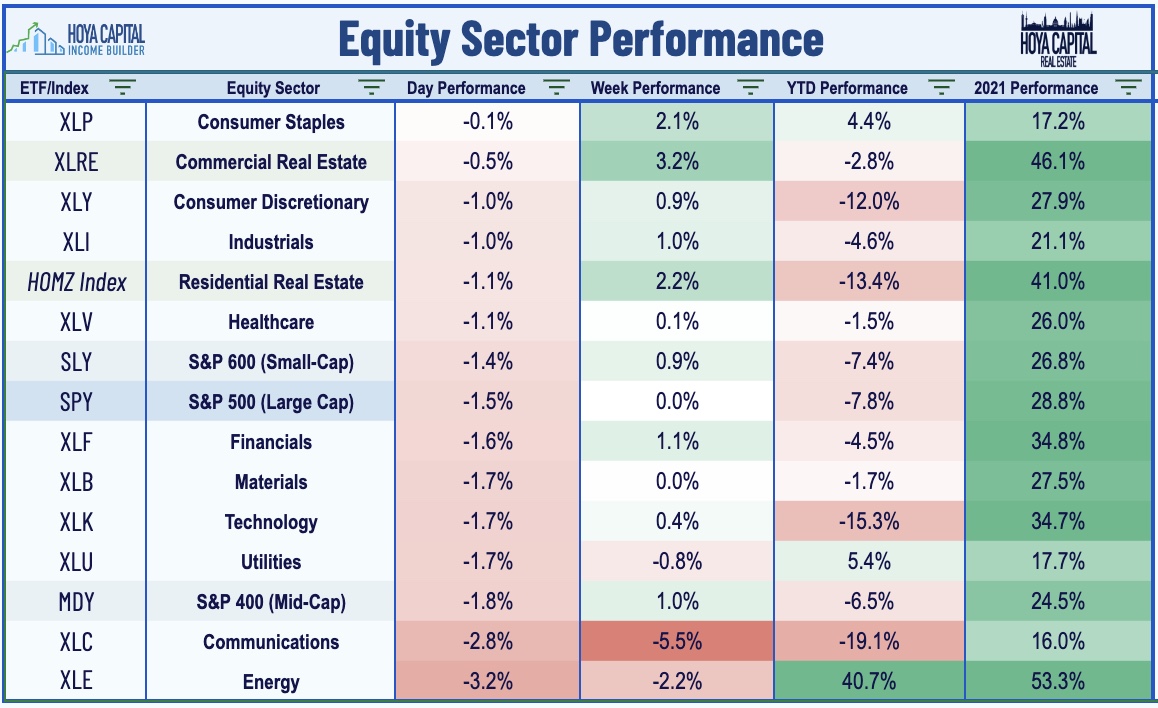

Hawkish commentary from Fed Chair Powell - who suggested that the Fed may need to move "more quickly" - on monetary tightening sparked the market reversal today, sending the 10-Year Treasury Yield to fresh three-year highs at 2.92% while the 2-Year Treasury Yield jumped 10 basis points to 2.67%. All eleven GICS equity sectors were lower on the day, dragged on the downside by the Energy (XLE) sector and Communications (XLC) ahead of another busy afternoon of corporate earnings results. Among the notable results over the past 24 hours, Tesla (TSLA) was an upside standout on record profit numbers, as was American Airlines (AAL) which noted an acceleration in the travel demand recovery.

Real Estate Daily Recap

Today, we published our Real Estate Earnings Preview which discussed the major themes and metrics we'll be watching across each of the real estate property sectors this earnings season. Despite the historic surge in interest rates over the past quarter driven by expectations of Fed monetary tightening, REITs enter the first-quarter earnings season with some momentum at their backs. Having lagged for most of this year, the broad-based Equity REIT Index jumped ahead of the S&P 500 on a year-to-date performance basis in early April following several weeks of outperformance. REITs with better inflation-hedging characteristics have led the gains in 2022 while large-cap technology REITs have continued to lag. We emphasize the importance of diversification across property sectors and market capitalization tiers.

Homebuilders: Weighed down by concern over the impact of rising mortgage rates, Tri Pointe (TPH) finished lower despite reporting solid results and boosting its full-year outlook. TPH expects to deliver 6.5K-6.8K homes (unchanged from previous view) at an average sales price of $680K-690K, up from $660K-670K in the prior forecast, and now sees its gross margin of at 26.5% for 2022 compared to it prior outlook for 25.5%. TPH noted on its earnings call, "from a demand side, we have not seen a falloff in demand but that doesn't mean there isn't concerned consumers out there." However, TPH did note ongoing supply chain challenges, commenting, "the supply chain isn't gotten any easier... there's no relief and insight that we see."

