Rents Still Rising • Student Housing Deal • Record Gas Prices

- U.S. equity markets slipped for the second-straight session Wednesday as benchmark interest rates marched higher amid persistent inflation concerns as gasoline prices in the U.S. climbed to fresh record-highs.

- Following declines of 0.6% yesterday, the S&P 500 slipped another 0.8% today- extending its drawdown to roughly 14%- while the tech-heavy Nasdaq declined 0.7% to push its drawdowns to 24%.

- Within the real estate sector, strong performance from residential REITs was offset by declines from retail REITs. The Equity REIT Index declined 0.8% today but Mortgage REITs advanced 0.3%.

- Data provider Apartment List published its June National Rent Report today. The firm reported that rent growth accelerated slightly again this month, with its national index rising by 1.2% in May - bringing its year-over-year rent growth total to a "staggering" 15.3%.

- Asset manager Greystar Real Estate announced a $4.2 billion deal to acquire Student Roast - a 23,000-bed student housing portfolio in the U.K. - from Brookfield Asset Management. Greystar will become the second-largest student housing owner with more than 100,000 beds.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets slipped for the second-straight session Wednesday as benchmark interest rates marched higher amid persistent inflation concerns as gasoline prices in the U.S. climbed to fresh record-highs. Following declines of 0.6% yesterday, the S&P 500 slipped another 0.8% today - extending its drawdown to roughly 14% - while the tech-heavy Nasdaq 100 declined 0.7% to push its drawdown to 24%. Within the real estate sector, strong performance from residential REITs was offset by declines from retail REITs. The Equity REIT Index declined 0.8% today with 15-of-19 property sectors in negative territory but the Mortgage REITs advanced 0.3%.

After moderating over the past several weeks on optimism of peaking inflation, global benchmark interest rates have rebounded rather sharply this week, buoyed by news of China reopening plans and by a continued rise in gasoline prices, which climbed to fresh record-highs today at $4.671 per gallon - up 53% from a year ago - while diesel prices climbed to $5.54 per gallon - up nearly 75% from last year. The 10-Year Treasury Yield jumped another 9 basis points to close at 2.93% - still below the 3.20% peak earlier this month - but above the 2.71% low last week. Ten of the eleven GICS equity sectors finished lower today with Financials (XLF) and Healthcare (XLV) dragging on the downside while the Energy (XLE) sector advanced nearly 2%.

