Rate Hike Unease • Office Recovery • Tech Rout

Summary

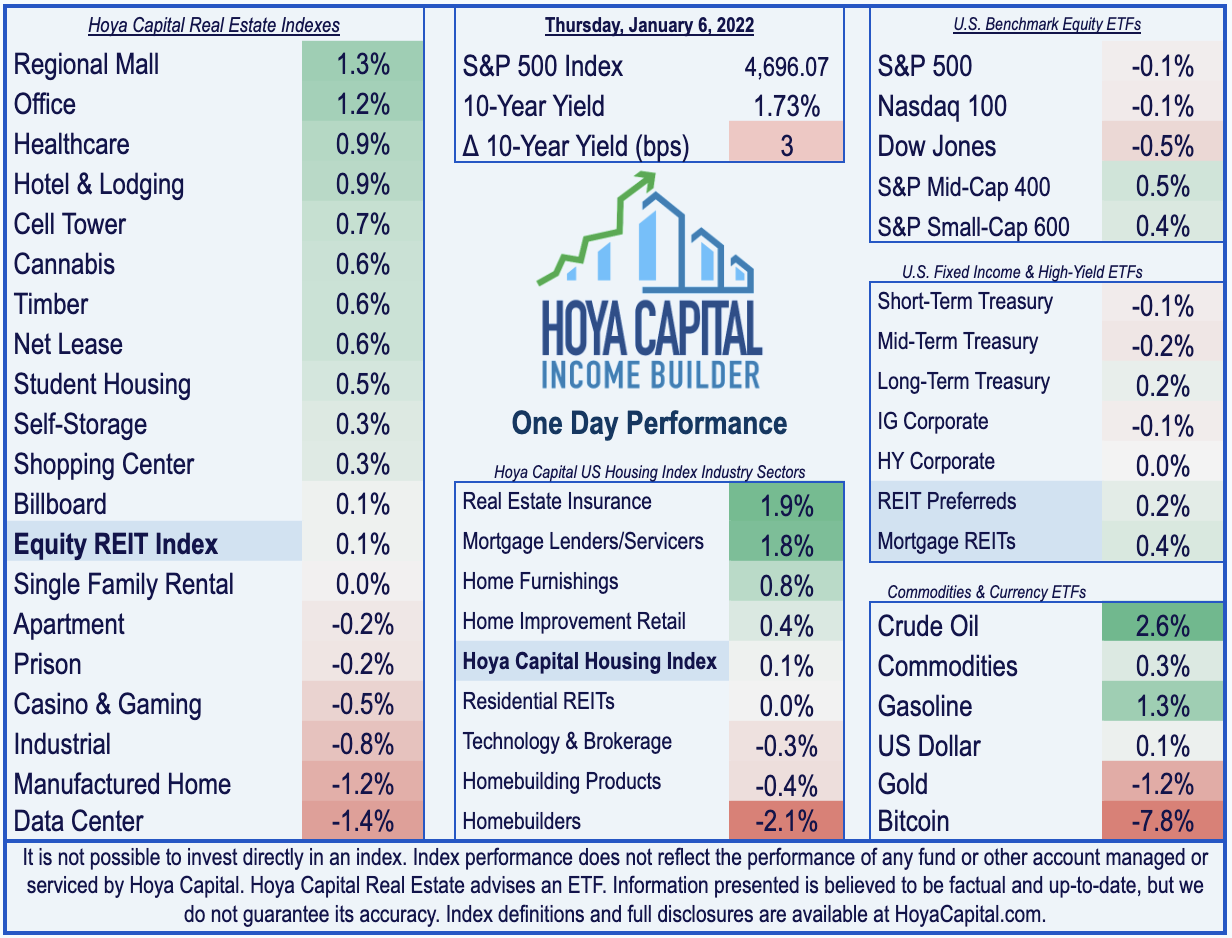

- U.S. equity markets were lower for the third-straight-day Thursday while Treasury yields climbed to the highest level since the start of the pandemic as investors priced-in expectations of Fed rate hikes.

- Following declines of nearly 2% yesterday, the S&P 500 slipped another 0.1% on the day while the tech-heavy Nasdaq 100 declined 0.1% and is on pace for its worst week since 2020.

- Real estate equities were among the leaders today with the Equity REIT Index advancing 0.1% on the day with 13-of-19 property sectors in positive territory while Mortgage REITs gained 0.4%.

