Timber Merger • REIT Dividend Hike • Week Ahead

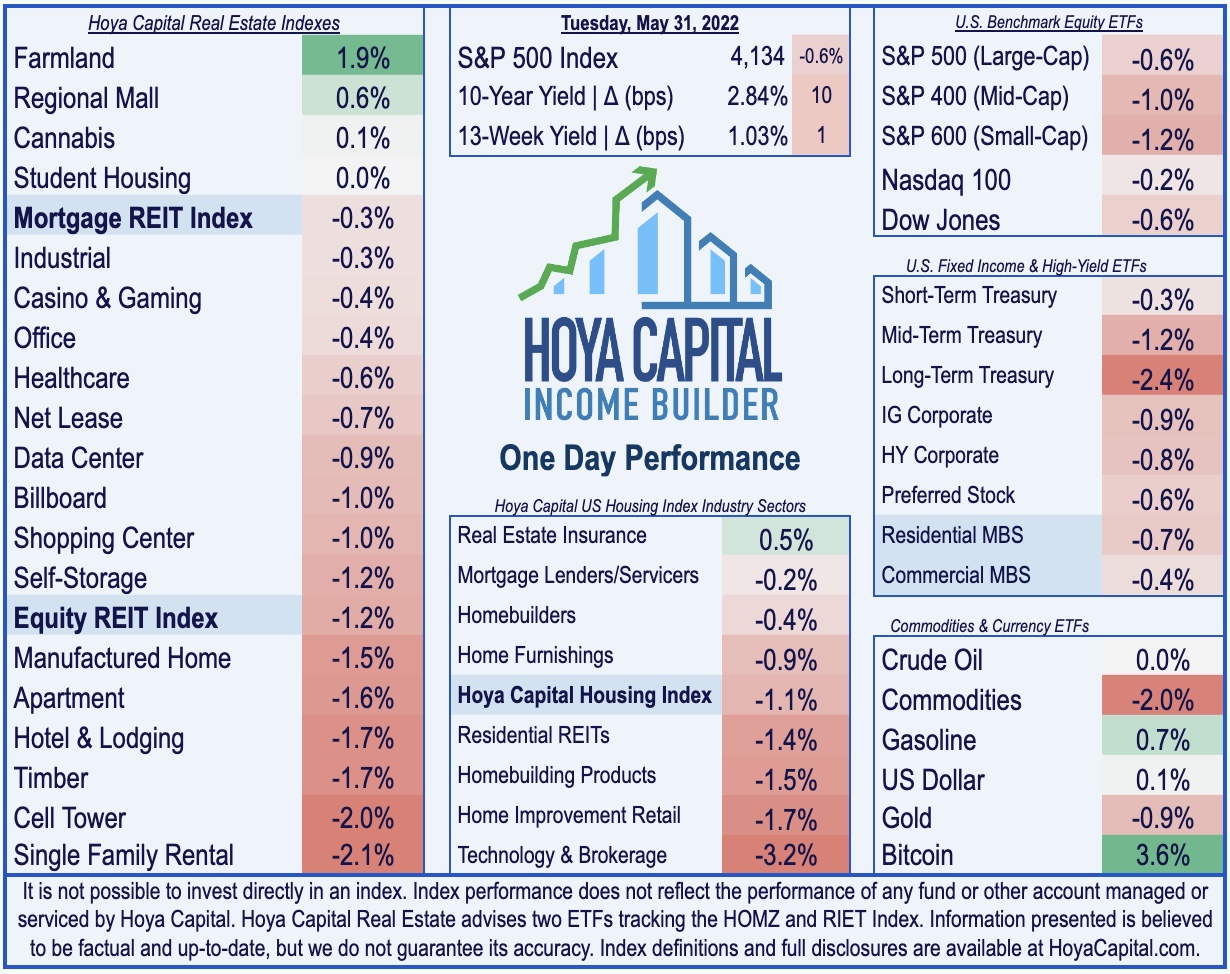

- U.S. equity markets slipped Tuesday following their best week since November 2020 as global interest rates rebounded today after China announced economic stimulus plans and began to ease COVID lockdowns.

- Giving back some of its 6.6% surge last week, the S&P 500 slipped 0.6% today - finishing the month of May with fractional gains - while the tech-heavy Nasdaq 100 declined 0.2%.

- Real estate equities were mostly lower as well today with the Equity REIT Index declining 1.2% with 15-of-19 property sectors in negative territory while Mortgage REITs declined 0.3%.

