Stocks Slump • Pot Problems • Redemption Rush

- U.S. equity markets declined for a third-straight session Thursday as investors parsed a downbeat slate of earnings reports alongside another round of hawkish Fed rhetoric and lukewarm economic data.

- Extending its week-to-date decline to 2.5%, the S&P 500 slipped 1.6% today while the tech-heavy Nasdaq 100 fell 1.0%. The 10-Year Treasury Yield remained near three-month lows at 3.40%.

- Real estate equities were among the better-performers with the Equity REIT Index posting declines of 0.5% with 3-of-18 property sectors in positive territory while the Mortgage REIT Index slipped 0.6%.

- Innovative Industrial (IIPR) slumped after reporting worsening rent collection issues as its cannabis cultivators - particularly smaller private single-state operators - continue to struggle with headwinds from lower pot prices and challenging financing conditions.

- Office REIT Vornado Realty (VNO) dipped 4% after it reduced its quarterly dividend by 29%. Asset manager KKR (KKR) announced that it would limit redemptions out of its private real estate fund after it saw requests for redemptions exceed its quarterly limit.

Income Builder Daily Recap

U.S. equity markets declined for a third-straight session Thursday as investors parsed a downbeat slate of earnings reports alongside another round of hawkish Fed rhetoric and lukewarm economic data. Extending its week-to-date decline to 2.5%, the S&P 500 slipped 1.6% today while the tech-heavy Nasdaq 100 fell 1.0%. The 10-Year Treasury Yield remained near three-month lows at 3.40%. Real estate equities were among the better-performers with the Equity REIT Index posting declines of 0.5% with 3-of-18 property sectors in positive territory while the Mortgage REIT Index slipped 0.6%.

Ahead of the start of their "quiet period" on Friday, Fed Governor Brainard echoed hawkish commentary from Fed officials earlier this week, reiterating that policy rates will "need to be sufficiently restrictive for some time" to tame inflation. While inflation data has exhibited an encouraging cooling trend amid a deepening demand slowdown, labor markets have remained seemingly unshakable, underscored by data this morning showing that Initial Jobless Claims slid to the lowest levels since September. Three of the eleven GICS equity sectors finished higher today with Energy (XLE) stocks leading to the upside as Crude Oil prices closed at the highest levels since early December.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Cannabis: Innovative Industrial (IIPR) slumped more than 15% after reporting worsening rent collection issues as its cannabis cultivators - particularly smaller private single-state operators - continue to struggle with headwinds from lower pot prices and challenging financing conditions. IIPR reported collection issues or deferrals with four additional tenants - Green Peak, Holistic, Calyx Peak, and Sozo Health - in addition to three tenants that it had previously reported having collection issues and/or rent renegotiations - Parallel, Kings Garden, and Vertical. None of the seven tenants are publicly-traded companies - which represent 55% of IIPR's portfolio. IIPR failed to collect 8% of its January rents due to partial defaults from Parallel (2.9%) and Green Peak (2.7%), a full default from Vertical (0.7%), and a deferral granted to Calyx Peak (1.2%). IIPR applied securities deposits from Sozo, Kings Garden, and Holistic over the course of December and January. IIPR noted that its balance sheet remained well-capitalized with a roughly 12% Debt Ratio with no major debt maturities until May 2026.