Real Estate Daily Recap

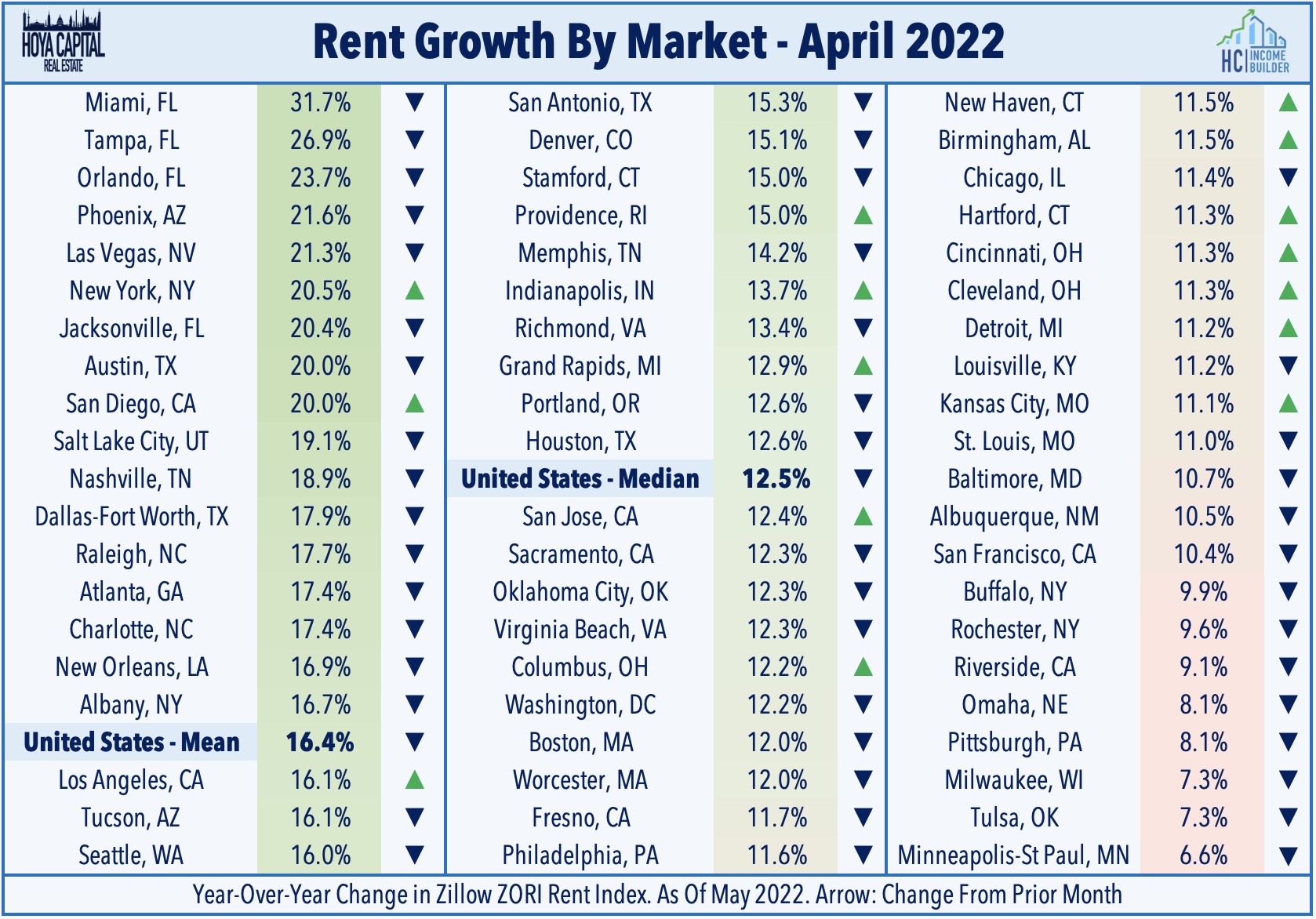

Apartments: Data provider Apartment List published its June National Rent Report today. The firm reported that rent growth accelerated slightly again this month, with its national index rising by 1.2% in May - bringing its year-over-year rent growth total to a "staggering" 15.3%. So far this year, rents are growing more slowly than they did in 2021, but faster than the growth observed in the years immediately preceding the pandemic. Over the first five months of 2022, rents have increased by a total of 3.9% percent, compared to an increase of 6.1% over the same months of 2021. Consistent with data last week from Zillow (Z), Apartment List reported that rents increased this month in 96 of the nation’s 100 largest cities while its vacancy index ticked higher to 5.0%, up from a low of 4.1%, but well below the pre-pandemic norm.

