Strong Housing Data • Oil Rebounds • REIT Dividends

- U.S. equity markets advanced for the third-straight day Thursday in another choppy session as strong housing and employment data in the U.S. eased some concerns over global stagflation.

- Pushing its week-to-date gains to roughly 5%, the S&P 500 advanced another 1.2% today while the tech-heavy Nasdaq 100 also gained 1.2%, pushing its weekly gains to over 6%.

- Real estate equities were also broadly higher once again today with the Equity REIT Index gaining 1.4% with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 0.2%.

- New home construction in the U.S. rebounded in February to the strongest pace since 2006, according to Housing Starts data this morning released by the Census Bureau, indicating continued resilient momentum behind the critical U.S. housing market.

- Lennar (LEN) advanced 1% today after reporting strong first-quarter results and boosted its full-year guidance for both deliveries and gross margins, commenting that the housing industry "continues to exhibit strong demand, outweighing supply."

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets advanced for the third-straight day Thursday in another choppy session as strong housing and employment data in the U.S. eased some concerns over global stagflation. Pushing its week-to-date gains to roughly 5%, the S&P 500 advanced another 1.2% today while the tech-heavy Nasdaq 100 also gained 1.2%, pushing its weekly gains to over 6%. Real estate equities were also broadly higher once again today with the Equity REIT Index gaining 1.4% with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 0.2%.

Energy prices rebounded sharply today after a precipitous decline in the prior two days with WTI Crude Oil (CL1:COM) soaring nearly 9% to close back above $103/barrel as investors weigh the effects of slowing growth and COVID lockdowns in China against the supply shortages from the ongoing Russia/Ukraine conflict. The 10-Year Treasury Yield remained at its highest level since late 2019 as traders digested yesterday's updated FOMC projections. All eleven GICS equity sectors were higher today led by the Energy (XLE) sector while homebuilders and the broader Hoya Capital Housing Index posted solid gains following strong earnings results from Lennar (LEN).

New home construction in the U.S. rebounded in February to the strongest pace since 2006, according to Housing Starts data this morning released by the Census Bureau, indicating continued resilient momentum behind the critical U.S. housing market. Starts increased 6.8% last month to a 1.77 million annualized rate, above consensus estimates of 1.70M. Building Permits eased to an annualized 1.86 million units from an upwardly-revised January, but remained near the strongest rate in more than ten years. Single-family starts advanced 5.7% in February to an annualized pace of 1.22M units. Multifamily starts advanced to 554k the strongest pace since January 2020.