- Treasury yields climbed for a fourth consecutive day with the 10-Year Treasury Yield rising to the highest level since the start of the pandemic after the Fed appeared unfazed by Omicron.

- Crown Castle (CCI) gained 2% after announcing a 12-year agreement with T-Mobile allowing increased access to its towers and small cells to build out its 5G network while AT&T and Verizon continue a battle with regulators over C-band deployment.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

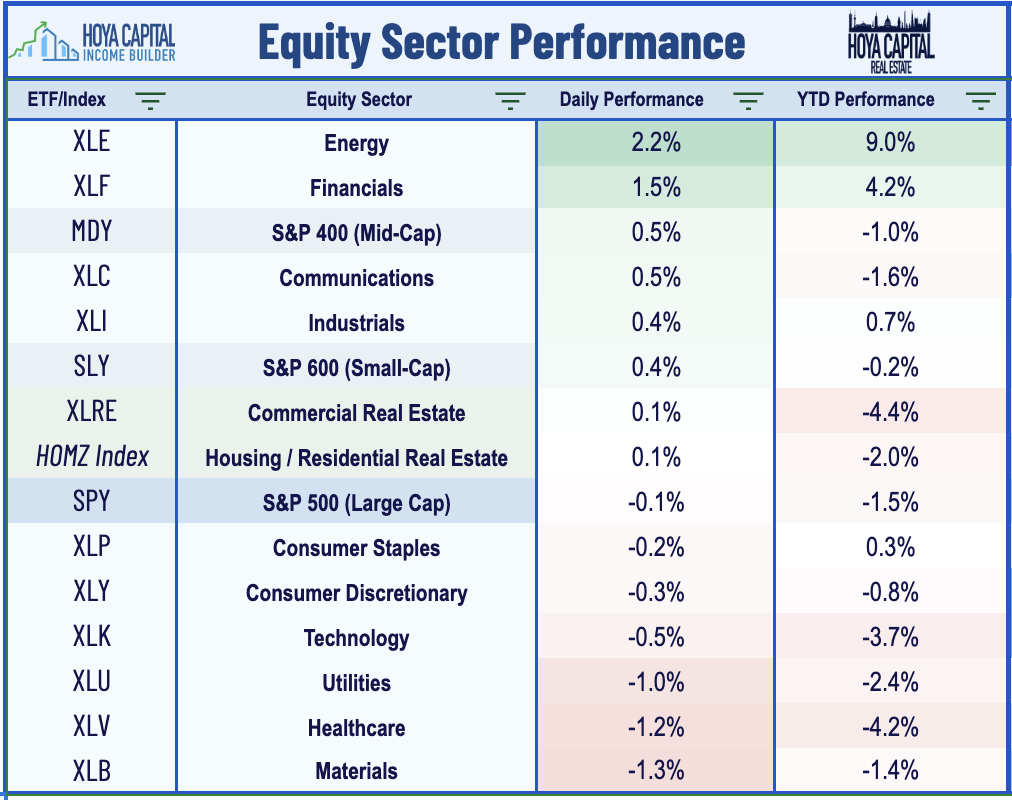

U.S. equity markets were lower for the third straight day Thursday while Treasury yields climbed to the highest level since the start of the pandemic as investors priced in expectations of Federal Reserve interest rate hikes. Following declines of nearly 2% yesterday, the S&P 500 slipped another 0.1% on the day while the tech-heavy Nasdaq 100 declined another 0.1% and is on pace for its worst week since 2020. Real estate equities were among the leaders today with the Equity REIT Index advancing 0.1% with 13-of-19 property sectors in positive territory while Mortgage REITs gained 0.4%.

Treasury yields climbed for a fourth consecutive day with the 10-Year Treasury Yield rising to the highest level since the start of the pandemic in early 2020 as investors expect the Fed to be unfazed by the Omicron outbreak. High-frequency data today continued to support the understanding that despite record-high case counts, economic activity hasn't materially slowed as weekly Initial Jobless Claims remained near historic lows at just over 200k. The Energy (XLE) sector continued its strong start to 2022 has already gained 9% this week while a strong day from home improvement firms and real estate financials lifted the Hoya Capital Housing Index to gains as well.

