Stocks Slide • S&P Rebalance • REIT Dividends

- U.S. equity markets were under-pressure Monday after solid economic data in the U.S. and reports that China plans to ease COVID lockdowns raised questions over the Fed's ability to pivot.

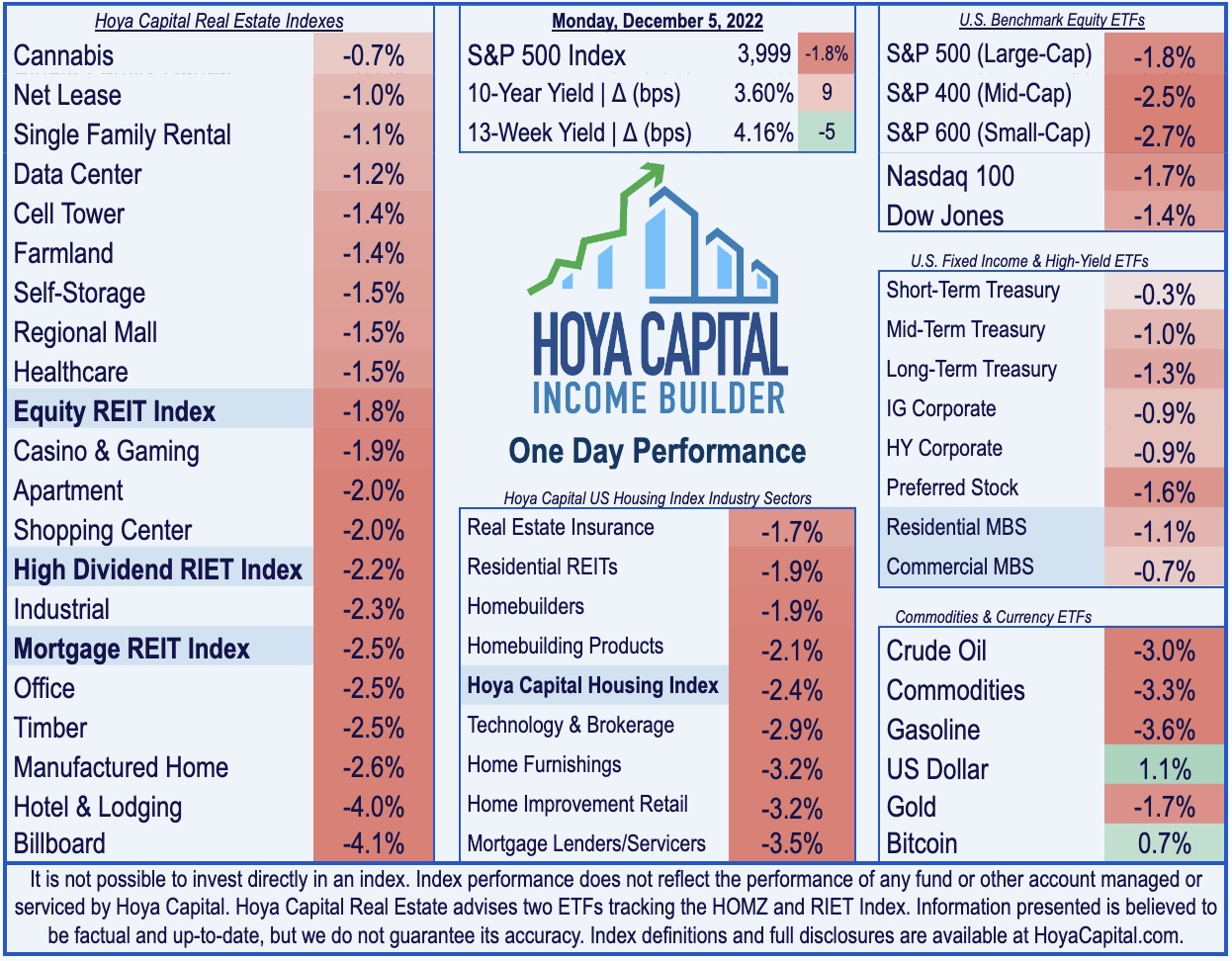

- After climbing to two-month highs last week with its fourth weekly-gain in seven weeks, the S&P 500 declined 1.8% today while the Mid-Cap 400 and Small-Cap 600 each slid by over 2.5%.

- Real estate equities were broadly lower as well today with the Equity REIT Index declining 1.8% today with all 18 property sectors in negative territory while Mortgage REITs declined 2.5%.

- CubeSmart (CUBE) - which we own in the REIT Dividend Growth Portfolio - was among the leaders today after S&P announced that it will be added to the S&P MidCap 400 prior to the open on Monday, December 19th.

