REIT Dividend Hike • Yields Jump • Jobs Week

Summary

- U.S. equity markets advanced on the first trading day of 2022 as investors looked ahead to a busy week of employment data while monitoring an ongoing surge in COVID cases.

- After delivering total returns of more than 28% in 2021 including 70 record-highs, the S&P 500 notched its first record-high of 2022, gaining 0.6% today.

- Real estate equities were laggards today after delivering the strongest returns of any asset class in 2021. The Equity REIT Index advanced 0.8% with 8-of-19 property sectors in positive territory.

- Picking Up Where They Left Off: After the close today, Life Storage (LSI) became the first REIT to raise its dividend this year following a historic wave of over 130 REIT dividend increases in 2021.

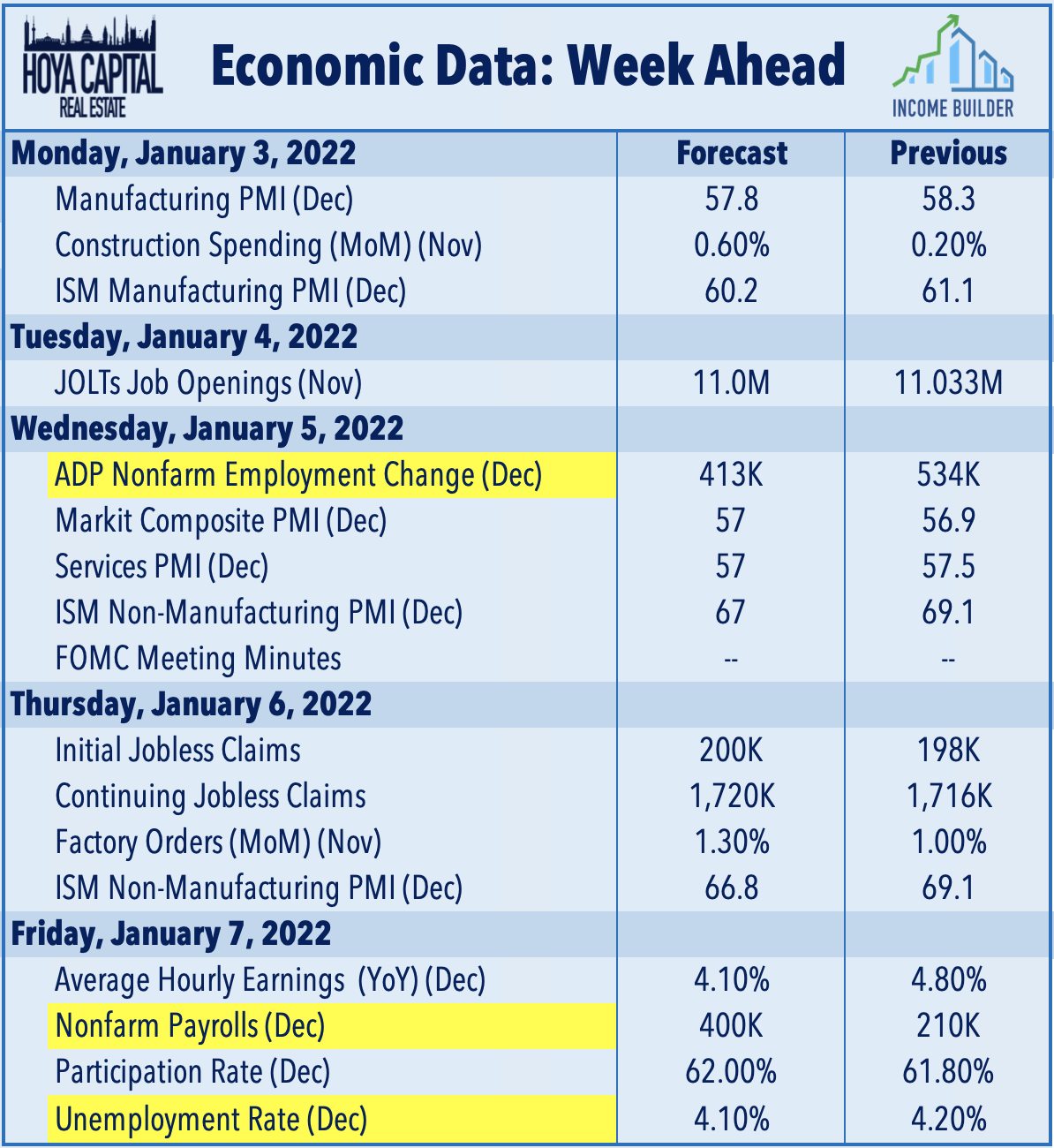

- Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

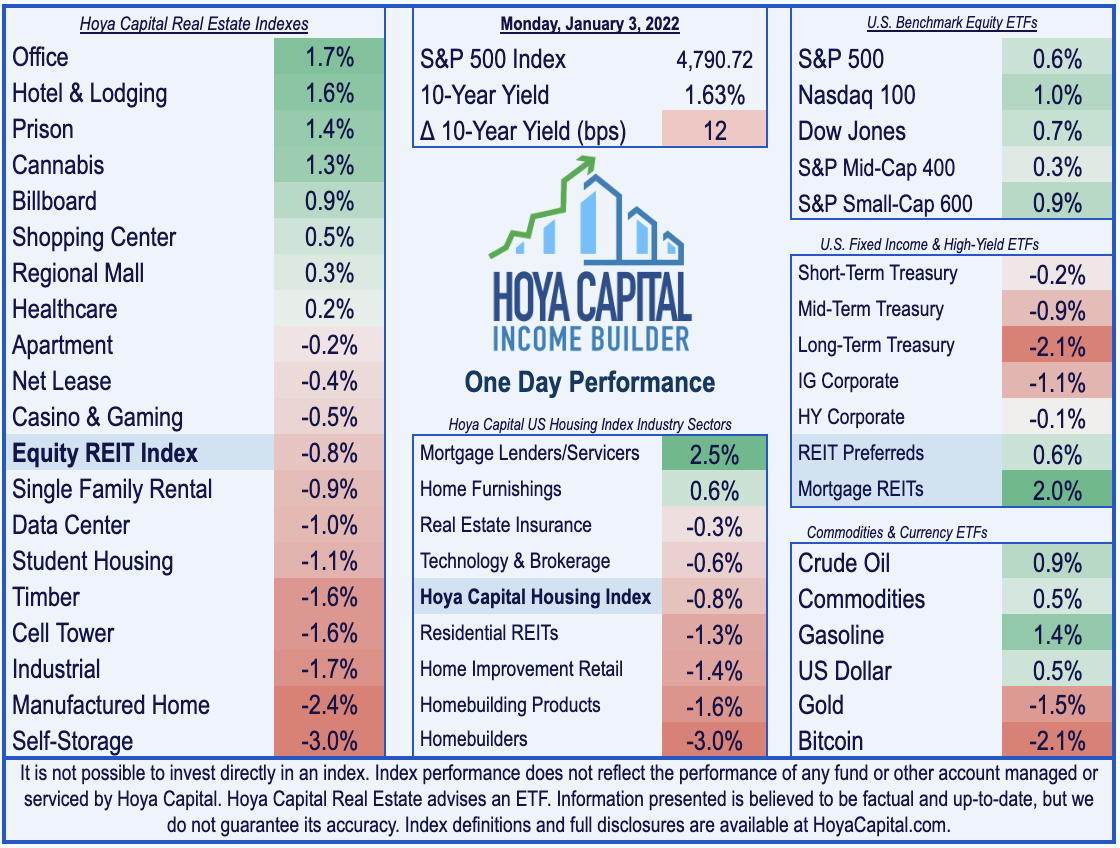

U.S. equity markets advanced on the first trading day of 2022 as investors looked ahead to a busy week of employment data while monitoring an ongoing surge in global COVID cases. After delivering total returns of more than 28% in 2021 including 70 record-highs, the S&P 500 notched its first record-high of 2022, gaining 0.6% today while the Mid-Cap 400 advanced 0.3% and the Small-Cap 600 climbed 0.9%. Real estate equities were laggards today after delivering the strongest returns of any asset class in 2021. The Equity REIT Index advanced 0.8% with 8-of-19 property sectors in positive territory while Mortgage REITs rallied more than 2%.

