Stocks Slide • CPI Ahead • REIT Dividend Hikes

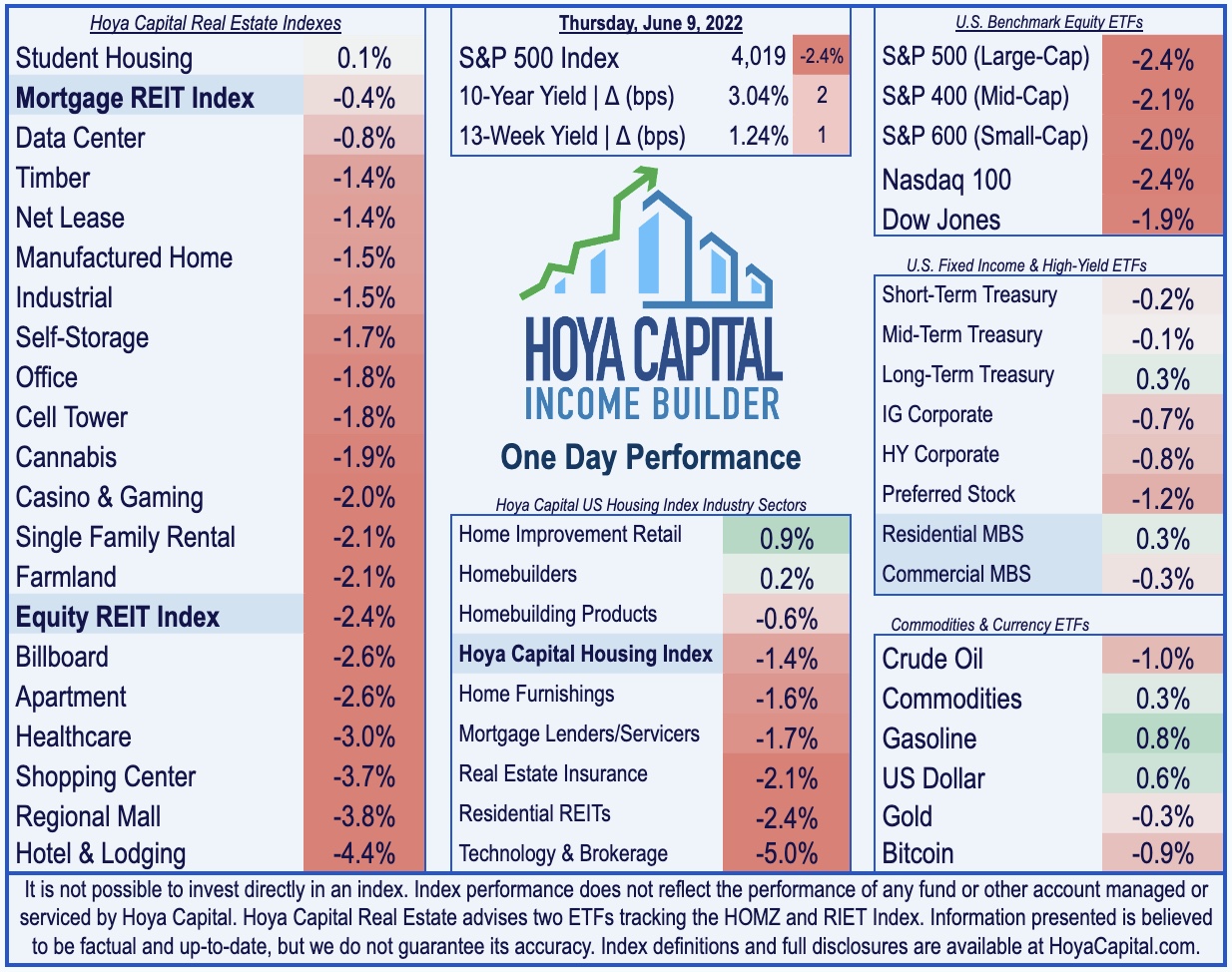

- U.S. equity markets slid into the close Thursday while yields marched higher ahead of a critical inflation report tomorrow that will carry weight in determining the pace of Fed rate hikes.

