Relief Rally • Fixer-Upper • Mall Earnings

- U.S. equity markets rebounded Tuesday as solid retail sales data and somewhat dovish Fed comments sparked a bid for beaten-down equity sectors, but also resumed the downward pressure on fixed-income securities.

- Following declines of 0.4% yesterday and seeking to snap a six-week streak of declines, the S&P 500 gained 2.0% today while the Mid-Cap 400 and Small-Cap 600 each rallied nearly 3%.

- Real estate equities were mostly-higher today led by retail and hotel REITs as the Equity REIT Index advanced 1.4% with 16-of-19 property sectors in positive territory while Mortgage REITs gained 1.0%.

- Fixer Upper: Home Depot (HD) rallied nearly 2% after the home-improvement retailer reported better-than-expected Q1 results highlighted by strong comparable sales growth of 2.2% as home improvement spending remains an area of strength despite the cooldown in home sales.

- Mall REIT CBL Properties (CBL) - which emerged from bankruptcy last November - rallied 10% after reporting decent Q1 results, recording a 290 basis point increase in portfolio occupancy which helped to drive a 10.7% year-over-year increase in same-center NOI.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Tuesday as solid retail sales data and somewhat dovish Fed comments sparked a bid for beaten-down equity sectors, but also resumed the downward pressure on fixed income securities. Following declines of 0.4% yesterday and seeking to snap a six-week streak of declines, the S&P 500 gained 2.0% today while the Mid-Cap 400 and Small-Cap 600 each rallied nearly 3%. Real estate equities were mostly-higher today - led by the "more pro-cyclical" property sectors including retail, timber, and hotel REITs - as the Equity REIT Index advanced 1.4% with 16-of-19 property sectors in positive territory while Mortgage REITs gained 1.0%.

A reprieve from the volatility in recent weeks, equity markets trended higher throughout the day following decent retail sales data in the morning and after comments from St. Louis Fed President James Bullard, who indicated that he supports the plan for half-point rate increases over more aggressive actions discussed previously. Ten of the eleven GICS equity sectors finished higher today, led on the upside by the Technology (XLK) and Materials (XLB) sectors, but weaker-than-expected results from Walmart (WMT) dragged on the Consumer Staples (XLP) sector. Reversing the recent bid for bonds, interest rates trended higher across the credit and maturity curve as the 10-Year Treasury Yield declined jumped 9 basis points to 2.97%, but remains shy of the 3.20% peak seen last Monday. Homebuilders and the broader Hoya Capital Housing Index were among the leaders today following strong results and an upbeat housing market outlook from Home Depot (HD).

On that point, despite the moderation in home sales activity amid the surge in mortgage rates, consumers continue to invest in - and prioritize spending on - their existing homes. Home Depot (HD) rallied nearly 2% after the home-improvement retailer reported better-than-expected Q1 results highlighted by strong comparable sales growth of 2.2% - well above analyst estimates for a 2.7% decline - as an 8.2% decline in transactions was offset by an average purchase price increase of about 11%. HD raised its full-year outlook and provided an upbeat forecast, citing longer-term housing industry tailwinds - notably the "chronic shortage" of housing units. Home Depot now expects mid-single digit earnings growth for the year, up from its prior forecast of low-single-digit gains, and comparable sales growth of around 3%.

The Census Bureau reported this morning that retail sales rose at a stronger-than-expected rate in April, but still recorded its fourth-straight month of growth. Total Retail Sales rose 0.9% in April - slightly below the 1% estimate - but the absolute dollar figure was higher than expected after upward revisions to prior months which pushed the year-over-year increase back to over 8%. The figures are not adjusted for inflation, however, and the 8.2% increase in retail sales was essentially fully offset on a "real" basis by the 8.2% year-over-year increase in the CPI. The gains in April were powered by strong spending at bars and restaurants, vehicles, and e-commerce and the increases came despite a 2.7% decrease in spending at gasoline stations.

Real Estate Daily Recap

Malls: CBL Properties (CBL) gained nearly 10% after reporting decent Q1 results in its third quarterly report since emerging out of Chapter 11 bankruptcy last November. Results were generally in-line with expectations and consistent with trends across the sector reported last week. Positively, CBL recorded a 290 basis point increase in portfolio occupancy which helped to drive a 10.7% year-over-year increase in same-center NOI. Rental rates remain under pressure, however, as renewal spreads dipped another 11.8% - in part due to a shift towards higher use of "percentage rent" in lease agreements, which can result in higher rent payments when times are good, but sharper declines in rent during downturns in retail spending. We'll discuss these results - and our post-earnings season outlook for the sector - in our Mall REIT report published this week on Income Builder.