Real Estate Daily Recap

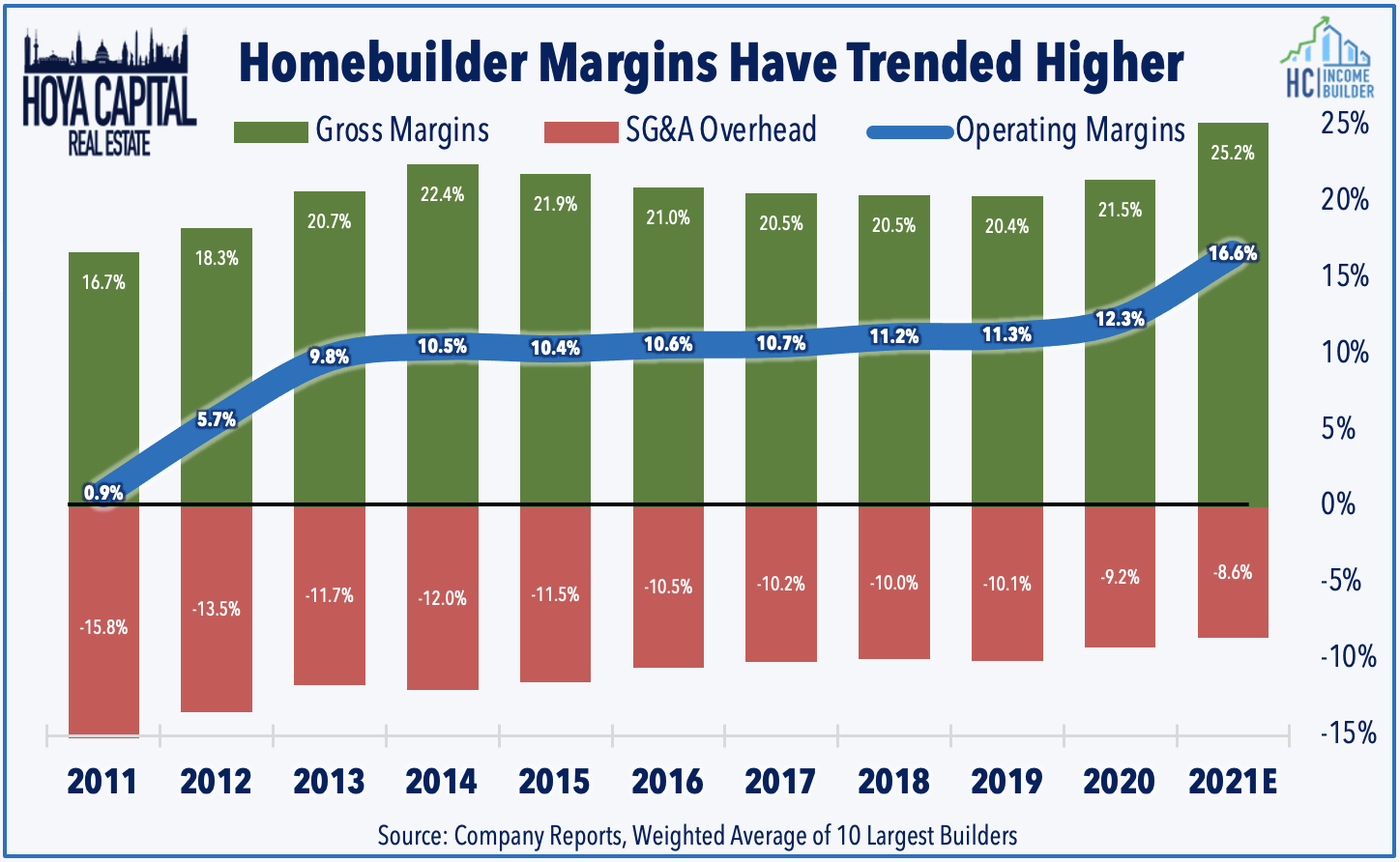

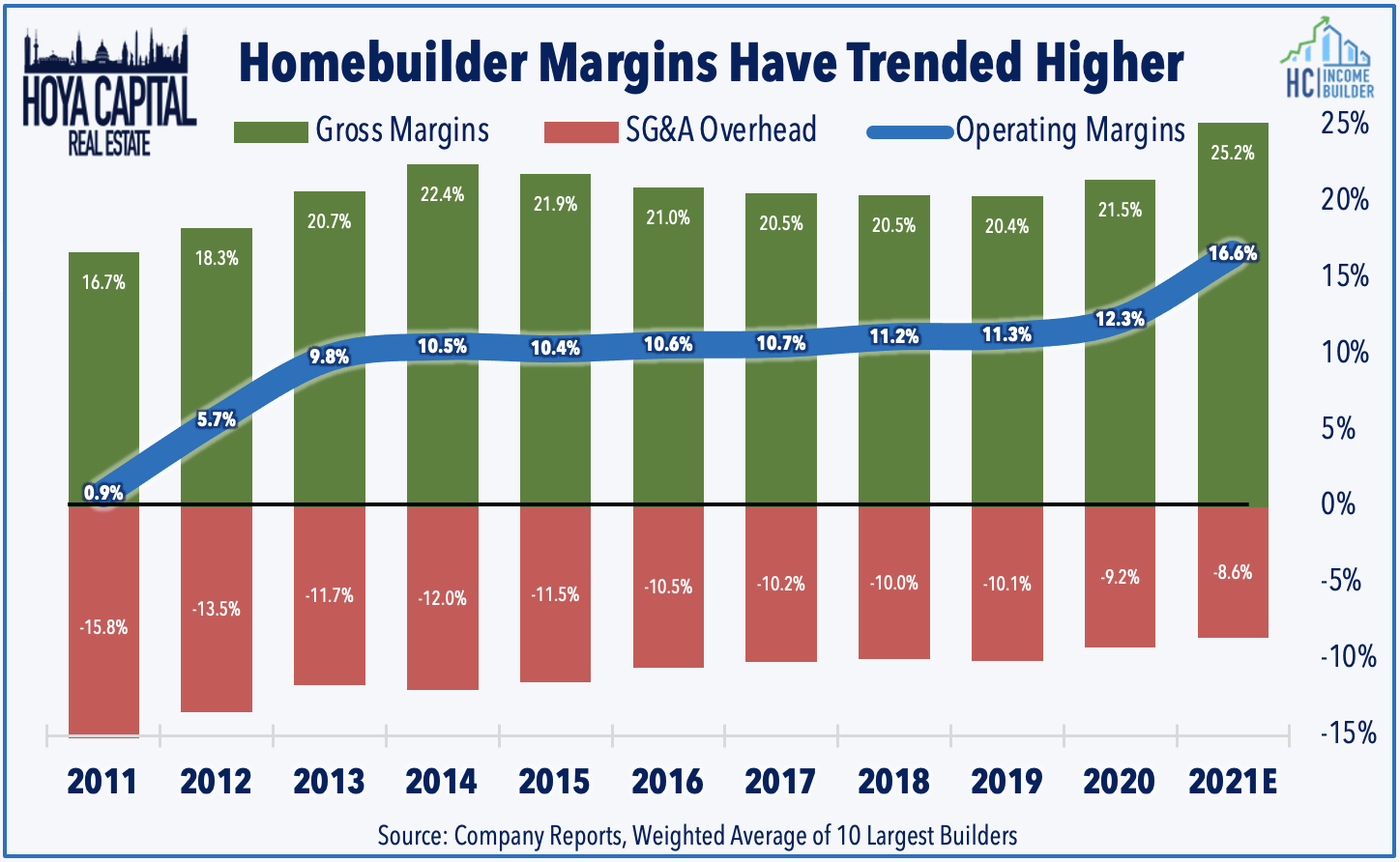

Homebuilders: Lennar (LEN) advanced 1% today after reporting strong first-quarter results and boosted its full-year guidance for both deliveries and gross margins, commenting that the housing industry "continues to exhibit strong demand, outweighing supply, and we are confident that we will continue to generate solid growth and enhance our current market position." LEN continues to battle ongoing supply chain constraints, however, noting that the supply chain is "all but broken" which has kept supply growth limited across the single-family housing space, likely prolonging the favorable supply/demand dynamics. As discussed in Growth At Very Reasonable Prices, homebuilders remain an unloved sector, trading at deep discounts to historical and market multiples - including mid-single-digit P/E ratios - despite double-digit earnings growth expected over the next several years.

Net Lease: Today, we published a new report on the net lease sector on Income Builder titled Rates Up REITs Down? Not So Fast. Understood to be one of the more "bond-like" and rate-sensitive REIT sectors, net lease REITs have underperformed the REIT average for three straight years despite their impressive post-pandemic rebound. Despite their reputation as bond-substitutes, net lease REITs have historically delivered above-average earnings growth as accretive external growth has more than offset the drag from muted property-level growth. In the report, we analyze how net lease REITs actually outperformed the REIT sector during the prior Fed rate hike cycle from 2015-2019 after significantly underperforming in the 18-months prior - a similar backdrop to the current dynamic, and discussed our top picks in the space.