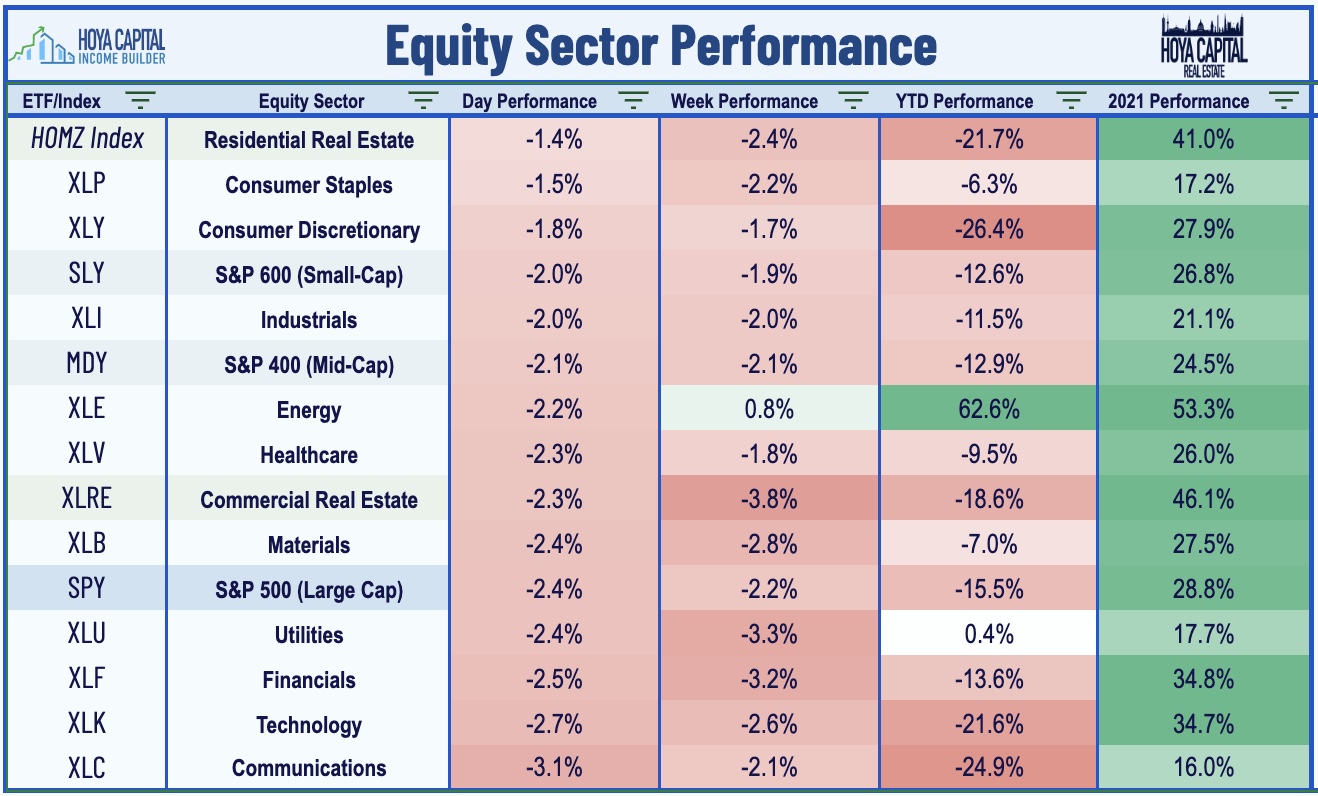

- Declining for the second-straight day and fully erasing its week-to-date gains, the S&P 500 slipped 2.4% today while the Mid-Cap 400 and the Small-Cap 600 each declined by roughly 2%.

- Real estate equities were also broadly lower today despite an upbeat slate of REITweek updates and dividend hikes. The Equity REIT Index declined 2.4% today with 18-of-19 property sectors lower.

