Red-Hot Inflation • Record-Low Confidence • Stocks Dive

- U.S. equity markets were slammed Friday - dragging the broad-based benchmarks to their worst week since January - after inflation data showed that consumer price pressures remain broad-based and unrelenting.

- Declining for the ninth week out of the past ten, the S&P 500 dipped 2.9% today, pushing its weekly declines to over 5%. The tech-heavy Nasdaq 100 dipped 3.5%.

- Real estate equities were also broadly lower today with the Equity REIT Index declining 2.3% today all 19 property sectors in negative territory while the Mortgage REIT Index declined 1.8%.

- Peak Inflation? Not Yet. Consumer prices rose at the fastest pace in more than four decades years in May and significantly faster than expected. Remarkably, the cost of food surged over 10% for the first time since March 1981 while energy prices soared 34.6%.

- Ongoing concerns over inflation sent the University of Michigan's consumer sentiment index plunging to all-time lows in June. Notably, with the midterm elections now months away, the report showed that sentiment among political independents dropped to the lowest on record.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets were slammed Friday - dragging the broad-based benchmarks to their worst week since January - after inflation data showed that consumer price pressures remain broad-based and unrelenting. Declining for the ninth week out of the past ten, the S&P 500 dipped 2.9% today, pushing its weekly declines to over 5%. The tech-heavy Nasdaq 100 dipped 3.5%, pushing its drawdown back to the cusp of 30%. Real estate equities were also broadly lower today with the Equity REIT Index declining 2.3% today all 19 property sectors in negative territory while the Mortgage REIT Index declined 1.8%.

Hotter-than-expected inflation data sent benchmark interest rates surging across the curve as the 2-Year Treasury Yield surged by 26 basis points to above 3.0% - the most since 2009 - marking a fresh 14-year high as investors price-in expectations of a more aggressive path of Fed rate hikes. The red-hot report prompted renewed calls for a 75 basis point rate hike at next week's FOMC meeting even after Fed Chair Powell pushed back on the idea of a triple-rate hike last month. All eleven GICS equity sectors were lower on the day - and on the week - with the Consumer Discretionary (XLY) and Technology (XLK) sectors dragging on the downside today.

Inflation Remains Red-Hot

Peak Inflation? Not Yet. Consumer prices rose at the fastest pace in more than 40 years in May - and significantly above analysts' estimates - as cost pressures continue to be far less "transitory" than economics and public officials projected. The annual increase in the headline Consumer Price Index accelerated to 8.5% in May - above the 8.3% rate expected - the highest since January 1981. The Core CPI - the metric on which the Fed focuses its attention - rose 6.0% - above expectations for a 5.9% gain. Remarkably, the energy index rose 34.6% over the last year, the largest 12-month increase since the period ending September 2005. The food index increased 10.1% for the 12-months ending May, the first increase of 10 percent or more since the period ending March 1981.

As we've discussed for the last year, we continue to project persistent pressure on the headline inflation metrics due to the delayed recognition of soaring shelter costs - the single largest weight in the CPI Index - which are just beginning to filter into the data. The cost of shelter increased 0.6% in May - the largest monthly increase since March 2004 - pushing its year-over-year rise to 5.5 - the largest 12-month increase since the period ending February 1991. We believe this still significantly understates the actual rise in shelter costs as private market rent data has shown that national rent inflation has been in the 10-15% range over the past twelve months while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

Ongoing concerns over inflation have weighed on consumer confidence since the middle of last year, sending the University of Michigan's consumer sentiment index plunging to all-time lows in June. The University of Michigan’s preliminary June sentiment index fell to 50.2, from 58.4 in May - substantially weaker than the 58.1 reading expected by economists. Just 13% expect their incomes to rise more than inflation, the lowest share in almost a decade. An index of expected business conditions over the next year fell to the second-lowest on record. Notably, with the midterm elections now months away with just four more inflation reports before Election Day, the report showed that sentiment among political independents dropped to the lowest on record.