Cell Tower: Crown Castle (CCI) kicked off tech REIT earnings on Wednesday with in-line results with no major changes to its outlook - modestly raising its full-year revenue growth outlook but maintaining its FFO guidance. CCI now sees property revenue growth of 9.5% in 2022 -up 70 basis points from its prior outlook - and maintained its expectations for 5.9% FFO growth this year. CCI commented on its earnings call: "With the three established network operators and a new intranet scale and DISH, all upgrading and developing nationwide 5G networks, the fundamentals in the U.S. market are as positive as I can remember during my 20-plus years at Crown Castle."

Office: Brandywine (BDN) - which is primarily focused on the Philadelphia market - was among the better-performers today after reporting solid Q1 results, highlighted by renewal spreads 12.9% on a cash basis. BDN maintained its full-year guidance which calls for FFO growth of 2.9%, which would mark a full recovery back to pre-pandemic 2019 levels. SL Green (SLG) - which focuses on the NYC market - finished flat after announcing in-line results with a slow but steady recovery in leasing demand in the Manhattan market. Even as office utilization rates in NYC remain below 40% of pre-pandemic levels, SLG still reported same-store occupancy of 92.7% at the end of Q1, and sees 94.3% by year-end, which would be down only slightly from its pre-pandemic rate. The rents on these leases, however, remain well below pre-pandemic levels as SLG noted its renewal spreads were negative -15.1% in Q1 in the Manhattan market.