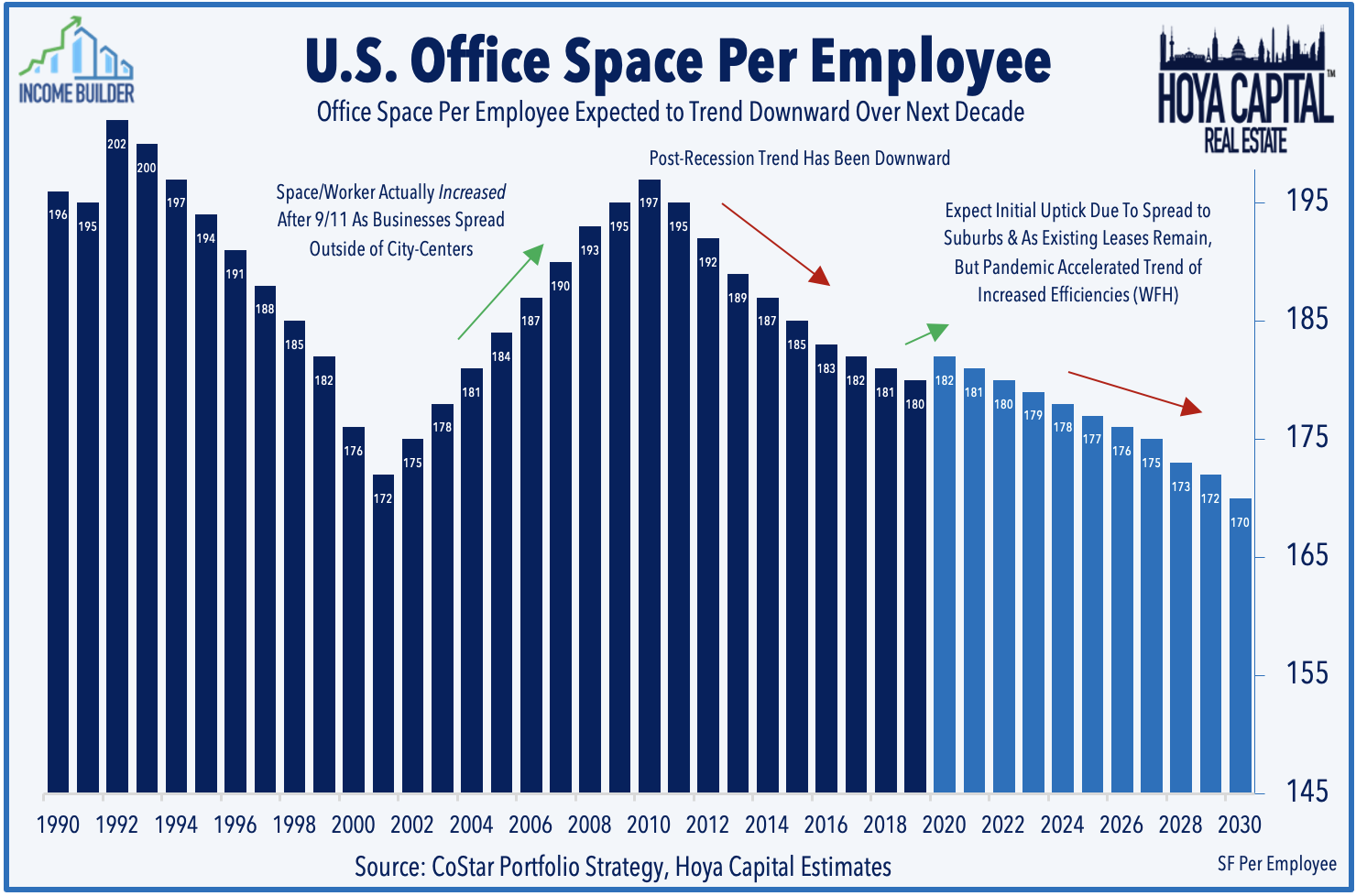

Office: Vornado Realty Trust (VNO) dipped 4% after it reduced its quarterly dividend by 29% citing "the current state of the economy and capital markets" and reflective of its "reduced projected 2023 taxable income, primarily due to higher interest expense." Vornado becomes the third office REIT to reduce its dividend in the past month with SL Green (SLG) and Douglas Emmett (DEI) reducing their payouts in December amid mounting questions about post-pandemic office demand. Utilization rates and space per employee were on a downward decline even before the pandemic, and there's mounting evidence that the pandemic simply accelerated the pre-existing trends of increased use of remote work arrangements. We expect a 15-20% decline in office space per employee by the end of 2030 as many corporate tenants in low-utilization markets significantly reduce their footprint in these regions and adopt more formalized "hybrid" work dynamics.

