Fed Hikes • Stocks Rebound • REIT Dividend Hikes

- U.S. equity markets rebounded Wednesday following a stretch of punishing declines as the Federal Reserve approved the largest rate hike since 1994 as it seeks to combat persistent inflationary pressures.

- While unable to fully climb out of "bear market" territory, the S&P 500 advanced 1.5% today - trimming its drawdown to roughly 21% - while the tech-heavy Nasdaq 100 rallied 2.5%.

- Real estate equities were among the outperformers today as long-term interest rates pulled back and after several REITs hiked their dividends. The Equity REIT Index rallied 2.4% today.

- Fed officials hiked short-term lending rates by 75 basis points and signaled a more aggressive path of future rate hikes this year, but investors were prepared for the hawkish pivot following three days of punishing declines.

- A wave of REITs hiked their dividends over the past 24 hours including a trio of cannabis REITs, a pair of net lease REITs, and a pair of mortgage REITs. More than 80 REITs have now hiked their dividends this year.

Income Builder Daily Recap

We recently launched Hoya Capital Income Builder - a premier income-focused investment research service through Seeking Alpha Marketplace - that will be the new exclusive home of all of Hoya Capital's investment research. Income Builder focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, capital appreciation, and inflation hedging. If you're not already on board, give us a try with a completely risk-free two-week trial and take a look around.

U.S. equity markets rebounded Wednesday following a stretch of punishing declines as the Federal Reserve approved the largest rate hike since 1994 as it seeks to combat persistent inflationary pressures. While unable to fully climb out of "bear market" territory, the S&P 500 advanced 1.5% today - trimming its drawdown to roughly 21% - while the tech-heavy Nasdaq 100 rallied 2.5%, but still remains more than 30% below its recent highs. Real estate equities were among the outperformers today as long-term interest rates pulled back and after several REITs hiked their dividends. The Equity REIT Index rallied 2.4% today all 19 property sectors in positive territory while the Mortgage REIT Index finished lower by 0.2%.

Fed officials hiked short-term lending rates by 75 basis points and signaled a more aggressive path of future rate hikes this year, but investors were prepared for the hawkish pivot following three days of punishing declines and market volatility following the hotter-than-expected CPI inflation report last Friday. Responding to weaker-than-expected Retail Sales data this morning and a downward revision by the Fed on several key expectations of economic growth, the 10-Year Treasury Yield pulled back from its highest level in over a decade, declining 9 basis points to 3.40% while the 2-Year Treasury Yield closed roughly 20 basis points below its highs on Tuesday.

Real Estate Daily Recap

Cannabis: A trio of cannabis REITs hiked their dividends over the past 24 hours. Chicago Atlantic Real Estate (REFI) - which went public last year - advanced 2% after hiking its quarterly dividend by 17.5% to $0.47/share. After the close today, AFC Gamma (AFCG) hiked its quarterly dividend by 2% to $0.56/share and NewLake Capital Partners (OTCQX:NLCP) hiked its quarterly dividend by 6.1% to $0.35/share. This evening, we'll publish an updated report on the Cannabis REIT sector to the Income Builder marketplace which will analyze the reasons behind the sharp declines across the sector this year and our updated outlook. Concerns over tenant credit has been the concern this year as tightening monetary policy and stalled legislative progress on federal marijuana legalization have sent valuations of cannabis cultivators plunging. Cannabis REITs have thrived in recent years despite weakness across the broader cannabis sector, benefiting from the murky and often contradictory regulatory framework of legalized marijuana.

Cannabis REITs weren't alone in the wave of REIT dividend hikes. Realty Income (O) rallied more than 3% after hiking its monthly dividend by 0.2% to $0.2475/share. After the close today, Safehold (SAFE) - which we hold in the new Landowner Portfolio - hiked its quarterly dividend by 4.1% to $0.177/share. We've now seen more than 70 equity REITs raise their dividend this year along with another half-dozen mortgage REITs. In our State of the REIT Nation report, we noted that FFO growth has significantly outpaced dividend growth over the past several quarters, driving the dividend payout ratios to just 68.8%, so REITs are well-equipped to deliver another year of robust dividend growth that may meet or exceed the record year in 2021.