- Timber REIT Potlatch (PCH) and lab space operator Alexandria (ARE) raised their quarterly dividends - two of 120 REITs to raise their dividends this year. Office REIT SL Green (SLG) reduced its payout - one of just three equity REITs to lower its dividends in 2022.

Income Builder Daily Recap

U.S. equity markets were under-pressure Monday after solid economic data in the U.S. and reports that China plans to ease some COVID lockdown measures raised questions over the Fed's ability to pivot from its aggressive pace of monetary tightening. After climbing to two-month highs last week with its fourth weekly gain in seven weeks, the S&P 500 declined 1.8% today while the Mid-Cap 400 and Small-Cap 600 each slid by over 2.5%. The 10-Year Treasury Yield closed back above 3.60% today after sliding to its lowest levels since late September last week. Real estate equities were broadly lower as well today with the Equity REIT Index declining 1.8% today with all 18 property sectors in negative territory while the Mortgage REIT Index declined 2.5% and Homebuilders slipped 1.9%.

The economic calendar slows down a bit in the week ahead, headlined by the Producer Price Index on Friday which investors - and the Fed - are hoping to show that the fastest pace of year-over-year increases is finally behind us. The headline PPI is expected to moderate to a 7.2% year-over-year rate while the Core PPI is expected to decelerate slightly to 5.9%. On Friday, we'll also get our first look at Michigan Consumer Sentiment for December. The Fed is particularly interested in the 5-Year Inflation Expectations survey, looking for signs of a potential "wage-price inflation spiral" through elevated consumer wage expectations. We'll also see a handful of Purchasing Managers Index ("PMI") reports throughout the week from S&P Global and the Institute for Supply Management. Both of these major surveys posted readings below the breakeven-50 level in their preliminary November data.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Storage & Healthcare:: CubeSmart (CUBE) - which we own in the REIT Dividend Growth Portfolio - was among the leaders today after S&P announced that it will be added to the S&P MidCap 400 prior to the open on Monday, December 19th. All five major storage REITs are now included in an S&P index with Public Storage (PSA) and ExtraSpace (EXR) included in the S&P 500 while Life Storage (LSI) and National Storage (NSA) are included in the S&P 400. Healthcare REIT Diversified Healthcare (DHC) slid 15%, however, after S&P announced that it will be removed from the S&P SmallCap 600.

A pair of REITs announced dividend hikes while one REIT reduced its payout. Timber REIT Potlatch (PCH) hiked its regular quarterly dividend last Friday afternoon by 2.3% to $0.45/share while also announcing a $0.95 special dividend. Lab space operator Alexandria Real Estate (ARE) hiked its quarterly dividend for a second time this year, boosting its payout by 2.5% to $1.21/share - one of 120 REIT dividend hikes this year. Office REIT SL Green (SLG) slid 6% today after becoming just the third equity REIT to reduce its dividend. SLG trimmed its monthly dividend by 13% to "match our current projection of Funds Available for Distribution (“FAD”) for 2023, which allows us to strike this balance as we continue to provide a yield on our common stock of approximately 8.0% while projecting an increase in liquidity to nearly $1.6 billion and a reduction of combined debt by almost $2.4 billion during 2023.”

Casino: VICI Properties (VICI) announced that it will provide $52M in capital for an expansion project at Century Casino Caruthersville. Upon completion of the improvements, the annual rent under the master lease with Century will increase by approximately $4.2M. Last week, VICI announced that it reached a $5.5B deal to acquire the remaining 49.9% share in the MGM Grand Las Vegas and the Mandalay Bay Resort from Blackstone (BX), giving VICI full ownership of the properties. Under the terms of the deal, Blackstone will receive $1.27B in cash while VICI will assume the private equity firm's share of roughly $3B in debt. VICI intends to fund the deal with cash on hand and proceeds from existing forward equity sale agreements. The transaction - which has an implied cap rate of 5.6% - is expected to be immediately accretive to AFFO/share and will generate annual rent of $310M next year and escalate at a fixed 2.0% rate through 2035 and up to 3.0% thereafter.