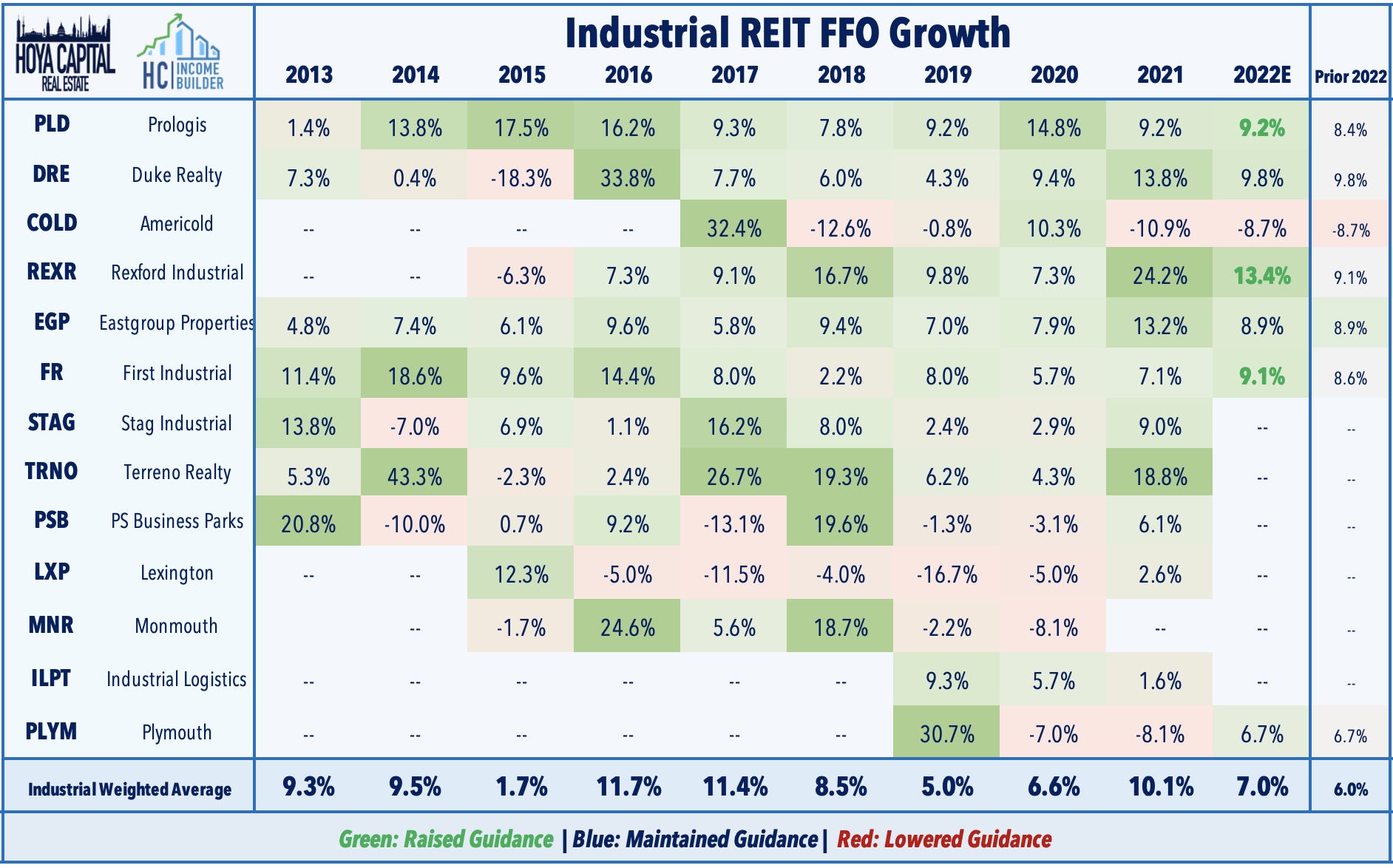

Industrial: First Industrial (FR) finished lower by about 2% after reporting in-line results yesterday afternoon. FR modestly raised the midpoint of its full-year FFO and NOI, as well as its occupancy guidance. FR now sees full-year FFO growth of 9.1% - up 50 basis points from its prior outlook - and sees same-store NOI growth of 8.3% - up also higher by 50 bps. Earlier in the week, Prologis (PLD) and Rexford (REXR) also raised their guidance across the board on incredible rent growth with PLD seeing rent growth on renewals of 42% and REXR recording releasing spreads of 71% as demand for logistics space remains insatiable amid ongoing supply chain disruptions.

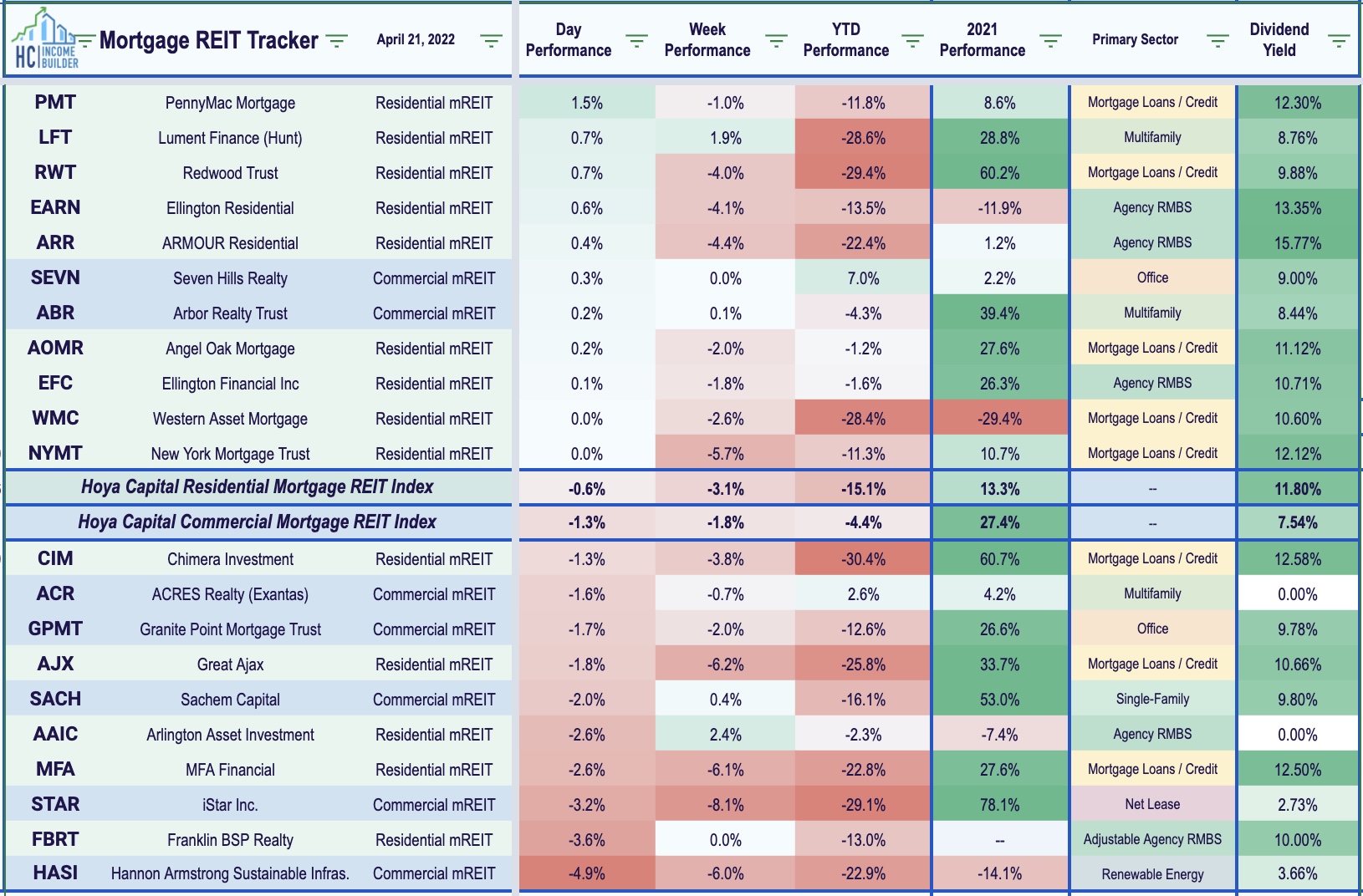

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mREITs were mostly-lower today as commercial mREITs slipped 1.3% while residential mREITs declined 0.6%. Mortgage REIT earnings season officially kicks off next Monday with results from KKR Real Estate (KREF) and Apollo Commercial (ARI).

