Stocks Rebound • Oil Dips • Inflation Ahead

- U.S. equity markets rebounded Wednesday as oil prices pared recent historic gains after U.S. officials finally indicated public support for increased domestic production as leaders scramble to contain the economic fallout.

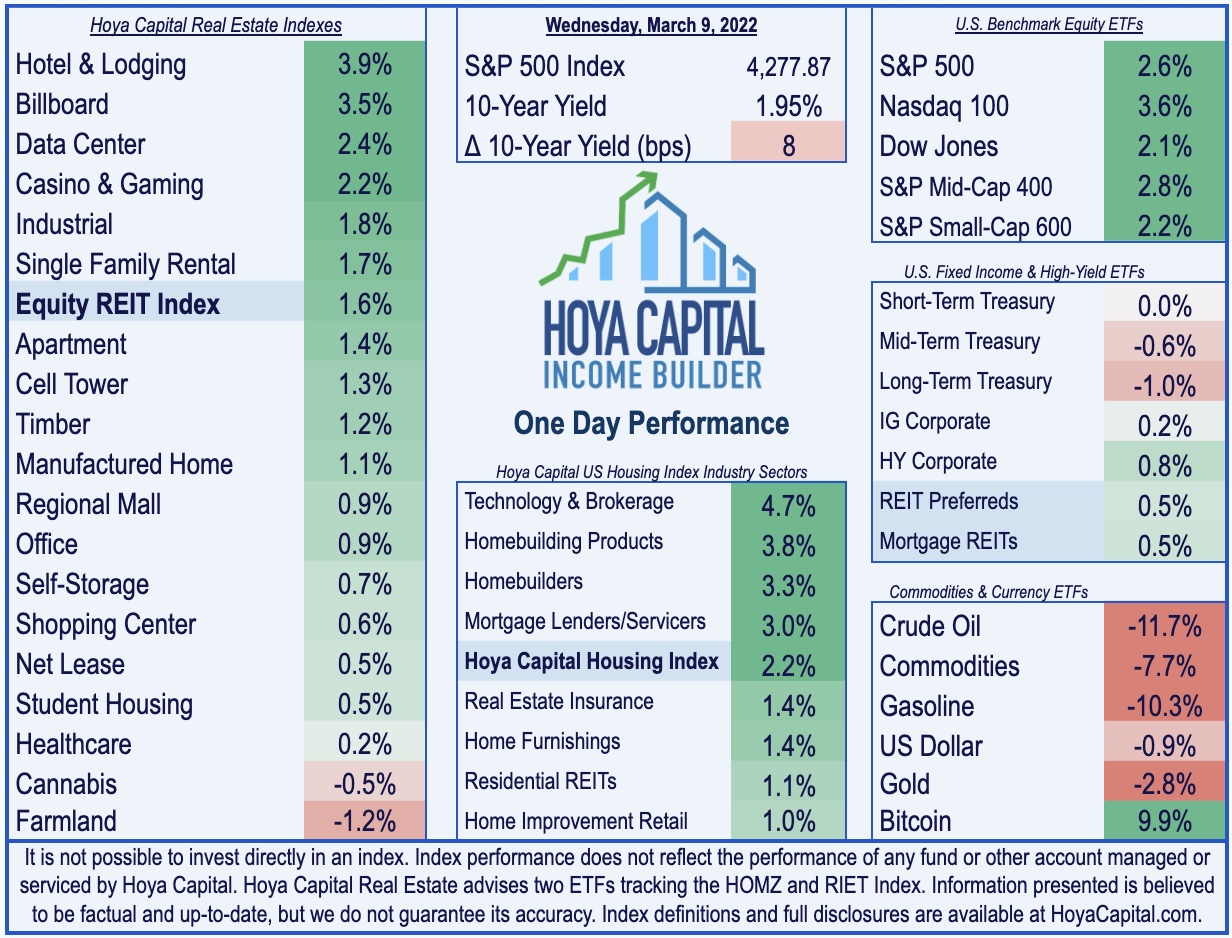

- Posting its best day of gains since June 2020 following sharp declines earlier this week, the S&P 500 rebounded 0.6% today while the tech-heavy Nasdaq 100 surged 3.6%.

- Real estate equities were also broadly-higher as the Equity REIT Index gained 1.5% today with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 0.6%.