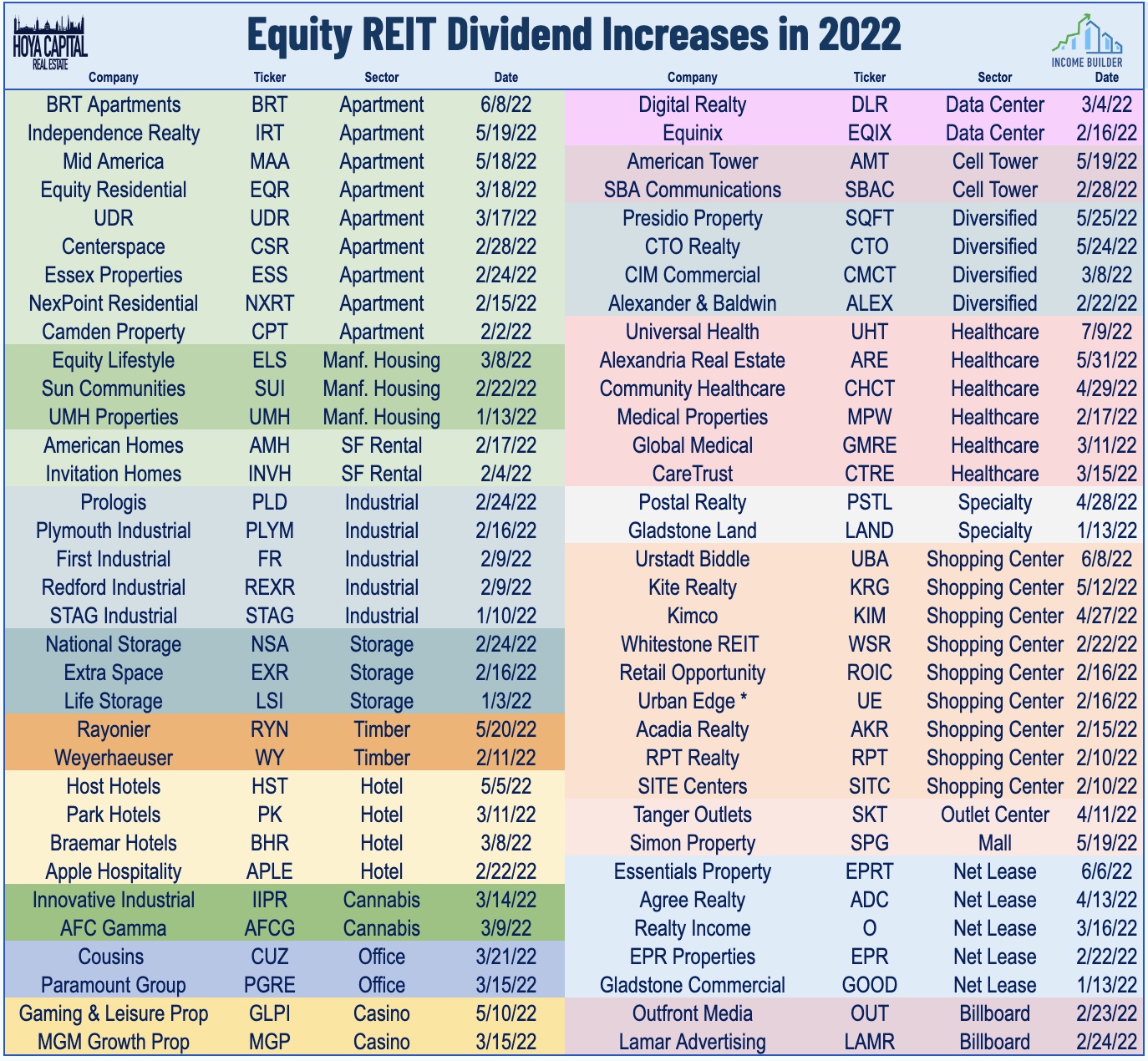

- Another day, another handful of REIT dividend hikes. Universal Health REIT and small-cap apartment REIT BRT Apartments each raised their quarterly dividends, bringing the full-year total up to 69 equity REIT dividend hikes.