Timber & Farmland: Yesterday, we published Land REITs: Ultimate Inflation Hedges. Publicly-traded landowners - specifically timber and farmland REITs - have been among the best-performing real estate sectors this year amid concerns over persistent inflation and soaring commodities prices. Amid the ongoing conflict with Russia- which is among the world's largest exporters of agriculture, gasoline, and timber products- the importance and value of North American production will become evident. Buying land has been a "hot trade" over the past year, and valuations appear extremely rich for farmland REITs with implied cap rates in the 2-3% range, but valuations of higher-quality timber REITs including PotlatchDeltic (PCH) and Weyerhaeuser (WY) remain quite attractive.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs advanced 0.8% today while residential mREITs gained 0.1%. Orchid Island (ORC) declined about 4% today after reducing its dividend for the second time this year, lowering its monthly payout to $0.045/share, representing a yield of 15.8%. ORC is one of two mREITs to lower its dividend this year along with Lument Finance (LFT) while seven mREITs have raised their dividends. The average residential mREIT pays a dividend yield of 11.14% while the average commercial mREIT pays a dividend yield of 7.46%.

Economic Data This Week

The jam-packed week of economic data concludes on Friday, with Existing Home Sales data which are each expected to show steady strength behind the housing industry despite the jump in mortgage rates. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.