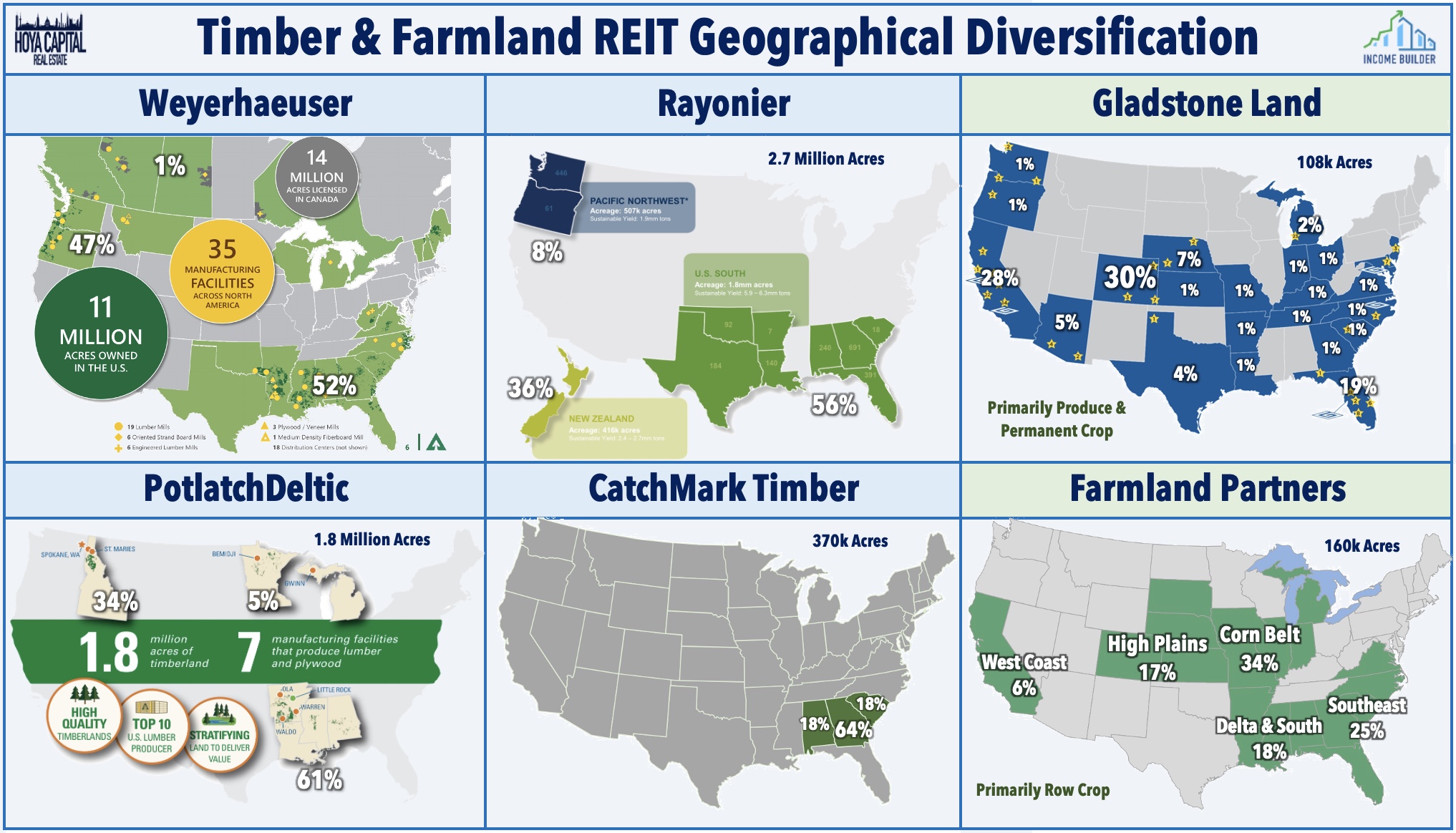

- PotlaticDeltic (PCH) announced that it will acquire CatchMark Timber (CTT) - the smallest of four timber REITs - in a roughly $600 million all-stock deal. The combined company will own 2.2 million acres of timberlands.

