Peace Talks • Yield Curve Inversion • Strong Housing Data

- U.S. equity markets advanced Tuesday while commodities prices retreated following reports of "constructive" peace talks between Russia and Ukraine, and on stronger-than-expected economic data across the labor and housing markets.

- Adding to Monday's gains of 0.7% and pulling the benchmark back within 4% of its recent highs, the S&P 500 advanced another 1.2% today while Mid-Caps and Small-Caps rallied more than 2%.

- Real estate equities were among the leaders for a second-straight day as the Equity REIT Index rallied 2.9% with all 19 property sectors in positive territory while Mortgage REITs advanced 1.9%.

- After cooling off slightly at the end of last year, home values reaccelerated in early 2022 as the effects of tight supply and strong demand are counteracting the headwinds from rising mortgage rates.

- Fed already ahead of the curve? The 10-Year Treasury Yield declined 8 basis points, briefly inverting the closely-watched 10-2 yield curve for the first time since late 2019, continuing a trend of flattening that typically occurs late in the Fed hiking cycle.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets advanced Tuesday while commodities prices retreated following reports of "constructive" peace talks between Russia and Ukraine, and on stronger-than-expected economic data across the labor and housing markets. Adding to Monday's gains of 0.7% and pulling the benchmark back within 4% of its recent highs, the S&P 500 advanced another 1.2% today while Mid-Caps and Small-Caps finally caught a bid, rising 2.1% and 2.4%, respectively. Real estate equities were among the leaders for a second-straight day as the Equity REIT Index rallied 2.9% with all 19 property sectors in positive territory while Mortgage REITs advanced 1.9%.

Hopes for a reasonably peaceful resolution to the Russia/Ukraine conflict has reversed some of the recent surge in commodities prices, while uncertainty over economic growth in Europe and Asia has contained the upward pressure on Treasury yields this week. The 10-Year Treasury Yield declined 8 basis points, briefly inverting the closely-watched 10-2 yield curve for the first time since late 2019. Led by a rebound in yield-sensitive segments of the market, 10 of the 11 GICS equity sectors were higher today led by Real Estate (XLRE) and Technology (XLK) while Homebuilders and the broader Hoya Capital Housing Index delivered a strong rebound, buoyed by strong economic data.

After cooling off slightly toward the end of last year, home values reaccelerated in early 2022, according to fresh Case Shiller data this morning, as the effects of tight supply and strong demand are counteracting the headwinds from rising mortgage rates. Home prices nationally rose 19.2% year over year in January, up from 18.9% in December. Phoenix, Tampa, and Miami saw the biggest annual gains at 32.6%, 30.8%, and 28.1%, respectively. Just as we saw back in 2018 when rising mortgage rates resulted in a notable near-term slowdown in buying activity, the longer-term outlook for the housing industry remains highly promising as demographic-driven growth in household formations, combined with the lingering housing shortage resulting from a decade of underbuilding, remain long-term tailwinds for the housing industry.

Real Estate Daily Recap

Single-Family Rental: Today, we published Renting The American Dream. Single-Family Rental REITs have been one of the best performing property sectors since their emergence onto the scene in the mid-2010s, outperforming the REIT Index for three straight years entering 2022. Too much demand, and not enough housing supply: Despite the double-digit surge in rental rates over the past year, rising mortgage rates have tilted the affordability scale further towards renting. Powered by the historic surge in rents, SFR REITs reported earnings growth of nearly 20% last year and have delivered dividend growth of over 30% per year since 2019. We discussed how Property Technology - or "PropTech" - has been the key catalyst behind the maturation of the SFR REIT sector and our updated outlook for these REITs.

Mall: Pennsylvania Real Estate (PEI) dipped more than 4% today despite providing a fairly upbeat update on the performance of its portfolio, noting that Comparable Sales per square foot hit an all-time high at $618 in its Core Mall portfolio. PEI has remained under pressure since reporting its Q4 results earlier this month in which it recorded its second-straight year of negative FFO. On the upside, the company did note improving portfolio metrics with a solid 290 basis point sequential rise in occupancy to 93.2% and flat renewal pricing after nearly four straight years of negative spreads, but investors wonder if it's "too little too late" as interest expenses on debt service accounted for 43% of revenues in 2021, up from 32% in 2020 and the firm reiterated that its credit facility prevents the payment of dividends with the exception of those needed to maintain its REIT status.

