Office REITs: Just How Bad Is It?

The new pariah of the commercial real estate sector, Office REITs have remained in free-fall in recent months, plunging another 30% this year following a plunge of nearly 40% last year.

Just how bad is it? The surge in interest rates has turned a weak-but-manageable situation into a bleak one, but there is more nuance to the prevailing narrative would suggest.

Debt service expenses have been the primary culprit behind the wave of recent loan defaults from private equity firms Brookfield, Blackstone, and Pimco, and the eight dividend cuts from office REITs.

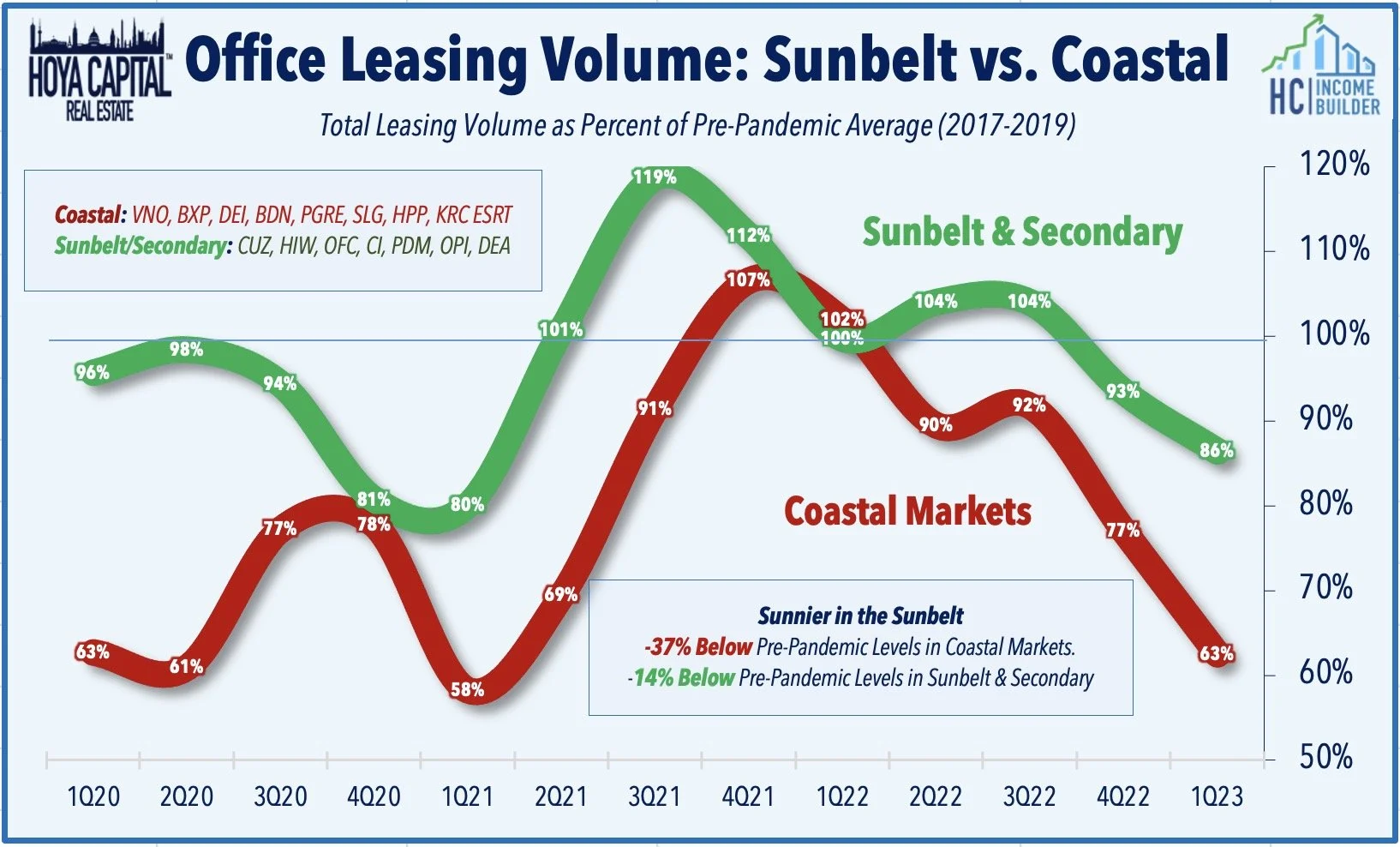

Nationally, property-level cash flows remain within 5% of pre-pandemic levels, but leasing activity has dipped by over 30%. Coastal tech-heavy markets remain at sub-50% daily utilization rates, but Sunbelt and secondary markets have recovered to over 75%.

Much like the e-commerce impact on malls, supply/demand conditions will eventually normalize as properties get repurposed or outright abandoned. We remain bearish on coastal REITs with transit-heavy commutes - the new "Class C/D malls" - but we're calling a bottom for the handful of Sunbelt-focused REITs.

The new pariah of the commercial real estate sector, Office REITs have remained in free-fall in recent months, plunging another 30% this year following a plunge of nearly 40% in 2022. Just how bad is it, though? As we'll explain throughout this report, the surge in interest rates has turned a weak-but-manageable situation into a bleak one, but there is more nuance to the prevailing narrative would suggest. Coastal tech-heavy markets remain at sub-50% daily utilization rates, but Sunbelt and secondary markets have recovered to over 75%. Leasing trends and rental rates have exhibited similarly wide variance with Sunbelt and secondary-focused REITs, so far, exhibiting leasing trends that are more akin to a typical recession than a catastrophic collapse that the current valuations would suggest.