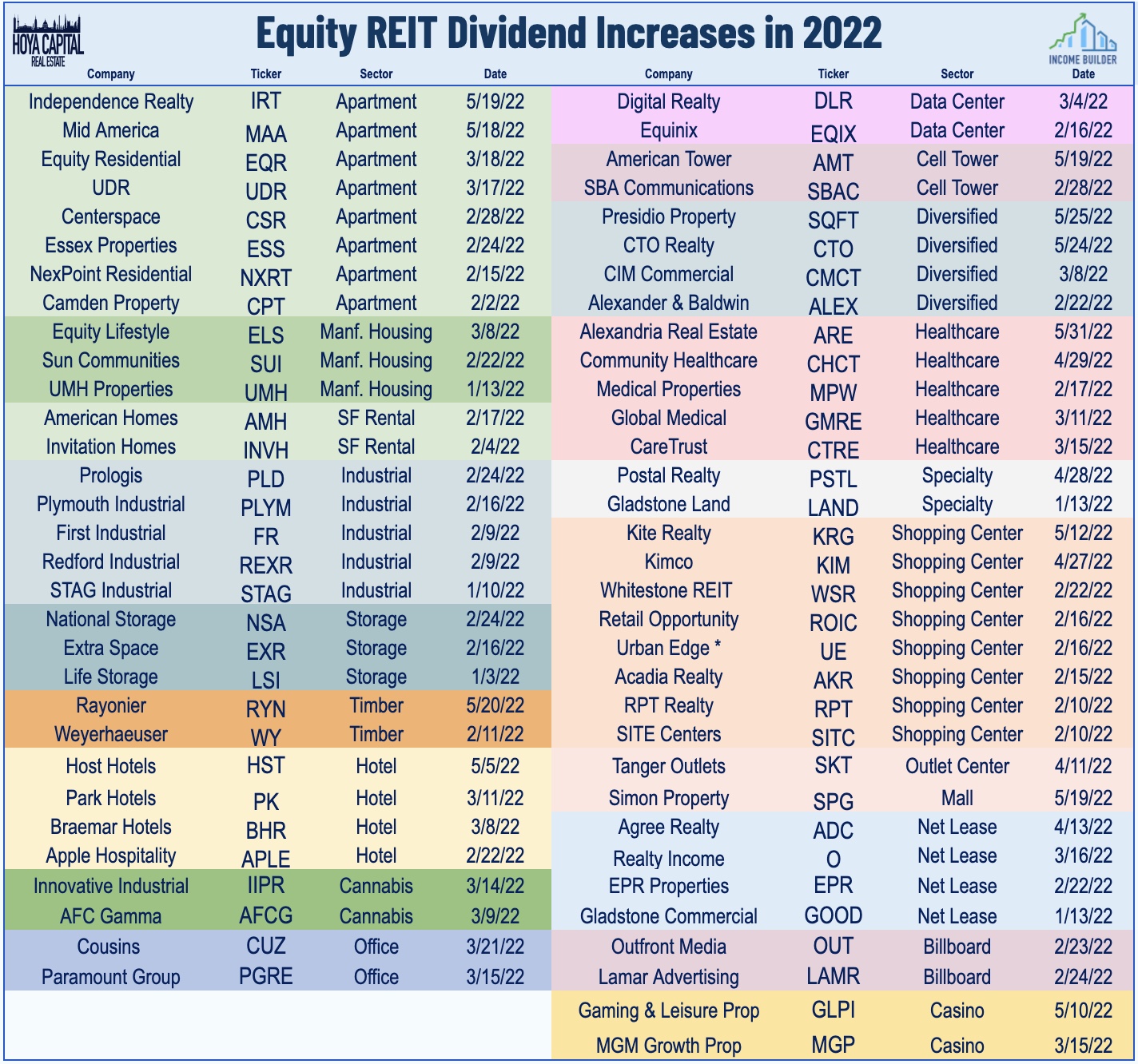

- Lab space operator Alexandria Real Estate (ARE) hiked its quarterly dividend by 2.6%. Alexandria - which has raised its dividend every year for more than a decade - becomes the 66th equity REIT to raise its dividend this year.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets slipped Tuesday following their best week since November 2020 as global interest rates rebounded today after China announced economic stimulus plans and began to ease COVID lockdowns. Giving back some of its 6.6% surge last week, the S&P 500 slipped 0.6% today - finishing the month of May with fractional gains - while the tech-heavy Nasdaq 100 declined 0.2% and finished May with declines of about 1%. Real estate equities were mostly lower on a busy day of M&A news as the Equity REIT Index slipped 1.2% today with 15-of-19 property sectors in negative territory while Mortgage REITs declined 1.3%.

As discussed in our Real Estate Weekly Outlook, the equity market rebound has been supported by a moderation in Treasury yields amid concerns over slowing global economic growth and signs of peaking inflation. Treasury yields rebounded today, however, as the 10-Year Treasury Yield jumped 10 basis points to close at 2.84%, but still well below the recent 3.20% peak earlier this month. Crude oil and commodities prices gained following China's stimulus announcement and after the EU rolled out a new oil embargo on Russia, but pared their gains late in the session. Ten of the eleven GICS equity sectors were lower today, dragged to the downside by the Energy (XLE) and Materials (XLB) sectors while the Consumer Discretionary (XLY) sector led to the upside.

