Rebound Rally • REIT Dividend Hikes • Medical Office M&A

- U.S. equity markets continued to rebound Friday- pushing the major averages into positive territory on a frenetic week- after Russia agreed to talks with Ukrainian leadership amidst its military incursion.

- Real estate equities were among the leaders today and for the week. The Equity REIT Index advanced 2.5% today with every property sector in positive territory while mortgage REITs gained 1.3%.

- Medical office building owners Health Trust of America (HTA) and Healthcare Realty Trust (HR) are reportedly in advanced discussions to combine in a transaction that would create a combined company valued at more.

- Another four equity REITs raised their dividend over the last 24 hours: industrial REIT Prologis (PLD), billboard REIT Lamar Advertising (LAMR), storage REIT National Storage (NSA), and apartment REIT Essex Properties (ESS).

- CubeSmart (CUBE) and Life Storage (LSI) each rallied today after rounding out a stellar earnings season for self-storage REITs. Across the storage sector, FFO growth is expected to average more than 16% in 2022 following incredible growth of 27% in 2021.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets continued to rebound Friday - pushing the major averages into positive territory on a frenetic week - after Russia agreed to talks with Ukrainian leadership amidst its military incursion. Ending a wild week with cumulative gains of 0.7%, the S&P 500 finished higher by 2.2% today while the tech-heavy Nasdaq 100 gained 1.6% and the Mid-Cap 400 rallied nearly 3%. Real estate equities were among the leaders today and on the week as the Equity REIT Index advanced 2.5% today with all 19 property sectors in positive territory while the Mortgage REIT Index gained 1.3%.

Hopes of a relatively peaceful resolution to the Russia/Ukraine conflict sparked a significant rally across U.S. equity markets beginning mid-day Thursday after the Nasdaq briefly dipped into "bear market" territory. All eleven GICS equity sectors were higher today, led to the upside by the Materials (XLB) and Financials (XLF) sectors while homebuilders and the broader Hoya Capital Housing Index delivered another strong day as investors priced in a more careful path of Federal Reserve monetary tightening in the wake of heightened geopolitical tensions. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Weekly Outlook report this weekend.

Real Estate Daily Recap

Another four equity REITs raised their dividend over the last 24 hours. Industrial REIT Prologis (PLD) - which we own in our REIT Dividend Growth Portfolio - hiked its dividend by 25%. Lamar Advertising (LAMR) - which we also own in the REIT Dividend Growth Portfolio - hiked its dividend by 10%. Apartment REIT Essex Property (ESS) hiked its dividend by 5.3%. Storage REIT National Storage (NSA) raised its dividend by 11%. Finally, bilWe've now seen 38 equity REITs hike their dividend through the first two months of 2022, outpacing the record-year of dividend hikes in 2021.