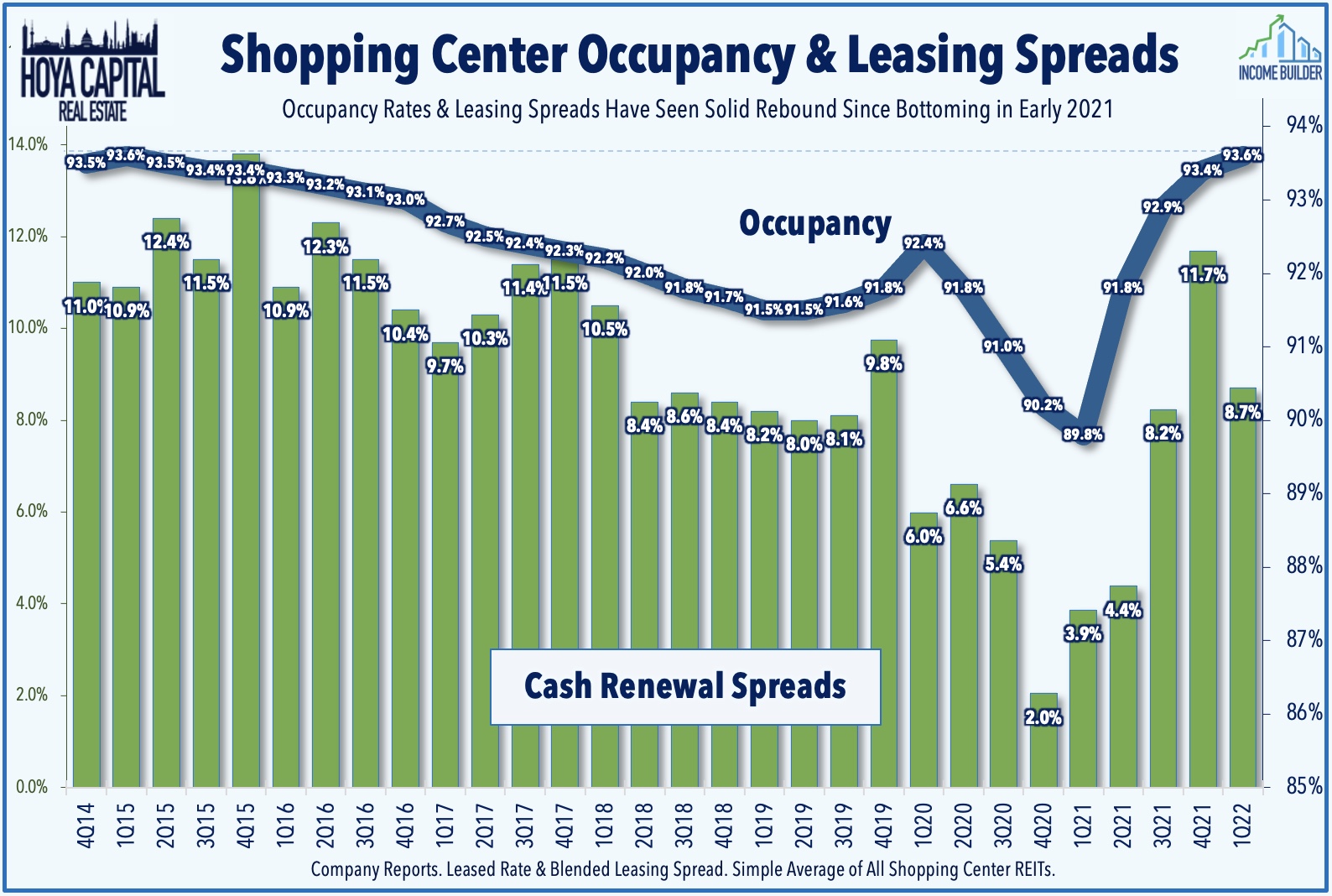

- Urstadt Biddle was among the best-performing REITs today after the small-cap shopping center REIT reported solid earnings results that highlighted an acceleration in rent growth on renewed leases.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets slid into the close Thursday while yields marched higher ahead of a critical CPI inflation report tomorrow morning that will carry weight in determining the pace of Fed interest-rate hikes. Declining for the second-straight day and fully erasing its week-to-date gains, the S&P 500 slipped 2.4% today while the Mid-Cap 400 and the Small-Cap 600 each declined by roughly 2%. Real estate equities were also broadly lower today despite an upbeat slate of REITweek updates and dividend hikes. The Equity REIT Index declined 2.4% today with 18-of-19 property sectors in negative territory while the Mortgage REIT Index finished lower by 0.4%.