Employment data highlights another busy week of economic data in the week ahead, headlined by ADP Employment and JOLTS data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 310k in May which would be the lowest month-over-month increase since April 2021 as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. We also saw home price data today with reports from Case Shiller and the FHFA but due to the nearly two-month lag in these indexes, the effect of the recent cool down in home sales activity may not yet be seen. We'll also be watching Construction Spending on Wednesday and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Real Estate Daily Recap

Timber: A pair of companies in our newly-launched Landowner Portfolio announced a merger today as PotlaticDeltic (PCH) announced that it will acquire CatchMark Timber (CTT) - the smallest of four timber REITs - in a roughly $600 million all-stock deal. The combined company will own 2.2 million acres of timberlands, including 626,000 acres in Idaho and over 1.5 million acres in the U.S. South and have a market valuation of roughly $4 billion. PCH reflects a price of $12.88 for each share of CTT - a 55% premium to its most recent close - which is roughly at the levels that CTT traded in late 2021 before running into a myriad of issues with its now-exited Triple T joint venture. PotlatchDeltic shareholders will own 86% of the combined company.

Healthcare: Another day, another REIT dividend hike. Lab space operator Alexandria Real Estate (ARE) - which we own in the REIT Dividend Growth Portfolio - hiked its quarterly dividend by 2.6% to $1.18/share, representing a forward yield of roughly 2.8%. ARE - which has raised its dividend every year for more than a decade - becomes the 66th equity REIT to raise its dividend this year. In our State of the REIT Nation report published earlier this month, we noted that FFO growth has significantly outpaced dividend growth over the past several quarters, driving the dividend payout ratios to just 68.8% in Q1, so REITs are well-equipped to deliver another year of robust dividend growth that may meet or exceed the record year in 2021.