Equity REIT & Homebuilder Daily Recap

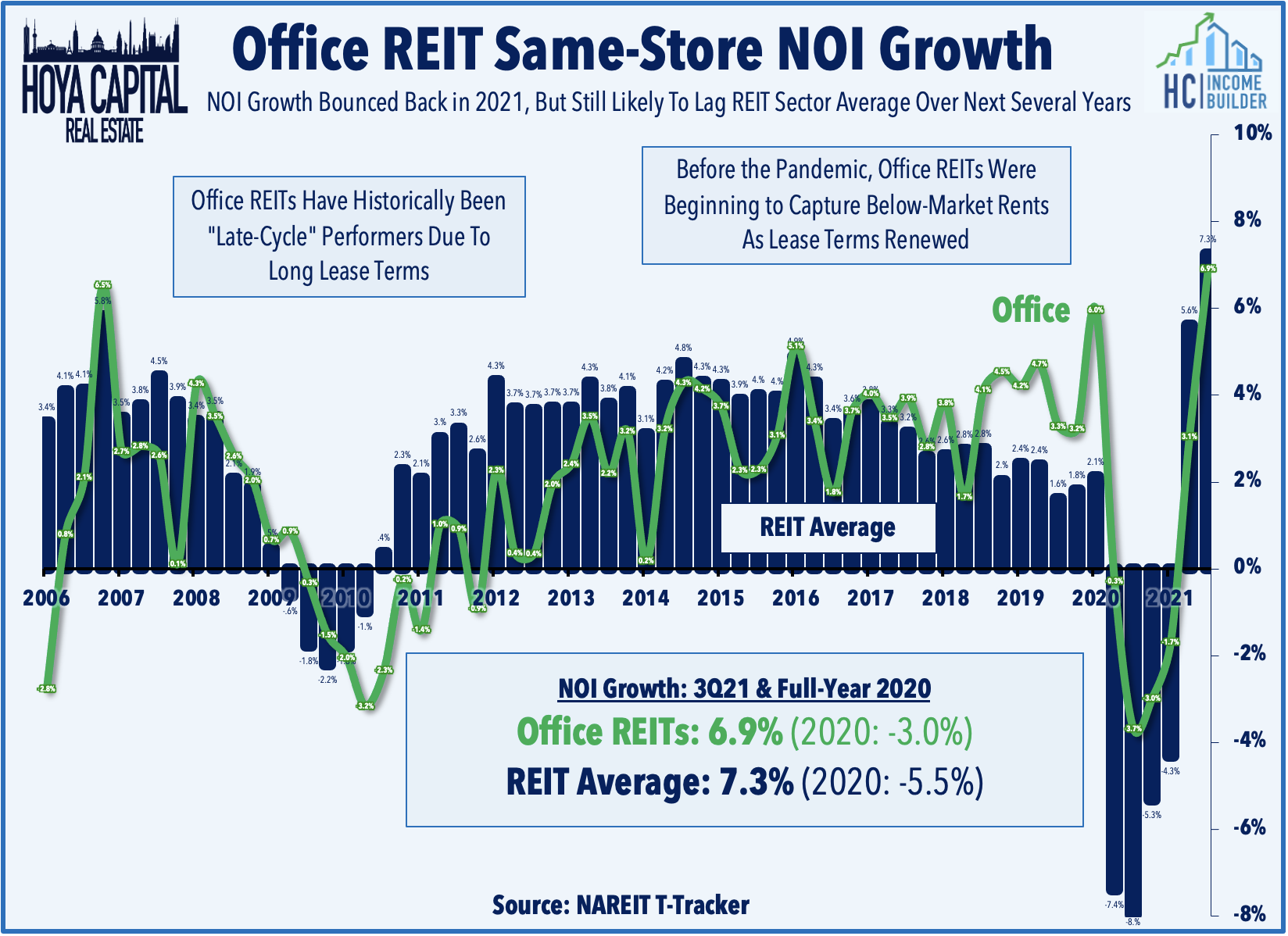

Office: Today, we published Always Sunnier in the Sunbelt. The long-delayed 'return to the office' has been postponed yet again by another wave of the pandemic, but office demand has been stronger than many assume. The office REIT outlook has brightened in recent months - particularly for REITs focused on business-friendly Sunbelt regions - following solid earnings results, favorable leasing trends, and strong comparable pricing. Office utilization rates have recovered only a fraction of pre-COVID levels, however, in dense coastal "shutdown cities" with longer transit-heavy commutes. Start a free two-week trial to read the full report here and how we're allocating to the office sector.

