Yields Tumble • REIT Dividend Hikes • Oil Prices Soar

- U.S. equity markets dipped Tuesday as Russian forces closed in on major Ukrainian cities, sending oil prices surging and sparking a bid for domestic safe-haven assets, notably long-term U.S. Treasuries.

- Following declines of 0.3% on Monday and finishing near session-lows, the S&P 500 finished lower by 1.5% today while the Mid-Cap 400 and Small-Cap 600 each dipped 1.9%.

- Real estate equities were among the outperformers today as Treasury yields plunged. The Equity REIT Index finished lower by 0.5% with 17-of-19 property sectors in negative territorywhile mortgage REITs declined 1.0%.

- Cell Tower REIT SBA Communications (SBAC) soared more than 4% after reporting very strong results and raising its dividend by 22%. SBAC recorded full-year AFFO growth of 13.9% in 2021 and sees growth of another 8.6% in 2022.

- Seritage Growth (SRG) - which emerged from the Sears bankruptcy and now owns 170 properties in primarily Class B and C mall locations - rallied nearly 8% today after confirming a Bloomberg report that it is indeed pursing a potential sale of the company.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets dipped Tuesday as Russian forces closed in on major Ukrainian cities, sending oil prices surging and sparking a bid for domestic safe-haven assets, sending Treasury Yields tumbling. Following declines of 0.3% on Monday and finishing near session-lows, the S&P 500 finished lower by 1.5% today while the Mid-Cap 400 and Small-Cap 600 each dipped 1.9%. Real estate equities were among the outperformers today as Treasury yields plunged with the Equity REIT Index finishing lower by 0.5% with 17-of-19 property sectors in negative territory while the Mortgage REIT Index declined by 1.0%.

Ten of the eleven GICS equity sectors finished lower today with Energy (XLE) sector once again the lone sector in positive territory as oil prices surged more than 6% during today's session, sending U.S. crude oil prices to their highest level since June 2014. The 10-Year Treasury Yield plunged another 13 basis points today back down to 1.71%, continuing a dramatic decline since climbing above 2.05% in mid-February as investors around the world piled into safe-haven U.S. assets and priced-in expectations of moderating inflation and slowing global economic growth.

Real Estate Daily Recap

This morning, we published our REIT Earnings Recap: REITs Are Now Cheap. More than 200 REITs have reported earnings results over the past five weeks, providing critical information on the state of the real estate industry amid the extreme volatility in early 2022. Dividend hikes have been among the prevailing themes of earnings season with 40 REITs already raising their payouts so far in 2022, outpacing the record-setting pace seen last year. The thesis for maintaining an overweight allocation to U.S. real estate equities in a balanced portfolio remains especially compelling given their minimal international exposure and inflation-hedging attributes.

Apartment: Centerspace (CSR) was among the leaders today after reporting solid results and hiking its dividend by 1.4%, becoming the 40th REIT to raise its payout this year. While its Midwest markets haven't seen the same level of rent growth as its apartment REIT peers focused on the Sunbelt and Coastal regions, CSR still recorded decent blended rent growth of 6.5% in Q4 and noted an acceleration to 7.5% in January. Preferred Apartments (APTS) - which announced last week that it will be acquired by Blackstone - was also among the leaders after reporting strong results which included blended rent growth of 17.0% in Q4 and 14.3% in January. APTS reiterated that it expects the deal to close in Q2 in a cash transaction at $25/share.

Cell Tower: SBA Communications (SBAC) soared more than 4% after reporting very strong results and raising its dividend by 22%. SBAC recorded full-year AFFO growth of 13.9% in 2021 - tied with CCI for the best in the cell tower sector - and sees growth of another 8.6% in 2022, which would be the strongest in the sector. SBAC noted strong leasing activity in both the U.S. and in Brazil, its largest international market as domestic same-tower revenue growth rose 6.3% on a gross basis and 3.9% on a net basis, including 2.4% of churn related to the Sprint/T-Mobile merger. SBAC provided a more upbeat outlook than its peers earlier in earnings season, projecting a "significant increase in organic leasing revenue contributions from new leases and amendments... and continued strong organic leasing activity during 2022."

