Rebound Rally • Inflation Data • Special REIT Dividend

Summary

- U.S. equity markets rebounded Friday - erasing their weekly declines on another volatile session - as upbeat corporate earnings reports eased recent investor jitters about rising interest rates and persistent inflation.

- Ending a historically volatile week with cumulative gains of nearly 1%, the S&P 500 rallied 2.5% today while the tech-heavy Nasdaq-100 gained 3.1%. Mid-Caps rebounded 2.0% while Small-Caps gained 1.5%.

- Real estate equities delivered their best day in several months to erase weekly losses. The Equity REIT Index finished higher by 3.2% with all 19 property sectors in positive territory.

- Consumer prices in the US continued surging in December with the PCE Price Index - the Fed's "preferred" measure of inflation- rising more than 5.8% from last year - the highest rate of inflation in more than three decades, sending Consumer Sentiment to the lowest since 2011.

- Timber REIT Weyerhaeuser (WY) rallied nearly 5% after posting strong Q4 results and declaring a special dividend of $1.45/share, propelled by robust demand for wood products from homebuilders and repair/remodel contractors.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Friday - erasing their weekly declines on another volatile session - as upbeat corporate earnings reports eased recent investor jitters about rising interest rates and persistent inflation. Ending a historically volatile week with cumulative gains of nearly 1%, the S&P 500 rallied 2.5% today while the tech-heavy Nasdaq 100 gained 3.1%. Mid-Caps rebounded by 2.0% while Small-Caps gained 1.5%. Real estate equities delivered their best day in several months as the Equity REIT Index finished higher by 3.2% with all 19 property sectors in positive territory while the Mortgage REIT Index finished higher by 0.8%.

The gains today - powered by strong reports from Apple (AAPL) and timber giant Weyerhaeuser (WY) - came despite worse-than-expected economic data this morning as inflation rose to 30-year highs while consumer confidence dipped to 10-year lows. Ten of the eleven GICS equity sectors finished higher today, led to the upside by the Technology (XLK), Real Estate (XLRE), and Communications (XLC) sectors. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

The BEA reported this morning that consumer prices in the US continued surging in December with the PCE Price Index - the Fed's "preferred" measure of inflation- rising more than 5.8% from last year - the highest rate of inflation in more than three decades. The headline PCE Index rose 0.4% in December - roughly matching expectations - while the Core PCE Index rose 0.4% from the prior month, which was above consensus estimates. Driving the gains was a 29.9% year-over-year surge in energy prices and a 5.7% increase in food prices - issues that have resulted in a sharp decline in consumer confidence metrics since late August.