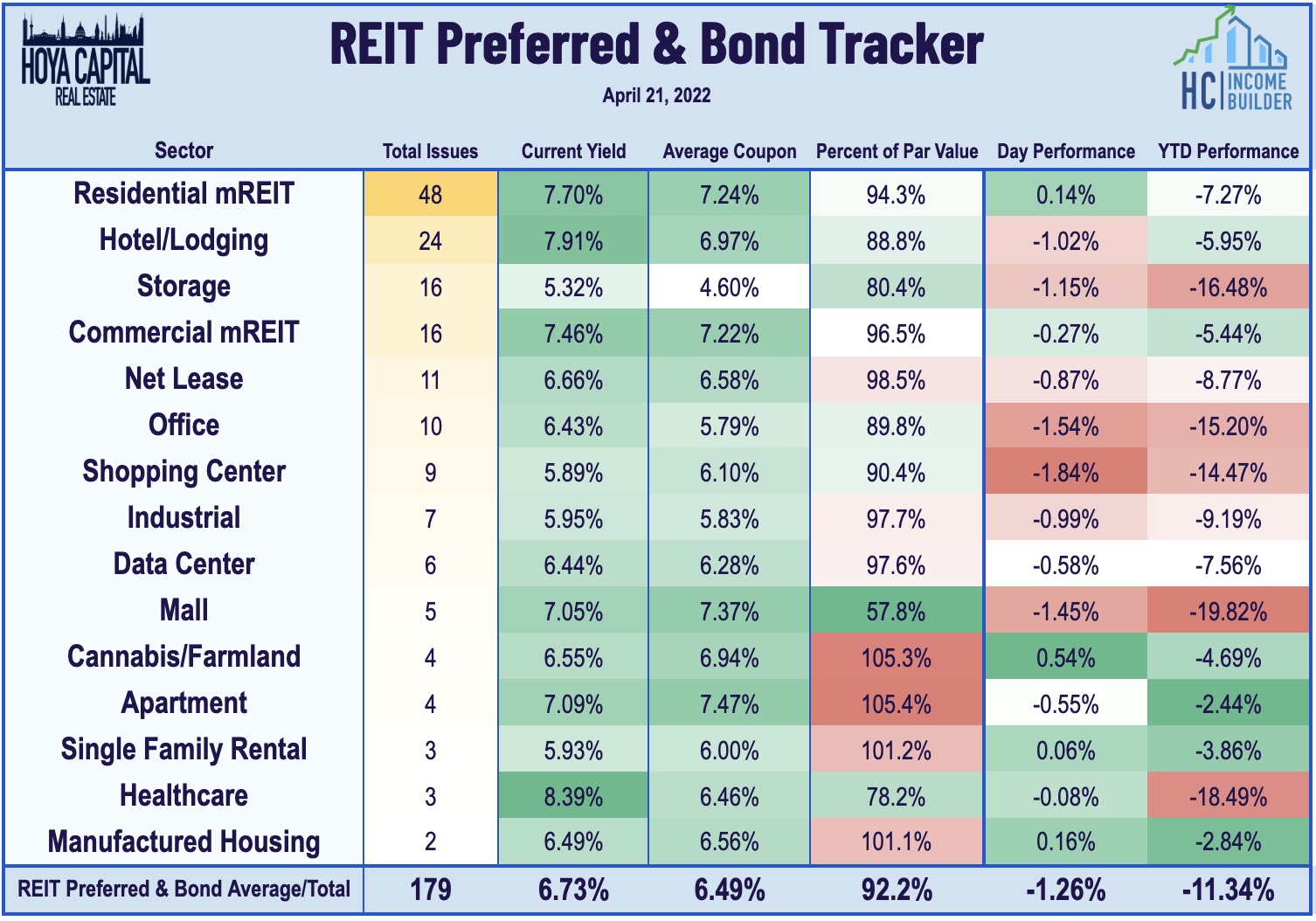

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 1.26% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 186 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.73%. Over in the capital market today, VICI Properties (VICI) priced $5B of senior unsecured notes in five tranches: $500M of 4.375% notes due May 15, 2025; $1.25B of 4.750% notes due February 15, 2028; $1B of 4.950% notes due February 15, 2030; $1.5B of 5.125% notes due May 15, 2032; and $750M of 5.625% notes due May 15, 2052.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.