REIT Earnings • Yields Rise • Diplomacy Talks

- U.S. equity markets advanced Tuesday following reports of easing tensions on the Russia/Ukraine border as volatility levels have retreated this week following a stretch of wild market swings in January.

- Bouncing back from declines of 0.4% yesterday, the S&P 500 finished higher by 0.8% today while the Mid-Cap 400 rallied 1.9% and the Small-Cap 600 gained 2.0%.

- Mortgage REIT New Residential (NRZ) surged 7% after reporting stronger-than-expected results yesterday afternoon, reporting that its book value gained 1% from last quarter and provided a bright outlook for 2022.

- Simon Property (SPG) slumped 4.5% after reporting mixed results as solid results in the back half of 2021 were offset by a relatively downbeat outlook for 2022. Occupancy rates appear to have stabilized, but rental rates remain under pressure.

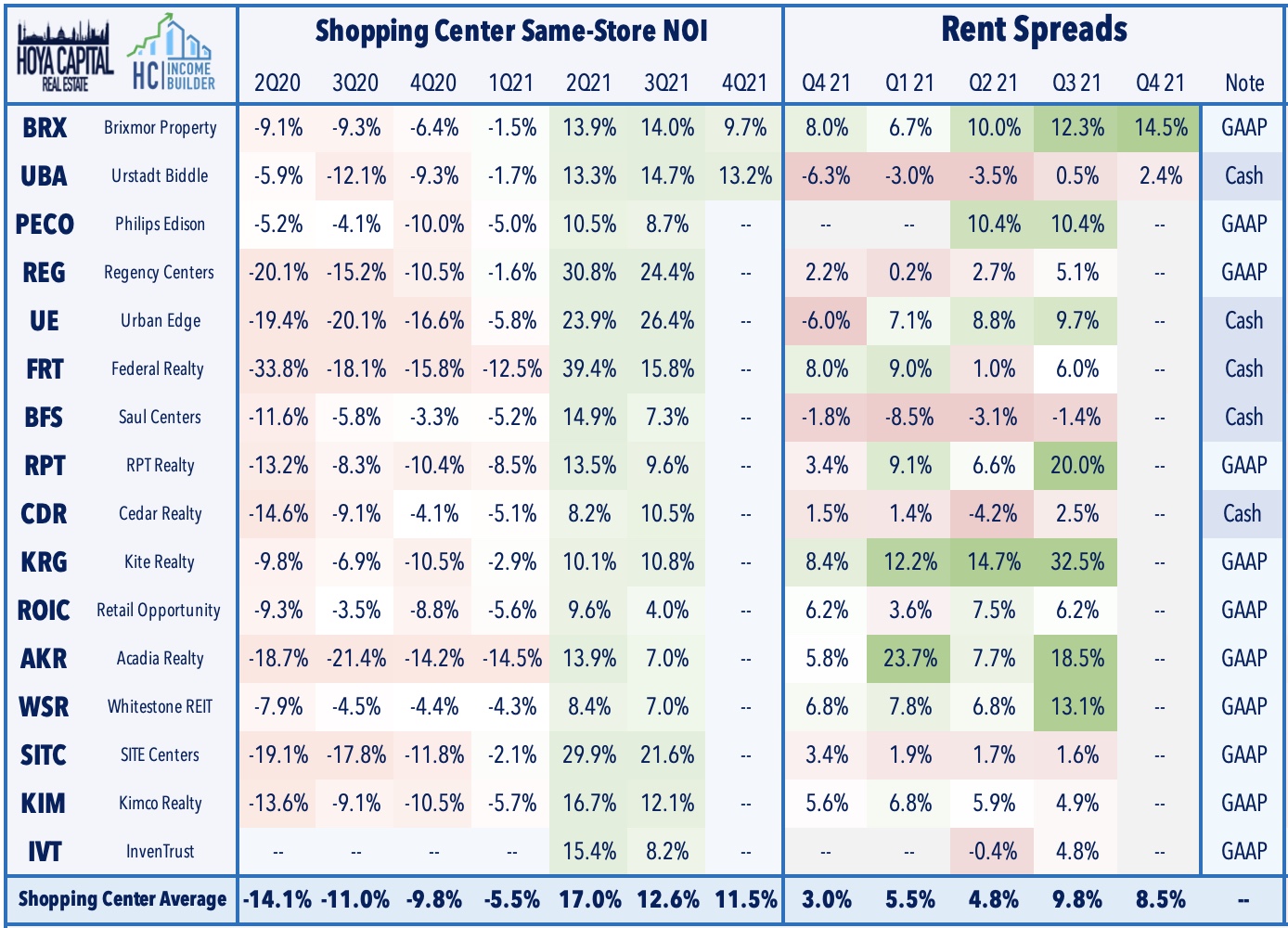

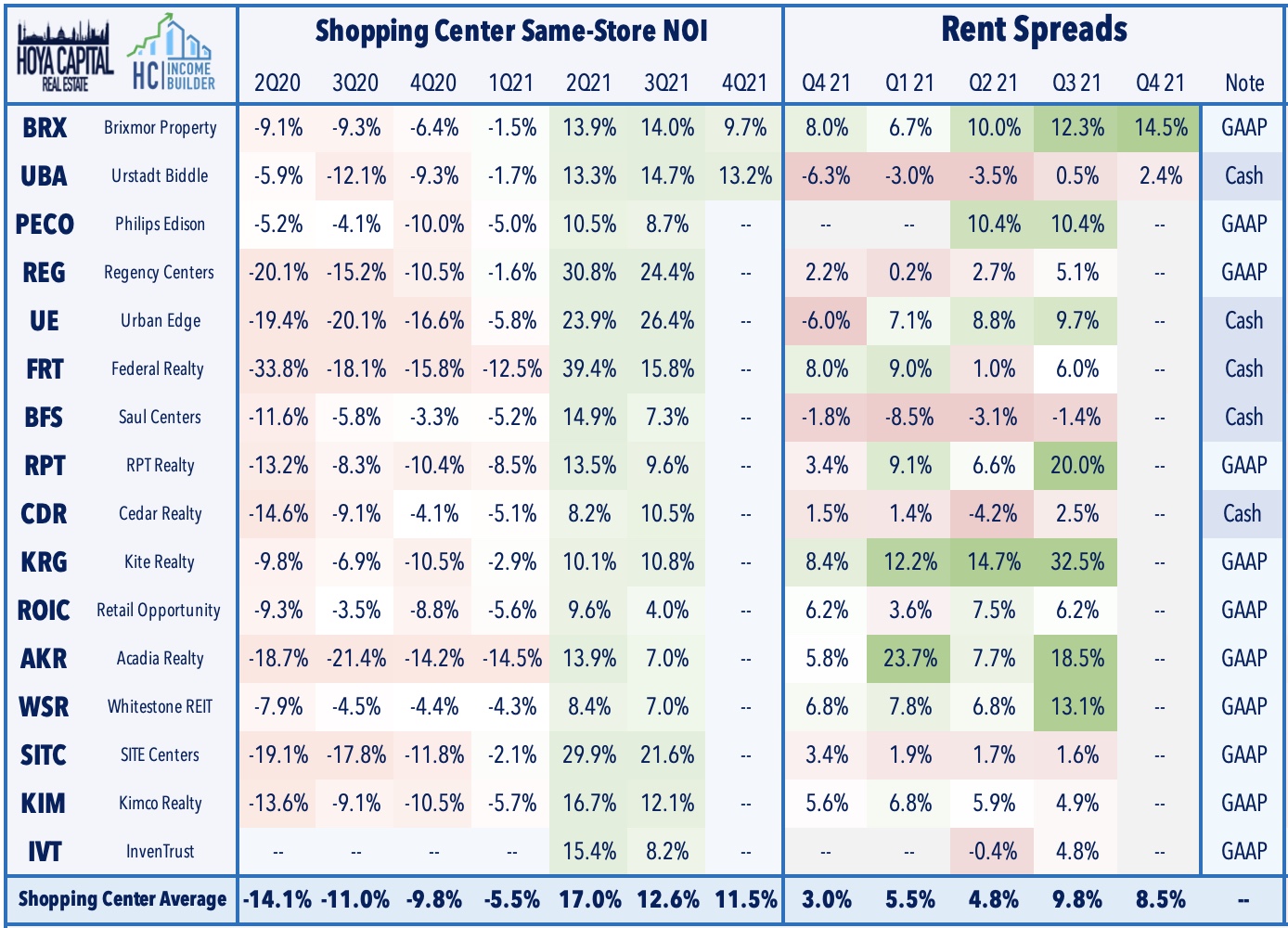

- Unlike their mall REIT peers, shopping center REITs are seeing significantly better fundamentals. Brixmor Property (BRX) gained 1.5% after it reported strong results, highlighted by 14.5% growth in releasing spreads and a continued uptick in occupancy.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets advanced Tuesday following reports of easing tensions on the Russia/Ukraine border as volatility levels have retreated this week following a stretch of wild market swings in January. Bouncing back from declines of 0.4% yesterday, the S&P 500 finished higher by 0.8% today while the Mid-Cap 400 rallied 1.9% and the Small-Cap 600 gained 2.0%. Real estate equities were mostly lower today ahead of key earnings reports this afternoon as the Equity REIT Index finished lower by 0.5% today with 8-of-19 property sectors in positive territory while the Mortgage REIT Index gained 1.0%.