Equity REIT Daily Recap

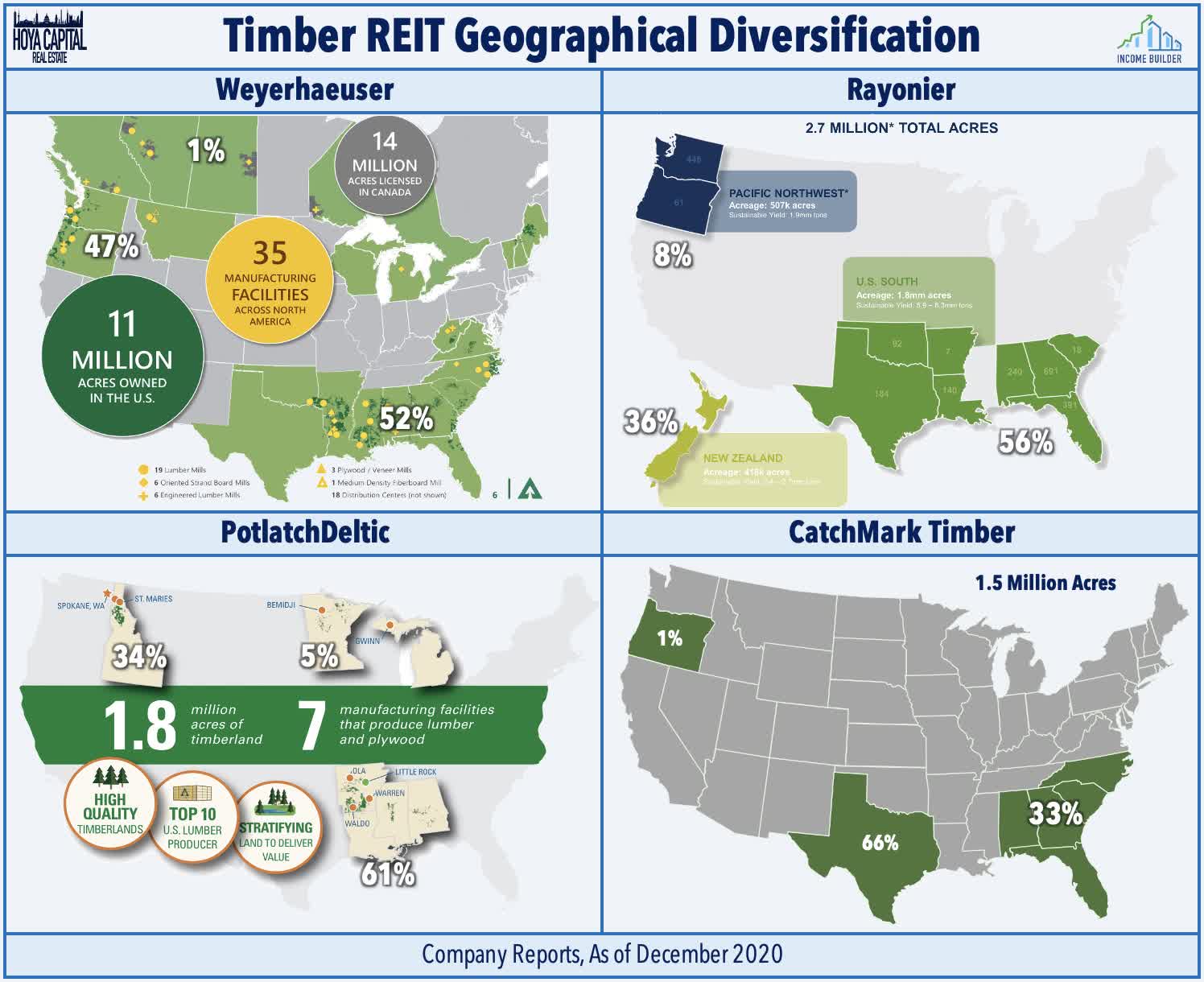

Timber: Weyerhaeuser (WY) rallied nearly 5% after posting strong Q4 results and declaring a special dividend of $1.45/share - consistent with its new dividend framework announced last year. Propelled by robust demand for wood products from homebuilders and repair/remodel contractors, WY reported that full-year EBITDA soared by 86% to a record $4.1B in 2021 and commented that it "continues to be encouraged by strong demand fundamentals" in early 2022. As noted in Timber REITs: Renewable Dividends, for investors that can tolerate the volatility, timber REIT valuations and long-term fundamentals appear compelling amid robust housing demand, record-low housing supply, as well as a substantial backlog of home construction.