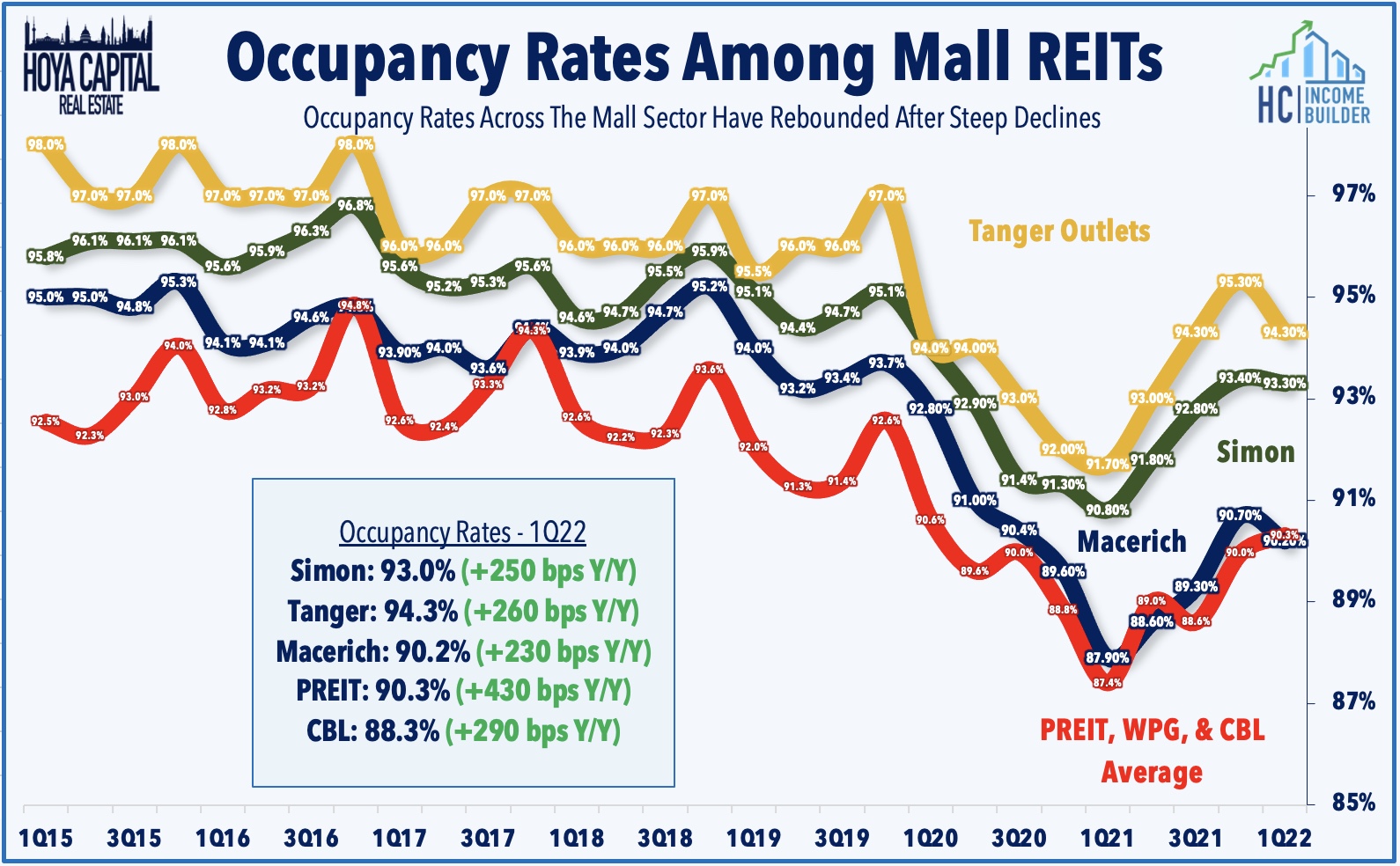

Mall: PREIT (PEI) surged more than 7% today after reporting progress in its asset-raising plans with the execution of sale agreements for 12 parcels that will generate gross proceeds of roughly $35M. PREIT - which has a Debt Ratio of around 80% - has been seeking to sell-off land around its mall assets to pay down its debt and had previously announced $275M in asset sales in progress. Last week in Mall REITs: Retail Rout, we noted that mall REITs earnings results were actually decently encouraging with Simon and Tanger boosting their full-year FFO outlook, noting a recovery in tenant sales and rent collection back to pre-pandemic levels. Soaring fuel prices and persistent inflation have triggered a "rapid slowdown" in several retail categories in recent months at some major retailers, however, and we reiterate that a recession could be a final death blow to many lower-tier malls.