Nine of the eleven GICS equity sectors were higher on the day, led to the upside by the Materials (XLB) and Consumer Discretionary (XLY) sectors. The red-hot Energy (XLE) sector lagged - as did oil and gasoline futures - on reports of successful diplomacy talks between Russia and NATO countries. The 10-Year Treasury Yield advanced 4 basis points to the highest level since late 2019. Homebuilders and the broader Hoya Capital Housing Index were among the outperformers again today following better-than-expected results from Taylor Morrison (TMHC), continuing a trend of strong earnings results across the housing sector.

Equity REIT Daily Recap

Malls: Simon Property (SPG) slumped 4.5% after reporting mixed results yesterday afternoon. Results in the back-half of 2021 were quite strong as SPG ended the year with full-year FFO growth of 31% - bringing its FFO back within 1% of its pre-pandemic level from 2019. Domestic property net operating income ("NOI") increased 22.4% year-over-year in Q4, bringing the full-growth to 12.0% - roughly 10% below pre-pandemic levels. The outlook for the year ahead was a bit disappointing as SPG sees its FFO at $11.60 at the midpoint, which would be about 3% below its 2021 level. Occupancy and rents appear to have stabilized – albeit at lower-levels than before the pandemic – with total portfolio occupancy at 93.4%, rising for the third-straight quarter but still 170 basis points below Q4 2019. We provided additional commentary and Price Target updates for Income Builder members last night.

Shopping Centers: Unlike their mall REIT peers, shopping center REITs are seeing significantly better fundamentals in the post-pandemic period as big box retailers have double-down on using their brick and mortar properties as hybrid "distribution centers" in a decentralized last-mile delivery network. Brixmor Property (BRX) gained 1.5% after it reported strong results, highlighted by 14.5% growth in releasing spreads and a continued uptick in occupancy. BRX - which reported one of the steepest declines in FFO in 2019 among its shopping center REIT peers - reported impressive full-year FFO growth of 19% in 2021 and sees another 9% growth in 2022, putting its FFO back to 2019 levels by year-end.

