REIT Dividend Hike • Stocks Rebound • Inflation Outlook Cools

- U.S. equity markets rebounded Friday- snapping a five-session losing streak- lifted by solid retail sales data and corporate earnings results and from data showing a retreat in consumer inflation expectations.

- Continuing a late-session rebound that began Thursday and paring its weekly declines to below 1%, the S&P 500 rallied 1.9% today while the Small-Cap 600 advanced more than 2%.

- Real estate equities were also broadly higher today and outperformed on the week as long-term benchmark interest rates moderated. The Equity REIT Index gained 1.7% with 17-of-18 property sectors in positive territory.

- National Retail (NNN) rallied more than 3% after hiking its quarterly dividend by 4% to $0.55 per share, representing a forward yield of 5.1%. National Retail becomes the 71st equity REIT to raise its dividend this year.

- The University of Michigan sentiment survey showed households’ expectations of where inflation will be in five years dropped more than expected to 2.8% from the previous reading of 3.1%.

Income Builder Daily Recap

U.S. equity markets rebounded Friday- snapping a five-session losing streak- lifted by solid retail sales data and corporate earnings results and from data showing a retreat in consumer inflation expectations. Continuing a late-session rebound that began Thursday and paring its weekly declines to below 1%, the S&P 500 rallied 1.9% today while the Small-Cap 600 advanced more than 2%. Real estate equities were also broadly higher today and outperformed on the week as long-term benchmark interest rates moderated. The Equity REIT Index finished higher by 1.7% with 17-of-18 property sectors in positive territory while the Mortgage REIT Index advanced 2.0%.

The 10-Year Treasury Yield retreated modestly to 2.93% - well below its recent high of 3.50% reached in early June - after inflation expectations data this morning showed potential signs of light at the end of the tunnel for inflation. All eleven GICS equity sectors were higher on the day, led to the upside by a rebound from the Financials (XLF) sector following better-than-expected results from Citigroup (C), which soared more than 13%. We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Following a pair of red-hot inflation reports earlier in the week, investors and the Fed got some reprieve today as a closely-watched survey of consumer inflation expectations showed a notable moderation. The University of Michigan sentiment survey showed households’ expectations of where inflation will be in five years dropped more than expected to 2.8% from the previous reading of 3.1%. Exactly what the Fed wanted to see, recession concerns - and fears of job losses - appear to be dampening inflation expectations. The balance of the report shows that consumers are indeed as concerned as ever, by some measures. The headline consumer sentiment index for July was 51.1 - barely above the all-time lows in the prior month. The consumer expectations index declined -40.1% year-over-year to 47.3, which is the lowest since the 1980s.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Net Lease: National Retail (NNN) rallied more than 3% after hiking its quarterly dividend by 4% to $0.55 per share, representing a forward yield of 5.1%. National Retail becomes the 71st equity REIT to raise its dividend this year and the 83rd REIT including mortgage REITs. We did see the first equity REIT dividend cut of the year during the week, however, as Industrial Logistics Properties (ILPT) slashed its dividend yesterday to $0.01, citing difficulties related to its recent acquisition of Monmouth. ILPT cited rising rates and difficult market conditions for delays to its post-acquisition financing plans.

Healthcare: Done deal. Shareholders of Healthcare Trust of America (HTA) and Healthcare Realty (HR) approved a combination at a vote on Friday. Approximately 79% of HR's shareholders voted in favor of the merger transaction with HTA. The deal - which will form the largest medical office REIT - is expected to close on or around Wednesday, and comes after several months of drama - including challenges from activist investors and a competing offer from Welltower (WELL). Medical office demand has remained relatively steady throughout the pandemic, while lab space demand from biotechnology and pharmaceutical companies has been extremely strong.

