Inflation Week • Stocks Mixed • REIT Earnings

U.S. equity markets finished mixed Monday while benchmark interest rates ticked higher ahead of a critical week of inflation data, debt ceiling negotiations, and the final stretch of first-quarter earnings season.

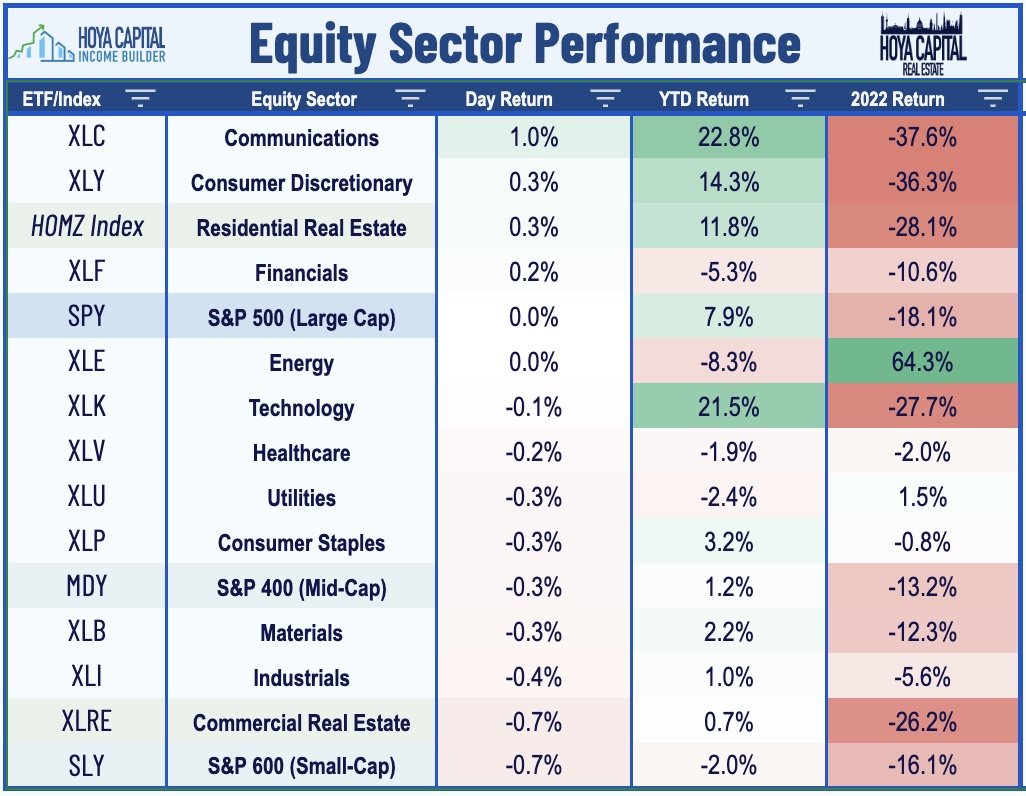

Trading in a tight range today following a turbulent prior week, the S&P 500 eked out a 0.1% advance, but the Mid-Cap 400 fell 0.3% and the Small-Cap 600 retreated 0.7%.

Real estate equities were mixed today as REIT earnings season winds down with the final two dozen reports over the next three days. The Equity REIT Index slipped 0.6% today.

Inflation is in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Wednesday with the Consumer Price Index followed by the Producer Price Index report on Thursday.

This afternoon, we'll hear results from a pair of healthcare REITs: Ventas (VTR) and Diversified Healthcare (DHC) as well as cannabis REIT Innovative Industrial (IIPR) and farmland REIT Gladstone Land (LAND).

Income Builder Daily Recap

U.S. equity markets finished mixed Monday while benchmark interest rates climbed ahead of a critical week of inflation data, debt ceiling negotiations, and the final stretch of first-quarter earnings season. Trading in a tight range today following a turbulent prior week, the S&P 500 eked out a 0.1% advance today, but the Mid-Cap 400 fell 0.3%, and the Small-Cap 600 retreated 0.7%. The Dow declined 56 points. Real estate equities were mixed today as REIT earnings season winds down with the final two dozen reports over the next three days, concluding an earnings season that has been stronger than expected. The Equity REIT Index slipped 0.6% today, with 11-of-18 property sectors in negative territory, while the Mortgage REIT Index gained 0.3%.

