Rally Resumes • Major Warehouse Deal • REIT Dividend Hikes

- U.S. equity markets rallied Tuesday despite a continued rise in Treasury yields as investors assessed the economic and valuation impacts of a more-aggressive Federal Reserve in tamping down soaring inflation.

- Resuming last week's rally after finishing flat on Monday, the S&P 500 advanced 1.1% today while the tech-heavy Nasdaq 100 rallied 1.8% and is back within 12% of its recent highs.

- Real estate equities were also higher today but lagged the broader indexes as the Equity REIT Index advanced 0.3% with 12-of-19 property sectors in positive territory while Mortgage REITs rallied 1.2%.

- Prologis (PLD) - the largest industrial REIT with a market cap of roughly $120B - reportedly bid more than $23B for Blackstone’s Mileway logistics warehouse company in Europe, a portfolio of about 2,000 European warehouses.

- Cousins Properties (CUZ) - which we own in the Income Builder REIT Portfolio - became the 61st REIT to raise its dividend this year, hiking its quarterly dividend by 3.2% to $0.32/share.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rallied Tuesday despite a continued rise in Treasury yields as investors assessed the economic and valuation impacts of a more aggressive Federal Reserve in tamping down soaring inflation. Resuming last week's rally after finishing flat on Monday, the S&P 500 advanced 1.1% today while the tech-heavy Nasdaq 100 rallied 1.8% and is back within 12% of its recent highs. Real estate equities were also higher today but lagged the broader indexes as the Equity REIT Index advanced 0.3% with 12-of-19 property sectors in positive territory while Mortgage REITs rallied 1.2%.

Soaring this week on hawkish comments from Fed Chair Powell, the 10-Year Treasury Yield rose to fresh three-year highs today above 2.35% while the yield curve remained near its flattest levels since February 2020. Ten of the eleven GICS equity sectors advanced today, led to the upside by the Consumer Discretionary (XLY) sector following strong earnings results from Nike (NKE). The Energy (XLE) sector lagged today as WTI Crude Oil (CL1:COM) prices slumped 1%, but remain higher by about 5% this week.