- Economic data today was stronger-than-expected with Job Openings data showing continued labor market strength while mortgage applications surged 9% after mortgage rates dropped for the first time in 12 weeks.

- All eyes will be on the CPI inflation report, which is expected to show the highest rate of inflation since 1982 at 7.9% and soaring commodities prices in recent weeks will keep significant upward pressure on inflation metrics over the next several months.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Wednesday as oil prices pared recent historic gains after U.S. officials finally indicated public support for increased domestic production as leaders scramble to contain the economic and political fallout. Posting its best day of gains since June 2020 following sharp declines earlier this week, the S&P 500 rebounded 2.6% today while the tech-heavy Nasdaq 100 surged 3.6%. Real estate equities were also broadly-higher as the Equity REIT Index gained 1.5% today with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 0.6%.

Indications of warming political support for increased U.S. oil production sent energy prices to their worst day in nearly two years as Gasoline (XB1:COM) futures dipped 10% today while WTI Crude Oil (CL1:COM) prices pulled back 11%. Ahead of the closely-watched CPI inflation report tomorrow morning, economic data today was stronger-than-expected with Job Openings data showing continued labor market strength while Homebuilders and the broader Hoya Capital Housing Index posted strong gains after mortgage applications surged 9% after mortgage rates dropped for the first time in 12 weeks. The 10-Year Treasury Yield climbed 8 basis points today but remains well below its mid-February highs of 2.05%.

Real Estate Daily Recap

It was a quiet day of REIT-related newsflow, but today we published Industrial REITs: Supply Chains At Breaking Point. On the front-lines of the historic supply-chain shortages, Industrial REITs outperformed the broad-based REIT Index for the sixth consecutive year in 2021, but have uncharacteristically lagged in early 2022. Industrial vacancy rates declined to record-lows below 4% despite robust levels of new development, driving rent growth of nearly 20% in North America with some markets seeing 50% year-over-year increases. Industrial REITs are never "cheap" but much like the residential sector, supply-demand fundamentals are likely to remain favorable into the late 2020s.

We also published Shopping Center REITs: Outlook Remains Upbeat as an exclusive report for Income Builder members. Unlike their mall REIT peers, Shopping Center REITs entered 2022 with fundamentals that are as strong - or possibly even stronger - than before the pandemic with a full recovery completed. Occupancy rate trends and leasing spreads have been especially impressive with rents rising by double-digit rates in Q4, indicating clear signs of pricing power for the first time since the mid-2010s. Shopping Center REIT valuations were becoming rich in late-2021, but the combination of Omicron and the Russia conflict have pulled valuations of several higher-quality REITs back toward "bargain" territory. We discussed our favorite names in the sector in the report.

Earlier this week, we published our State of the REIT Nation. The "REIT Recovery" from the pandemic is essentially complete as FFO levels are back to pre-pandemic levels. Dividend payouts have lagged, however, setting the stage for significant growth in 2022. While REITs have pulled back into "cheap" territory in early 2022, REITs benefited from premium valuations over the past year which helped to jump-start external growth and awaken animal spirits. We highlighted how REIT balance sheets look far more like a typical operating company than the highly leveraged holding companies of yesteryear, which served them well during the pandemic-related volatility and should be a cushion to buffer the impact from the geopolitical issues in early 2022.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, residential mREITs rallied 1.2% today while commercial mREITs finished higher by 0.3%. Great Ajax (AJX) continued its strong week with gains of another 4.1% today after announcing an 8% dividend hike yesterday morning. We'll hear results from cannabis REIT AFC Gamma (AFCG) on Thursday. The average residential mREIT pays a dividend yield of 11.13% while the average commercial mREIT pays a dividend yield of 7.59%.

Economic Data This Week

The economic calendar slows down a bit in the week ahead with the major report of the week coming on Thursday when the BLS will report the Consumer Price Index for February which is expected to show the highest rate of inflation since 1982 at 7.9%. While most economists expected the inflation rate to peak in early 2022, soaring commodities prices in recent weeks amid the Russian invasion of Ukraine - which together are major global suppliers of oil, gas, wheat, iron, and fertilizer - will keep significant upward pressure on inflation metrics over the next several months. We'll also be watching Michigan Consumer Sentiment data on Friday which sunk to the lowest level in ten years in February amid intensifying concerns over inflation.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.