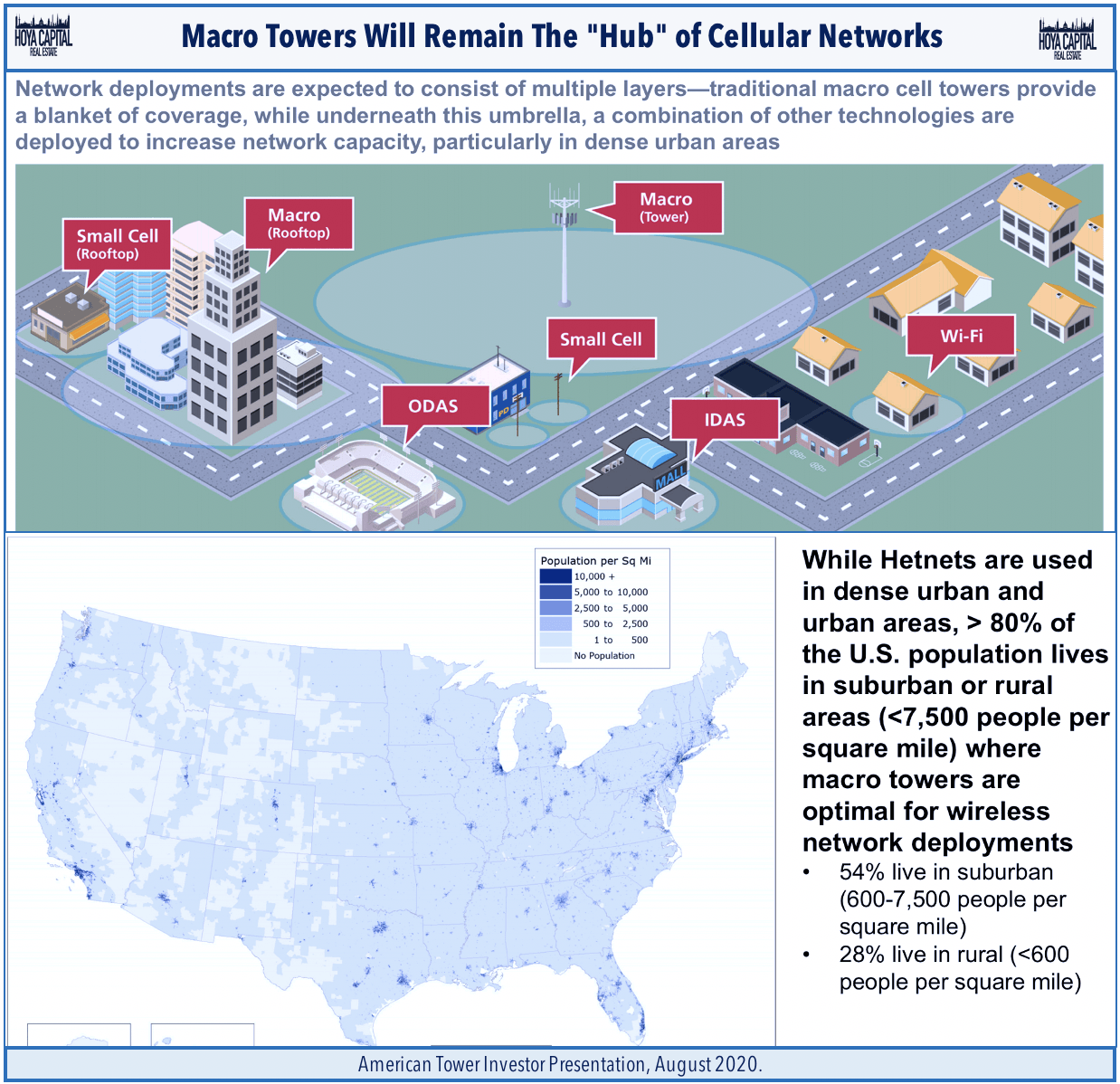

Cell Tower: Crown Castle (CCI) gained about 2% today after announcing a 12-year agreement with T-Mobile (TMUS) allowing increased access to CCI's towers and small cell locations to build out its nationwide 5G network. Cell Tower REITs and carriers - specifically Verizon (VZ) and AT&T (T) have been in focus over the last week amid a regulatory battle over the deployment of 5G networks using C-band frequencies, which the airline industry alleges interfere with airplane equipment using similar frequencies. We discussed these potential headwinds in a report last week - Living On The Edge.