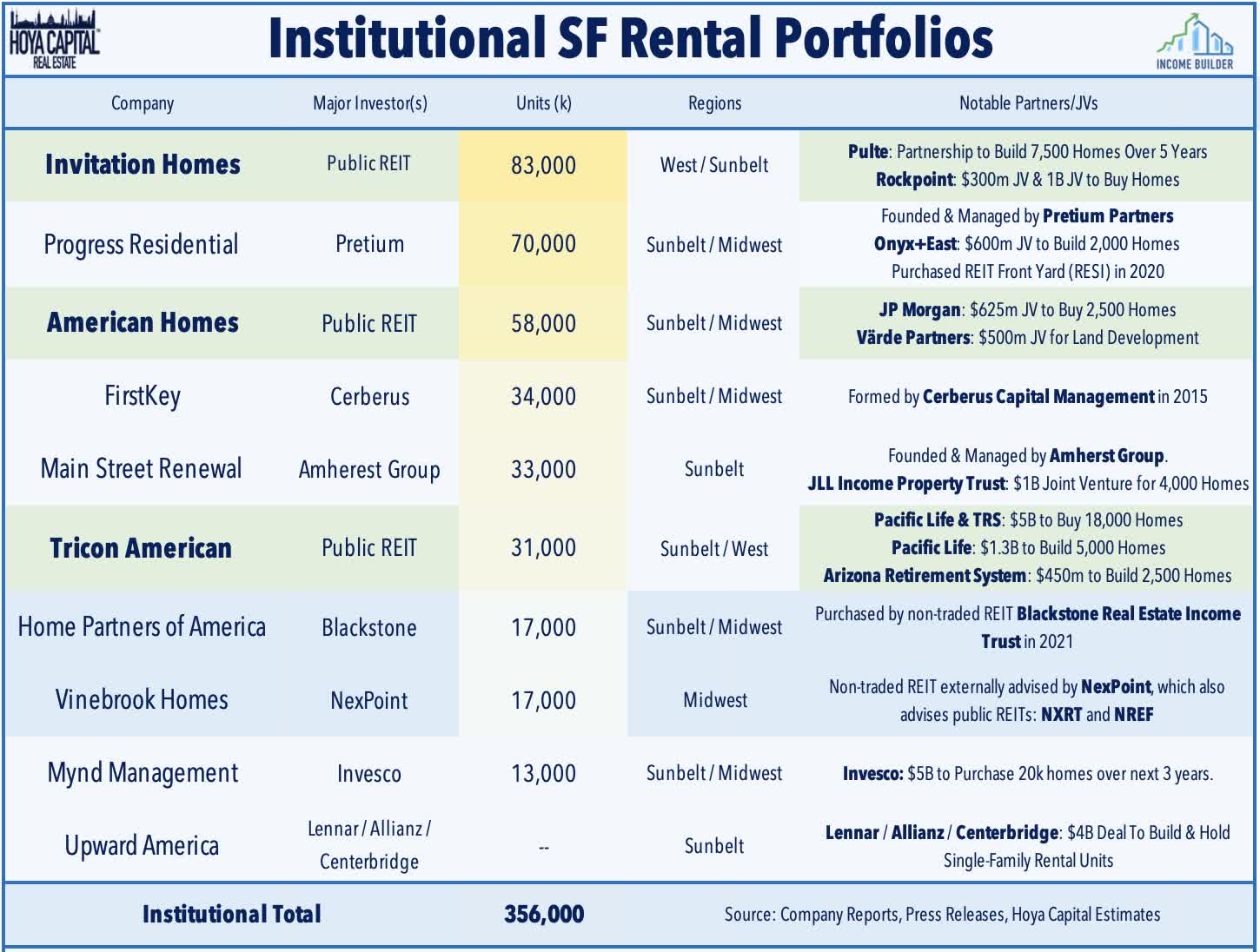

Single-Family Rental: Today, we published Single-Family Rental REITs: Shelter From Stagflation. Amid mounting recession worries and a return of heart-stopping market volatility, residential REITs - particularly the traditionally countercyclical single-family rentals - should prove to be a source of relative shelter. SFR REITs were born from the last economic crisis when a cascade of foreclosures enabled a new class of institutional rental operators to emerge by buying distressed properties en-masse. Similar distress in the U.S. housing market is highly unlikely given the underlying supply constraints resulting from a decade of underbuilding, and ironically, due to the presence of well-capitalized institutional investors. SFR REITs enter this uncertain period on solid footing, benefiting from historically favorable Buy vs. Rent economics.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs were mixed today with residential mREITs finishing lower by 0.4% while commercial mREITs rebounded by 1.0%. After the close today, Ladder Capital (LADR) hiked its quarterly dividend by 10% to $0.22/share while BrightSpire (BRSP) hiked its quarterly dividend by 5.3% to $0.20/share. The remaining ten mortgage REITs to declare dividends over the past 24 hours held their payouts steady: Starwood Property (STWD), TPG RE Finance (TRTX), Dynex Capital (DX), Apollo Commercial (ARI), Orchid Island (ORC), MFA Financial (MFA), Ready Capital (RC), AG Mortgage (MITT), Broadmark Realty (BRMK), and Lument Finance (LFT).

In Mortgage REITs: Everything In Moderation, we highlighted the potential risks related to rate volatility while noting that - even the double-digit average dividend yield - most mREIT dividends are covered by EPS and not at immediate risk of reductions. We've now seen 12 mortgage REITs raise their dividend this year compared to four dividend reductions.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 1.11% today, on average, following a rough start to the week. REIT Preferreds are lower by roughly 13% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 7.06%.

Economic Data This Week

The jam-packed week of economic data and monetary policy decisions kicked off today with the Producer Price Index for May. On Wednesday, we'll see Retail Sales data - which is expected to show the lowest month-over-month increase of 2022 - while Homebuilder Sentiment is expected to show a moderation to 68 which would be the lowest level since early in the pandemic. All eyes will be on the Federal Reserve on Wednesday afternoon for the FOMC Interest Rate Decision. Finally, on Thursday, we'll see Housing Starts and Building Permits which are expected to show a continued moderation in the pace of new home construction.

Access Our Complete Research Library

We recently launched Hoya Capital Income Builder - the new premier investment research service focused on real income-producing asset classes. Whether your focus is High Yield or Dividend Growth, we’ve got you covered with high-quality, actionable investment research and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. And of course, subscribers receive complete access to our investment research - including reports that are never published elsewhere - from Hoya Capital and our team of contributors.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Additional Disclosure: It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Data quoted represents past performance, which is no guarantee of future results. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy.