Storage REITs: Storage Wars Intensify

Storage REITs are the best-performing property sector this year after lagging in late 2022, lifted by surprisingly solid earnings results and a thawing of the previously icy-cold housing market.

Storage demand is driven largely by housing activity – specifically, home sales and rental market turnover - and the recent moderation in mortgage rates has eased concern of a deepening housing recession.

Despite declines in new lease rates, Storage REITs easily topped earnings expectations and provided an initial 2023 outlook calling for mid-single-digit earnings growth, buoyed by "sticky" rent growth on existing tenants.

Storage Wars Intensify: After turning down a bid from Public Storage, Life Storage agreed to be acquired by Extra Space in a $12.4B deal that will form the largest storage REIT. Following PSA's failed bid, the takeout odds have increased for both National Storage and CubeSmart.

Irrespective of potential mergers, we expect storage REITs to leverage their stellar balance sheets to scoop-up highly-levered upstarts seeking an exit. We continue to like the longer-term prospects given the 'stickiness' of demand, bulletproof balance sheets, low cap-ex needs, and impressive margin profile.

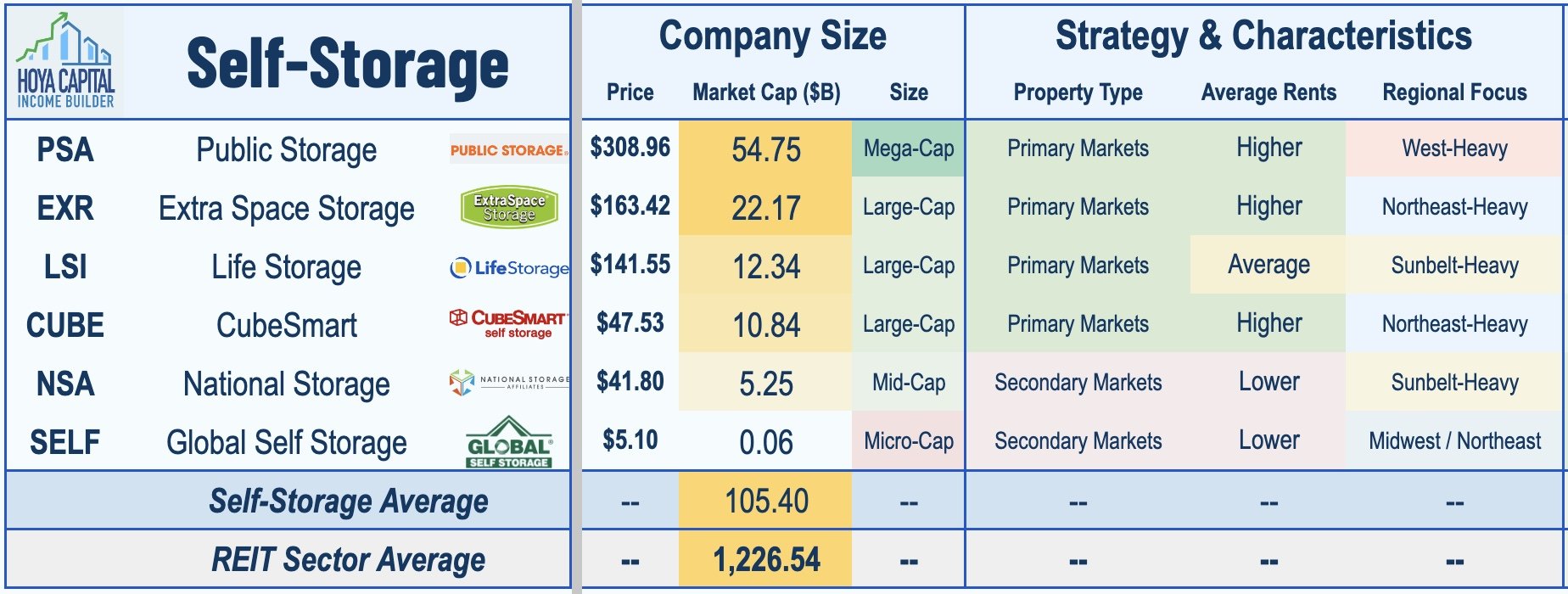

In the Hoya Capital Self-Storage REIT Index, we track the five major self-storage REITs, which account for roughly $100 billion in market value: Public Storage (PSA), Extra Space Storage (EXR), CubeSmart (CUBE), Life Storage (LSI), National Storage (NSA), along with micro-cap Global Self Storage (SELF). Revenue and expense management technology, brand value, and cost of capital have historically given these REITs a competitive advantage over private market competitors and smaller brands. The three largest REITs - Public Storage, CubeSmart, and Extra Space - operate relatively higher-rent portfolios in more primary markets, while Life Storage, National Storage, and Global Self Storage operate facilities with lower rents in secondary and tertiary markets.

There are roughly 50,000 self-storage facilities in the United States, and proximity to one's home is typically cited as the most important feature. One in ten US households rents a self-storage unit, and 70% of self-storage customers are residential while 30% are businesses. The self-storage industry remains fairly fragmented with these six REITs owning roughly 20% of the total square footage, but these REITs also provide third-party management services to another 5% of storage facilities.