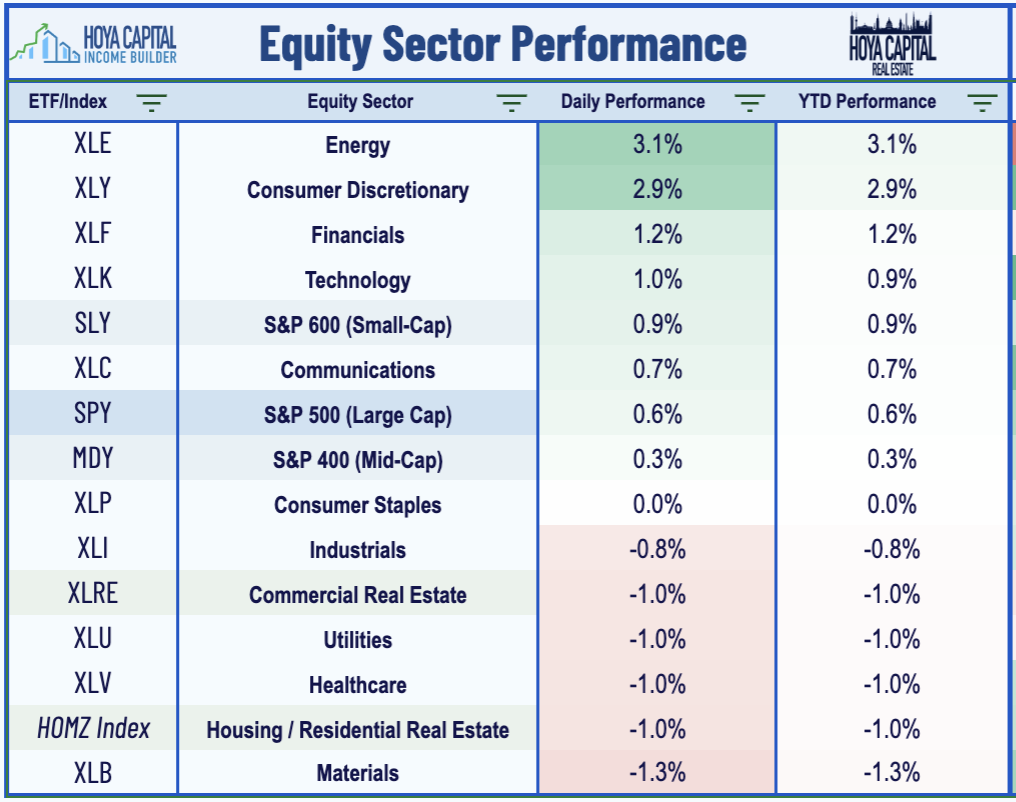

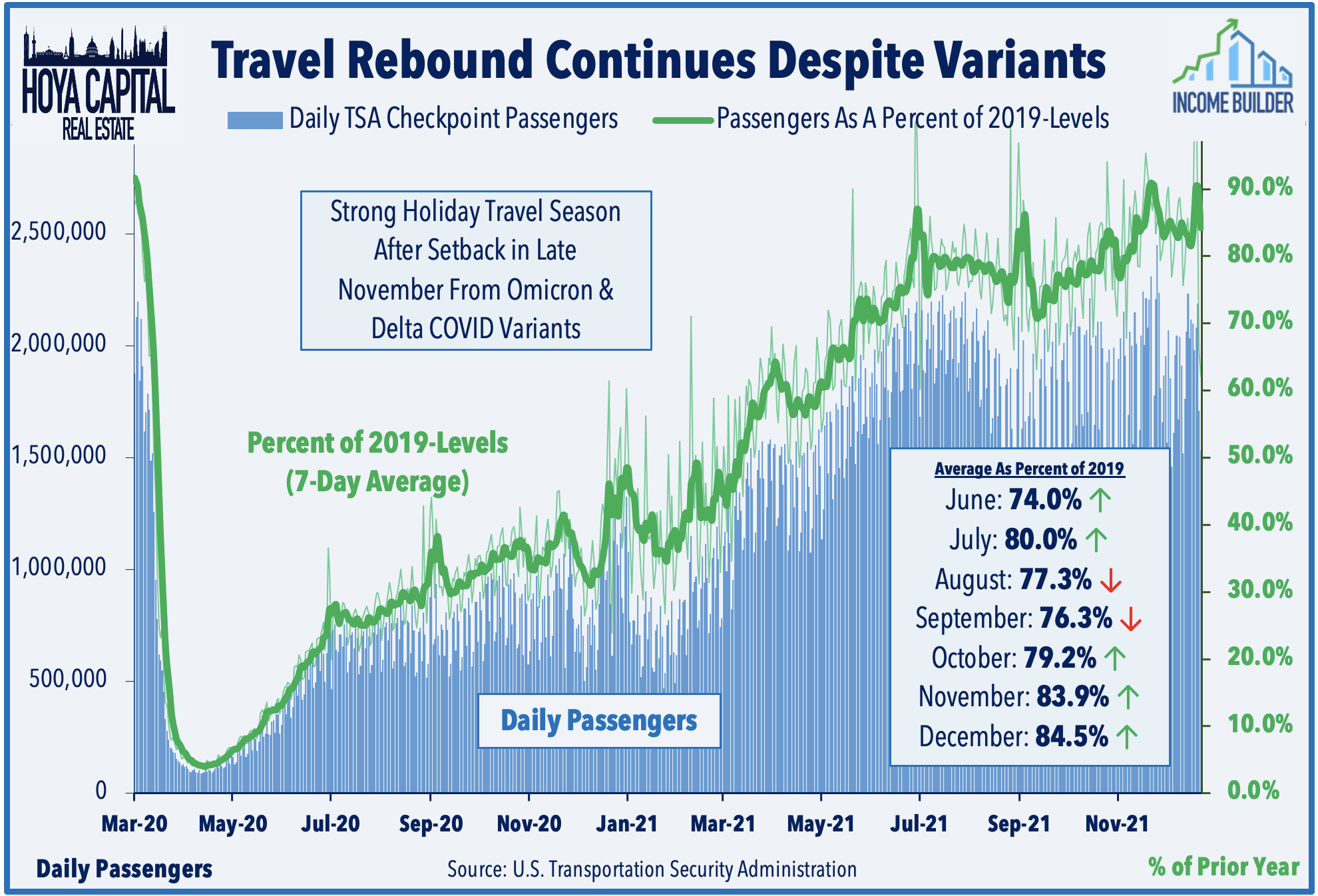

As discussed in our Real Estate Weekly Outlook, even as the Omicron variant sent newly-recorded COVID-19 case counts to record-highs globally, high-frequency economic data has shown no substantial slowdown in U.S. economic activity, even in at-risk categories like air travel and restaurants. After ending 2021 near the flattest level of the year, the yield curve steepened today with the 10-Year Treasury Yield gaining 12 basis points to close at 1.63%. Five of the eleven GICS equity sectors finished higher today, led to the upside by the Energy (XLE) sector while Apple (APLE) eclipsed $3T in market capitalization, the first company to reach that milestone.

Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 400k in December following last month's weaker-than-expected employment growth of 210k and for the unemployment rate to tick lower to 4.1%. We also saw Construction Spending today and will see JOLTs Job Openings data on Tuesday, and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Equity REIT & Homebuilder Daily Recap