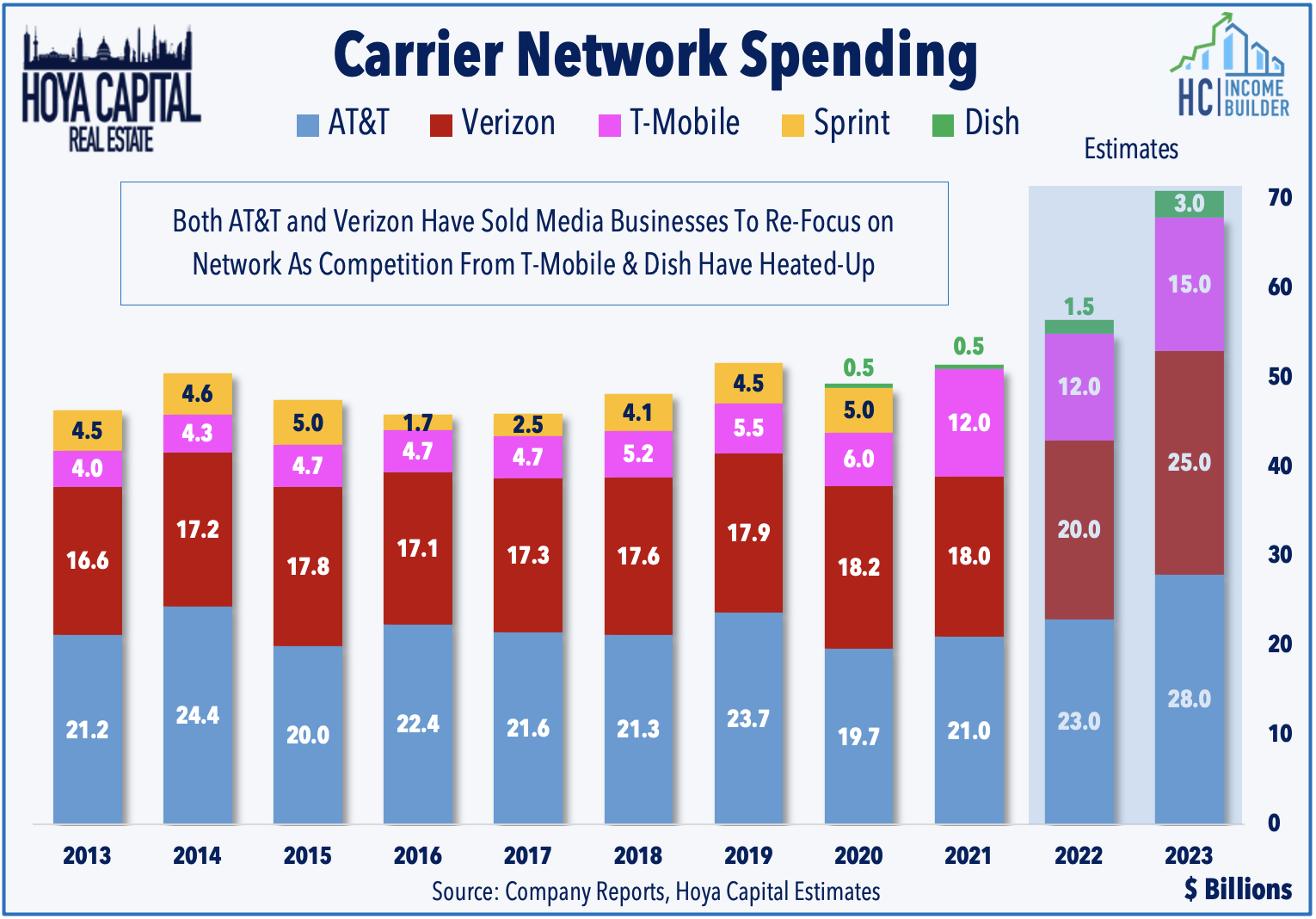

Cell Tower: This evening, we'll publish our updated cell tower REIT report as an exclusive report on the Income Builder Marketplace. Cell Tower REITs - a perennial performance leader in the real estate sector - have uncharacteristically lagged this year, dipping into "bear market" territory for just the second time in history. Several factors are behind the recent slump including potential competition from Low-Earth-Orbit satellite networks, hurdles in 5G deployment related to airline interference, and broader tech-related weakness. Despite the hurdles, U.S. cell carriers are "all-in" on 5G, driving record levels of activity at cell tower sites and powering another year of double-digit earnings and dividend growth for Cell Tower REITs.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs advanced 1.6% today while commercial mREITs gained 1.7%. On another quiet day of newsflow in the mREIT space, Invesco Mortgage (IVR) was among the leaders after holding its quarterly dividend steady at $0.09/share, representing a forward yield of 16.18%. The average residential mREIT pays a dividend yield of 10.66% while the average commercial mREIT pays a dividend yield of 7.22%.

Economic Data This Week

Employment data highlights another busy week of economic data in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 488k in March following two-straight months of stronger-than-expected job growth while the unemployment rate is expected to decline to 3.7% from 3.8% in February. We'll also get the third and final revision to Q4 GDP data, which is expected to confirm that the U.S. economy was growing at a 7% rate at the end of 2021. We'll also see home price data with the Case Shiller Home Price Index on Tuesday and we'll also be watching Construction Spending on Friday and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.