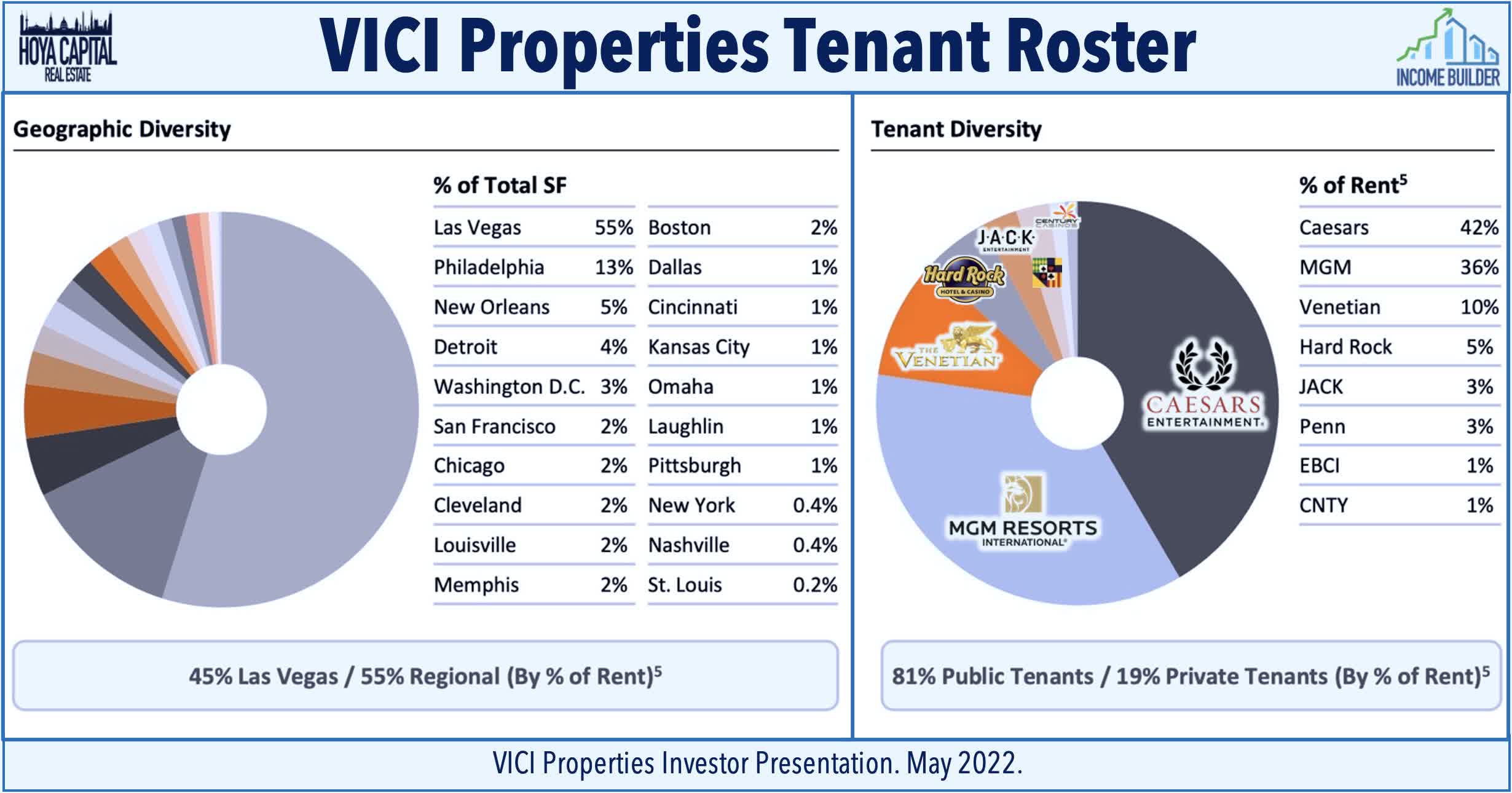

Casinos: Today, we published Casino REITs: Gambling On Inflation? Casino REITs have been among the best-performing property sectors this year as the positive tailwinds from the leisure demand recovery have offset inflation headwinds and economic growth concerns. Despite their ultra-long-term triple net lease structures, casino REITs are better protected from inflation than many would presume, making heavy use of CPI-linked escalators and tenant revenue share agreements. Casino REITs- which emerged in the late 2010s- have benefited from an upward "re-rating" from investors as the sector has matured and as the business model has become better understood. While no longer under the radar, Casino REITs remain one of our favorite yield-oriented property sectors, providing strong value with 5-6% dividend yields and growth potential through continued consolidation.

