Merger Monday • Housing Rebound • REIT Earnings

- U.S. equity markets rebounded Monday following their worst week of the year as investors assessed another slate of hotter-than-expected economic data, which has complicated the monetary policy outlook.

- Following declines of nearly 3% last week, the S&P 500 rebounded 0.3% today while the tech-heavy Nasdaq 100 rallied 0.7%. The Dow advanced 72 points.

- Real estate equities were mostly-higher as well today as REIT earnings season entered its final stretch. The Equity REIT Index advanced 0.1% today with 9-of-18 property sectors in positive territory.

- Pending Home Sales data this morning showed the effects of the short-lived pullback in mortgage rates in early 2023 with home buying activity surging by the most since June 2020 on a month-over-month basis.

- Merger Monday: Broadmark Realty (BRMK) surged after it agreed to be acquired by fellow commercial mortgage REIT Ready Capital (RC) in a $787M all-stock at an implied value of $5.90/share - a 41% premium to BRMK's last closing price.

Income Builder Daily Recap

U.S. equity markets rebounded Monday following their worst week of the year as investors assessed another slate of hotter-than-expected economic data, which has complicated the monetary policy outlook. Following declines of nearly 3% last week, the S&P 500 rebounded 0.3% today, while the tech-heavy Nasdaq 100 recovered 0.7%. The Dow advanced 72 points. Real estate equities were mostly-higher as well today as REIT earnings season entered its final stretch. The Equity REIT Index advanced 0.1% today, with 9-of-18 property sectors in positive territory. The Mortgage REIT Index slipped 0.6% while Homebuilders gained 0.5%.

As discussed in our Weekly Outlook, hotter-than-expected economic has likely made the path to an economic "soft landing" more turbulent, raising concerns that the central bank may be forced to keep interest rates higher for longer. Pending Home Sales data this morning showed the effects of the short-lived pullback in mortgage rates in early 2023, with home buying activity surging by the most since June 2020 on a month-over-month basis. The 10-Year Treasury Yield - which closed today at 3.92% - is now 40 basis points above the average rate during January. A recent retreat in energy prices has given investors some reason for optimism on the inflation outlook as Crude Oil prices declined another 1% today after data last week showed that crude stockpiles rose to their highest since May 2021 while Natural Gas prices have plunged more than 50% since the start of the year.

We'll see another busy week of economic data in the week ahead. The state of the U.S. housing market will be a focus early in the week. Following Pending Home Sales data today. on Tuesday, we'll see home price data via the Case Shiller Home Price Index, which is expected to show a sixth consecutive month of declining home prices. The 20-City composite is expected to show that prices are now more than 5% below recent peaks. On Thursday, we'll be watching the final Jobless Claims report for February ahead of nonfarm employment data in the following week. We'll also be watching Unit Labor Costs data from the revised GDP report on Thursday - an inflation metric that is closely watched by the Federal Reserve - as well as a busy slate of Purchasing Managers' Index ("PMI") data throughout the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

With 95% of the REIT sector now having reported results, today we published our REIT Earnings Recap on the Income Builder Marketplace. Rising rate concerns overshadowed a surprisingly strong slate of reports across most property sectors. Roughly two-thirds of REITs beat earnings expectations, the third-best among the 11 industry groups tracked by FactSet. Bifurcation is back: After delivering broad-based double-digit growth in 2022, headwinds from cooling aggregate demand, variable-rate debt expenses, property taxes, and labor costs will hit some REITs harder than others. Our primary focus this earnings season was on 2023 FFO guidance. Residential and Industrial REITs were upside standouts, forecasting mid-single-digit growth. Technology REITs see 2-3% growth, while retail REITs see flat growth. Many Office REITs and several Healthcare REITs forecast double-digit FFO declines.

Dividend sustainability was also in focus. 36 REITs have hiked their dividends this year, tracking slightly behind last year's record pace, but we've already seen more reductions than last year's total. External growth remains challenged for now, but REITs will have opportunities as reality sets in for many over-levered private-market property owners. Stock performance patterns since the start of earnings season have largely lined up with fundamental performance, with storage and apartment REITs leading on the upside while office, farmland, and cell tower REITs have lagged. The final dozen equity REITs will report results over the next week, including reports this afternoon from Innovative Industrial (IIPR), National Storage (NSA), RLJ Lodging (RLJ), and Summit Hotels (INN). Tomorrow morning, we'll hear results from Spirit Realty (SRC) and Easterly Government (DEA).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs slipping 0.5% while commercial mREITs declined 0.3%. Broadmark Realty (BRMK) surged 17% after it agreed to be acquired by fellow commercial mREIT Ready Capital (RC) in a $787M all-stock at an implied value of $5.90/share - a 41% premium to BRMK's last closing price, which was still a 15% discount to BRMK's tangible BVPS of $6.99. BRMK - which focuses on residential construction lending - traded at the steepest discount to BV in the mREIT space after plunging nearly 60% last year amid a rise in loan defaults, which rose to 20% of its loan book in Q4. Ready Capital - which dipped 11% on the news - cited several benefits of the merger, including an immediate de-leveraging impact, meaningful expense synergies, and an expected accretion to FY2024 EPS by "low-to-mid teens." Upon the expected completion of the deal in Q2, RC shareholders will own roughly 64% of the combined company's stock, while BRMK stockholders will own 36%.

