Stocks Slide • Manufacturing Recession • Hotel Updates

U.S. equity markets slumped Friday- posting their worst week since March- as central bank officials in the U.S. and Europe reiterated their stance that further monetary tightening is necessary.

Declining in four of the past five trading sessions, the S&P 500 slipped 0.8% today, dragging its weekly declines to roughly 1.5%. The Mid-Cap 400 posted steeper declines.

Real estate equities were laggards today- and for the week- as benchmark interest rates hovered around three-month highs. The Equity REIT Index slipped 1.4% today and 4% this week.

Pebblebrook Hotels (PEB) finished lower by about 1% today after it provided a business update in which it noted that it expects Revenue Per Available Room ("RevPAR") for the second quarter to fall "slightly below expectations."

On Thursday, mortgage REIT Two Harbors (TWO) trimmed its dividend yield by 25% to $0.45/share, becoming the 21st REIT to lower its dividend this year. 58 REITs have raised their dividends this year.

Income Builder Daily Recap

U.S. equity markets slumped Friday - posting their worst week since March - as central bank officials in the U.S. and globally reiterated their stance that further monetary tightening is necessary to contain inflation. Declining in four of the past five trading sessions, the S&P 500 slipped 0.8% today, dragging its weekly declines to roughly 1.5%. The Mid-Cap 400 posted steeper declines of 1.2% today and 2.5% for the week. The Dow slipped 219 points. Real estate equities were laggards today - and for the week - as benchmark interest rates hovered around three-month highs. The Equity REIT Index slipped 1.4% today with 14-of-18 property sectors in negative territory, while the Mortgage REIT Index slumped 2.0%. Homebuilders remained a bright spot, however, continuing their impressive rebound this year following a strong slate of housing data and homebuilder earnings results throughout the week.

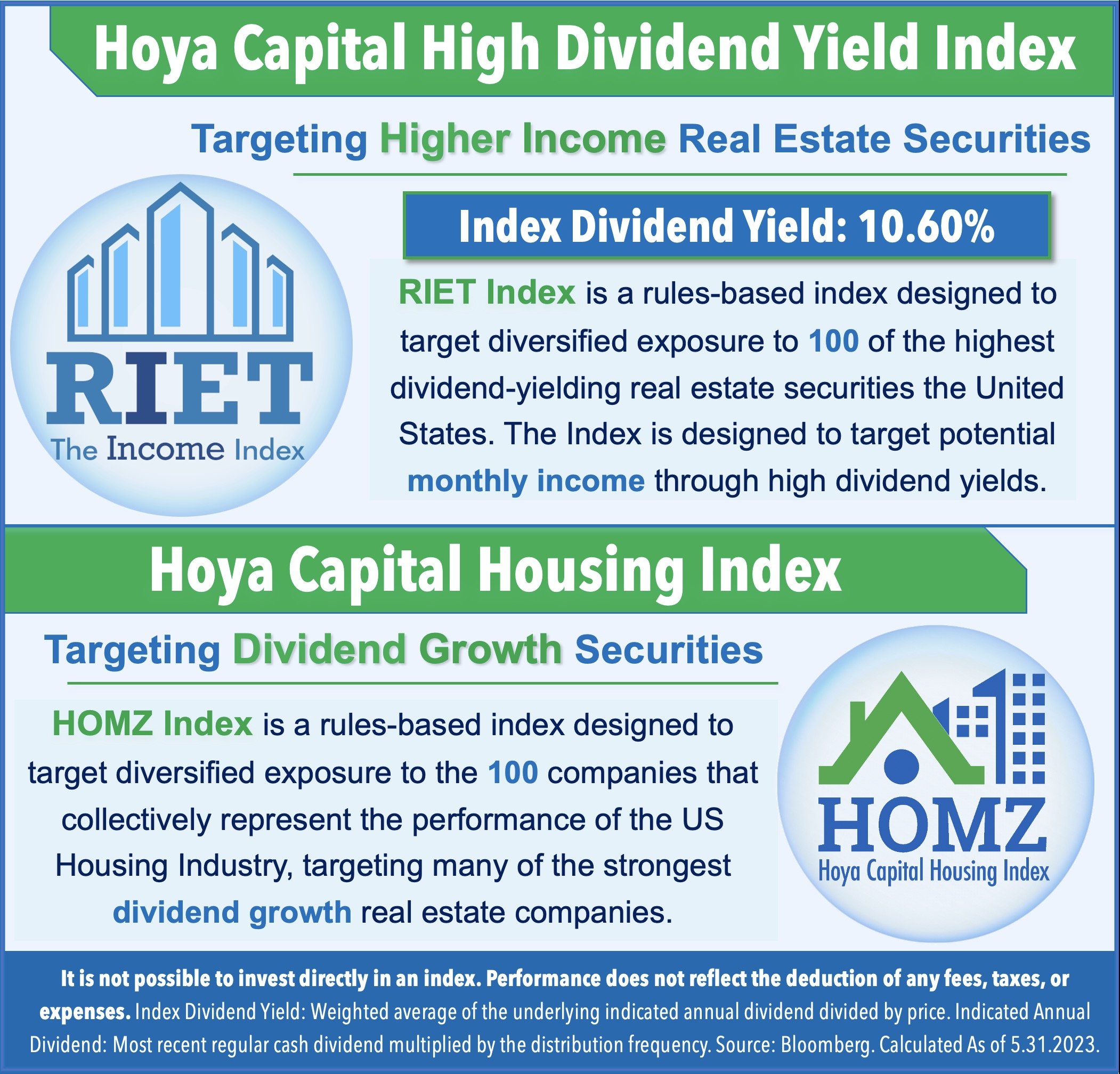

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds ("ETFs") listed on the NYSE. In addition to any long positions listed, Hoya Capital is long all components in the Hoya Capital Housing Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.