Drill Baby Drill • REIT Acquisitions • Jobs Day Ahead

- U.S. equity markets rebounded Thursday ahead of the closely-watched employment report Friday as dovish Fed commentary and an OPEC agreement to increase oil production eased some concern over rising rates.

- Erasing two days of losses and pushing its week-to-date gains to 0.5%, the S&P 500 rallied 1.8% today while the tech-heavy Nasdaq 100 jumped nearly 3%.

- Led by the industrial and technology REIT sectors real estate equities were also broadly higher as the Equity REIT Index advanced 1.4% today with all 19 property sectors in positive territory.

- A handful of REITs announced additions to their property portfolio. Rexford Industrial acquired four industrial properties for $163.8M; Terreno Realty (TRNO) acquired an industrial property for $34.6M; EPR Properties acquired a pair of Canadian resorts for $142M.

- In tomorrow's employment report, economists are looking for job growth of 310k in May which would be the lowest month-over-month increase since April 2021 as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Thursday ahead of the closely-watched employment report Friday as dovish Fed commentary and an OPEC agreement to increase oil production eased some concern over rising rates. Erasing two days of losses and pushing its week-to-date gains to 0.5%, the S&P 500 rallied 1.8% today while the tech-heavy Nasdaq 100 jumped nearly 3%. The Mid-Cap 400 and Small-Cap 600 each advanced about 2%. Led by the industrial and technology REIT sectors real estate equities were also broadly higher as the Equity REIT Index advanced 1.4% today with all 19 property sectors in positive territory while the Mortgage REIT Index advanced 0.4%.

This week's rebound in benchmark interest rates moderated today following somewhat dovish comments from Federal Reserve Vice Chairwoman Lael Brainard, who stated that half-percentage-point interest-rate increases would likely be "appropriate" at the Fed’s next two meetings, pushing back on calls for 75 basis point hikes. The 10-Year Treasury Yield declined 1 basis point to close at 2.91% - still below the 3.20% peak earlier this month - but above the 2.71% low last week. Crude Oil prices gained today despite an OPEC agreement to a bigger-than-expected oil-production increase as gasoline prices in the U.S. set yet another record-high today at $4.715 per gallon. Led to the upside by the Consumer Discretionary (XLY) and Materials (XLB) sectors, ten of the eleven GICS equity sectors were higher today.

Real Estate Daily Recap

Shopping Center: Today, we published Shopping Center REITs: Winning The Last Mile. Significantly outpacing their mall REIT peers, shopping center REITs are the second-best performing major property sector this year. Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are as strong – if not stronger - than before the pandemic with a full recovery in both FFO and NOI now complete. Results in the first quarter pushed the average occupancy rate to the highest level since early 2015 while rental rate spreads have exhibited a notable acceleration since bottoming early last year. Importantly, we believe that this slowed pace of store closings - particularly in the strip center format - goes beyond the near-term COVID-related trends and is indicative of a sustained retailer focus on highly efficient and well-located large-format space which can serve as hybrid showroom/distribution centers.

Industrial & Net Lease: A handful of REITs announced additions to their property portfolio. Rexford Industrial (REXR) acquired four industrial properties for $163.8M within its primary Southern California region, bringing the company's YTD total to $774M. Terreno Realty (TRNO) acquired an industrial property located in San Leandro, California for $34.6M. Experience-focused net lease REIT EPR Properties (EPR) acquired the Village Vacances Valcartier resort and hotel in Quebec and the Calypso Waterpark in Ottawa for $142M. The Village Vacances Valcartier is an four-season resort covering approximately 225 acres and offering indoor and outdoor water park attractions and winter activities. Calypso Waterpark is the largest themed waterpark in Canada covering approximately 350 acres.