Mortgage REIT Daily Recap

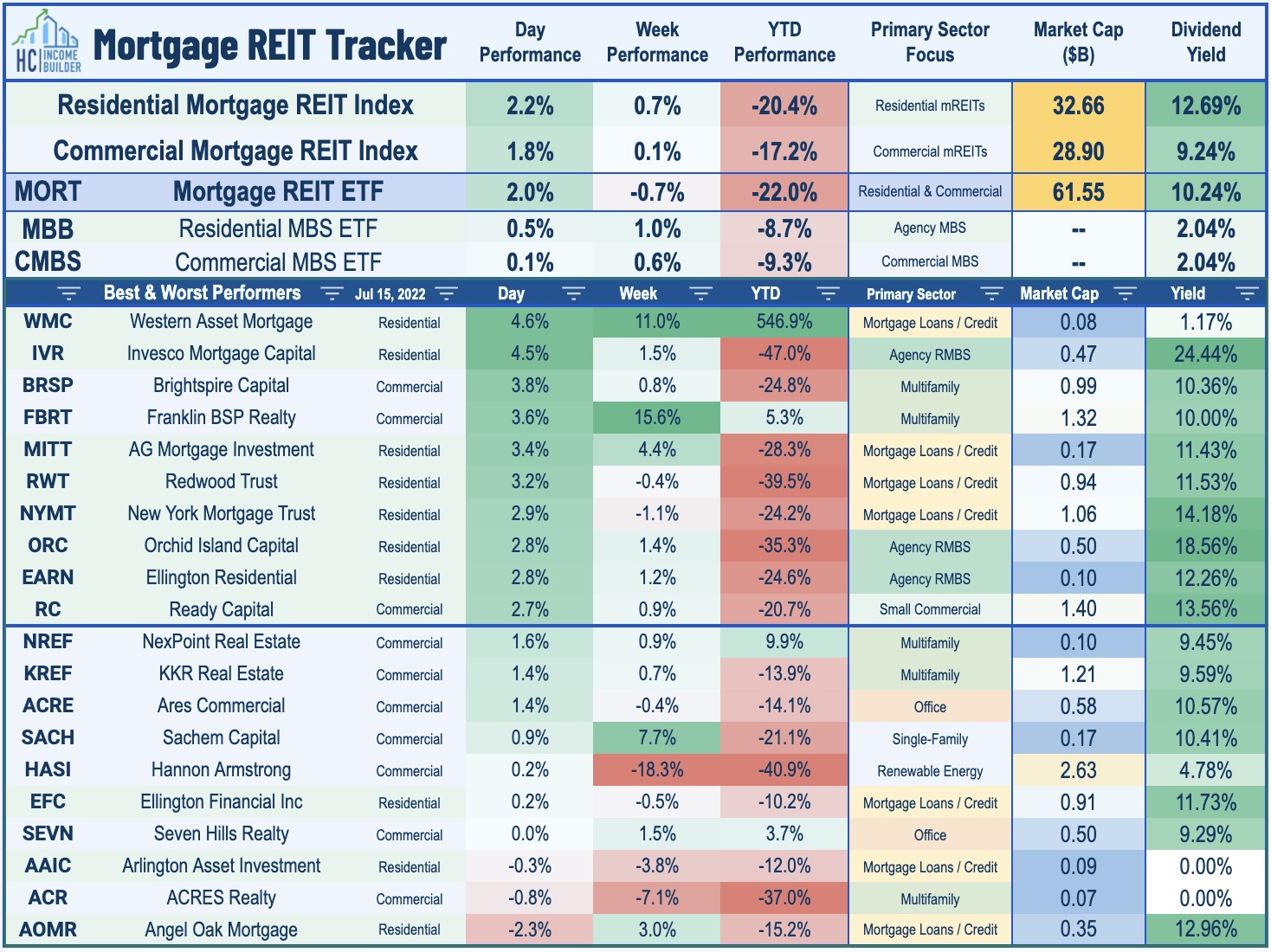

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs rebounded today with residential mREITs advancing 2.2% while commercial mREITs gained 1.8%. Western Asset Mortgage (WMC) was among the leaders today after its 1-for-10 reverse stock split became effective. On an otherwise quiet day of mREIT newsflow, Invesco Mortgage (IVR) and Brightspire (BRSP) were also upside standouts while Angel Oak Mortgage (AOMR) lagged today but was among the leaders for the week.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished lower by 0.05% today, on average. REIT Preferreds are lower by roughly 10% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.97%.

Economic Data This Week

We'll publish a full analysis and commentary of this week's developments in the real estate industry, as well as an analysis of the busy week of economic data in our Real Estate Weekly Outlook published this weekend.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.