All eyes will be on CPI inflation data tomorrow morning with investors and the Federal Reserve hoping to see signs of peaking consumer price inflation. Inflation remains an issue in the Eurozone as well, prompting the European Central Bank to lift off from negative levels on its key interest rate by September while ending its bond-buying program. The 10-Year Treasury Yield rose modestly to 3.04% today - still below the 3.20% peak in May - but above the 2.71% low in early June. All eleven GICS equity sectors declined on the day, dragged on the downside by the Communications (XLC) and Technology (XLK) sectors. Homebuilders and the broader Hoya Capital Housing Index were a notable source of strength, however, after Redfin data showed a continued acceleration in rent growth and robust demand for rental housing, consistent with REITweek updates throughout the week.

Real Estate Daily Recap

Shopping Center: Urstadt Biddle (UBP) - which we own in the REIT Focused Income Portfolio - was among the best-performing REITs today after reporting solid earnings results for its quarter ending April 30. Consistent with the broader shopping center REIT sector, UBP reported sequential gains in occupancy rates and an acceleration in rent growth on new and renewed leases. UBP commented that it believes that "the increasing demand for space will continue, particularly as supply becomes more constrained." In Shopping Center REITs: Winning The Last Mile, we discussed why shopping center fundamentals are now strong – if not stronger than before the pandemic. The versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid "distribution centers" in last-mile delivery networks.