As discussed in our Real Estate Weekly Outlook, equities are coming off a turbulent week after the Federal Reserve continued its historically-aggressive monetary tightening course, sparking renewed turmoil in the regional banking sector. Two of the most closely-watched regional banks - PacWest (PACW) and Western Alliance (WAL) - finished higher today - a second-straight session of gains following a brutal plunge early last week - which helped to ease jitters across financial markets. Benchmark interest rates rebounded from nine-month lows with the 2-Year Treasury Yield climbing 9 basis points to 3.99% while the 10-Year Treasury Yield climbed 8 basis points to 3.52%. The WTI Oil benchmark rebounded 2% today after tumbling 7% last week. Critical for the inflation outlook, oil prices are now nearly 50% below their 52-week highs while Natural Gas futures are over 75% below their highs.

Inflation is in the spotlight in another jam-packed week of economic data in the week ahead. The main event comes on Wednesday with the Consumer Price Index for April, which investors and the Fed are hoping will show a cooling of inflationary pressures. The headline CPI is expected to moderate to a 5.0% year-over-year rate, while the Core CPI is expected to decelerate to 5.5%. As with recent months, the metric we're watching most closely is the CPI-ex-Shelter Index. On Thursday, we'll see the Producer Price Index, which is expected to show an even more significant cooling of price pressures, with the headline PPI expected to slow to a 2.5% year-over-year rate - down from the recent peak last March at 11.8%. On Friday, we'll get the first look at Michigan Consumer Sentiment for May, a report which includes the closely-watched inflation expectations survey.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

REIT earnings season wraps up over the next several days with reports from the final two dozen REITs. As noted in our Earnings Halftime Report and subsequent updates, REIT results have been stronger than expected. Of the 83 equity REITs that provide full-year Funds from Operations ("FFO") guidance, 37 (44%) raised their full-year earnings outlook, while 5 (6%) lowered guidance. The "beat rate" for the critical property-level metric - same-store Net Operating Income ("NOI") - was actually slightly better, with over 50% of REITs providing upward revisions. Surprisingly buoyant rent growth - particularly across the residential, industrial, hospitality, technology, and retail sectors - was the prevailing theme of these revisions. This afternoon, we'll hear results from a pair of healthcare REITs: Ventas (VTR) and Diversified Healthcare (DHC), cannabis REIT Innovative Industrial (IIPR); farmland REIT Gladstone Land (LAND); and hotel REIT Services Properties (SVC).

Additional Headlines from The Daily REITBeat on Income Builder

Welltower (WELL) launched a $750 million offering of exchangeable senior notes due in 2028 in a private placement

Four Corners (FCPT) announced the acquisition of a Brookshire Brothers grocery store in Texas for $3.0M at a 6.8% cap rate

Mortgage REIT Daily Recap

Mortgage REITs rebounded today following rather steep declines last week resulting from the fallout from regional banking concerns. Arbor Realty (ABR) rallied another 4% today after reporting strong results last Friday and raising its dividend by 5% to $0.42/share (15.4% dividend yield), the fourth mortgage REIT to raise its dividend this year. Mortgage REIT earnings season wraps-up this week with reports from the final dozen mREITs including reports this afternoon from Cherry Hill (CHMI), Ready Capital (RC), and Ellington Financial (EFC). Through the end of last week, Residential mREITs reported an average change in Book Value of -1.7% in Q1, which matches the -1.7% change reported by Commercial mREITs as well. Only half of the residential mREITs reported distributable EPS that covered their Q1 dividend, however, while 10-of-13 commercial mREITs fully covered their dividend. Two mREITs have lowered their dividend since the start of earnings season: Redwood Trust (RWT) and Great Ajax (AJX).

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.