Correction Deepens • REIT Dividend Hikes • Earnings Recap

- U.S. equity markets continued their slide Wednesday, dipping deeper into correction territory on reports that Western diplomacy efforts have failed to prevent a full-scale deployment of Russian military troops into Ukraine.

- Now nearly 12% below its recent highs, the S&P 500 declined another 1.8% today while the tech-heavy Nasdaq 100 declined 2.6% today and is now nearly 20% off its highs.

- Real estate equities were among the better-performers today following a handful of strong earnings results and dividend hikes as the Equity REIT Index declined 1.7% today with 3-of-19 sectors higher.

- Student housing REIT American Campus (ACC) was among the best performers today after reporting strong results and providing guidance that projects a full recovery in FFO in 2022.

- Four more REITs hiked their dividends over the last 24 hours including Apple Hospitality (APLE) which became the first hotel REIT to meaningfully restore its dividend.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets continued their slide Wednesday, dipping deeper into correction territory on reports that Western diplomacy efforts have failed to prevent a full-scale deployment of Russian military troops into Ukraine. Now nearly 12% below its recent highs, the S&P 500 declined another 1.8% today while the tech-heavy Nasdaq 100 declined 2.6% and is now nearly 20% off its highs. Real estate equities were among the better performers today following a handful of strong earnings results and dividend hikes as the Equity REIT Index declined 1.7% today with 3-of-19 property sectors in positive territory while the Mortgage REIT Index slipped 2.2%.

The trio of risk factors - inflation, tightening monetary policy, and geopolitical tensions - has resulted in the highest sustained level of stock market volatility since the height of the pandemic two years ago. Ten of the eleven GICS equity sectors were lower today, dragged on the downside by the Consumer Discretionary (XLY) and Technology (XLK) sectors while the Energy (XLE) sector was higher as Crude Oil prices climbed closer to $100/barrel - the highest level since 2014. The 10-Year Treasury Yield climbed 3 basis points to close at 1.98% today, below its recent highs above 2.05% but still near the highest level since late 2019.

Real Estate Daily Recap

Four more REITs hiked their dividends over the last 24 hours. Apple Hospitality (APLE) - which we own in the REIT Dividend Growth Portfolio - became the first hotel REIT to meaningfully restore its dividend, announcing a $0.05/month distribution. Alexander & Baldwin (ALEX) declared a $0.19/share quarterly dividend, a 5.6% increase from its prior dividend. Whitestone REIT (WSR) declared a $0.04/share monthly dividend, an 11.6% increase from its prior dividend. Finally, EPR Properties (EPR) announced a 10% dividend increase alongside its results.

Student Housing: American Campus (ACC) - which we own in the REIT Focused Income Portfolio - was among the best performers today after reporting strong results and providing guidance that projects a full recovery in FFO in 2022. The student housing sector has delivered a swifter-than-expected rebound as students at flagship universities returned to campus for the 2021-2022 academic year. Despite the broader enrollment declines at the national level due to a myriad of short-term and structural headwinds, student housing fundamentals in these top-tier university markets have improved above the pre-pandemic baseline. ACC commented, "we are now targeting pre-pandemic occupancy levels and expect to produce attractive rent growth for the 2022-2023 academic year, with same-store rental revenue growth of 3.2% to 4.6% for the fourth quarter of 2022 included in our annual guidance.”

Storage: Public Storage (PSA) rallied more than 3% today after reporting impressive results, recording FFO growth of 21.9% in 2021 - significantly topping its prior guidance range and driven by a 15% increase in same-store NOI - and sees FFO growth of another 17.6% in 2022. PSA's guidance assumes same-store NOI growth of 13.4%-18.0%, same-store revenue growth of 12%-15%, and $1.0B in acquisitions. Self-Storage REITs stumbled into the pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, but catalyzed by housing market strength, self-storage demand has been insatiable since late 2020. We'll hear results this afternoon from ExtraSpace (EXR), Life Storage (LSI) tomorrow, and we'll hear results from CubeSmart (CUBE) on Friday.

Net Lease: EPR Properties (EPR) - which focuses on "experience-oriented" properties including movie theaters and was among the hardest hit REITs during the pandemic - soared more than 6% today after reporting an impressive recovery in 2021 with the upward momentum continuing into this year. EPR recorded full-year FFO growth of over 70% in 2021 and sees another 35% growth this year. After plunging more than 65% in 2020, however, its 2022 FFO level would still be 20% below its pre-pandemic 2019 level. EPR announced that it collected 97% of Q4 rents along with $11M in deferred rents and with a repaired balance sheet, is projecting a return to external growth in 2022 with guidance of $600M in acquisitions this year. Realty Income (O), Agree Realty (ADC), and Broadstone (BNL) were all little-changed after reporting results.

Industrial: Plymouth (PLYM) dipped more than 6% today after reporting disappointing results, noting that its Core FFO/share declined by 8.1% in full-year 2021 due to the impact of the 60% increase in its share count during the year as it worked to reduce its leverage. With much of the "heavy lifting" on the balance sheet now complete, PLYM projects decent 5.7% FFO growth for 2022 driven by a 3.75% increase in same-store cash NOI. PLYM did also note that its Board approved a 4.8% increase in its cash dividend.

