Peak Inflation? • Stocks Rally • Real Income Declines

- U.S. equity markets delivered broad-based gains Friday and for the week- snapping a dismal seven-week skid of declines- after inflation data showed signs of a potential peak in consumer prices.

- Posting its best weekly gains since November 2020, the S&P 500 advanced 2.5% today - pushing its weekly advance to over 6.6% - while the tech-heavy Nasdaq 100 rallied 3.2%.

- Real estate equities were broadly higher as well with the Equity REIT Index gaining 2.6% today with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 1.4%.

- Peak Inflation? The PCE Index increased 6.3% in April from a year ago, slowing from the 6.6% pace last month. Notably, the month-over-month increase of 0.2% in April was the smallest increase in a year and a half.

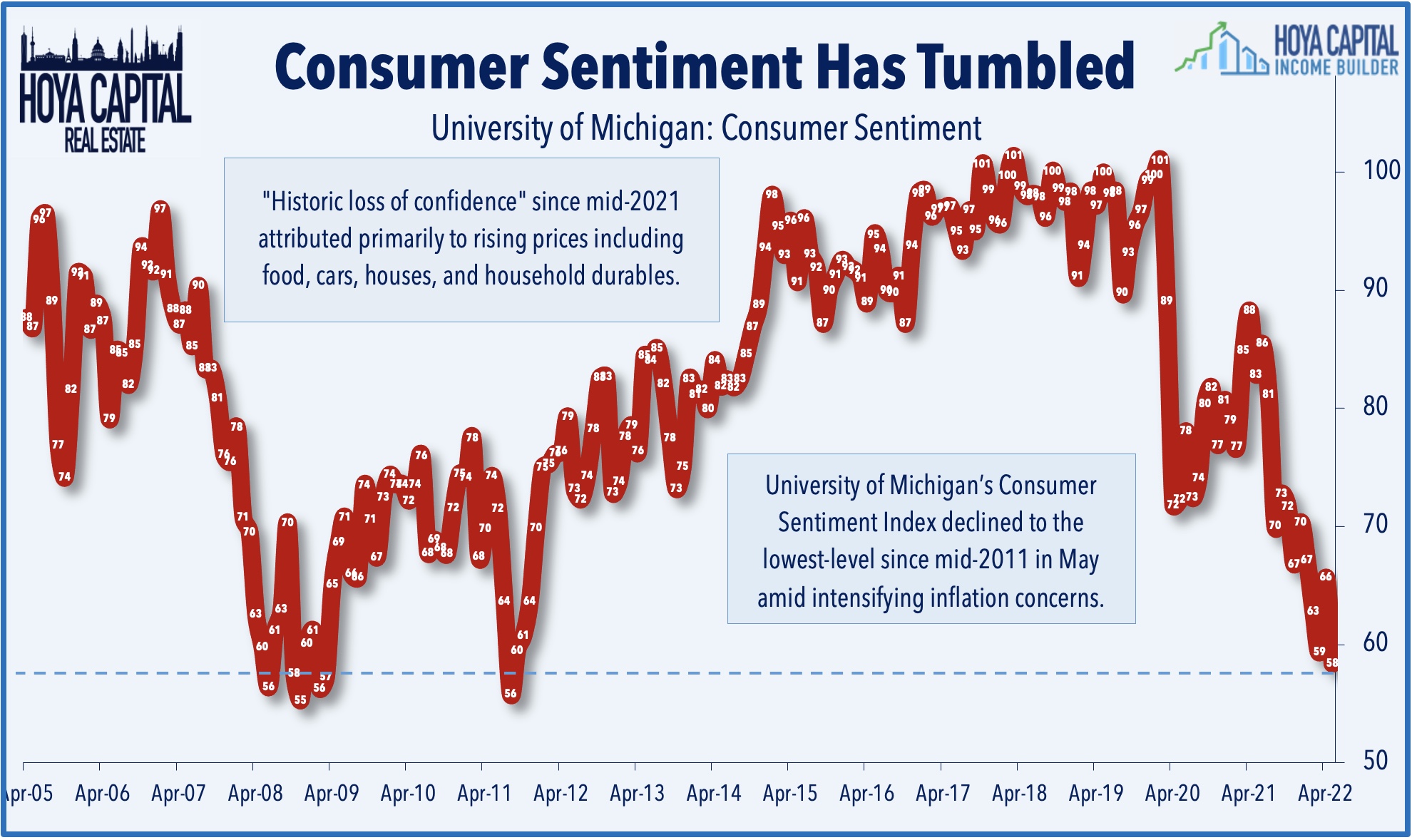

- Income growth has fallen significantly shy of inflation so far in 2020, pushing Consumer Sentiment to 10-year lows. Remarkably, real disposable personal income is 20% below its peak in March 2021, which occurred at the height of the stimulus check distribution.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets delivered broad-based gains Friday and for the week - snapping a dismal seven-week skid of declines - after inflation data showed emerging signs of a potential peak in consumer prices. Posting its best weekly gains since November 2020, the S&P 500 advanced 2.5% today - pushing its weekly advance to over 6.6% - while the tech-heavy Nasdaq 100 rallied 3.2% today and over 7% for the week. Real estate equities were broadly higher as well with the Equity REIT Index gaining 2.6% today with 18-of-19 property sectors in positive territory while Mortgage REITs advanced 1.4%.

Signs of peaking inflation powered a broad-based relief rally as all eleven GICS equity sectors were higher by at least 1% on the day and by at least 3% on the week. Despite the equity market rally, Treasury yields were little changed today as the 10-Year Treasury Yield declined 1 basis point to close the week at 2.74% - well below the recent 3.20% peak earlier this month. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Peak Inflation? The Core Personal Consumption Expenditures ("PCE") Price index - the Fed’s favored inflation gauge - rose 4.9% from a year ago in April - in line with estimates - a deceleration from March. The headline PCE - which includes food and energy - increased 6.3% in April from a year ago, which was also a cooldown from the 6.6% pace last month. Notably, the month-over-month increase of 0.2% in April was the smallest increase in a year and a half. Alongside the inflation data, the BEA reported that personal income rose 0.4% during the month - slightly below the 0.5% estimate - while consumer spending rose 0.9% - higher than the 0.7% rise expected. On a year-over-year basis, personal income growth has cooled quite substantially as the fiscal stimulus measures have expired, rising just 1.7% so far in 2022 - far below the mid-single-digit inflation rate - after having risen by 7.5% in 2021 and 6.5% in 2020.