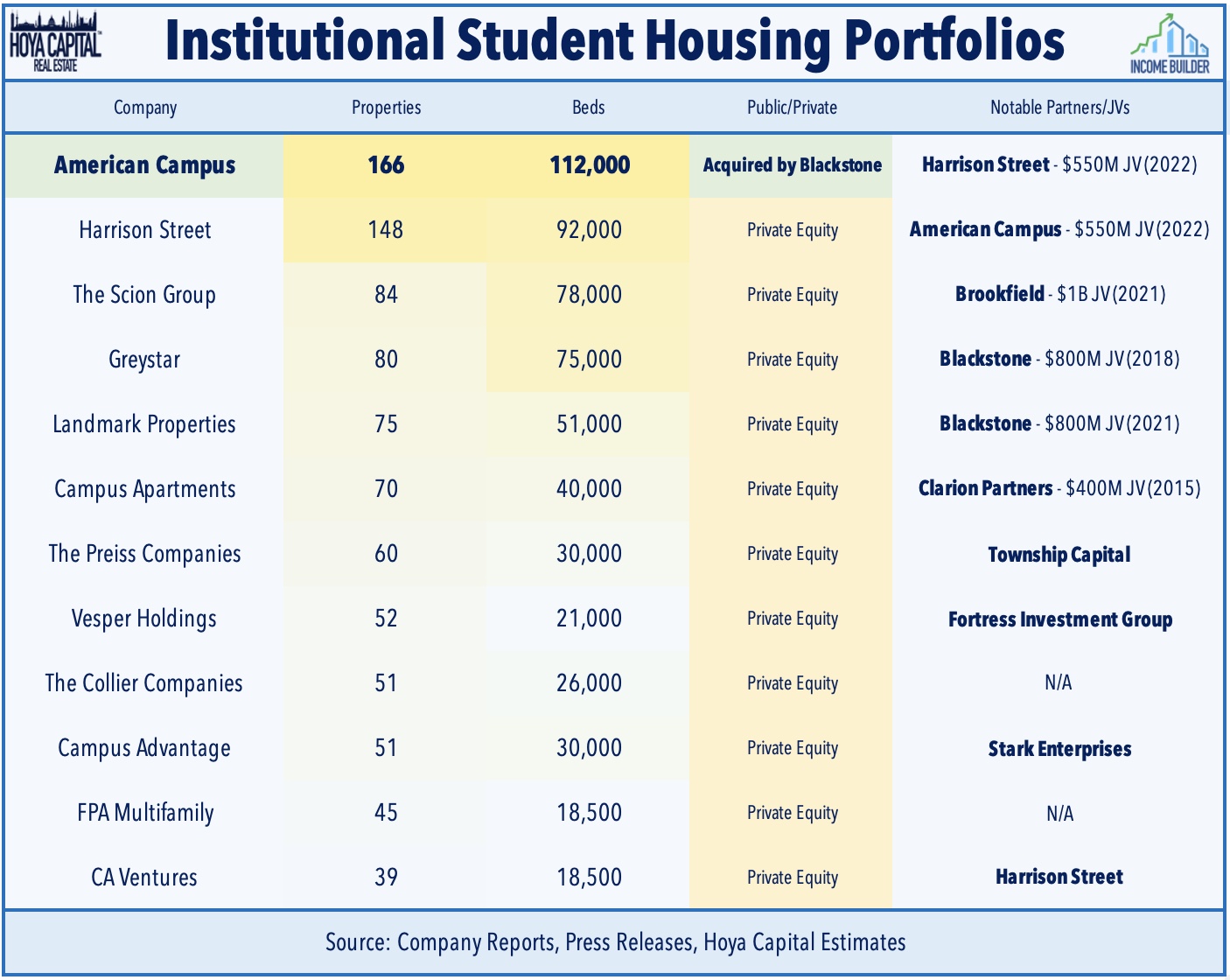

Student Housing: Privately-owned asset manager Greystar Real Estate announced a $4.2 billion deal to acquire Student Roast - a 23,000-bed student housing portfolio in the U.K. - from Brookfield Asset Management (BAM). Student Roost - the largest student housing operator in England - operates in more than 20 cities across the UK and reportedly drew interest from Blackstone (BX), among others. With the deal, Greystar will become the second-largest student housing owner with more than 100,000 beds, second only to American Campus (ACC), which was acquired by Blackstone earlier this year in a $12.8 billion in an all-cash transaction. ACC was the last remaining public REIT following Greystar's 2018 acquisition of EDR and Harrison Street's 2015 acquisition of Campus Crest.