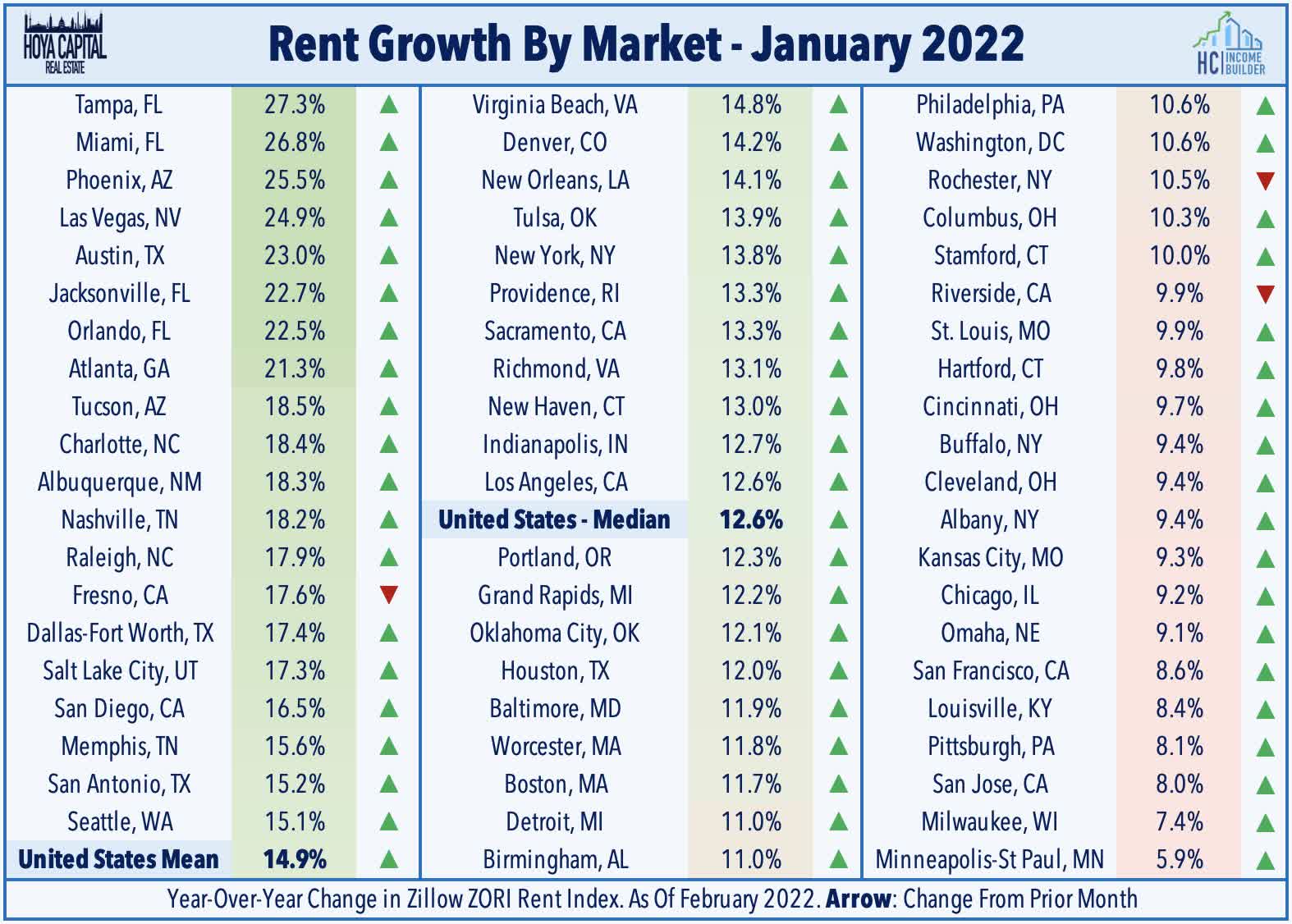

Apartments: Today, we published Shelter From Inflation which discussed rent trends and our updated outlook for the Apartment REIT sector. Rents are soaring at the fastest pace on record in essentially every major market across the country. After rising nearly 20% in 2021, renters should prepare for double-digit growth again in 2022. Riding the rental boom, Apartment REITs continue to report stellar earnings results, ending 2021 with record-high occupancy rates with the momentum accelerating in 2022 with 15% earnings growth this year. Not only are residential REITs an effective inflation hedge, they should also benefit from rising mortgage rates if households get priced out of the ownership markets. We'll hear results this afternoon from Veris Residential (VRE) which recently converted from an office to apartment REIT.

Highlights of this afternoon's earnings calendar include billboard REIT Outfront Media (OUT); net lease REITs Store Capital (STOR) and Getty Realty (GTY); storage REIT ExtraSpace (EXR); healthcare REIT Diversified Healthcare (DHC); apartment REIT Veris Residential (VRE); and hotel REITs Summit Hotels (INN) and Ashford (AHT). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout REIT earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs declined 1.6% today while residential mREITs finished lower by 2.3%. TPG Real Estate (TRTX) declined more than 3% today despite reporting that its Book Value Per Share ("BVPS") increased 1% to $16.37 in Q4.MFA Financial (MFA) slipped nearly 5% after reporting that its BVPS declined 1% to $4.78 in Q4. We'll hear results from Ellington Financial (EFC) after the close today and from AG Mortgage (MITT) and iStar (STAR) before the opening bell tomorrow morning.

Economic Data This Week

We have another frenetic week of economic data and earnings reports in the Presidents' Day-shortened week. On Thursday and Friday, we'll see New Home Sales and Pending Home Sales which are both expected to show that even with the recent rise in mortgage rates and historically-low inventory levels, overall housing demand remains robust. On Friday, we'll see inflation data via the PCE Index which is expected to show the highest rate of consumer inflation in four decades as well as Personal Income & Spending data.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.