Real Estate Daily Recap

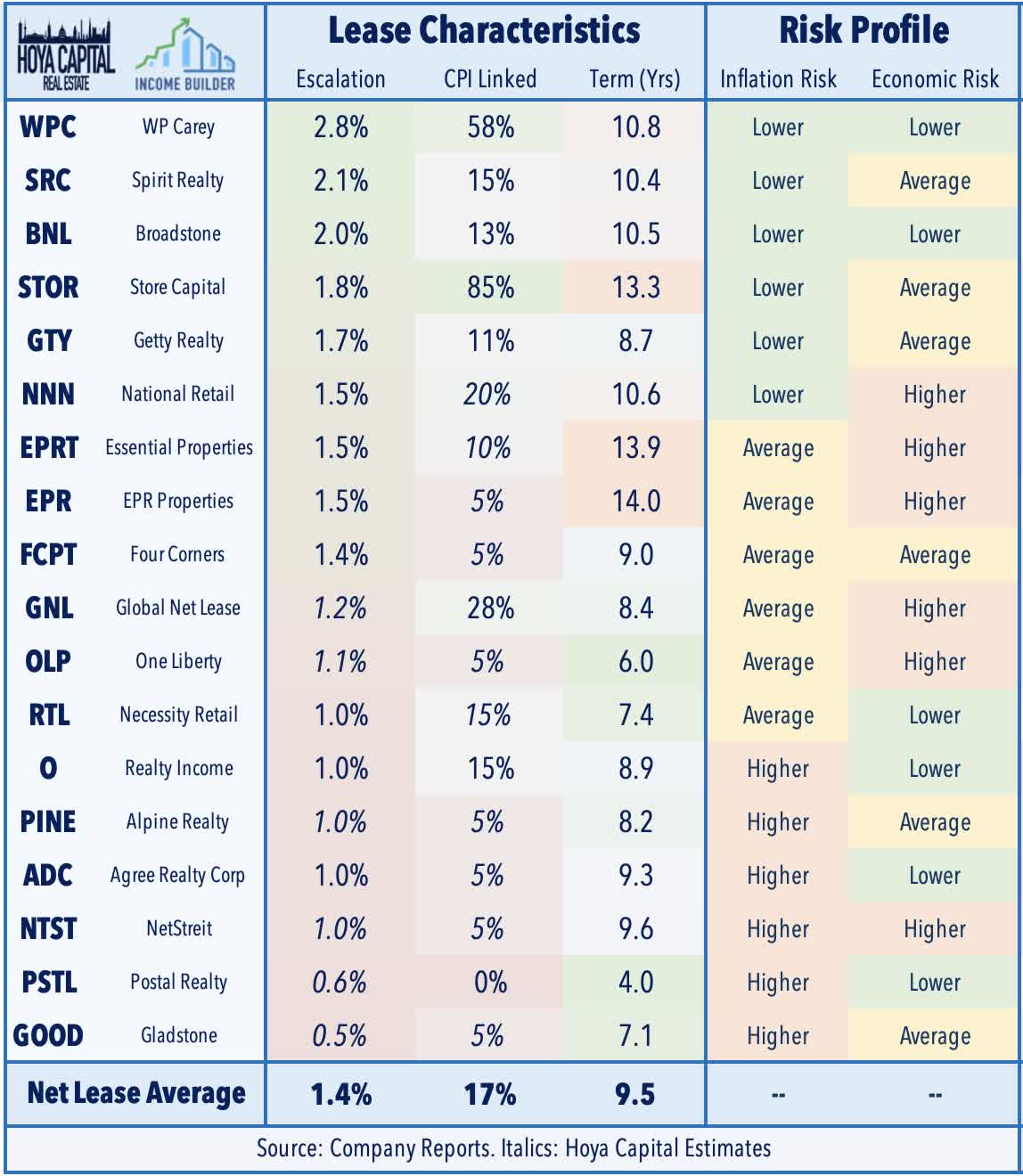

Net Lease: Today, we published Net Lease REITs: Surviving Inflation, For Now. Understood to be one of the more "bond-like" and rate-sensitive REIT sectors, net lease REITs have surprisingly been among the best-performing property sectors this year despite the challenging macroeconomic environment. Even with rent growth significantly lagging inflation, net lease REITs are still on-pace for double-digit earnings growth as robust accretive external growth has more than offset the drag from muted property-level growth. Within the net lease sector, inflation risk isn't always efficiently-priced, however, and after taking a deep-dive into the inflation risk across the sector, we reiterate our positive outlook on a handful of REITs that can outperform in a variety of potential macroeconomic environments.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were also broadly lower today as residential mREITs slipped 2.0% while commercial mREITs also declined 2.0%. After the close yesterday, AGNC Investment (AGNC) held its monthly dividend steady at $0.12/share, representing a forward yield of 11.8%. Redwood Trust (RWT) also held its quarterly dividend steady at $0.23/share, representing a forward yield of 10.19%. Dividend yields now average over 10%, a hearty premium to the 3.1% average for equity REITs. While some mREITs are pushing the upper limits of their payout capacity, we've seen twice as many dividend increases as decreases this year.

Yesterday, we published Mortgage REITs: Risk And Reward In Ultra-High Yield. Mortgage REITs – along with other fixed income-oriented securities across the credit and maturity curve - have stabilized in recent weeks as bond market volatility has calmed following a historically rough start to 2022. Earnings results confirmed that the challenging macro environment- marked by a "double-whammy" of rising rates and widening MBS spreads- wasn't the catastrophe to mREITs Book Values that some expected. Mortgage REITs are now outperforming Equity REITs for the year, and we continue to see value in a modest allocation towards higher-quality mREITs in a balanced income-focused real estate portfolio.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.