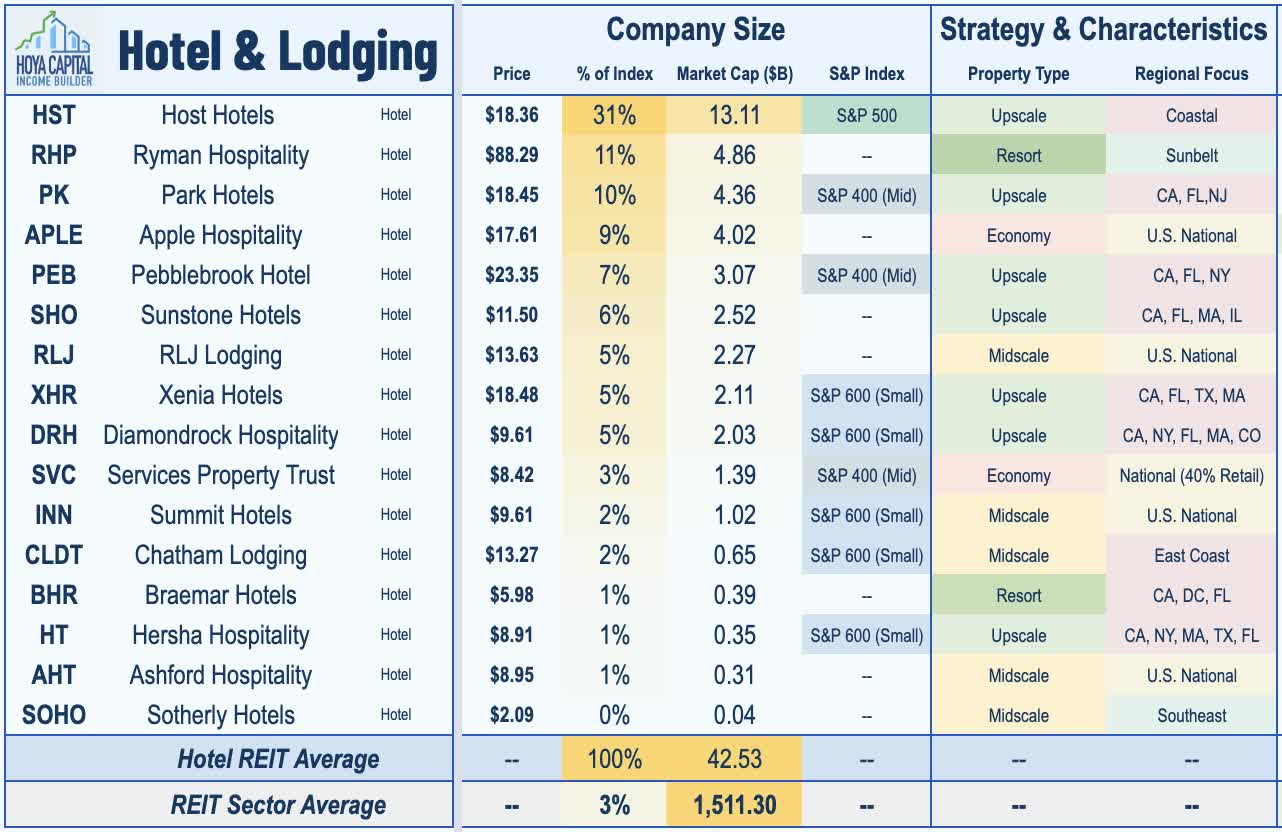

Hotel: Sunstone Hotels (SHO) announced that it will acquire a 25% joint venture interest in the 1,190-room Hilton San Diego Bayfront from Park Hotels (PK). Following the acquisition, Sunstone will own 100% of the venture's interests in the Hotel. Sunstone will pay Park $102M in cash and will effectively assume Park's $55 million share of the existing mortgage loan on the Hotel, which is already fully consolidated as part of Sunstone's financial statements. The purchase price implies a $628M value for the Hotel, or $527,700 per key, and represents a 13.2x multiple on the Hotel's 2022 forecasted EBITDA and a 6.6% cap rate on 2022 forecasted NOI.

Shopping Center: On the Income Builder marketplace yesterday, we published Shopping Center REITs: The Bigger The Better. Significantly outpacing their mall REIT peers, shopping center REITs are the second-best performing major property sector this year despite the recent "retail rout." Results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are as strong – if not stronger - than before the pandemic with a full recovery in both FFO and NOI now complete. Results in the first quarter pushed the average occupancy rate to the highest level since early 2015 while rental rate spreads have exhibited a notable acceleration since bottoming early last year. We discussed our updated outlook and our favorite names in the sector.