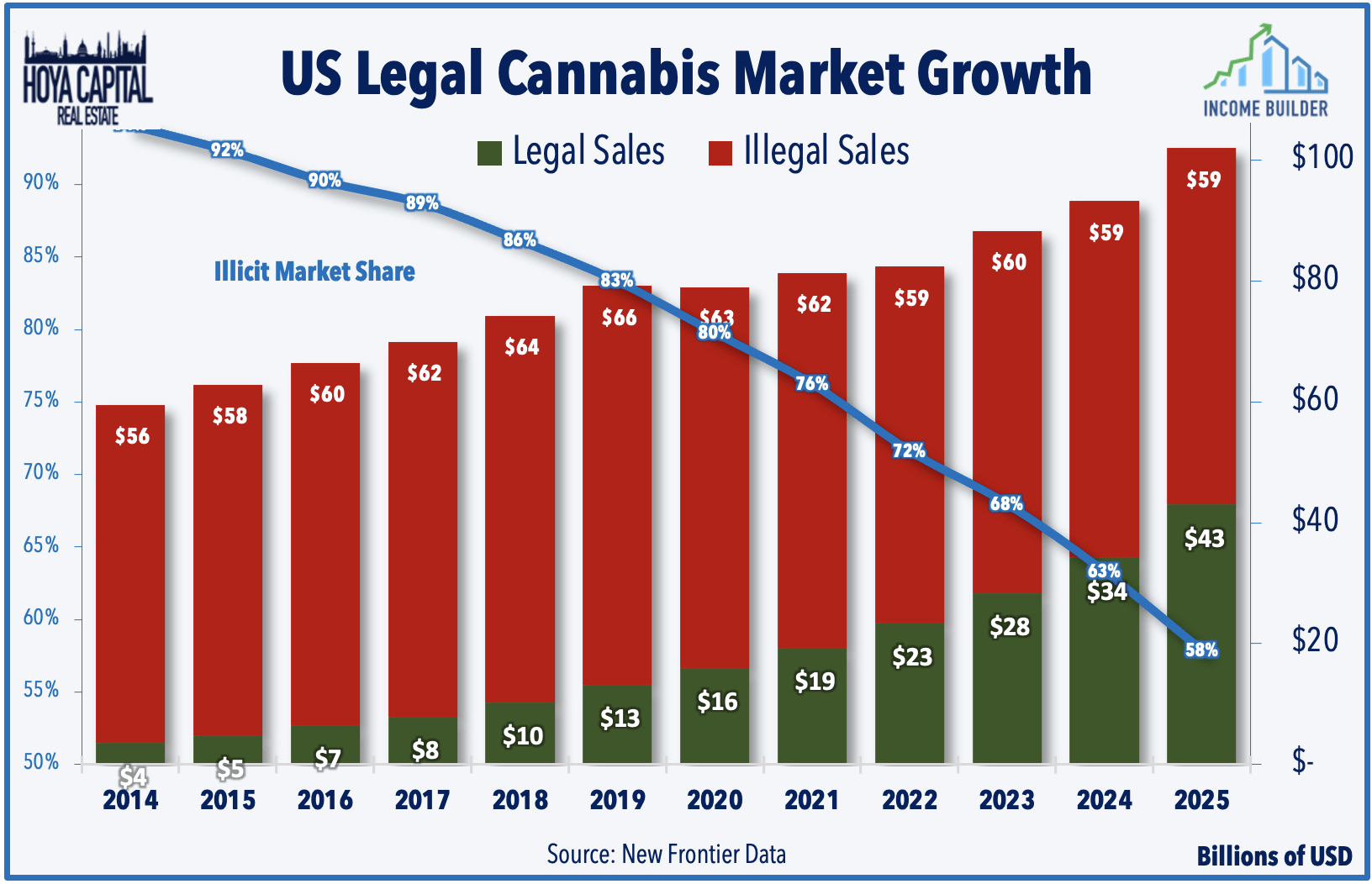

Cannabis: Innovative Industrial (IIPR) gained 1.5% today after it announced that it exchanged outstanding notes for stock in a $110M private transaction. AFC Gamma (AFCG) was lower by nearly 3% after launching a secondary common stock offering of 3M shares at $20.50/share for expected gross proceeds of $61.5M. As discussed in When They Go Low, We Get High, Cannabis REITs are far-and-away the best-performing REIT sector of the past half-decade as the budding industry thrives in the murky and often contradictory regulatory framework of legalized marijuana.