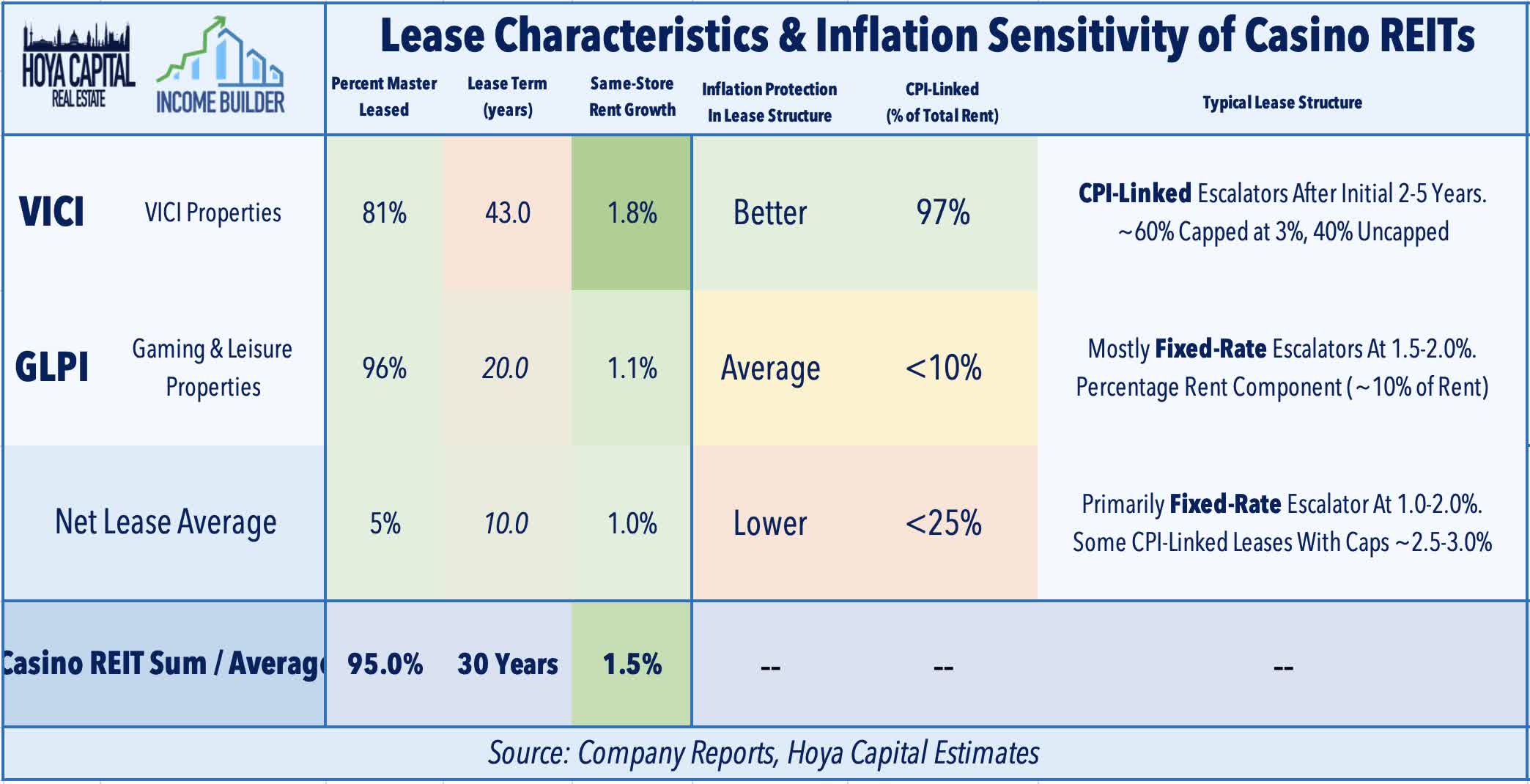

Casinos: Earlier this week, we published Casino REITs: Gambling On Inflation? Casino REITs have been among the best-performing property sectors this year as the positive tailwinds from the leisure demand recovery have offset inflation headwinds and economic growth concerns. Despite their ultra-long-term triple net lease structures, casino REITs are better protected from inflation than many would presume, making heavy use of CPI-linked escalators and tenant revenue share agreements. Casino REITs- which emerged in the late 2010s- have benefited from an upward "re-rating" from investors as the sector has matured and as the business model has become better understood. While no longer under the radar, Casino REITs remain one of our favorite yield-oriented property sectors, providing strong value with 5-6% dividend yields and growth potential through continued consolidation.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly higher today as residential mREITs advanced 0.9% while commercial mREITs gained 0.4%. PennyMac Mortgage (PMT) was flat today after holding its quarterly dividend steady at $0.47/share, representing a forward yield of 11.55%. Franklin BSP Realty (FBRT) gained 0.4% after announcing the closing of five mortgage floating-rate bridge loans totaling $368.4M for enabling the acquisition of twenty multifamily assets, totaling 2,899 units. The loans are structured with 2-year initial term and three one-year extension options. In our Earnings Recap published last week, we noted that mortgage REITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.03% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.72%. Over in the capital markets today, American Tower (AMT) announced a secondary offering of 8.35M shares of common stock to fund its CoreSite Realty acquisition, which closed in December 2021. KKR Real Estate (KREF) announced the launch of a public offering of 7M shares of KREF common stock, using the proceeds to originate, acquire and finance target assets in a manner consistent with its investment strategies and investment guidelines.

Economic Data This Week

Employment data highlights another busy week of economic data in the week ahead, headlined by ADP Employment and JOLTS data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 310k in May which would be the lowest month-over-month increase since April 2021 as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. We also saw home price data today with reports from Case Shiller and the FHFA but due to the nearly two-month lag in these indexes, the effect of the recent cool down in home sales activity may not yet be seen. We'll also be watching Construction Spending on Wednesday and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.