Taiwan Tensions • Yields Jump • REIT Earnings

- U.S. equity markets slumped Tuesday as long-term benchmark interest rates rebounded from four-month lows amid concerns over heightened tensions with China amid a Taiwan visit from the U.S. House Speaker.

- Pushing its week-to-date declines to roughly 1%, the S&P 500 slipped 0.5% today while the Mid-Cap 400 declined 0.9% and the tech-heavy Nasdaq 100 declined 0.2%.

- Real estate equities were among the laggards today - pressured by the reversal in interest rates - ahead of the busiest 48-hour stretch of REIT earnings reports.

- Fixed income securities across the credit and maturity curve were under pressure today as investors worried that the Taiwan visit by the Speaker could inflame tensions between Beijing and Washington and potentially further disrupt supply chains and prolong the inflationary pressure.

- Mall REIT Simon Property (SPG) slumped nearly 3% despite raising its full-year outlook and hiking its dividend for the third time this year, citing "extremely strong" demand for its space that drove a third-straight quarter of increases in its average bases rent.

Real Estate Daily Recap

U.S. equity markets slumped Tuesday as long-term benchmark interest rates rebounded from four-month lows amid concerns over heightened tensions with China amid a Taiwan visit from the U.S. House Speaker. Pushing its week-to-date declines to roughly 1%, the S&P 500 slipped 0.5% today while the Mid-Cap 400 declined 0.9% and the tech-heavy Nasdaq 100 declined 0.2%. Real estate equities were among the laggards today - pressured by the reversal in interest rates - ahead of the busiest 48-hour stretch of REIT earnings reports. The Equity REIT Index declined 1.3% today with all 18 property sectors in negative territory while the Mortgage REIT Index slumped 3.4%.

Fixed income securities across the credit and maturity curve were under renewed pressure today as investors worried that the Taiwan visit by U.S. House Speaker Nancy Pelosi could inflame tensions between Beijing and Washington and potentially further disrupt supply chains and prolong the inflationary pressure. The 10 Year Treasury Yield jumped 13 basis points to close at 2.74% today after closing at its lowest level since April on Monday. Ten of the eleven GICS equity sectors were lower on the day with yield-senstive sectors -including Real Estate (XLRE) and Utilities (XLU) dragging on the downside following a strong stretch of outperformance. Energy (XLE) stocks were notable outperformers as Crude Oil prices rebounded after declining to nearly six-month lows earlier in the week.

Real Estate Daily Recap

Best & Worst Performance Today Across the REIT Sector

Mall: Simon Property (SPG) slumped nearly 3% despite raising its full-year outlook and hiking its dividend for the third time this year to $1.75/share, pushing its dividend yield up to representing a dividend yield of roughly 6.4%. Citing "extremely strong" demand for its space that drove a third-straight quarter of increases in its average bases rent, SPG raised its full-year FFO growth target by 50 basis points Occupancy rates increased to 93.9% - up 210 basis points for the year - but still below its pre-pandemic rate of roughly 95%. Recession concerns continue to overshadow the recent signs of stabilization reported by Simon and Macerich (MAC), but mall REITs have managed to claw back some of their year-to-date declines over the past month with a double-digit rebound.

Shopping Center: A pair of shopping center REITs continued the trend of "beat-and raise" results. Brixmor (BRX) slumped 1.5% despite boosting its full-year FFO growth target to 11.4% - up 200 basis points from last quarter - and raising its same-store NOI target to 5.8% - also higher by 200 basis points. Like its peers, BRX reported double-digit rent spreads - 14.6%, on new and renewed leases - and commented that it's seen "growth in traffic to our centers, strong leasing volumes, compelling lease spreads" in recent quarters. InvenTrust (IVT) also declined by about 2% despite raising its FFO target by 40 basis points to 10.0%. We'll hear results this afternoon from Kite Realty (KRG), Acadia Realty (AKR), and Whitestone (WSR) while Urban Edge (UE) will report before the open tomorrow.

Net Lease: EPR Properties (EPR) - owns a portfolio primarily comprised of movie theaters and sports and entertainment complexes - slumped 2% despite reporting better-than-expected results and raising its full-year outlook. Driven by progress on its collection of missed rents throughout the pandemic, EPR now sees FFO growth of 39.6% for the year - up 250 basis points from its prior outlook. EPR - which was hit harder by missed rents than any net lease during the pandemic - noted that it has collected over $100 million of rent and interest from customers that was deferred as a result of the impact of the pandemic and is expecting to collect another $12 million over the coming quarters. We'll hear results this afternoon from Agree Realty (ADC) while National Retail (NNN) will report before the open tomorrow.