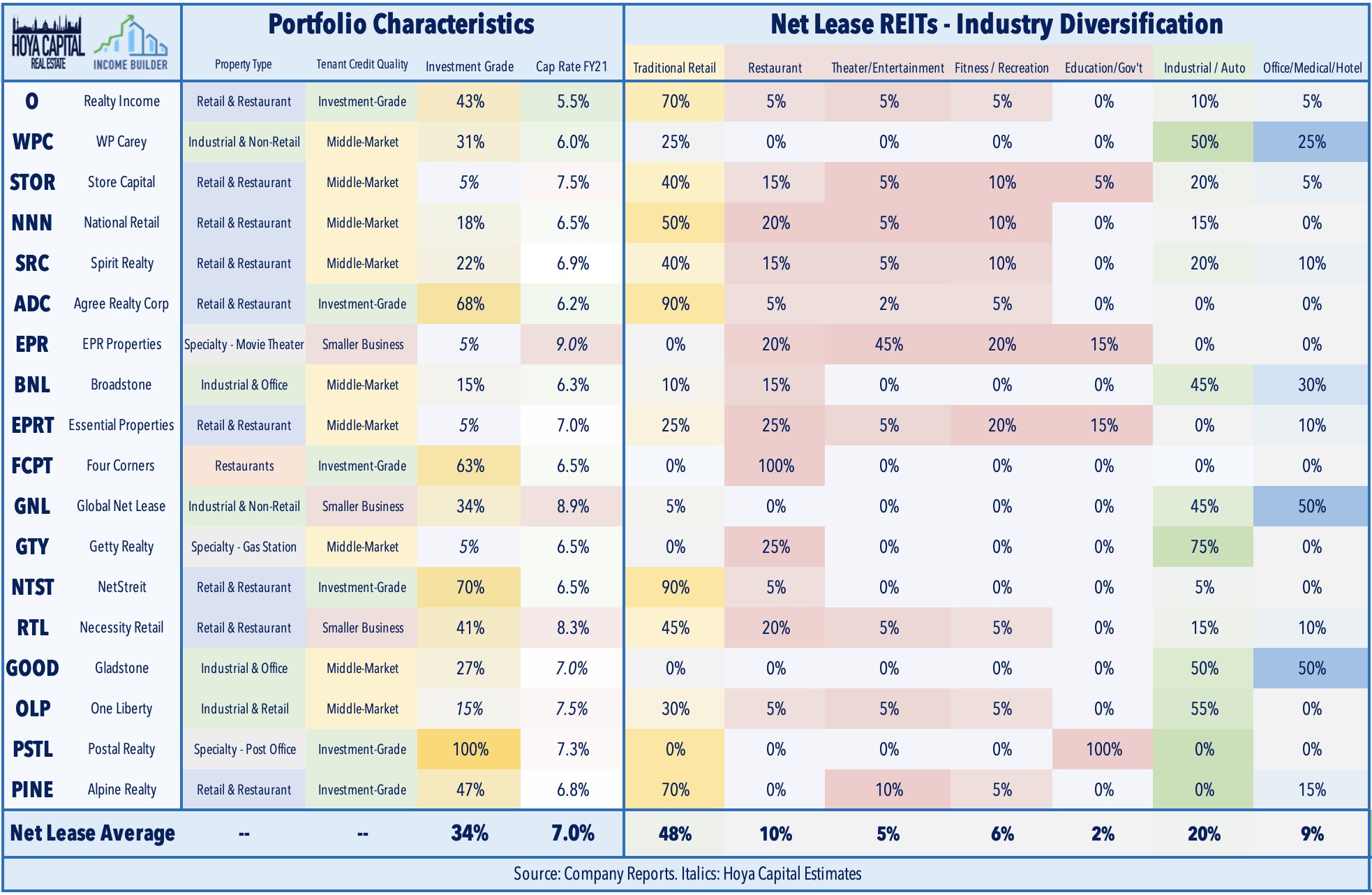

Net Lease: Today, we published Net Lease REITs: Deep-Dive Into Inflation Risk on the Income Builder marketplace. Understood to be one of the more "bond-like" and rate-sensitive REIT sectors, net lease REITs have surprisingly been among the best-performing property sectors this year despite the challenging macroeconomic environment. Even with rent growth significantly lagging inflation, net lease REITs are still on-pace for double-digit earnings growth as robust accretive external growth has more than offset the drag from muted property-level growth. The counterintuitive outperformance is consistent with the phenomenon discussed earlier this year in which net lease REITs actually outperformed the REIT sector during the prior Fed rate hike cycle from 2015-2019. Within the net lease sector, inflation risk isn't always efficiently-priced. We take a deep dive into the inflation risk across the sector, and reiterate our positive outlook on a handful of REITs that can outperform in a variety of potential macroeconomic environments.

Another day, another handful of REIT dividend hikes. Universal Health REIT (UHT) was among the leaders today after hiking its quarterly dividend by 1% to $0.71/share, representing a forward yield of 5.4%. Yesterday, small-cap apartment REIT BRT Apartments (BRT) raised its quarterly dividend by 9% to $0.25/share, an 8.7% increase from its prior dividend of $0.23. We've now seen 69th equity REITs raise their dividend this year along with another half-dozen mortgage REITs. In our State of the REIT Nation report published earlier this month, we noted that FFO growth has significantly outpaced dividend growth over the past several quarters, driving the dividend payout ratios to just 68.8% in Q1, so REITs are well-equipped to deliver another year of robust dividend growth that may meet or exceed the record year in 2021.