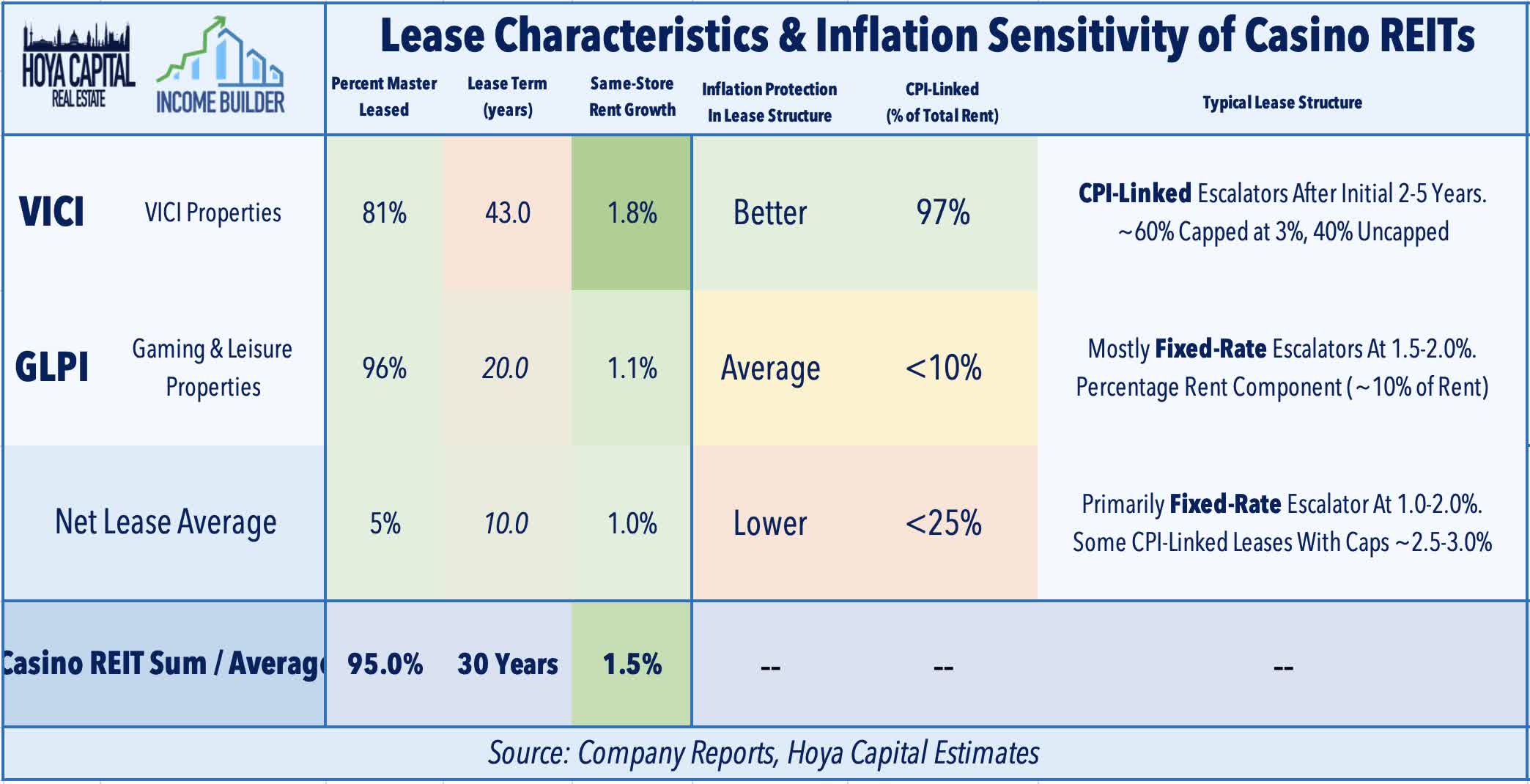

Casinos: Yesterday, we published Casino REITs: Gambling On Inflation? Casino REITs have been among the best-performing property sectors this year as the positive tailwinds from the leisure demand recovery have offset inflation headwinds and economic growth concerns. Despite their ultra-long-term triple net lease structures, casino REITs are better protected from inflation than many would presume, making heavy use of CPI-linked escalators and tenant revenue share agreements. Casino REITs- which emerged in the late 2010s- have benefited from an upward "re-rating" from investors as the sector has matured and as the business model has become better understood. While no longer under the radar, Casino REITs remain one of our favorite yield-oriented property sectors, providing strong value with 5-6% dividend yields and growth potential through continued consolidation.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today as residential mREITs advanced 0.1% while commercial mREITs declined 0.6%. On another slow day of mREIT newsflow, MFA Financial (MFA) and Orchid Island (ORC) led to the upside while Angel Oak Mortgage (AOMR) lagged following an analyst downgrade. In our Earnings Recap published last week, we noted that mortgage REITs have been an upside standout over the past several weeks after earnings season showed that Book Value declines were generally not as steep as analysts projected. Residential mREIT Book Value Per Share ("BVPS") metrics declined by 8.4%, on average while commercial mREIT reported an average BVPS increase of 0.1%.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished higher by 0.05% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.72%.

Economic Data This Week

Employment data highlights another busy week of economic data in the week ahead, headlined by ADP Employment and JOLTS data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of 310k in May which would be the lowest month-over-month increase since April 2021 as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. We also saw home price data today with reports from Case Shiller and the FHFA but due to the nearly two-month lag in these indexes, the effect of the recent cool down in home sales activity may not yet be seen. We'll also be watching Construction Spending on Wednesday and a flurry of Purchasing Managers' Index ("PMI") data throughout the week.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.