REIT Dividend Hikes • Bid For Bonds • Sell-Off Deepens

- U.S. equity markets remained under pressure Thursday following disappointing economic data and sour retail earnings reports while the Federal Reserve has yet to "blink" amid clear signs of economic slowing.

- Following its worst single-day decline since June 2020 and now sitting on the cusp of "bear market" territory, the S&P 500 declined another 0.6% today while the tech-heavy Nasdaq 100 declined.

- Real estate equities were mixed today despite positive dividend news as the Equity REIT Index declined 0.4% with 6-of-19 property sectors in positive territory while Mortgage REITs declined 1.0%.

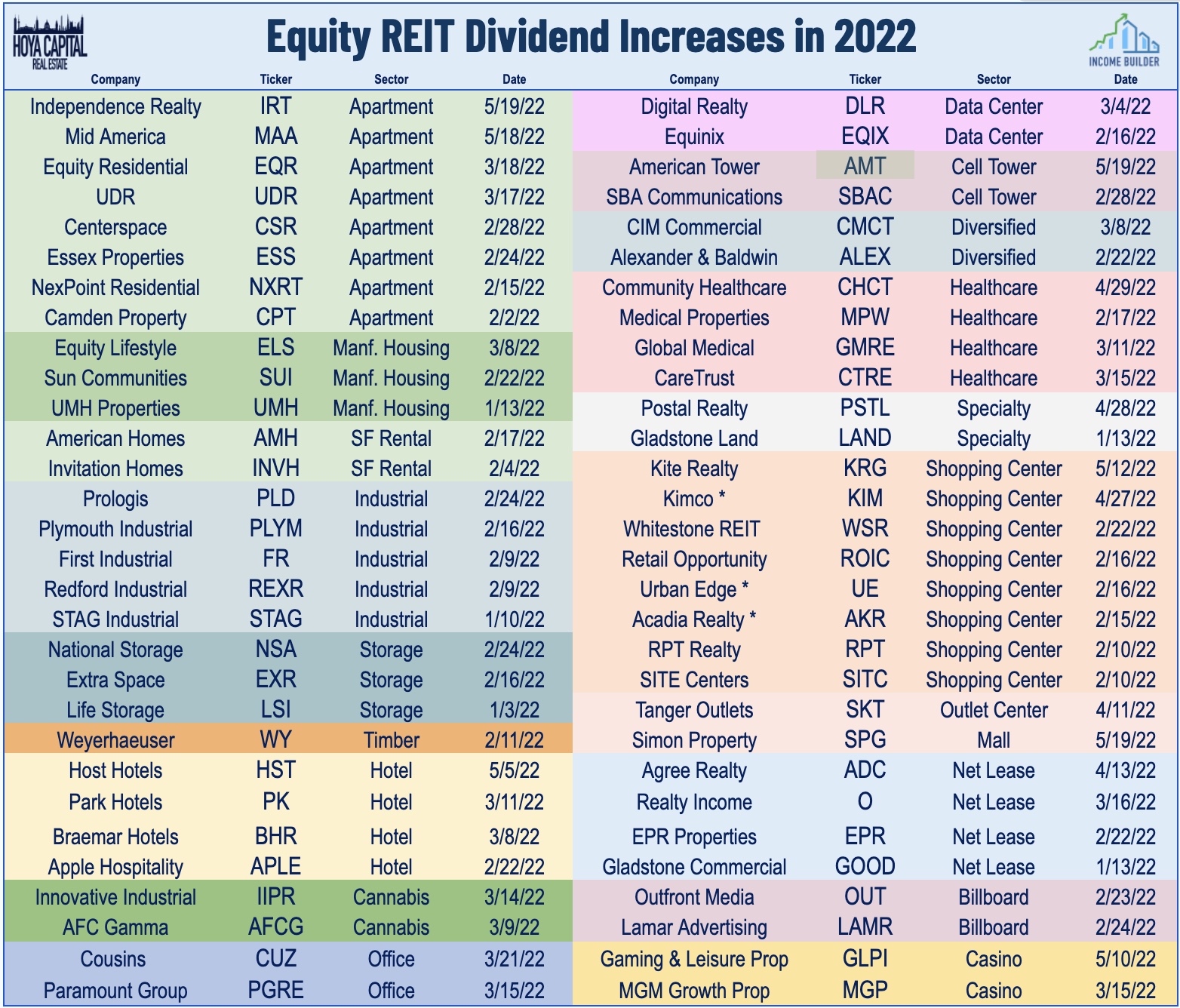

- Apartment REIT Independence Realty gained after hiking its quarterly dividend by 17% and announcing a share buyback program. Elsewhere, Cell tower REIT American Tower raised its dividend for the 53rd consecutive quarter.

- This afternoon, billboard REIT Lamar Advertising hiked its quarterly dividend by 9.1%. We've now seen 60 equity REITs and 10 mortgage REITs raise their payouts in 2022, roughly on pace to match the record-high of 130 seen last year.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets remained under pressure Thursday following disappointing economic data and sour retail earnings reports while the Federal Reserve has yet to "blink" amid clear signs of economic slowing. Following its worst single-day decline since June 2020 and now sitting on the cusp of "bear market" territory, the S&P 500 declined another 0.6% today while the tech-heavy Nasdaq 100 declined 0.5%. Real estate equities were mixed today despite positive dividend news as the Equity REIT Index declined 0.4% with 6-of-19 property sectors in positive territory while Mortgage REITs declined 1.0%.

While still on pace for their worst year on record, bonds have caught a bid in recent weeks amid mounting concern over global economic growth. The 10-Year Treasury Yield pulled back another 3 basis points to close at 2.86% - well below the 3.20% peak seen last Monday. Of note, the benchmark Aggregate Bond ETF (AGG) has rebounded nearly 2% since its lows on May 6th while residential and commercial MBS have seen a similar firming in valuations. Three of the eleven GICS equity sectors finished higher today, led on the upside by the Materials (XLB) and Healthcare (XLV) sectors while homebuilders and the broader Hoya Capital Housing Index were among the leaders today, aided by a recent moderation in mortgage rates and Existing Home Sales data showing that housing supply remains near record-lows.