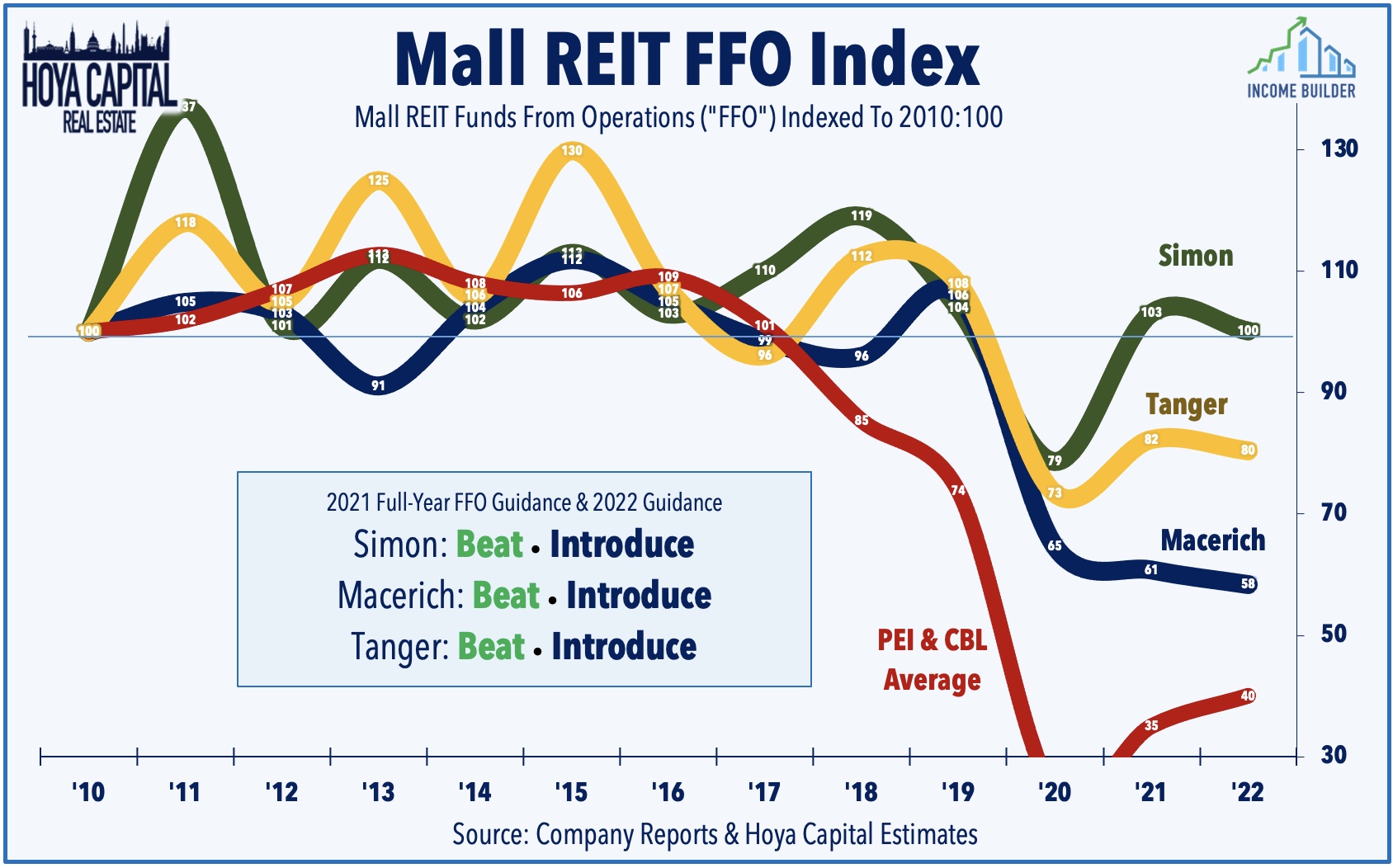

Mall: Seritage Growth (SRG) - which emerged from the Sears bankruptcy and now owns 170 properties in primarily Class B and C mall locations - rallied nearly 8% today after confirming a Bloomberg report that it is indeed pursuing a potential sale of the company. SRG officially announced today that its Board of Trustees has commenced a process to review a broad range of strategic alternatives to enhance shareholder value and will continue to evaluate its balance sheet strategy and corporate structure. In our recent report, Mall REITs: Last Man Standing, we noted how mall REITs were the best-performing REIT sector in 2021 - nearly doubling in value amid hopeful signs of stabilizing fundamentals - snapping a dreadful six-year-long streak of underperformance. SRG has not yet reported its fourth-quarter results.

We'll hear results from the final handful of REITs over the next several days including single-family rental REIT Tricon American (TCN). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout REIT earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs declined 1.0% today while residential mREITs finished lower by 1.4%. Broadmark Realty (BRMK) slumped 3% after reporting mixed earnings results yesterday afternoon with EPS and origination volumes falling short of consensus estimates in the fourth quarter following a strong Q3 with the company citing "competitive conditions." We'll hear earnings results from Arlington Asset (AAIC) and Western Asset (WMC) tomorrow afternoon and from Great Ajax (AJX) on Thursday.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 0.22% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now 190 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.76%. Yesterday, Cygnus Capital, Inc. issued an open letter to Pennsylvania REIT (PEI) announcing that it has nominated two members to serve as preferred stock trustees on PEI's Board of Trustees. PEI's preferred issues have not paid a dividend since early 2020 - the only REIT preferred that remains suspended.

Economic Data This Week

Employment data highlights the busy economic calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 438k in February following stronger-than-expected job growth of 467K in January which included significant revisions to prior months while the unemployment rate is expected to decline to 3.9% after ticking up to 4.0% last month. We also saw Construction Spending data on Tuesday and will see a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.