World On Edge • Stocks Rebound • Strong REIT Earnings

- U.S. equity markets rebounded on a frenetic Thursday trading session after Russia launched a full-scale military invasion into Ukraine, triggering a new wave of economic sanctions imposed by Western nations.

- After opening the session with declines of nearly 2.5%, the S&P 500 recovered throughout the day, posting gains of 1.5% while the tech-heavy Nasdaq 100 rallied 3.4%, nearly 7-percentage-points above its lows.

- Real estate equities also finished with broad-based gains today with the Equity REIT Index gaining 1.6% today with all 19 property sectors in positive territory while Mortgage REITs rallied 2.2%.

- Cell tower REIT American Tower (AMT) – the largest REIT by market cap – gained nearly 2% today after reporting solid results including full-year AFFO growth of 13.7% in 2021.

- Cannabis REIT Innovative Industrial (IIPR) rallied 3.4% after reporting another impressive quarter, recording full-year AFFO growth of 78% driven by investment volume of $714M.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded on a frenetic Thursday trading session after Russia launched a full-scale military invasion into Ukraine, triggering a new wave of sanctions and concerns over the potentially destabilizing fallout across Europe. After opening the session with intra-day declines of nearly 2.5%, the S&P 500 recovered throughout the day, posting gains of 1.5% while the tech-heavy Nasdaq 100 rallied 3.4%, nearly 7-percentage-points above its lows. Real estate equities also finished with broad-based gains today with the Equity REIT Index gaining 1.6% today with all 19 property sectors in positive territory while the Mortgage REIT Index rallied 2.2%.

U.S. equities were buoyed by expectations of a less aggressive path of monetary tightening by the Federal Reserve in light of the mounting geopolitical concerns. The U.S. - the largest oil producer in the world ahead of Russia in second - is widely seen as more insulated from the looming energy crisis that will afflict Western European nations that are still heavily reliant on Russian energy imports to fuel their economies. Seven of the eleven GICS equity sectors finished higher today, led to the upside by the Technology (XLK) and Communications (XLC) sectors. Homebuilders and the broader Hoya Capital Housing Index rebounded today as mortgage rates pulled-back and after solid New Home Sales data for January.

Real Estate Daily Recap

Cell Tower: American Tower (AMT) – which we own in the REIT Dividend Growth Portfolio – gained nearly 2% today after reporting solid results. AMT reported full-year AFFO growth of 13.7% in 2021 – above its prior guidance – and sees growth of 4.1% in 2022 at the midpoint of its initial guidance range driven by 13.2% revenue growth. As expected, the Sprint/T-Mobile merger has dragged down U.S. organic “same tower” growth to 2.9% in 2021 and AMT sees just 1% U.S. organic growth in 2022, but its organic international growth at 6% with total billings (including site expansions) at an impressive 16%. While AMT is among the most "international" REITs among U.S. listed names, it has no exposure to Russia, China, or Eastern Europe.

Net Lease: Store Capital (STOR) – which we own in the REIT Focused Income Portfolio – rallied 2.4% after it reported FFO growth of 12% in 2021, well above its prior guidance and exceeding its pre-pandemic 2019 FFO by 3%. STOR’s guidance was also impressive, raising its 2022 outlook which now calls for growth of another 7.3%. Getty Realty (GTY) – which we also own in the REIT Focused Income Portfolio – gained 1% after it delivered strong results as well with FFO growth of 7.1% in 2021 and sees growth of 6.1% in 2022 which, if achieved, would be 22% above its pre-pandemic 2019 level – the best in the net lease sector.