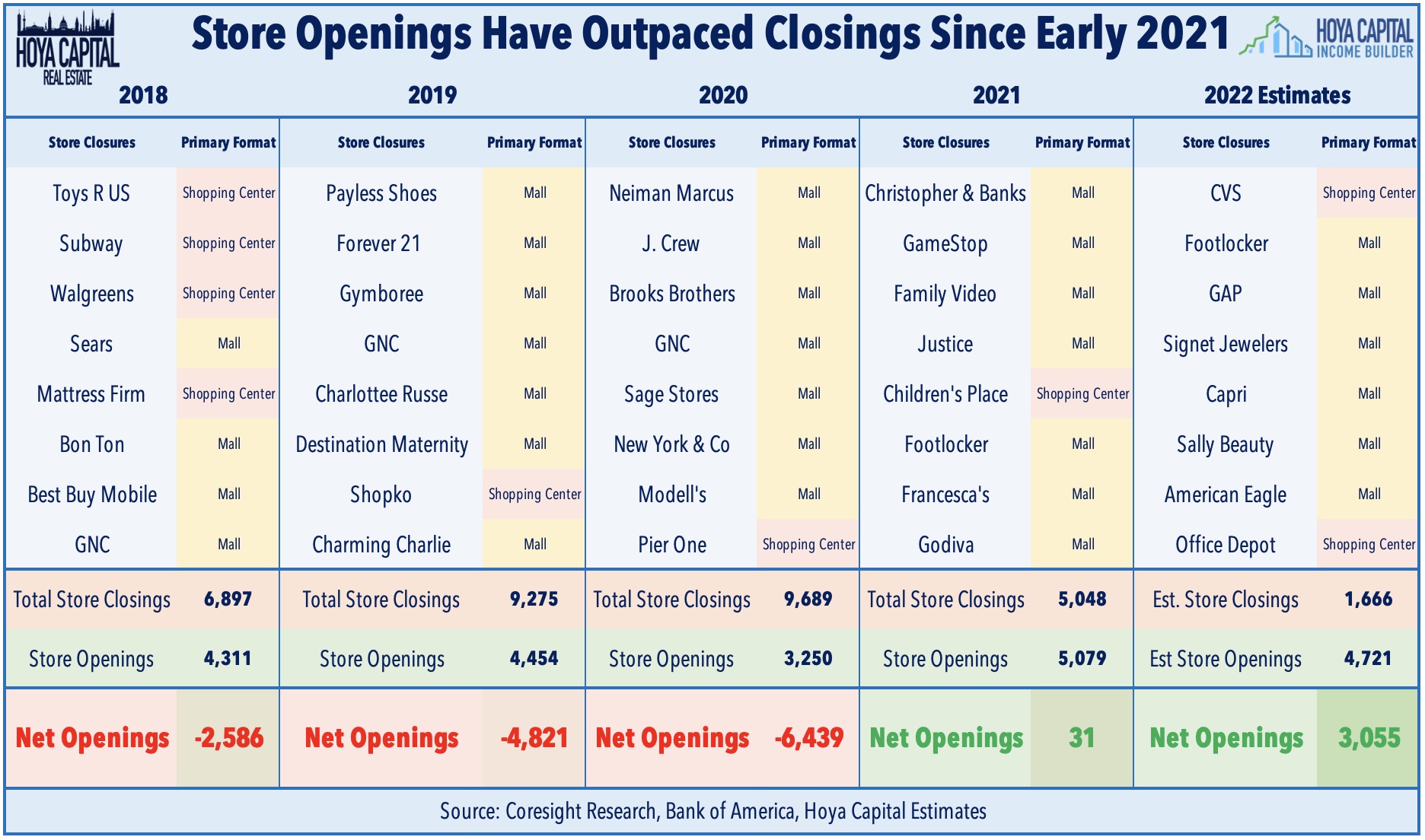

Shopping Center: On the Income Builder marketplace this afternoon, we'll publish our updated REIT Rankings report on the Shopping Center sector. Significantly outpacing their mall REIT peers, shopping center REITs are the second-best performing major property sector this year despite the recent "retail rout." Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are as strong – if not stronger - than before the pandemic with a full recovery in both FFO and NOI now complete. Results in the first quarter pushed the average occupancy rate to the highest level since early 2015 while rental rate spreads have exhibited a notable acceleration since bottoming early last year. After a surge in store closings in 2020, the number of store openings have outpaced store closings by nearly 2x since the start of 2021 per Coresight Research's Store Closings Tracker.

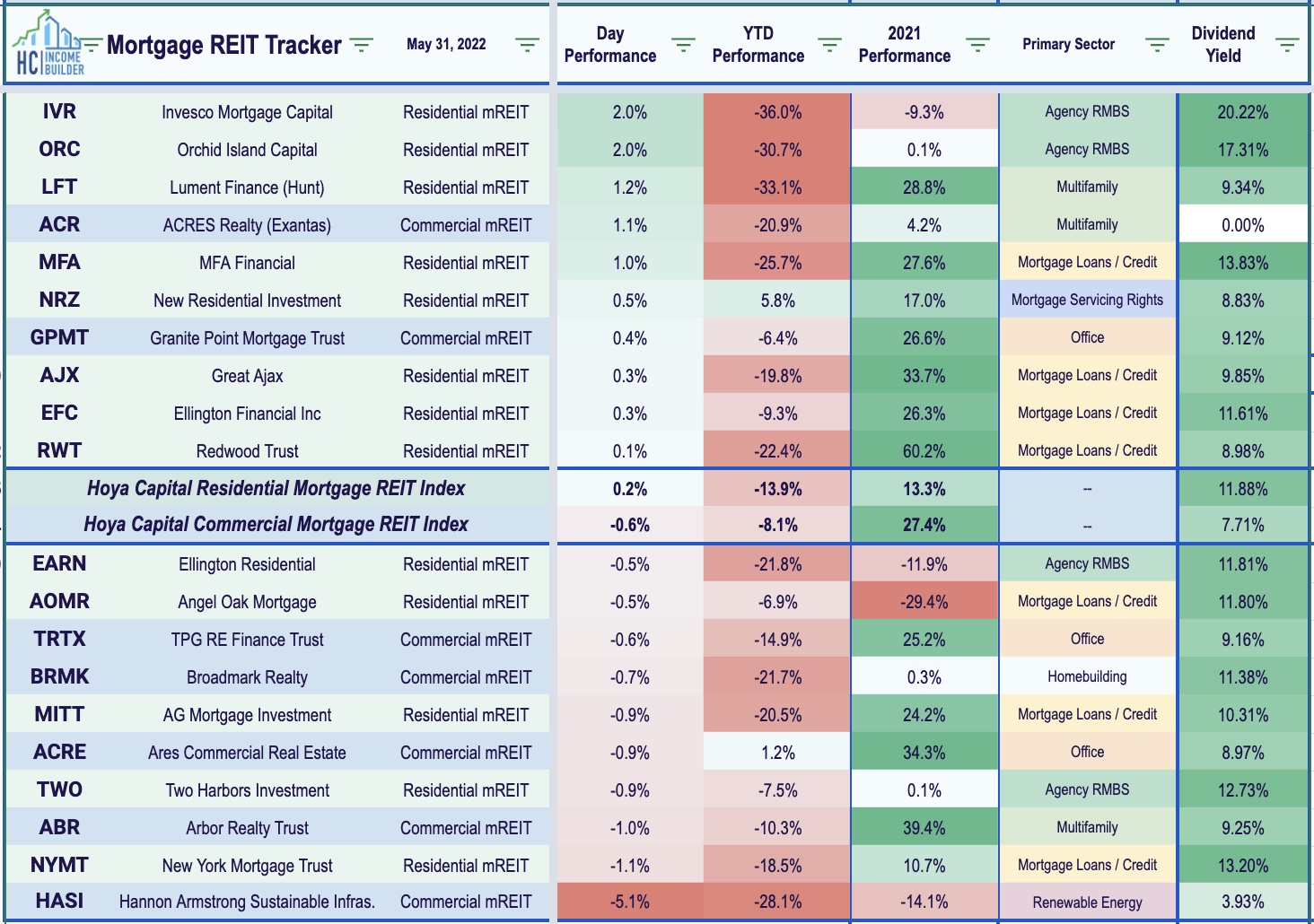

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today following their best week in over a year as residential mREITs advanced 0.2% while commercial mREITs declined 0.6%. In our Earnings Recap published last week, we noted that mREITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