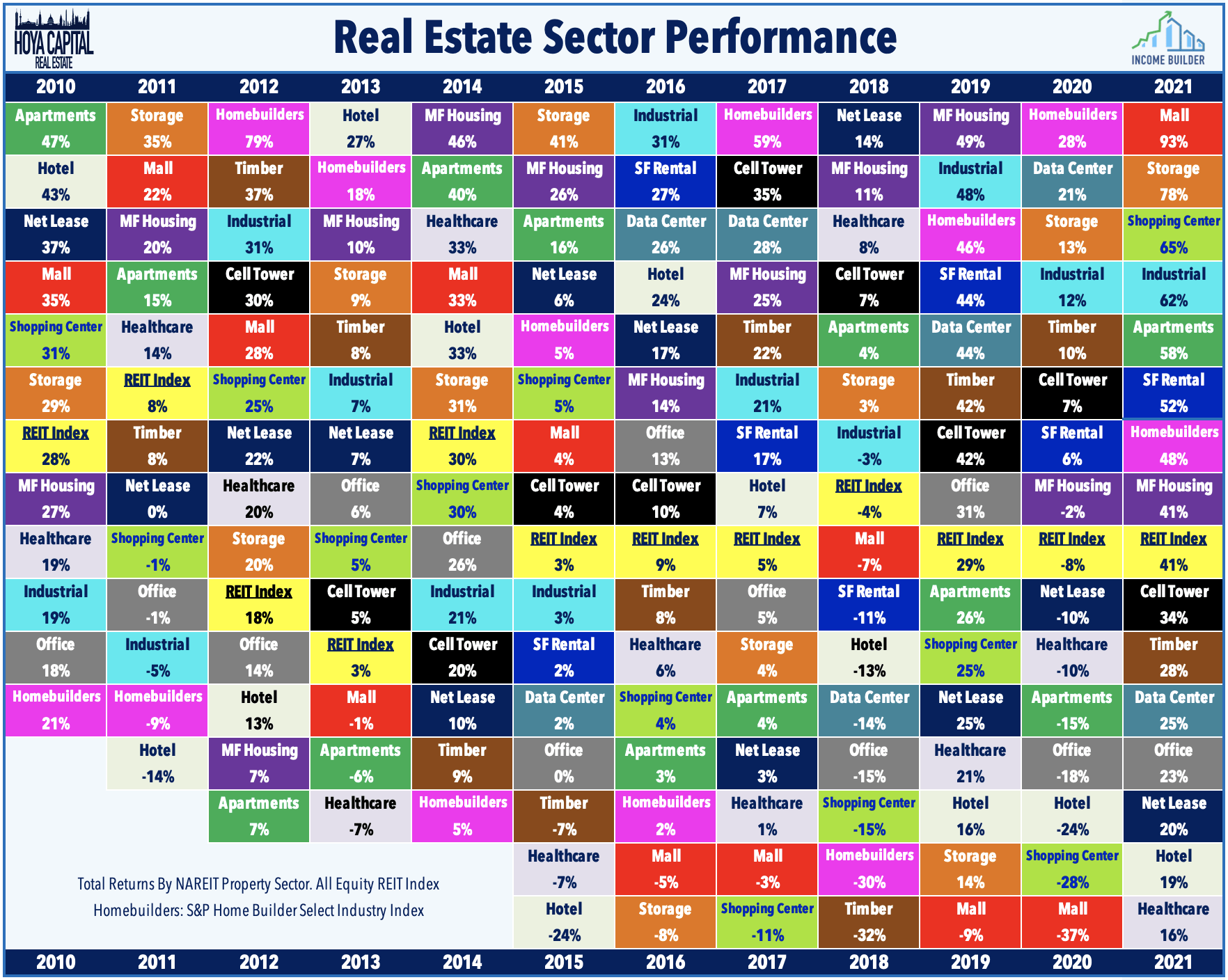

Manufactured Housing: Earlier this week, we published Don't Mess With The Best, an abridged article of our full report published to Hoya Capital Income Builder last week. Manufactured Housing REITs - the best-performing property sector of the past decade – continued their stellar performance in 2021, riding favorable fundamentals of robust rent growth and limited housing supply. MH REITs edged out the REIT Index on the final day of 2021 to push their remarkable streak of outperformance to nine years, the longest of the Modern REIT Era. The secular tailwinds resulting from the intensifying affordable housing shortage should persist into the back half of the 2020s, if not longer. While never "cheap," MH REITs remain an essential component of dividend growth-oriented real estate portfolios.