Real Estate Daily Recap

Another day, another trio of REIT dividend hikes. Apartment REIT Independence Realty (IRT) gained 0.5% today after hiking its quarterly dividend by 17% to $0.14/share. IRT - which was the only residential REIT to reduce its dividend in 2020 during the pandemic - also announced that its Board of Directors authorized a repurchase program of up to $250 million of the Company’s common stock. Elsewhere, cell tower REIT American Tower (AMT) raised its quarterly dividend by 2.1% to $1.43/share - the 53rd consecutive quarter that AMT has raised its dividend. This afternoon, billboard REIT Lamar Advertising (LAMR) hiked its quarterly dividend by 9.1% to $1.20/share- its second dividend hike this year.

Yesterday, we published our State of the REIT Nation which noted that amid the 'REIT Recovery,' FFO growth has significantly outpaced dividend growth, driving the dividend payout ratios to just 68.8% in Q1 - well below the 20-year average of 80%. With a historically low dividend payout ratio, we believe that REITs are well-equipped to deliver another year of robust dividend growth that may meet or exceed the record year in 2021 - despite the challenging macro environment. REITs enter this period of economic uncertainty on solid footing and balance sheets as strong as they've been. The "REIT Recovery" from the pandemic is now complete as FFO levels are back to pre-pandemic levels.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs declining 1.0% while commercial mREITs declined 0.7%. Sachem Capital (SACH) rallied another 10% today after presenting at a Small-Cap investor conference. Ellington Financial (EFC) was among the better-performers today after reporting that its estimated book value per share ("BVPS") was $17.10 at the end of April, down 3.6% from its BPVS on March 31st. In our Earnings Recap published last week, we noted that mREITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