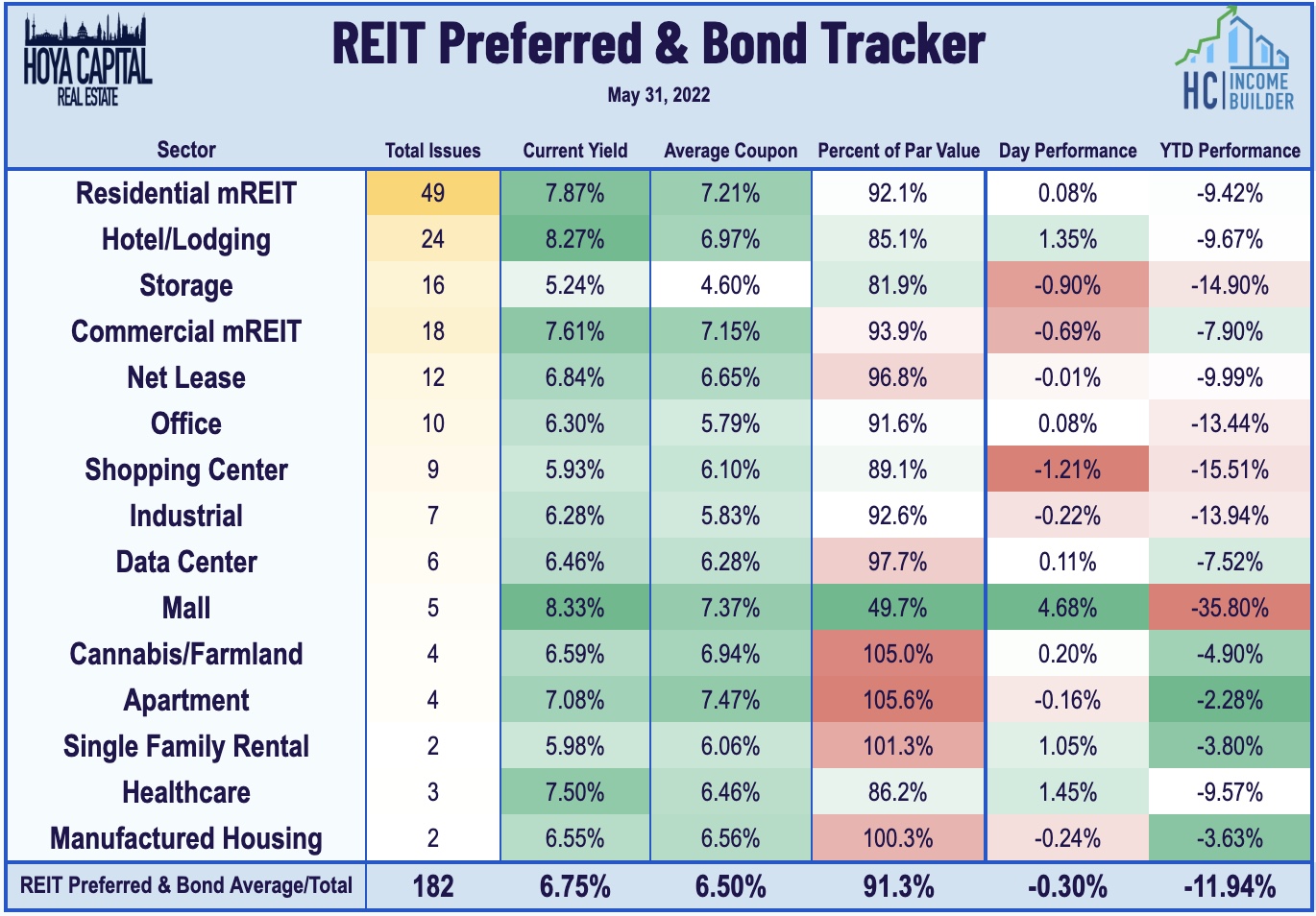

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.30% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.96%. Over in the capital markets, Fitch Ratings upgraded the credit rating for Mid-America Apartments (MAA) ”A-“ from “BBB+” with a stable outlook.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.