Homebuilders: Taylor Morrison (TMHC) advanced 1% after reporting solid results yesterday afternoon, highlighted by a continued improvement in margins and a strong outlook for 2022. TMHC recorded full-year revenue growth of 22% in 2021 and sees another strong year of 21% revenue growth in 2022 as it works through its historically large backlog of home orders. Despite rising construction costs and ongoing supply chain headwinds, homebuilders have reported a nearly 4 percentage-point increase in operating margins this quarter to the highest overall average on record.

Last week, we published REIT Earnings Preview: Dividend Hikes And 2022 Outlook. Highlights of this afternoon's earnings slate includes EastGroup (EGP), HealthPeak (PEAK), UDR (UDR), Douglas Emmett (DEI), and Highwoods (HIW). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential finished the day higher by 0.9% while commercial mREITs advanced 0.3%. New Residential (NRZ) surged 7% after reporting stronger-than-expected results yesterday afternoon, reporting that its book value gained 1% from last quarter to 11.45, commenting that it believes its “extremely well-positioned to benefit from the current rate environment given our large portfolio of MSRs and our complimentary operating businesses.” We'll hear results this afternoon from KKR Real Estate (KREF) and Apollo Commercial (ARI).

We're excited to announce the launch of our new investment research service on Seeking Alpha - Hoya Capital Income Builder. We've put together a great team of contributors from across the REIT, dividend, and ETF industry, so whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.