Real disposable personal incomes ("Real DPI") however, were flat in April and are now lower by 6.2% from last year. Naturally, negative real income growth has weighed heavily on consumer sentiment. Remarkably, Real DPI is now more than 20% below its peak in March 2021, which occurred at the height of the stimulus check distribution. The University of Michigan’s Consumer Sentiment Index fell to a final May reading of 58.4 to its lowest level in more than 10 years - and below the initial reading of 59.1. The Current Conditions Index, meanwhile, fell to 63.3 in May from 69.4 in April, while the Consumer Expectations fell sharply to 55.2 from 62.5 in the previous month.

Real Estate Daily Recap

Industrial: Eastgroup Properties (EGP) filed an 8-K yesterday afternoon that disclosed that the company will acquire an unnamed third-party entity that owns a portfolio of properties in California for roughly $325M in stock. The transaction is expected to close in the second quarter of 2022. Earlier this week, we published Industrial REITs: Amazon's Wake of Carnage, which discussed how industrial REITs have been slammed over the past month after Amazon (AMZN) announced plans to cut costs in its logistics network, pumping the breaks on its aggressive pandemic-fueled footprint expansion amid rising costs and slowing consumer spending, seeking to reduce overcapacity through sublets and renegotiated leases. The downbeat Amazon report followed an otherwise stellar slate of industrial REIT earnings reports - highlighted by incredible 30% rent growth - and overshadowed several major M&A developments including a potential takeout of Duke Realty (DRE).

Casinos: Yesterday, we published Casino REITs: Game On as an exclusive report on the Income Builder marketplace. Casino REITs - one of the highest dividend-yielding REIT sectors - continue to provide strong value for income-oriented investors with 5-6% dividend yields backed by master leases that have 25-50 year initial terms and cross-default provisions, helping to provide a steady and predictable stream of cash flows which is augmented by accretive external growth. Casino REITs have indeed benefited from an upward "re-rating" from investors as the sector has matured and as the business model - and economic "moat" around these REITs - has become better understood. The M&A environment remains as active as ever. Over the past month, VICI Properties (VICI) closed on its $17.2 billion acquisition of MGM Properties while Realty Income (O) entered the sector with a nearly $2B acquisition.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs completed their best week in over a year with residential REITs gaining another 0.7% today - and 4.9% on the week - while commercial mREITs gained 1.4% today - pushing their gains to 5.4% for the week. In our Earnings Recap published last week, we noted that mREITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