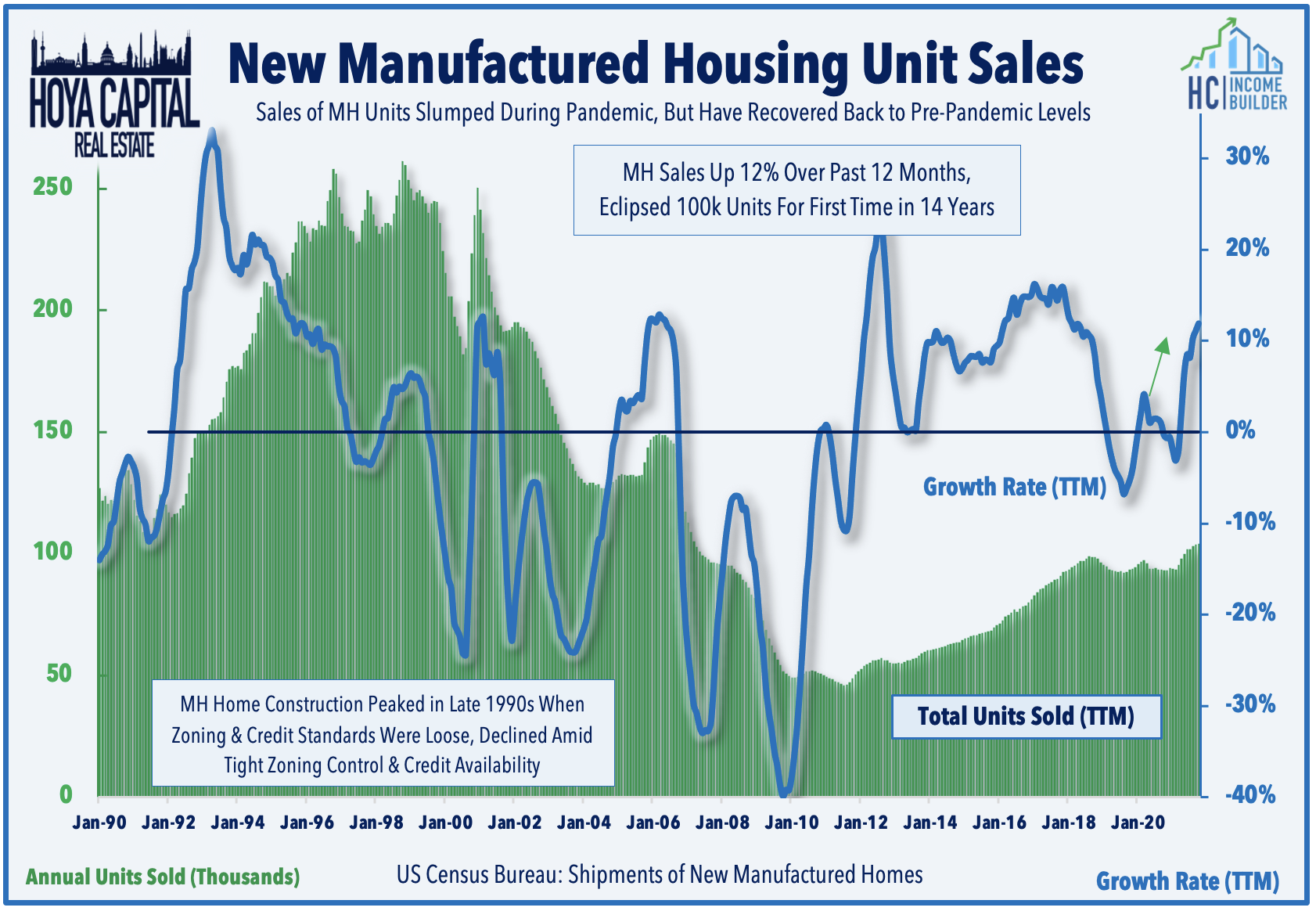

Manufactured Housing: Today we published Don't Mess With The Best, an abridged article of our full report published to Hoya Capital Income Builder last week. Manufactured Housing REITs - the best-performing property sector of the past decade – continued their stellar performance in 2021, riding favorable fundamentals of robust rent growth and limited housing supply. MH REITs edged out the REIT Index on the final day of 2021 to push their remarkable streak of outperformance to nine years, the longest of the Modern REIT Era. The secular tailwinds resulting from the intensifying affordable housing shortage should persist into the back half of the 2020s, if not longer. While never "cheap," MH REITs remain an essential component of dividend growth-oriented real estate portfolios.