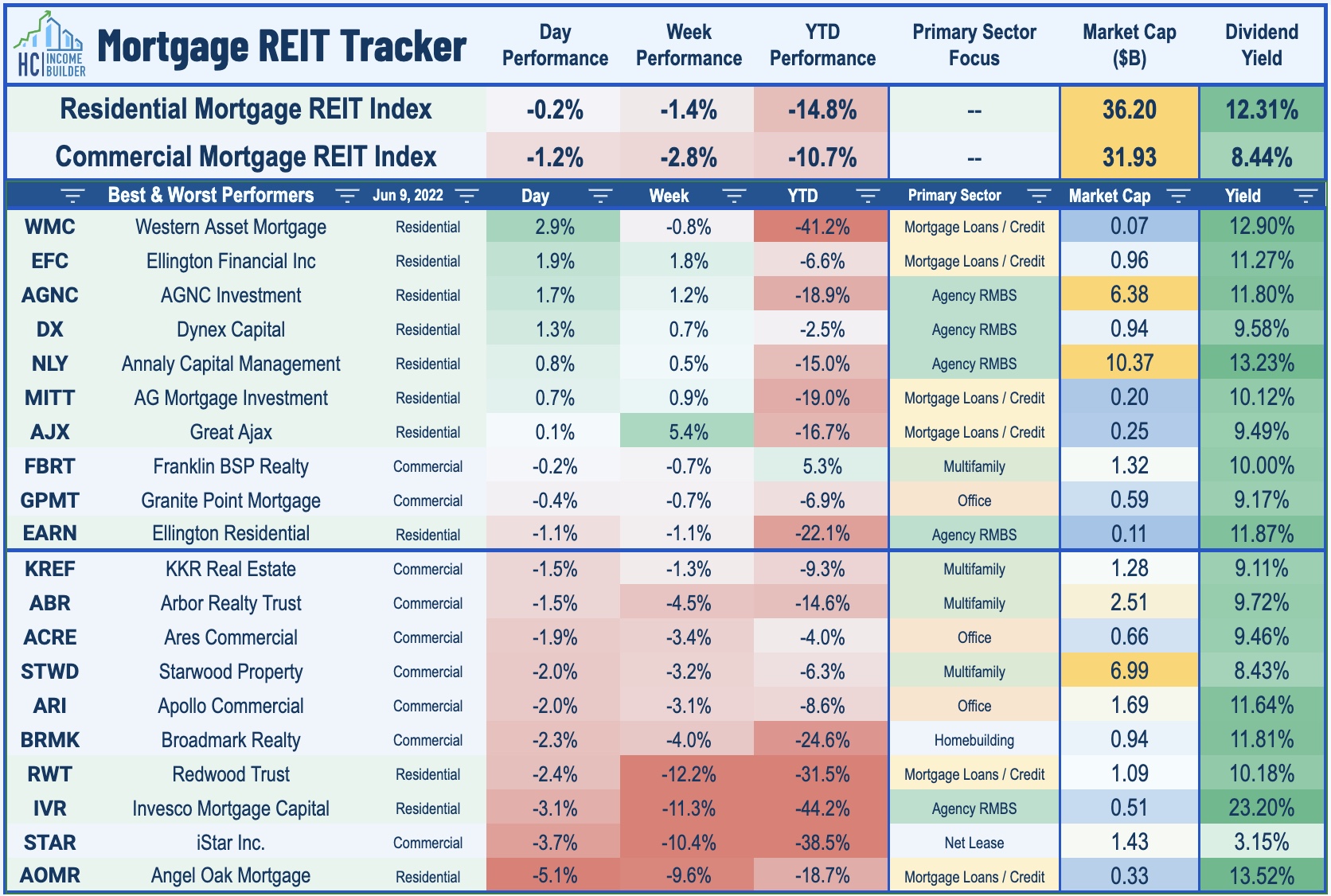

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mostly lower today as residential mREITs slipped 0.2% while commercial mREITs declined 1.2%. After the close yesterday, Annaly Capital (NLY) held its quarterly dividend steady at $0.22/share, representing a forward yield of 13.4%. Earlier in the week, Ellington Residential (EARN) and Ellington Financial (EFC) also held their monthly dividends steady at $0.08/share and $0.15/share, respectively. Dividend yields now average over 10%, a hearty premium to the 3.1% average for equity REITs. While some mREITs are pushing the upper limits of their payout capacity, we've seen twice as many dividend increases as decreases this year.

Yesterday, we published Mortgage REITs: Risk And Reward In Ultra-High Yield. Mortgage REITs – along with other fixed income-oriented securities across the credit and maturity curve - have stabilized in recent weeks as bond market volatility has calmed following a historically rough start to 2022. Earnings results confirmed that the challenging macro environment- marked by a "double-whammy" of rising rates and widening MBS spreads- wasn't the catastrophe to mREITs Book Values that some expected. Mortgage REITs are now outperforming Equity REITs for the year, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio.