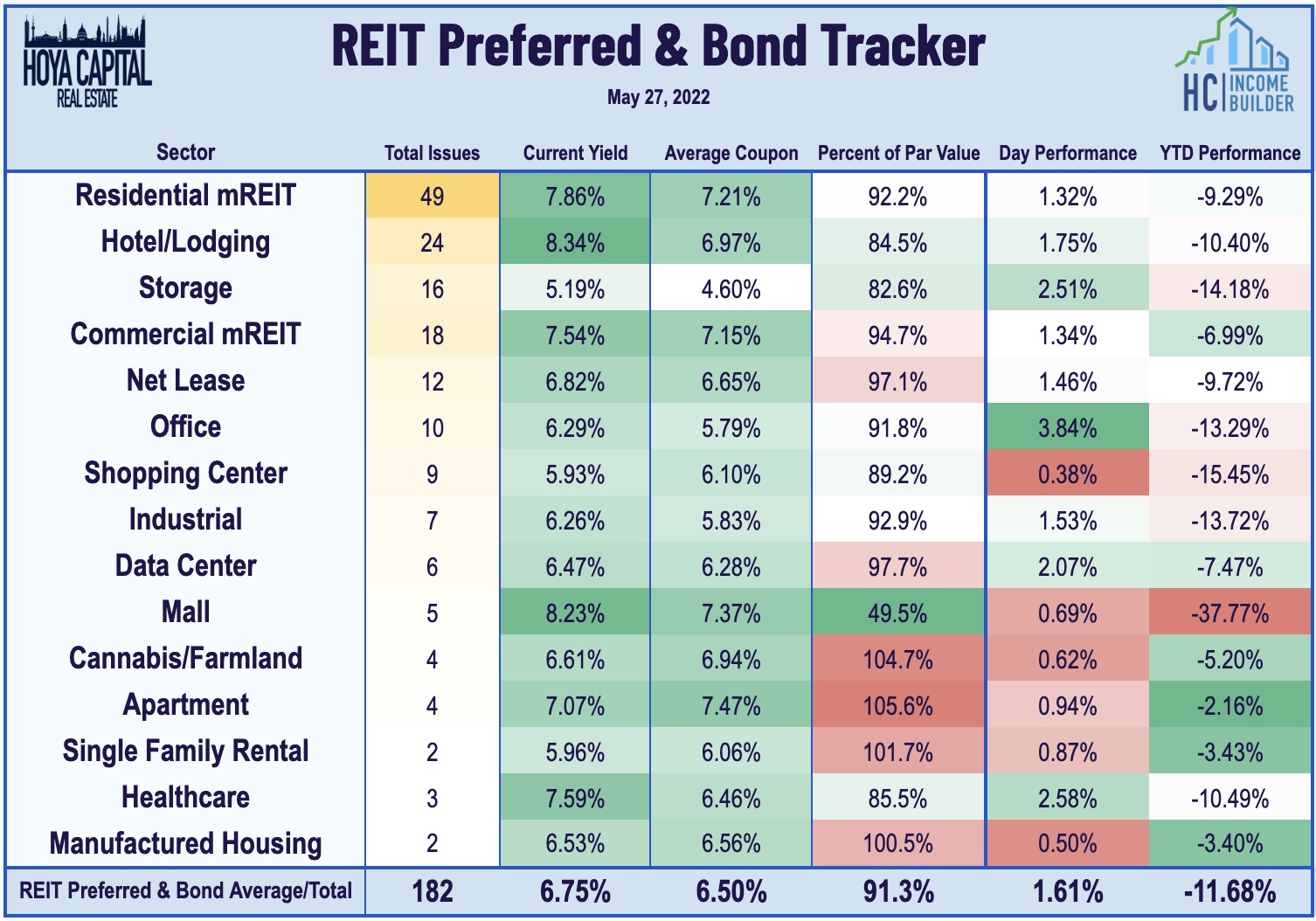

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 1.61% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.96%. Yesterday, Fitch Ratings affirmed Hannon Armstrong's (HASI) “BB+” while S&P Ratings affirmed Physician's Realty's (DOC) “BBB” credit rating with a stable outlook.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.