Apartment: Midwest-focused multifamily REIT Centerspace (CSR) was among the leaders today after rounding out an impressive earnings season for apartment REITs with solid results. Driven by an acceleration in rent growth in Q2 and into July, Centerspace raised its FFO growth target by 200 basis points to 13.5% while also raising its same-store NOI growth target by 200 basis points to 11.0%. As we'll discuss in an updated report published to Income Builder this evening, all ten apartment REITs raised their full-year same-store NOI growth target - which is now expected to average more than 13% this year - while seven of the nine boosted their full-year FFO target with an average increase of 2%. Benefiting from the affordability issues plaguing the ownership markets of late, both Sunbelt and Coastal-focused REITs are seeing similar trends of sustained double-digit rent growth, historically high occupancy rates, and record-low turnover.

Healthcare: Skilled nursing REIT Omega Healthcare (OHI) was among the outperformers today after reporting decent Q2 results highlighted by improving occupancy rates and signs of relief on labor shortages while it continues to work through tenant operator struggles. OHI reccorded sequential improvement in AFFO as some restructured operators restarted rent payments, but the company noted that it "continues to be impacted by nonpayment of rent by a few operators and, with both facility occupancy and profitability still meaningfully below pre-pandemic levels, the risk of further operator issues remains.” As discussed in Healthcare REITs: Coming Out of Rehab, NIC data last week showed that SNF occupancy rates recovered to 78.5% in Q2, continuing a recovery from its pandemic low of 74% in the first quarter of 2021 but still far below its pre-pandemic level of 86.6%. We'll hear results this afternoon from Healthpeak (PEAK) and Community Healthcare (CHCT).