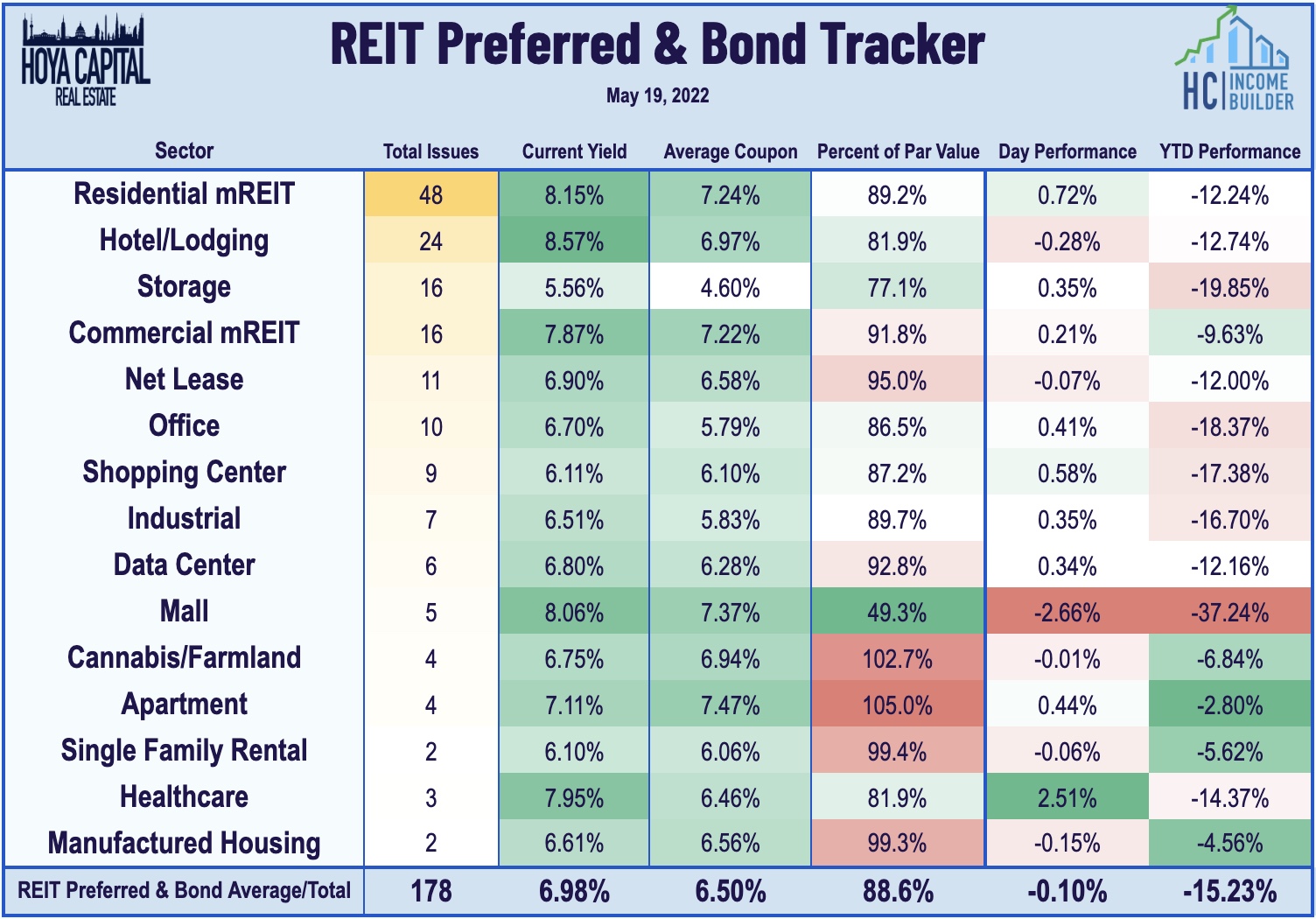

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.10% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.96%. Over in the capital markets today, S&P Ratings raised Essential Properties' (EPRT) credit rating to “BBB-“ from “BB+” with a stable outlook. S&P also affirmed Ventas' (VTR) “BBB+” issuer credit rating and raised its outlook to stable from negative. S&P Ratings also affirmed Necessity Retail's (RTL) “BB+” credit rating with a negative outlook and removed it from CreditWatch negative.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.