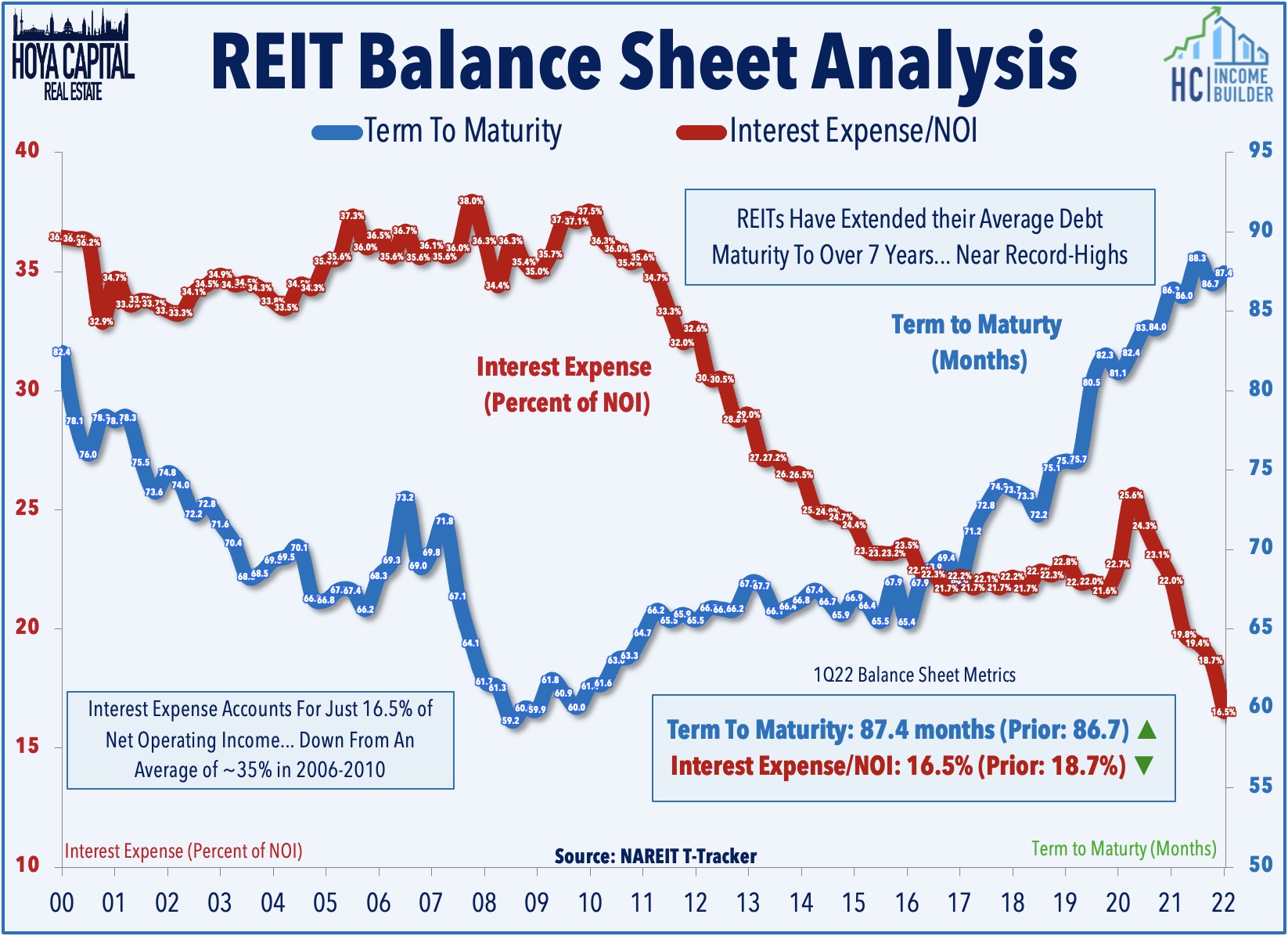

Today, we published our State of the REIT Nation report as an exclusive report on Income Builder. We highlighted the fact that owing to the harsh lessons learned during the financial crisis, most REITs have been exceedingly conservative with their balance sheet and strategic decisions over the past decade. In doing so, REITs ceded some ground to private market players and non-traded REIT platforms that were willing to take on more leverage and finance operations with short-term debt. Amid the more challenging capital raising environment, we believe that the pendulum has quickly swung in favor of REITs over private players and that the "true" competitive advantage of REITs is revealed in times of mild distress. Perhaps most critically, publicly-traded REITs have far more ample access to longer-term, unsecured debt that has allowed REITs to push their average debt maturities to over 7 years - avoiding the need to refinance during unfavorable market conditions.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly-higher today with commercial mREITs gaining 2% while residential mREITs advanced 0.6%, on average. Annaly Capital (NLY) was a laggard today after launching a secondary common stock offering of 100M shares for gross proceeds of $645M. Broadmark Realty (BRMK) gained 2% after holding its dividend monthly steady at $0.07/share, representing a forward yield of 11.31%. In our Earnings Recap published last week, we noted that mREITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

Economic Data This Week

Housing data highlights the economic calendar in the week ahead which investors and the Fed will be watching carefully for indications of the impact of surging mortgage rates on housing demand. On Tuesday, we'll Homebuilder Sentiment which is expected to show a moderation to 75. On Wednesday, we'll see Housing Starts and Building Permits which are also expected to moderate from last month's stronger-than-expected levels. On, Thursday we'll see Existing Home Sales data which is expected to show a more pronounced pull-back to a 5.53M annualized rate, which would be the lowest since June 2020. We'll also see Retail Sales data on Tuesday and hear a half-dozen scheduled Federal Reserve member speeches or events including remarks from Chair Powell on Tuesday.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.