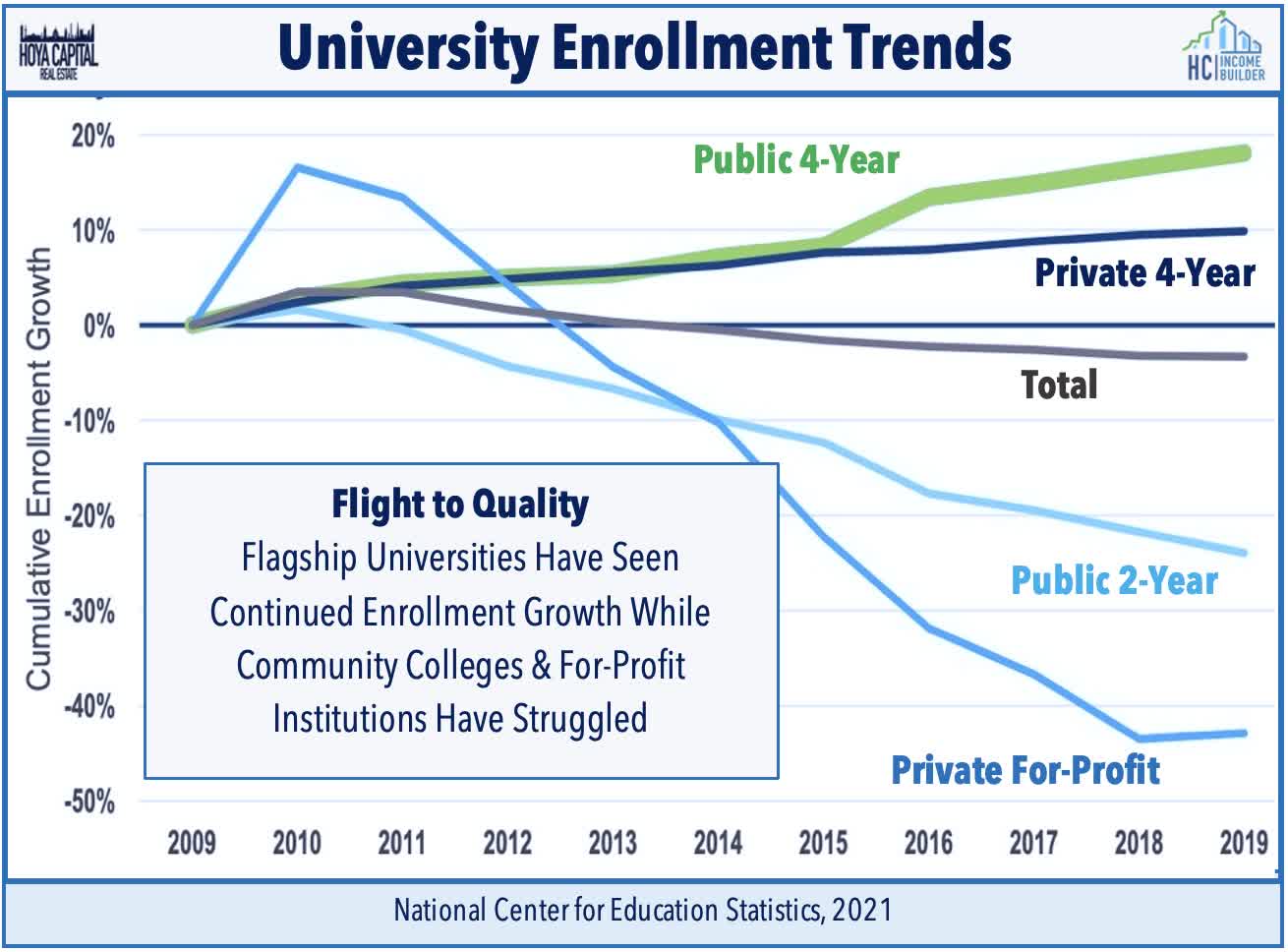

Student Housing: Today, we published Student Housing REITs: Back to School. American Campus Communities (ACC) - along with the broader student housing sector - have delivered a swifter-than-expected rebound as students at flagship universities returned to campus for the Fall semester. Despite the broader enrollment declines at the national level due to a myriad of short-term pandemic-related effects and structural headwinds related to demographics and the shift to online education, student housing fundamentals in top-tier university markets have returned to pre-pandemic levels.

Earlier this week we published REIT Earnings Preview: Dividend Hikes And 2022 Outlook. Real estate earnings season kicks off this week, and REITs enter fourth-quarter earnings season at an interesting crossroads, having been the best-performing asset class of 2021, but also one of the weakest through the first three weeks of 2022. REIT property-level fundamentals remain on an upward trajectory and we expect another strong quarter from residential REITs, in particular, as recent data indicates that rents continue to soar by double-digit rates. We'll see more than a dozen reports next week including Alexandria (ARE), Equity Residential (EQR), AvalonBay (AVB), and Mid-America Apartments (MAA).

We're excited to announce the launch of our new investment research service on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.