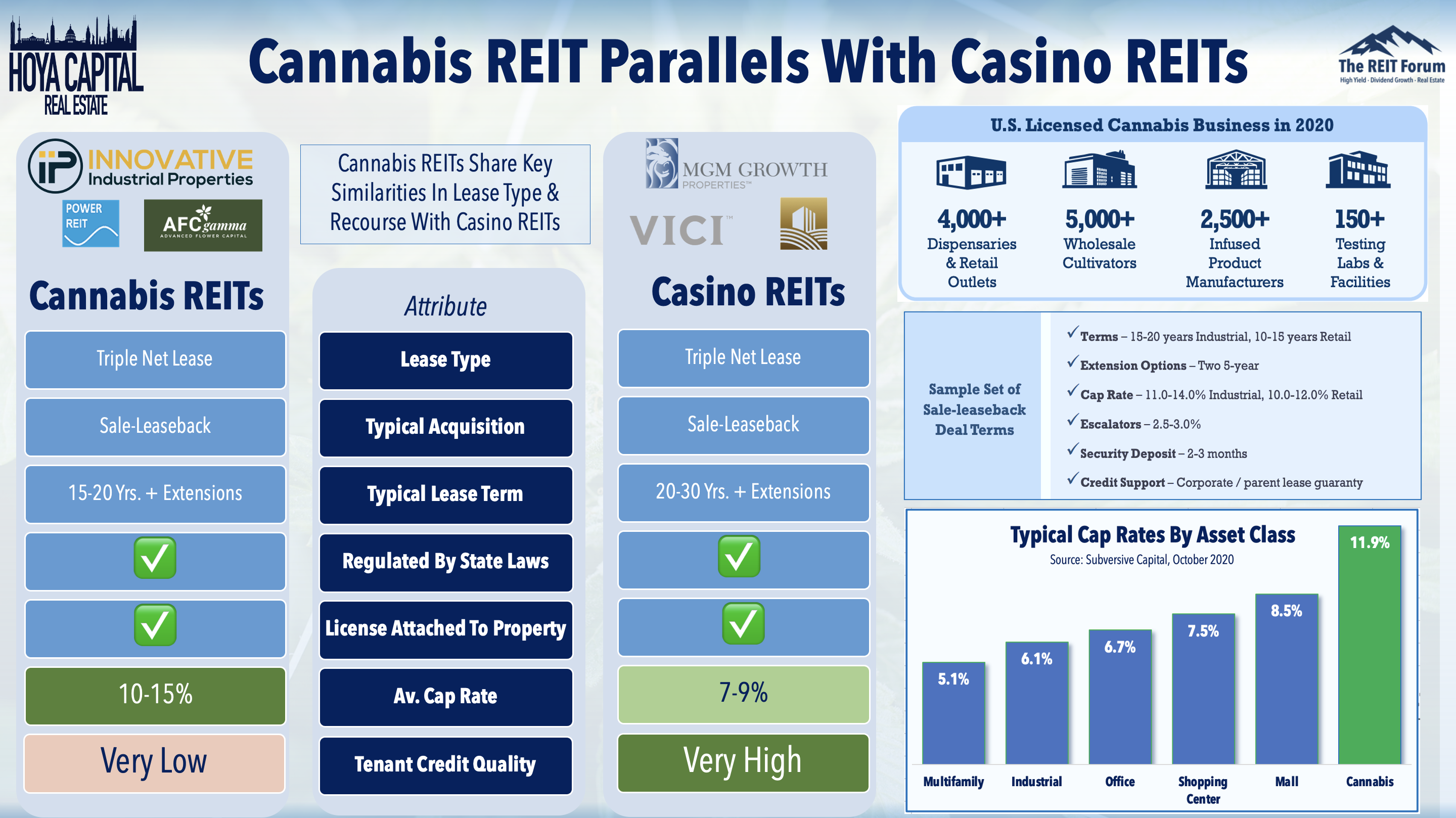

Cannabis: Innovative Industrial (IIPR) - which we own in the REIT Dividend Growth Portfolio - finished higher by 3.4% after reporting another impressive quarter, recording full-year AFFO growth of 78% driven by investment volume of $714M. IIPR acquired 31 additional cannabis-related properties in Q4 and early 2022, bringing its portfolio up to 105 properties. In our recent report - When They Go Low, We Get High - we discussed the cannabis REIT sectors' parallels with the casino industry where REITs have carved out a profitable and attractive niche with a sustainable competitive advantage as the most efficient source of capital despite their tenants' legal access to traditional sources of capital. Critically, as additional states adopt tax and regulatory frameworks, marijuana cultivation licenses are increasingly "attached" to the real estate asset - and limited in quantity - an ideal structure for these REITs.

Data Center: Iron Mountain (IRM) surged nearly 8% after reporting very strong results in its growing data center business, noting that it booked 27 megawatts of new and expansion leases in the fourth quarter, bringing its full-year total to 49 MW, far above its guidance of 30 MW. IRM also provided guidance calling for AFFO growth of 8.0% in 2022 following impressive growth of 13.4% in 2021. Digital Bridge (DBRG) also rallied after reporting solid results. Driven by record leasing volume reported by Digital Realty (DLR), data center leasing metrics substantially exceeded their previous record high even without accounting for two of the three REITs that were acquired in 2021.

Over the next 24 hours, we'll hear results from storage REITs CubeSmart (CUBE), Life Storage (LSI); net lease REIT Netstreit (NTST); residential REITs UMH Properties (UMH) and American Homes 4 Rent (AMH); industrial REIT Americold (COLD); and casino REIT Gaming & Leisure Properties (GLPI). We'll continue to provide real-time coverage with our Earnings QuickTake posts for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout REIT earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, commercial mREITs and residential mREITs each advanced 1.4% today. iStar (STAR) rallied 4.5% after reporting solid results and reiterating its strategy of simplifying its portfolio, highlighting its agreement announced earlier this month to sell a portfolio of net lease assets for $3.1B. AG Mortgage (MITT) finished higher today despite reporting that its Book Value Per Share ("BVPS") increased decreased 13% to $14.64 resulting in part from a large equity raise in November. We'll hear results from Granite Pointe (GPMT), Orchid Island (ORC), and Ready Capital (RC) this afternoon.

Economic Data This Week

The frenetic week of economic data continues on Friday with inflation data via the PCE Index which is expected to show the highest rate of consumer inflation in four decades as well as Personal Income & Spending data. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook report published this weekend.

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing assets classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.