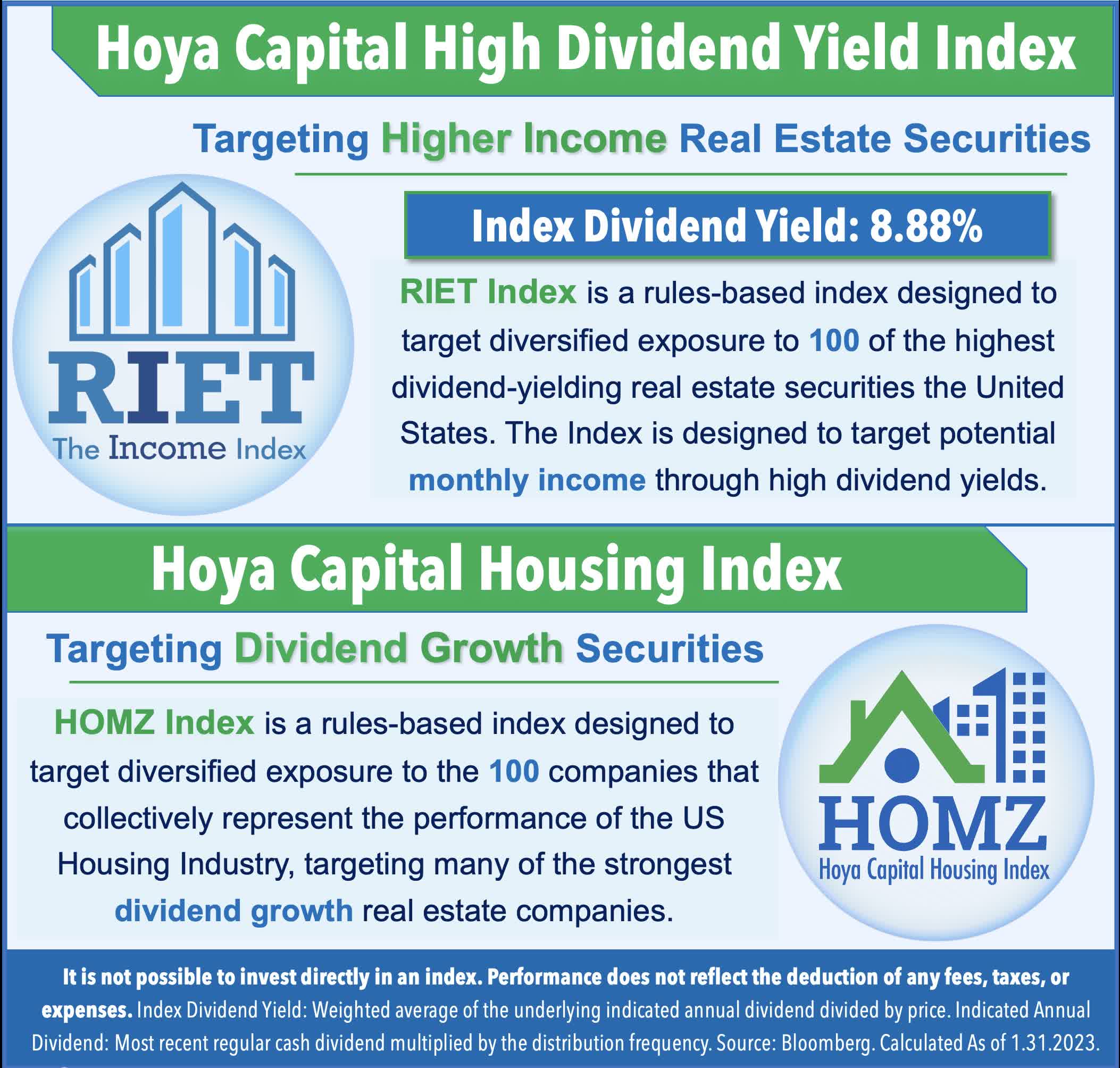

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.