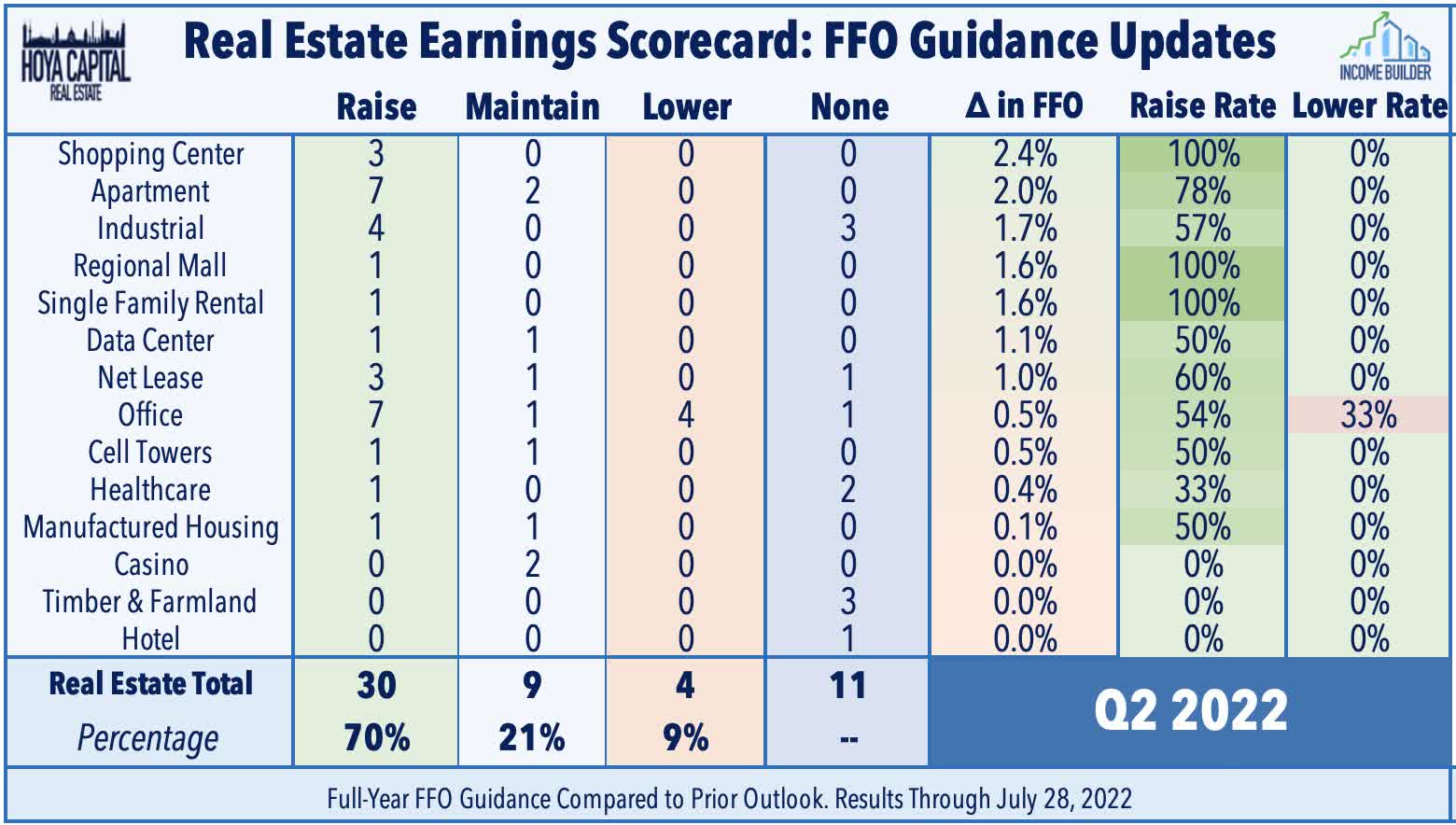

Yesterday we published our Real Estate Earnings Halftime Report. At the halfway point of earnings season, 30 REITs (70%) have raised their full-year FFO outlook while just 4 REITs (9%) have lowered or withdrawn their outlook. Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as just 45% of S&P 500 companies boosted their outlook while 55% have lowered. REITs perform their best in a relatively "slow and steady" economic regime. Upside standouts thus far have been Apartment, Shopping Center, and Industrial REITs. In addition to the aforementioned REITs, we'll also hear earnings reports this afternoon from ExtraSpace Storage (EXR), Franklin Street (FSP), Summit Hotels (INN), JBG Smith (JBGS), Ashford Hotels (AHT), and Plymouth (PLYM). We'll continue to provide real-time coverage for Hoya Capital Income Builder members and will publish follow-up articles summarizing our thoughts and analysis throughout earnings season.

Mortgage REIT Daily Recap

Per the REIT Rankings Tracker available to Income Builder subscribers, mortgage REITs retreated following a two-week stretch of notable outperformance as residential mREITs pulled-back 2.7% today while commercial mREITs declined by 2.2%. Rithm Capital (RITM) - formerly New Residential (NRZ) - slumped after reporting mixed results in Q2 with better-than-expected EPS growth offset by a modest decline in its Book Value Per Share (BVPS). RITM - which reported a sector-leading 10% rise in its BVPS in Q1 - saw a 2.2% decline last quarter. NRZ rebranded to Rithm Capital alongside the internalization of its management which it expects will add approximately $0.12 to $0.15 in core earnings. We'll see more than a dozen reports from mREITs over the next 48 hours including New York Mortgage (NYMT) on Wednesday and Starwood Capital (STWD) on Thursday.

REIT Preferreds & Capital Raising

Per the Income Builder Preferred Tracker available to Income Builder subscribers, REIT Preferred stocks finished higher by 1.22% today, on average. REIT Preferreds are lower by roughly 5% on a total return basis this year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. There are now roughly 180 REIT-issued exchange-listed preferred and debt securities with an average current yield of 6.89%.

Economic Data This Week

Employment data highlights another busy week of economic data and corporate earnings reports in the week ahead, headlined by JOLTS data on Tuesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 250k in July which would be the lowest month-over-month increase since the start of the pandemic as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. Purchasing Managers' Index ("PMI") data will continue to be a major market focus - particularly in Europe and Asia - as recent reports have barely managed to hold on to the breakeven 50-level.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital Research & Index Innovations (“Hoya Capital”) is an affiliate of Hoya Capital Real Estate, a registered investment advisory firm based in Rowayton, Connecticut that provides investment advisory services to ETFs, individuals, and institutions. Hoya Capital Research & Index Innovations provides non-advisory services including market commentary, research, and index administration focused on publicly traded securities in the real estate industry.

This published commentary is for informational and educational purposes only. Nothing on this site nor any commentary published by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. This commentary is impersonal and should not be considered a recommendation that any particular security, portfolio of securities, or investment strategy is suitable for any specific individual, nor should it be viewed as a solicitation or offer for any advisory service offered by Hoya Capital Real Estate. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing.

The views and opinions in all published commentary are as of the date of publication and are subject to change without notice. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Any market data quoted represents past performance, which is no guarantee of future results. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any outlook made in this commentary will be realized.

Readers should understand that investing involves risk and loss of principal is possible. Investments in real estate companies and/or housing industry companies involve unique risks, as do investments in ETFs. The information presented does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Hoya Capital Real Estate and Hoya Capital Research & Index Innovations have no business relationship with any company discussed or mentioned and never receives compensation from any company discussed or mentioned. Hoya Capital Real Estate, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings and additional important disclosures is available at www.HoyaCapital.com.