Real Estate Daily Recap

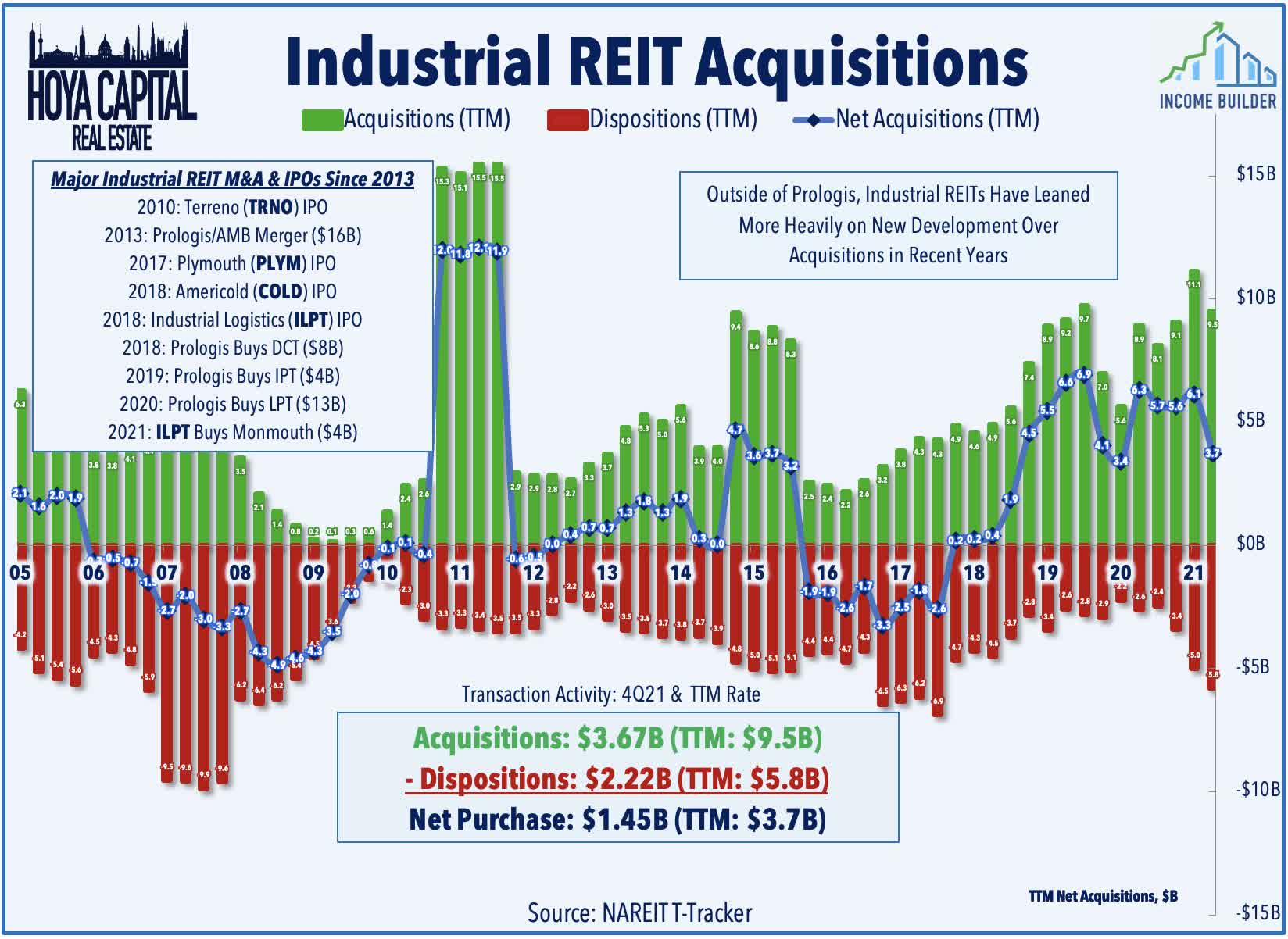

Industrial: Prologis (PLD) - the largest industrial REIT with a market cap of roughly $120B - reportedly bid more than $23B for Blackstone’s Mileway logistics warehouse company in Europe, a portfolio of about 2,000 European warehouses that Blackstone has accumulated over the past six years. The deal, if completed, would be the largest industrial real estate deal in history and the largest ever for a REIT, eclipsing PLD's $13B acquisition of Liberty Property Trust in 2020 and its $8B acquisition of DCT Industrial in 2018. As discussed in Supply Chains At Breaking Point, industrial REITs are never "cheap" but much like the residential sector, supply-demand fundamentals are likely to remain favorable into the late 2020s and should continue delivering robust earnings and dividend growth.

Office: Cousins Properties (CUZ) - which we own in the Income Builder REIT Portfolio - became the 61st REIT to raise its dividend this year, hiking its quarterly dividend by 3.2% to $0.32/share. As we discussed in our recent office REIT report, It's Always Sunny In the Sunbelt, Cousins - which focuses on the Sunbelt markets of Atlanta, Charlotte, Austin, Phoenix, Tampa, and Chapel Hill - is the only office REIT to hike its dividend in each of the past three years. Elsewhere in the office today, Paramount Group (PGRE) traded higher by about 1% after turning down Monarch Alternative Capital's proposal to acquire the REIT for $12.00/share, saying the offer "significantly" undervalued the company. Currently trading at $10.81, PGRE is higher by more than 20% since reports of the offer emerged in late February.

Cannabis: Yesterday, we published Cannabis REITs: High On Dividend Growth as an exclusive report for Hoya Capital Income Builder members. Cannabis REITs have stumbled in early 2022, pressured by the broader growth-to-value rotation and uncertainty over progress on federal legalization. Owning the "Pharmland" - the physical real estate - has been one of the few themes in the space that has worked as cannabis ETFs have delivered dismal investment performance since 2019. Thriving in the murky and often contradictory regulatory framework of legalized marijuana, recent movement in Washington on cannabis-related bills has raised questions about the future prospects in a federally-legalized environment. In the report, we discussed our updated price targets and ratings.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs rallied 1.6% today while residential mREITs advanced 1.5%. New Residential (NRZ) gained 1.4% today after it held its dividend steady at $0.25/share, representing a forward yield of roughly 9.4%. The average residential mREIT pays a dividend yield of 10.89% while the average commercial mREIT pays a dividend yield of 7.38%.

Economic Data This Week

The economic calendar slows down a bit in the week ahead with the major reports coming on Wednesday with New Home Sales and on Friday with Pending Home Sales, which are expected to show continued strength in home buying activity amid robust demand from institutional build-to-rent owners and individual homeowners. On Friday, we'll also see revised Consumer Sentiment data for March which dipped to recessionary levels in the initial reading last week amid mounting anxiety over soaring inflation. We'll also be watching PMI data on Thursday and the Baker Hughes Rig Count on Friday for indications on whether U.S. oil and gas production is accelerating to address the surge in global energy prices.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.