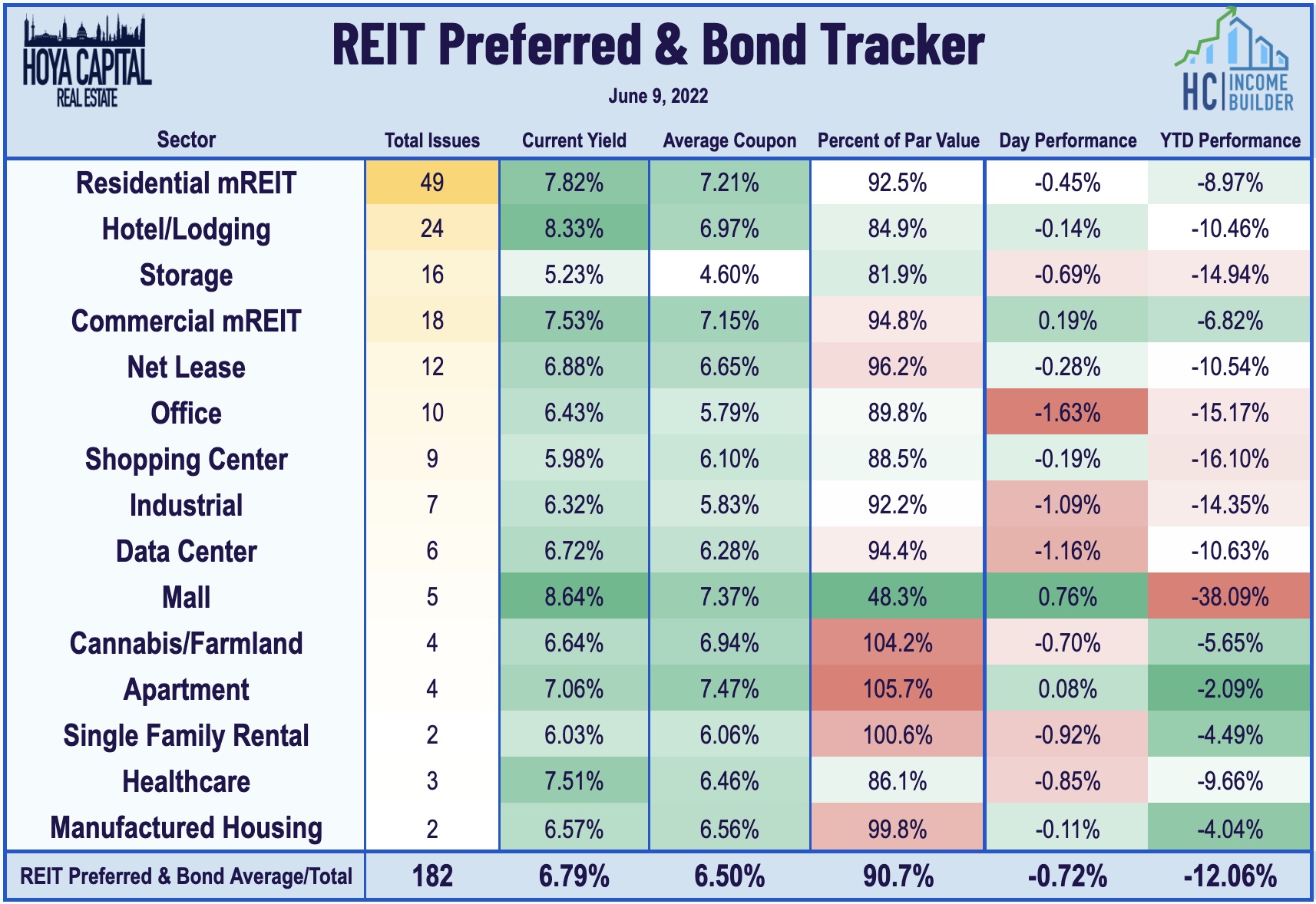

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, the Hoya Capital REIT Preferred Index finished lower by 0.72% today. REIT Preferreds ended 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.72%.

Economic Data This Week

Inflation data highlights the slower slate of economic data in the week ahead. On Friday, the BLS will report the Consumer Price Index which may potentially reveal that the fastest pace of year-over-year increases is finally behind us as both the headline and Core CPI is expected to show a cooldown in May to 8.3% and 5.9%, respectively. On Friday, we'll also get our first look at Michigan Consumer Sentiment for June. Last month, sentiment fell to the lowest level in more than 10 years as persistent inflation and worries over economic growth have weighed on confidence.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.