Economic Data This Week

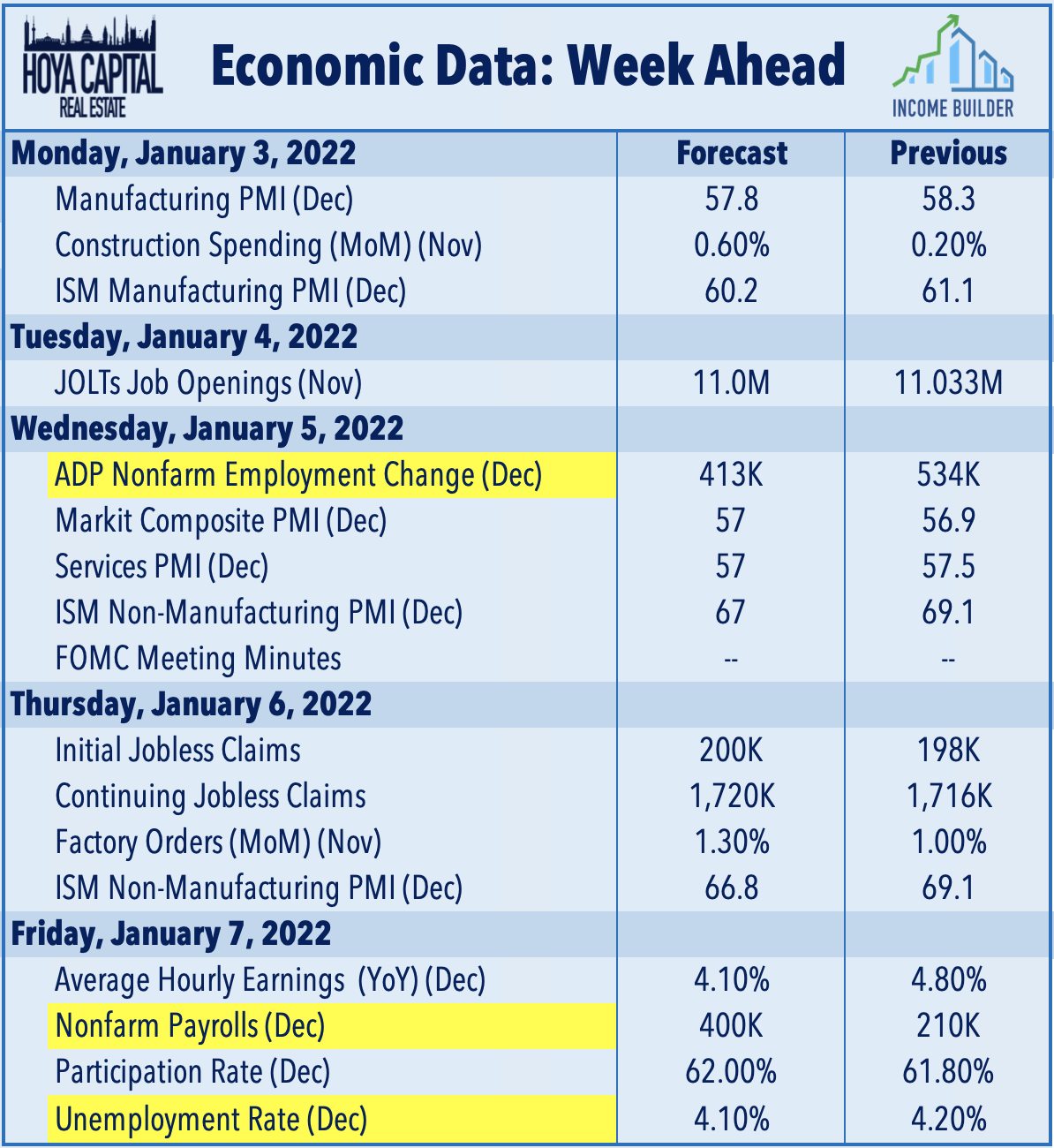

Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 400k in December following last month's weaker-than-expected employment growth of 210k and for the unemployment rate to tick lower to 4.1%. We also saw Construction Spending yesterday and JOLTs Job Openings data on Tuesday, and will see and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.