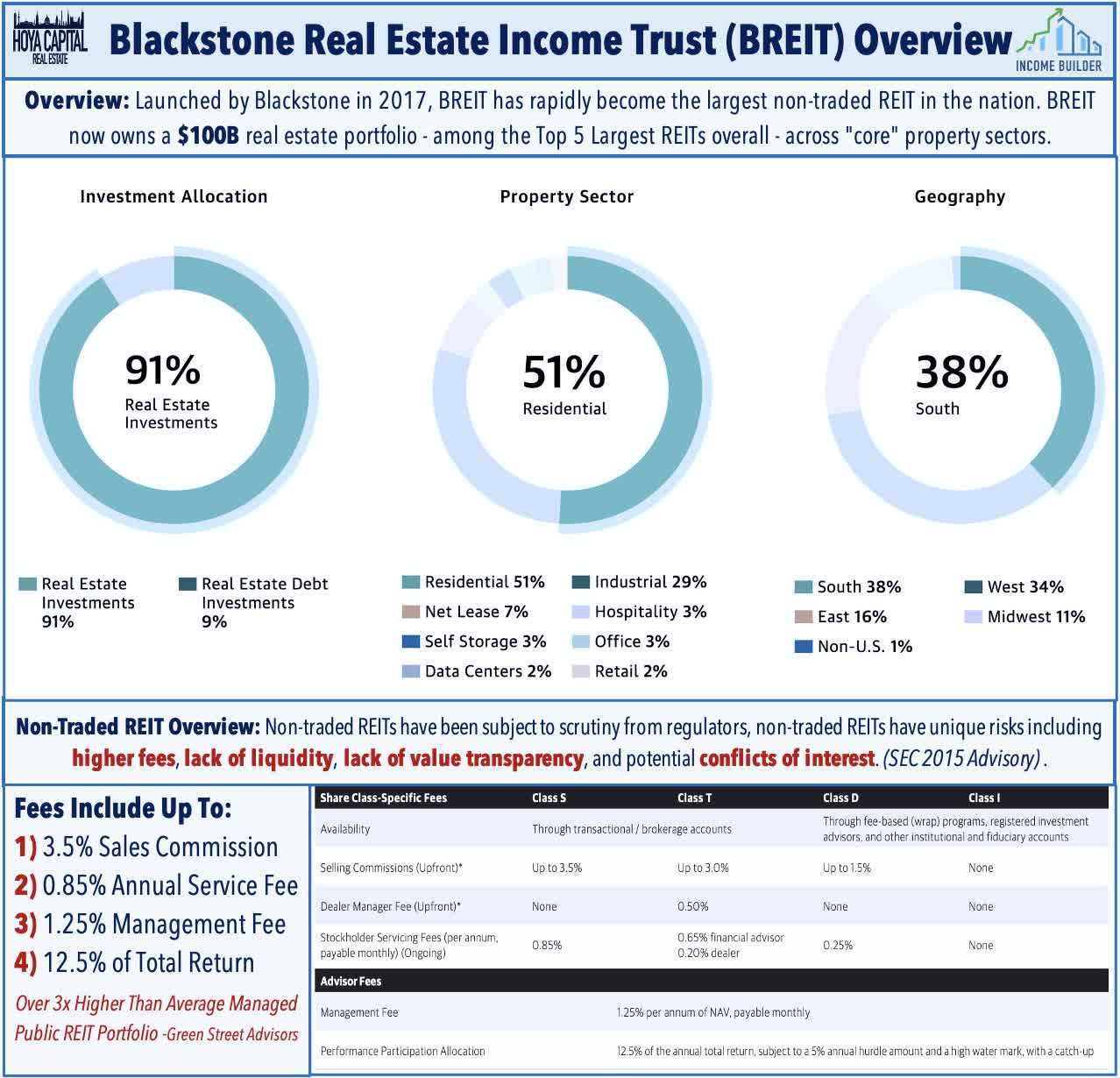

Apartments: Veris Residential (VRE) dipped 4% after it announced after the close yesterday that it will not proceed with a proposed takeover offer from Kushner Companies to buy the REIT at $18.50/share. Veris Residential said that in this instance they are left to conclude that Kushner Companies is "either not serious about consummating a transaction with the company or lacks the financing to execute a transaction with certainty" and it was now left with no choice other than to cease further discussions. Nareit published a report today which recapped the busy year of M&A activity across the REIT sector in 2022. Total REIT merger and acquisition (M&A) activity came to $83.0 billion in 2022, the second-highest annual figure since 2007, with transactions taking place across a range of property sectors. Total public-to-public REIT M&A in 2022 was $69.2 billion - comprising 83% of total REIT M&A activity - with the remaining 17% representing public-to-private deals. Blackstone (BX) was also a major player with deals that included the purchase of four public REITs for its privately-traded BREIT platform.

Speaking of non-traded REITs, another asset manager - KKR (KKR) dipped 5% after it announced that it would limit redemptions out of its private real estate fund after it saw requests for redemptions exceed its quarterly limit of 5% of net asset value. KKR Real Estate Select Trust (KREST) - a privately-traded REIT - reported in a filing that it received requests to repurchase 8.1% of its net asset value, exceeding the 5% quarterly limit. The trust fulfilled 62% of each shareholder’s request. The redemption limit comes after similar moves from Blackstone and Starwood, moves that spurred queries by the US Securities and Exchange Commission. All three asset managers have faced questions over the self-reported NAV valuations which claimed positive NAV returns in 2022 despite the worst year for publicly-traded REITs since 2008. Non-traded REITs have long been the subject of scrutiny from regulators due to their high fee structure, lack of liquidity, and potential conflicts of interest.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were also mostly-lower today with residential mREITs slipping 0.3% while commercial mREITs declined 0.9%. On a quiet day of mREIT newsflow, NexPoint Real Estate (NREF) and Orchid Island (ORC) led the gains to the upside while Hannon Armstrong (HASI) was the laggard. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

Economic Data This Week

The busy week of economic data concludes on Friday with Existing Home Sales data, which is expected to dip to a 4 million-unit annualized rate for the first time since August 2010 - which is currently the only month in the past quarter century with a sales rate below 4 million. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.