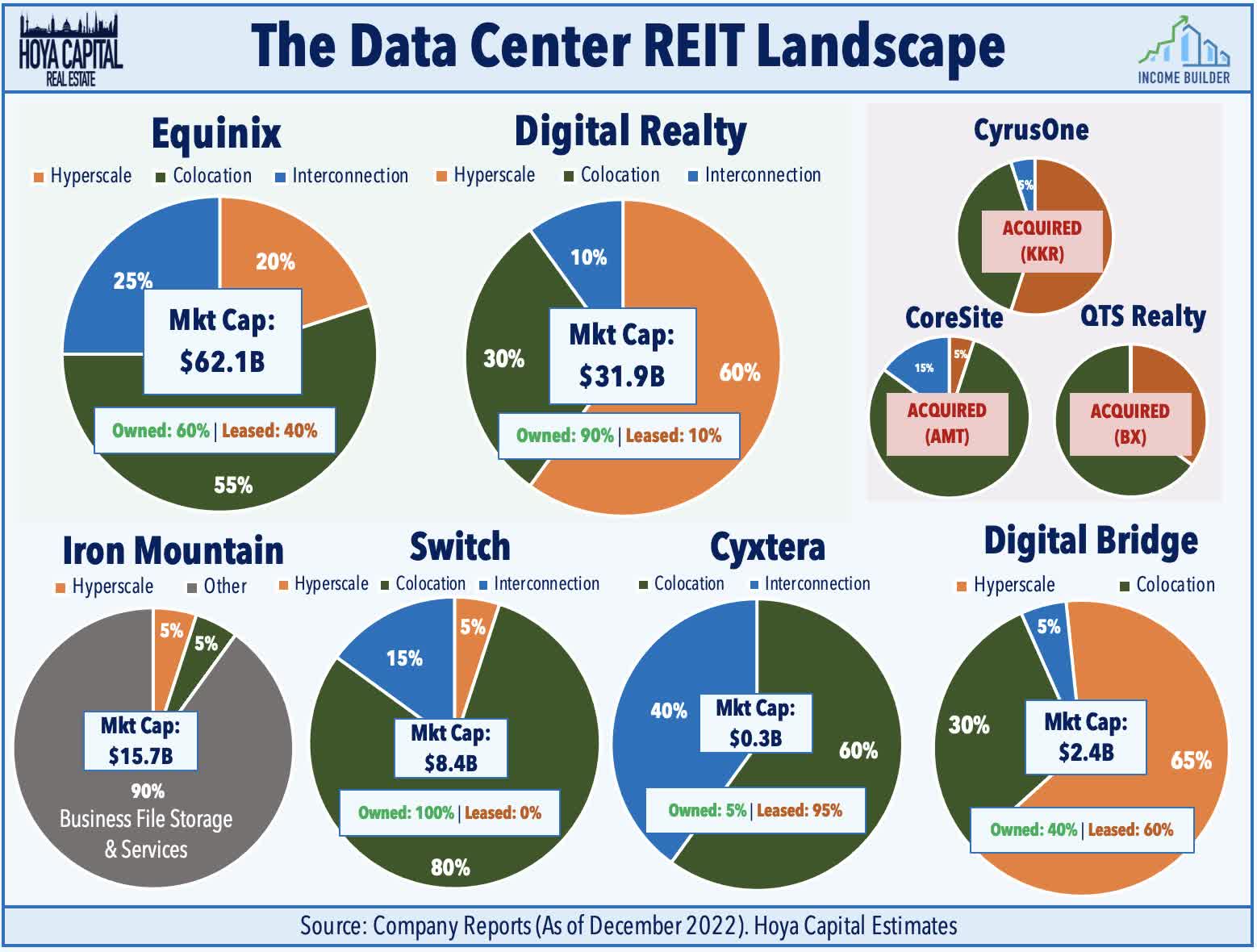

Data Center: Today we published Data Center REITs: Patience Pays Off. Data Center REITs have been one of the best-performing property sectors over the past quarter as property-level fundamentals have strengthened despite an expected downshift in cloud-related spending. Ironically, just as Data Center REITs became a trendy “short” idea centered on a thesis of weak pricing power and competition from hyperscalers, rental rate trends have meaningfully improved. Competition from the hyperscale giants– Amazon, Microsoft, Google– has been a well-established risk. With negotiating power tilting back towards landlords, there appears to be enough economic value to be shared. Equinix and Digital Realty were notably quiet on the acquisition front amid the frenzy of M&A activity during the pandemic. Their patience appears to be quite prudent in hindsight, positioning them to be aggressors as other more-highly-levered private players seek an exit. Some potential private equity firms to watch as potential sellers include Blackstone (BX) - which acquired QTS Realty last year - along with KKR (KKR) which acquired CyrusOne (CONE).

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were also broadly lower today with residential mREITs slipping 2.4% while commercial mREITs declined 2.1%. Last week, we published Mortgage REITs: High Yields Are Fine, For Now. Mortgage REITs - which were left for dead amid a historically brutal year across fixed-income markets - have rebounded in recent weeks as earnings results were not as catastrophic as feared. Mortgage REITs are now outperforming Equity REITs for the year, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.