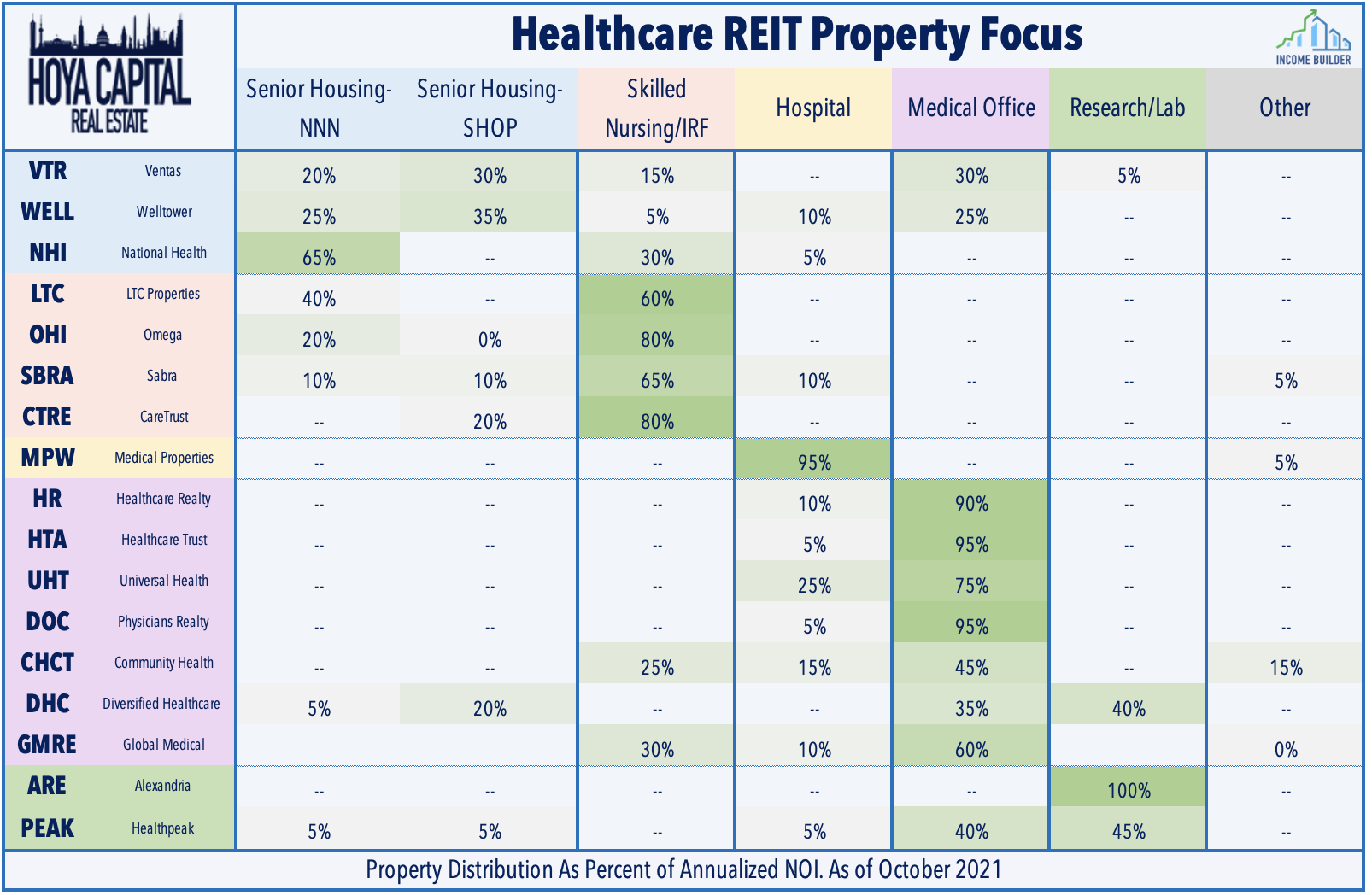

Healthcare: Medical office building owners Health Trust of America (HTA) and Healthcare Realty Trust (HR) are reportedly in advanced discussions to combine in a transaction that would create a combined company valued at more than $10B in a cash and stock deal may be completed as soon as next week, according to the WSJ report. The potential deal comes after HTA, which has been targeted by activist investors - said last November that it was exploring a potential sale. HR - which trades at a roughly 10% discount to Net Asset Value based on private market valuations - declined more than 3% on the report as some analysts raised concern of potential dilution if the deal is completed at valuations above $30/share. HTA closed Friday higher by more than 3% at $31.05/share.

Storage: CubeSmart (CUBE) – which we own in the REIT Dividend Growth Portfolio – rallied nearly 3% today alongside Life Storage (LSI) after rounding out a stellar earnings season for self-storage REITs with very strong reports. All five storage REITs delivered NOI and FFO growth above their prior guidance for full-year 2021 as self-storage demand has been insatiable over the last 18 months. Across the storage sector, FFO growth is expected to average more than 16% in 2022 following incredible growth of 27% in 2021. Earlier in the week, EXR commented that it continues to see rent growth in the magnitude of 20% in early 2022 but does expect to see some moderation throughout the year following the historic surge in rents in 2021.

Billboard: Lamar Advertising (LAMR) – which we own in the REIT Dividend Growth Portfolio - reported strong earnings results yesterday afternoon which included a 10% dividend hike to $1.10, which is above its pre-pandemic rate of $1.00. LAMR recorded full-year FFO growth of 29% - which was 13% above its pre-pandemic level in 2019, a rather remarkable turnaround over the past 18 months considering that its billboard REIT peer Outfront (OUT) recorded full-year FFO that was still 40% below its 2019-level. OUT did also hike its dividend by 3x, but its payout of $0.30 is still below its pre-pandemic rate of $0.36. The outlook for LAMR continues to be more favorable with guidance calling for FFO growth of another 8% this year.

Single-Family Rental: American Homes 4 Rent (AMH) rallied 2.3% today after reporting another strong quarter as single-family rents continue to soar across the country. AMH delivered FFO growth of 17.2% in 2021 and expects impressive growth of another 12.5% this year from the combination of nearly 10% same-store NOI growth and a low-single-digit contribution from external growth through the addition of between 3,300 to 3,900 new homes to its wholly-owned portfolio. Notably, despite the highly competitive home sales market, AMH added nearly 1,000 new homes to its portfolio in Q4 with about half coming through its internal AMH Development Program as the SFR REIT has quickly become one of the nation's largest homebuilders as well.

Industrial: Americold (COLD) was among the laggards today after reporting a notably weak report, recording an FFO decline of nearly 11% in 2021 and it sees another 9% decline in 2022. Unlike other industrial REITs that are net beneficiaries of the ongoing supply chain issues and resulting investment in additional logistics space, COLD is more “services-oriented” than other pure-play property-owning industrial REITs and has been negatively impacted by “the impact of food supply chain disruption resulting in lower economic occupancy and throughput in our same-store portfolio.”

We're now 95% complete with REIT earnings season with a handful of REITs left to report results next week, which will include Centerspace (CSR), SBA Communications (SBAC), Easterly Government (DEA), Global Medical REIT (GMRE), Tricon American (TCN), and Postal Realty (PSTL). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout REIT earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs and residential mREITs each advanced 1.4% today. Starwood Property (STWD) - which we own in the REIT Focused Income Portfolio - rallied 2% today after reporting record investment activity of $7.1B in Q4 - and recorded that its undepreciated book value per share increased by nearly 20% in Q4 to $20.74. Ready Capital (RC) rallied after reporting that its adjusted net book value rose 2% in Q4 to $15.35. Granite Pointe (GPMT) finished lower today after reporting that its BVPS declined 3.6% in Q4 to $16.70. Orchid Island (ORC) dipped nearly 6% after reporting that its BVPS declined 9.0% in Q4 to $4.34.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.