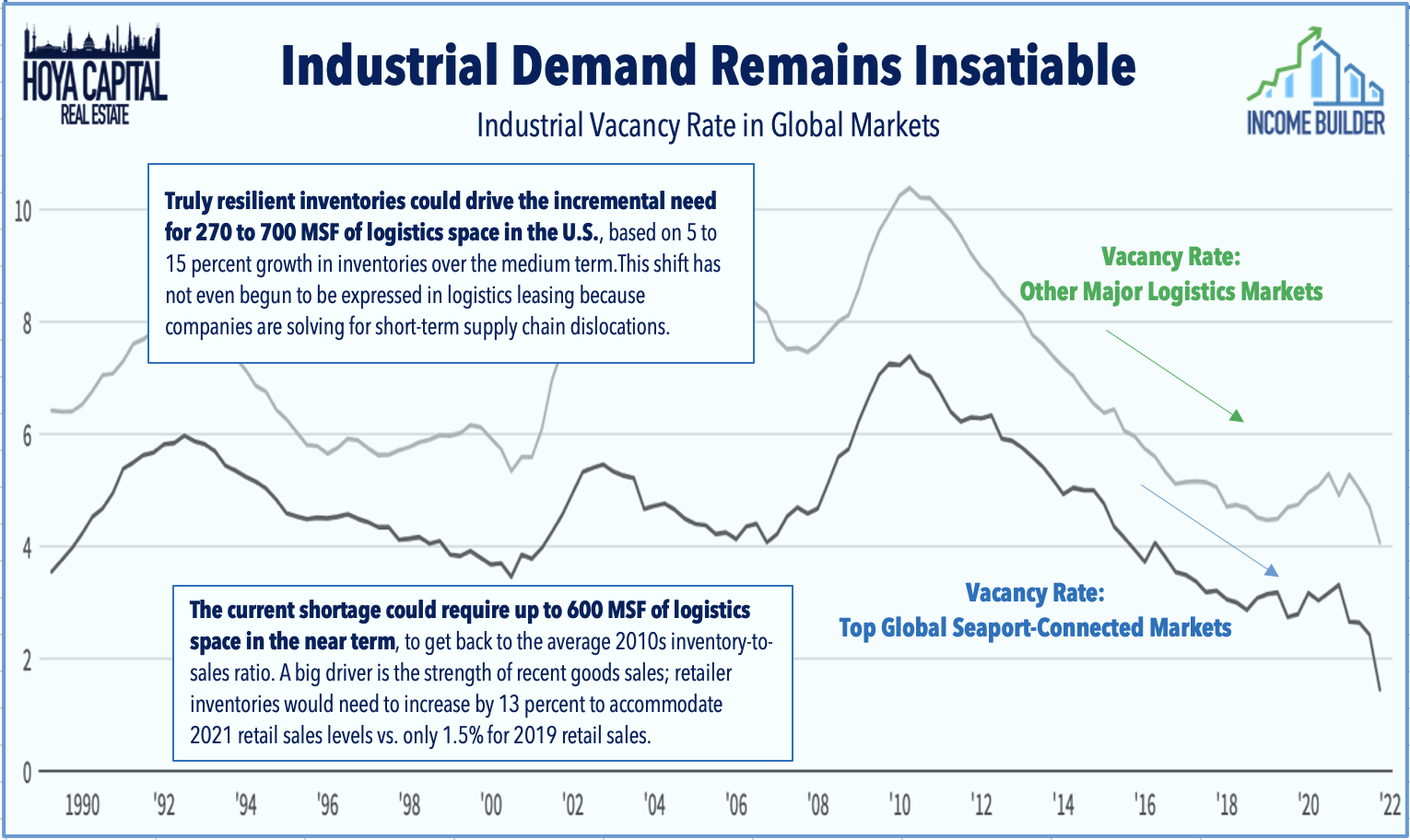

Industrial: A pair of industrial REITs provided business updates this morning. Rexford (REXR) announced that it acquired eight properties in Southern California for $270M, bringing its full-year acquisition total to $1.9B and its total portfolio to 296 properties, primarily located in its home Southern California region. LXP Industrial (LXP) launched a joint venture to which it sold a 22-property portfolio consisting primarily of manufacturing assets through a sale to a new joint venture with an affiliate of Davidson Kempner Capital Management LP. The portfolio’s total gross valuation of $550 million represents GAAP and Cash capitalization rates of 7.4% and 7.2%, respectively. LXP will retain a 20% interest in the new joint venture.

Hotels: Last Friday, we published Hotel REITs: Unfazed by Omicron. In a twist of fate, after posting dramatic gains during the vaccine development stages, hotel REITs have been the weakest-performing property sector since vaccines became widely available in late April. Encouragingly, recent TSA travel data has indicated that the Omicron effect is surprisingly muted as the domestic travel recovery has continued this holiday season after a brief pull-back in early December. Hotel occupancy - which is closely correlated with domestic airline travel - has exhibited similar resilience over the past two quarters and managed to climb back above the 20-Year average in early December for the first time since the pandemic began. In the report, we discussed our top picks in the sector and our updated outlook.

We're excited to announce the launch of our new investment research service here on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.